1.4: Consumer Surplus

- Last updated

- Save as PDF

- Page ID

- 45334

Consumer surplus is a measure of consumer welfare. The concept is remarkably simple and can be conceptualized as the value that the consumers receive above the price paid for the product. Consumer surplus is an important part of the value created by market transactions but is often overlooked as it does not formally get recorded on the seller’s financial statements nor is it quantified on customer receipts. The notion of consumer surplus will be used at different points later in the course. It is useful to introduce it now because it can be used to explain the law of demand in terms of consumers seeking to obtain surplus through market transactions.

Explaining Consumer Surplus

To motivate the idea of consumer surplus, imagine that you have a difficult exam in your 1:30 PM class. Because you are so worried about the exam you decide to forego lunch and use the time to study instead. At 2:30, after having written the exam, you realize how very hungry you are. You head to your favorite sandwich shop for lunch. You are willing to pay up to $12 for a sandwich and are pleased to see that sandwiches are priced at $8 on the menu. Does the purchase of a sandwich make you better off? Absolutely. By paying $8 you receive a good that provides you with satisfaction worth $12. Your consumer surplus is $4 and can be computed as the value you place on the product ($12) less the purchase price ($8).

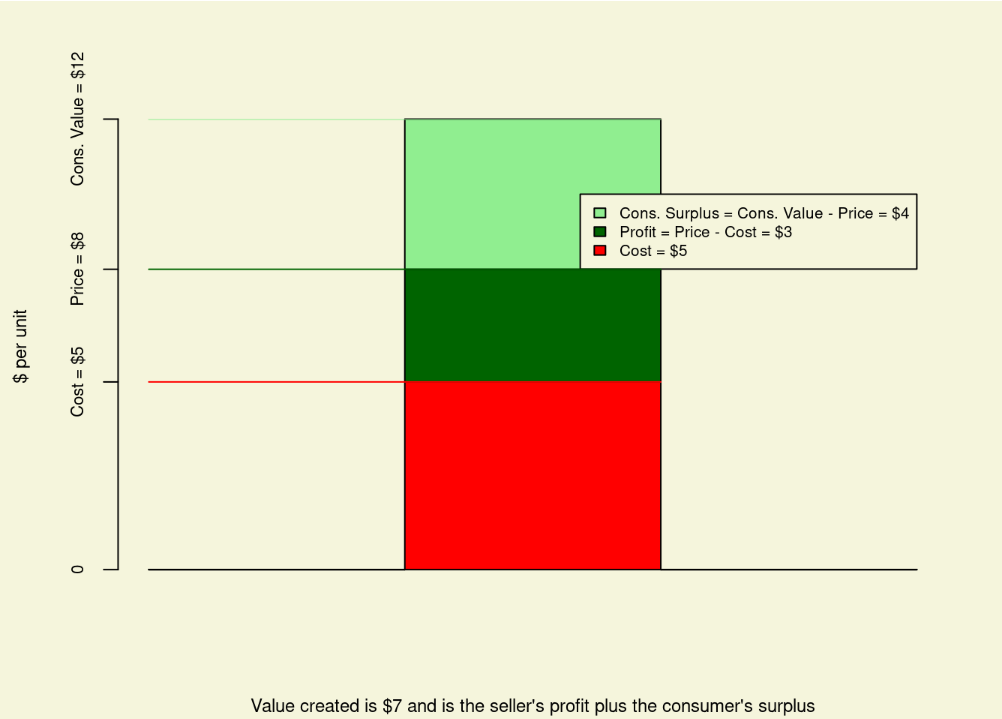

Figure 1 shows that value from a market transaction such as this one is divided among the consumer (in the form of consumer surplus) and the firm (in the form of profits). Suppose the sandwich shop can produce the sandwich for $5 per unit. The shop receives a profit margin of $8 - $5 = $3. The total value created by the transaction is $7 (the $12 value you place on the sandwich less the production cost of $5) and is also equal to the $3 profit margin going to the shop plus the $4 consumer surplus going to you. Thus, there is a simple identity for the value created from a transaction such as this:

\(Value \: Created \equiv \: Consumer \: Valuation - Production \: Cost \equiv \: Consumer \: Surplus + Profit\)

Firms create value by producing goods and services that consumers value more highly than the costs of production. Typically, as in our sandwich example, some of this value will be captured as a profit margin. The rest of the value gets passed on to consumers in the form of surplus. Thus, even though consumer surplus is not entered into a company’s books or onto customer receipts, it is important to profitability. Firms that create superior value can be said to have a competitive advantage in that they can gain market share by providing consumers with more-attractive surplus propositions and or can command higher profit margins while still offering consumers surplus on par with their competitors (Besanko et al. 2010).

Consumer Surplus in the Context of Diminishing Marginal Utility

Recall from above that the law of demand reflects diminishing marginal utility from successive units of a product. To see this, let us continue our sandwich example. A very hungry person receives a great deal of satisfaction from the first sandwich, probably enjoys the second, might nibble a bit on a third, but is not much interested in the fourth. What is happening here is that as the person eats more and more, he or she starts to become satiated. The first sandwich was wonderful but the fourth sandwich creates indigestion. This translates into the monetary value the consumer places on sandwiches. The hungry consumer is willing to pay a relatively high price for the first sandwich, a moderate price for the second, and much less, if anything, for the third or fourth sandwich. This leads to the negative relationship between price and quantity as stipulated by the law of demand.

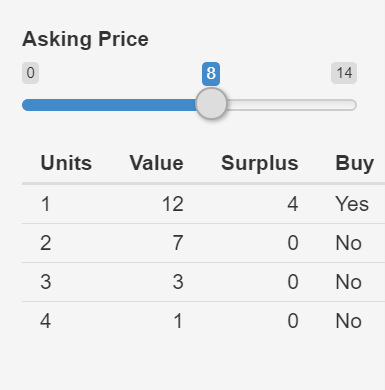

Let us continue this example with Demonstration \(\PageIndex{1}\) below. Suppose that your marginal valuation, the value you place on additional sandwiches, is as presented in Demonstration \(\PageIndex{1}\). If sandwiches are priced at $8, you buy one and receive consumer surplus of $4. You are quite hungry and would enjoy another, but the first sandwich has taken the edge off your hunger and you only value the second sandwich at $7 which is less than the $8 purchase price. For this reason, you will only buy one sandwich if they are priced at $8. Notice from Demonstration 3 that as prices fall, you purchase additional sandwiches (again giving rise to a downward sloping demand schedule). In addition to buying more sandwiches at lower prices, you obtain more surplus from each sandwich you purchase.

With this in mind, let us consider a slightly different situation: suppose that when you showed up at the sandwich shop, you were pleasantly surprised to see that the shop owner was running a special and had sandwiches priced at $6 instead of $8. Move the price down to $6 in Demonstration \(\PageIndex{1}\) to verify that in this case, you would gladly buy two sandwiches at $6 apiece. Now you would get a total $8 in consumer surplus ($7 from the first sandwich and $1 from the second).

Now let us think about this from the perspective of the shop owner. It costs her $5 to produce each sandwich, so she makes only $2 in profit by selling you the two sandwiches at $6 apiece. If she would have kept her sandwiches priced at $8 as normal, she would have only sold you one sandwich but would have made $3 in profit from the transaction with you. She faces a dilemma. She can profitably sell you a second sandwich since you value the second sandwich at $7 and it only costs her $5 to produce it. However, if she sets price low enough to induce you to buy two sandwiches, she gives up the high margin she could have commanded on the first sandwich. Moreover, there are probably less hungry customers that would have bought one sandwich at $8 but would not want a second sandwich even at the low price of $6. By pricing at $6, the shop owner sacrifices the higher margin on sandwiches sold to all these less-hungry customers as well.

Is there a way the shop owner could resolve this dilemma? One way would be to price sandwiches so that they are $8 for one sandwich or $14 for two sandwiches. Now, a hungry customer like you would go for the two for $14 option and the shop owner will make a profit of $4 on the transactions with you and other similarly hungry customers. Better yet, she will still get a profit of $3 on transactions with the less-hungry customers who buy only one sandwich. There are some potential problems here though. What if lots of couples come to the sandwich shop? Couples would qualify for the $14 deal. The shop owner could have made a profit of $6 per couple by selling each couple two sandwiches at $8 apiece as opposed to a profit of $4 per couple under the two for $14 deal. Another way the plan could backfire would be if enterprising customers bought sandwiches on the two for $14 deal and then resold them to less hungry customers outside the shop for something like $7.50, which is lower than the $8 asking price of the shop owner.

An important point here is that consumers are only in the market when they can get positive surplus. As you progress through the course, you will learn that many marketing strategies can be characterized as efforts to capture surplus and resolve dilemmas similar to that faced by the shop owner in this example. In other words, many strategies are aimed at taking what would or could be consumer surplus and turning it into higher profits. For now, however, the main goal is to use the idea of consumer surplus to strengthen your understanding of the law of demand, and the main takeaway from Demonstration 3 is that each customer will be inclined to purchase more units at lower prices and fewer units at higher prices.

Demonstration \(\PageIndex{1}\): Surplus with diminishing marginal utility.

Consumer Surplus in the Context of Different Valuations Across Consumers

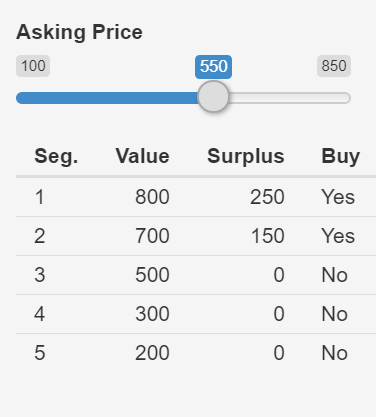

Another reason for the law of demand is that different consumers place different valuations on the same product. This means more consumers will participate in the market at lower prices and fewer consumers will participate at higher prices. Suppose that potential consumers of the latest electronic gadget can be divided into five segments, as shown by the points in Demonstration \(\PageIndex{2}\) below. Consumers in segment 1 are very enthusiastic about the gadget and value it at $800. Consumers in segment 5 are least enthusiastic and value it at $200. Segments 2, 3, and 4 fall somewhere in-between in terms of their willingness to pay for the new gadget. If the price of the device is set at $550 dollars, then only segments 1 and 2 are willing to participate in the market. These are the only two segments that could derive positive consumer surplus from buying the device. Positive surplus is denoted in the table of the demonstration as well as by the height of the green bars in the chart. If the price was lowered to below $500, consumers in segment 3 would enter the market and there would be more demanded. If the price increased to above $700, consumers in segment 2 would exit the market and fewer units would be demanded. Notice that consumers in all five segments value the gadget, but only those who can derive positive surplus participate in the market. Adjust the price-control slider in Demonstration \(\PageIndex{2}\). Make sure you understand the surplus calculation for consumers in each segment and are predict the price points at which different segments enter or exit the market.

Calculating Total Consumer Surplus Using the Demand Schedule

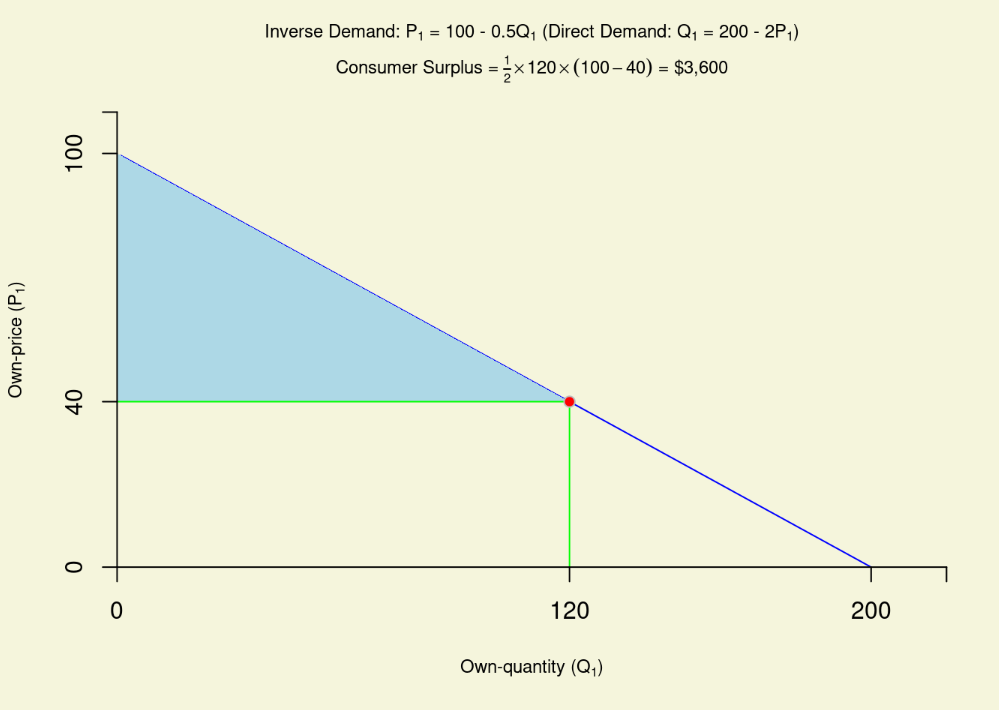

It should be clear from Demonstrations \(\PageIndex{1}\) and \(\PageIndex{2}\) that there is a link between consumer surplus and the demand schedule. Graphically, the consumer surplus in a market can be computed as the area below the demand schedule but above the prevailing price. In Figure \(\PageIndex{2}\), the consumer surplus is the triangular area that is shaded in blue. If the demand schedule is linear (as in the demand schedule presented in Figure \(\PageIndex{2}\)), you can use the formula for the area of a triangle to compute consumer surplus. You may recall that the area of a triangle is given by \(12 \times \dfrac{base}{frac}\). With this in mind, when given a value of \(P\), say \(\bar{P}\), you can compute consumer surplus from a linear demand schedule:

\(CS = \dfrac{1}{2} \times Q (\bar{P}) \times (Intercept \: of \: Inverse \: Demand \: Schedule - \bar{P})\)

In Figure \(\PageIndex{2}\), \(\bar{P}_{1} = 40\). Let us use the information in the figure to compute consumer surplus.

- Evaluate the direct demand schedule at \(\bar{P}_{1} = 40\) to get \(Q_{1} (\bar{P}_{1}) = 200 - 2(40) = 120\). This is the base of the consumer surplus triangle.

- Look at the equation for the inverse demand schedule provided in the figure and notice that it has an intercept of 100. Compute the height of the consumer surplus triangle as the difference between this intercept and \(\bar{P}_{1}\), which is \(100-40 =60\).

- Use the formula for the area of a triangle to get consumer surplus as \(12 \times 120 \times (60) = $3600\).

Provided the demand schedule is linear, you can use the formula for an area of triangle to get consumer surplus. Pedagogically, linear demand schedules will be fine for most of what you will encounter in this course; however, in many empirical applications you may not want to assume that demand schedules are linear. In general, if the demand schedule is not linear you can compute consumer surplus using the integral as \(\int_{0}^{Q*} P(Q)dQ - P(Q)Q*\), where \(P(Q)\)is the inverse demand curve and \(Q* \geq 0\) is an arbitrary quantity value.