It is important to make a clear distinction between a government budget as it affects and is affected by national income and an individual or household budget. The large size of the government sector relative to the economy (see Table 7.2) means any change in government expenditure or taxes also changes national income and government tax revenue. An increase in government expenditure also increases its tax revenue by increasing national income. A cut in government expenditure reduces national income and tax revenue. A household can improve its budget balance by cutting its expenditure without affecting its income. A government cannot. Recent experience in many countries provides a record of the difficulties governments have in trying to reduce budget deficits by cutting government expenditures.

The government budget function provides a useful tool for the discussion of these questions. It illustrates two-way linkages between the government budget and national income and the internal feedback within the government budget.

Think of a budget as the revenue and spending plan of an individual, a company, or a government. The government budget describes what goods and services the government will buy during the coming year, what transfer payments it will make, and how it will pay for them. Most spending is financed by taxes, but some revenue comes from charges for services. A balanced budget has revenues equal to spending. When revenues exceed spending, there is a budget surplus. When revenues fall short of spending, there is a budget deficit, which is financed by borrowing through the sale of government bonds to the public.

Government budget: planned government spending and revenue.

Balanced budget: revenues are equal to expenditures.

Budget surplus: revenues are greater than expenditures.

Budget deficit: revenues are less than expenditures.

Continuing to use G for government expenditure on goods and services, and NT for net tax revenue or taxes minus transfer payments (ignoring other sources of revenue, for simplicity):

|

(7.5) |

The budget balance, whether deficit, surplus or zero, is determined by three things:

- the net tax rate t set by the government;

- the level of expenditure G set by the government; and

- the level of output Y determined by AE and AD.

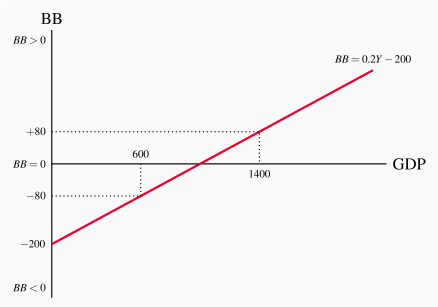

We can summarize the relationship between national income and the government's budget balance in a way we will find useful for discussing a government's budget and fiscal policies. Figure 7.4 shows a budget function. This budget function assumes t0=0.20 and G0=200. This is a specific fiscal program and budget plan, namely BB0.

BB0=0.2Y–200

Budget function: the relationship between the budget balance and the level of national income for a specific budget program.

A budget function is a simple illustration of the way the budget balance for one fiscal policy program depends on levels of national income.

In Figure 7.4, if national income Y were 600 the budget BB0 would be in deficit by 80. If a rise in autonomous aggregate expenditure increased equilibrium national income to 1400 the budget BB0 would be in surplus. Changes in national income induce changes in the revenues generated by the tax rate t=0.2 and automatically change the government's budget balance. The fiscal program and budget plan have not changed.

Once that fiscal program is set, the budget function is set, but the budget balance is not. The budget balance depends on the performance of the economy in terms of national income. In presenting the budget, the Minister of Finance gives a forecast of the budget balance based on a forecast of national income. If the income forecast is wrong, the budget program will result in either a larger or smaller budget balance than initially predicted.

Recent experience illustrates this relationship. In April of 2015 the Minister of Finance, Joe Oliver, tabled a government budget plan that was intended to result in a balanced budget (BB=0) in the fiscal year 2015–2016. That budget plan was based on the assumption the GDP in Canada would grow at an annual rate of 2 per cent in 2015–2016 and generate corresponding government tax revenue. However, by mid-July 2015 there were serious questions about that growth rate assumption. The Parliamentary Budget Office in a Budget Update that used the Bank of Canada's latest forecasts for real GDP growth at an annual rate of 1.0 percent estimated a budget deficit of $1.5 billion for 2015–2016. The promised balanced budget was at risk as real GDP would be less by the end of the budget year. The finance minister makes a budget plan but the performance of the economy determines the budget outcome.

This recent experience is not anomalous. For many years before the financial crisis of 2008 and the recession that followed the Canadian federal government ran budget surpluses that frequently exceeded predictions, while many provincial government budget deficits were smaller than predicted. Economic growth during those years was stronger than forecast when the budgets were designed. Clearly the difficulties in making accurate income forecasts have important effects on the actual government budget balances.

Finally, notice that because a budget function describes one fiscal plan, any change in the fiscal plan will change the BB line to show a new budget function.

. The budget balance depends on the equilibrium level of GDP determined by AE.

. The budget balance depends on the equilibrium level of GDP determined by AE. . The budget balance depends on the equilibrium level of GDP determined by AE.

. The budget balance depends on the equilibrium level of GDP determined by AE.