7.7: Aggregate demand and equilibrium output

- Page ID

- 45776

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \) \( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)\(\newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\) \( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\) \( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\) \( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\) \( \newcommand{\Span}{\mathrm{span}}\) \(\newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\) \( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\) \( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\) \( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\) \( \newcommand{\Span}{\mathrm{span}}\)\(\newcommand{\AA}{\unicode[.8,0]{x212B}}\)

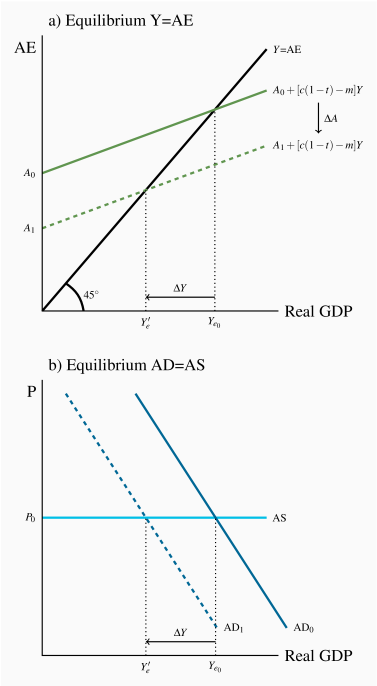

Figure 7.11 AE, AD and equilibrium output

Example Box 7.1 The effect of the government sector on equilibrium income

| a) Equilibrium with no Government | |||

| Autonomous expenditure | =A0 | Autonomous expenditure | =80 |

| Induced expenditure | =(c–m)Y | Induced expenditure | =(0.8–0.2)Y=0.6Y |

| Aggregate expenditure | =A0+(c–m)Y | Aggregate expenditure | =80+0.6Y |

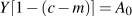

| Equilibrium income: |  |

Equilibrium income: |  |

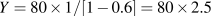

| Y=A0+(c–m)Y | Y=80+0.6Y | ||

|

|

||

|

|

||

| Y=200 | |||

|

|

|||

| b) Equilibrium with added government sector: G=25, NT=0.10Y | |||

| Autonomous expenditure | =A0+G0 | Autonomous expenditure | =105 |

| Induced expenditure | =c(1–t)–m | Induced expenditure |  |

| Aggregate expenditure |  |

Aggregate expenditure | =105+0.52Y |

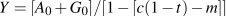

| Equilibrium income: |  |

Equilibrium income: |  |

|

Y=105+0.52Y | ||

|

Y(1–0.52)=105 | ||

|

|

||

| Y=218.4 | |||

to

to  , which is the fall in A times the multiplier.

, which is the fall in A times the multiplier. .

.