Budget balances and outstanding debt are closely related. A student's debt at the time of graduation is the sum of her budget balances during years of study. In any year in which her income is less than her expenses, she finances the difference by borrowing. In another year, if income is greater than expenses, she can repay some previous borrowing. In the end, the sum of borrowings minus the sum of repayments is her outstanding student debt (loan). This debt is a result of borrowing to finance investment in education.

Similarly, the outstanding public debt (PD) at any point in time is simply the sum of past government budget balances. Governments borrow to finance budget deficits by selling government bonds to households and businesses. Budget surpluses reduce the government's financing requirements. Some bonds previously issued mature without being refinanced. In simple terms, the budget balance in any year changes the outstanding public debt by an equal amount but with the opposite sign. A positive balance, a surplus (BB>0), reduces the public debt ( ). A negative balance, a deficit (BB<0), increases the public debt (

). A negative balance, a deficit (BB<0), increases the public debt ( ). Using PD to represent the outstanding public debt, we can express the link between the public debt and the government's budget balance as:

). Using PD to represent the outstanding public debt, we can express the link between the public debt and the government's budget balance as:

|

(7.7) |

Public debt (PD): the outstanding stock of government bonds issued to finance government budget deficits.

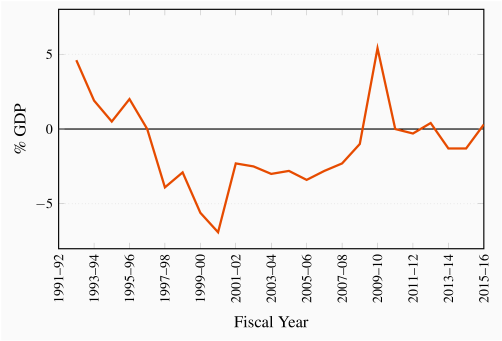

Figures 7.9 and 7.10 show the relationship between the government budget balance and the change in the public debt relative to GDP based on Canadian data for the 1991 – 2016 period. Recognizing that growth in the economy makes absolute numbers for deficits and debt hard to evaluate, the budget balance and the change public debt are presented as percentages of nominal GDP. The effects of budget balances on the public debt are illustrated clearly in the diagrams.

In the years from 1995 to 2007 the Government of Canada had budget surpluses. Things were different in the years before 1995. Large budget deficits, averaging more than 5 percent of GDP, were the norm in the late 1980s and early 1990s. As a result, the outstanding federal government public debt increased, and increased faster than GDP, pushing the ratio of public debt to GDP up from 38 percent of GDP in 1983 to 68 percent of GDP in 1996. The cost of the interest payments the government had to make to the holders of its bonds increased from $3.9 billion to $42.4 billion. These costs accounted for almost 30 percent of budgetary expenses in 1995.

As a result, Canadian fiscal and budgetary policy shifted in 1995 to focus much more on deficit and debt control than on income stabilization. As Figure 7.9 shows, the federal budget was in surplus from 1997 until 2007. This reduced the debt to GDP ratio each year until 2008 as in Figure 7.10.

The financial crisis and recession of 2008-2009 and the federal government's Economic Action Plan changed this focus and pattern of fiscal policy. Fiscal stimulus through increased government expenditures and modest tax credits together with the recession in income created budget deficits in 2008-2013. These deficits added directly to the federal government debt. Larger debt combined with little or no growth in nominal GDP in 2009 and 2010 caused a sharp increase in the debt ratio shown in Figure 7.10. The focus of Federal Budget plans for recent years, as the recovery from recession seems to be underway, has shifted back to budget deficit control and reduction and a return to lower public debt ratios.

Although cumulative deficits can raise the public debt dramatically, it is not the absolute value of the outstanding debt that should be of interest or concern. If, at the same time the debt is rising, the economy is growing and tax revenues are rising as a result of a growing tax base, the government may be able to service a growing debt without having to raise taxes. The public debt ratio (PD/Y) is then the appropriate measure of the debt situation. A rise in the outstanding debt is not in itself a source of concern. However, the government cannot allow the debt ratio to rise without limit.

Public debt ratio (PD/Y): the ratio of outstanding government debt to GDP.

Recent sovereign debt crises in Portugal, Ireland, Greece and Spain provide clear examples of the difficulties high and rising public debt ratios cause. In those countries and others in Europe, and in the US, the government costs of rescuing banks in financial distress after 2008 combined in many cases with already large budget deficits, compounded by the recession in economic growth raised public debt ratios sharply. Table 7.2 shows increase in public debt ratios from 2007 to 2015. The consequence was a loss of financial market confidence in the ability of some of these countries to pay interest on and subsequently retire outstanding government bonds, let alone service new bond issues to finance current deficits. Interest rates for new bond issues increased sharply and Greece and Ireland needed financial bailouts from joint EU rescue funds. This has provided time for fiscal adjustment but the economic growth required to solve sovereign debt issues remains elusive.

We will return to the relationship between fiscal policy and the public debt and examine the dynamics of the public debt ratio in Chapter 11.

This completes our introduction to the government budget, fiscal policy, aggregate expenditure, and the economy. It recognizes the importance of another set of linkages and feedback effects within the macro economy. We have seen two ways in which the government sector affects aggregate expenditure and output. Government expenditure is a part of autonomous aggregate expenditure. It affects the position of the AE function, equilibrium output, and the aggregate demand curve. The net tax rate diverts income from the household sector to government revenue and reduces induced expenditures. It changes the slope of the AE function, the size of the multiplier. Together the change in autonomous government expenditure and the effect of the net tax rate on induced expenditure change equilibrium income, and the AD curve. The size and direction of the change depends on the government's actual budget balance.

At the same time, conditions in the economy have significant effects on the government's budget. Recessions cause induced budget deficits and booms generate budget surpluses, both of which complicate the evaluation of the government's policy stance. Furthermore feedback effects within the government budget provide revenue support for fiscal expansion and revenue resistance to fiscal restraint or austerity. These effects mean government budget cannot be judged in the same way a private or household budget might be.

). A negative balance, a deficit (BB<0), increases the public debt (

). A negative balance, a deficit (BB<0), increases the public debt ( ). Using PD to represent the outstanding public debt, we can express the link between the public debt and the government's budget balance as:

). Using PD to represent the outstanding public debt, we can express the link between the public debt and the government's budget balance as: