12.3: Problems in Work and the Economy

- Page ID

- 14568

The Loss of Jobs and Wages

The Decline of Labor Unions

Unemployment

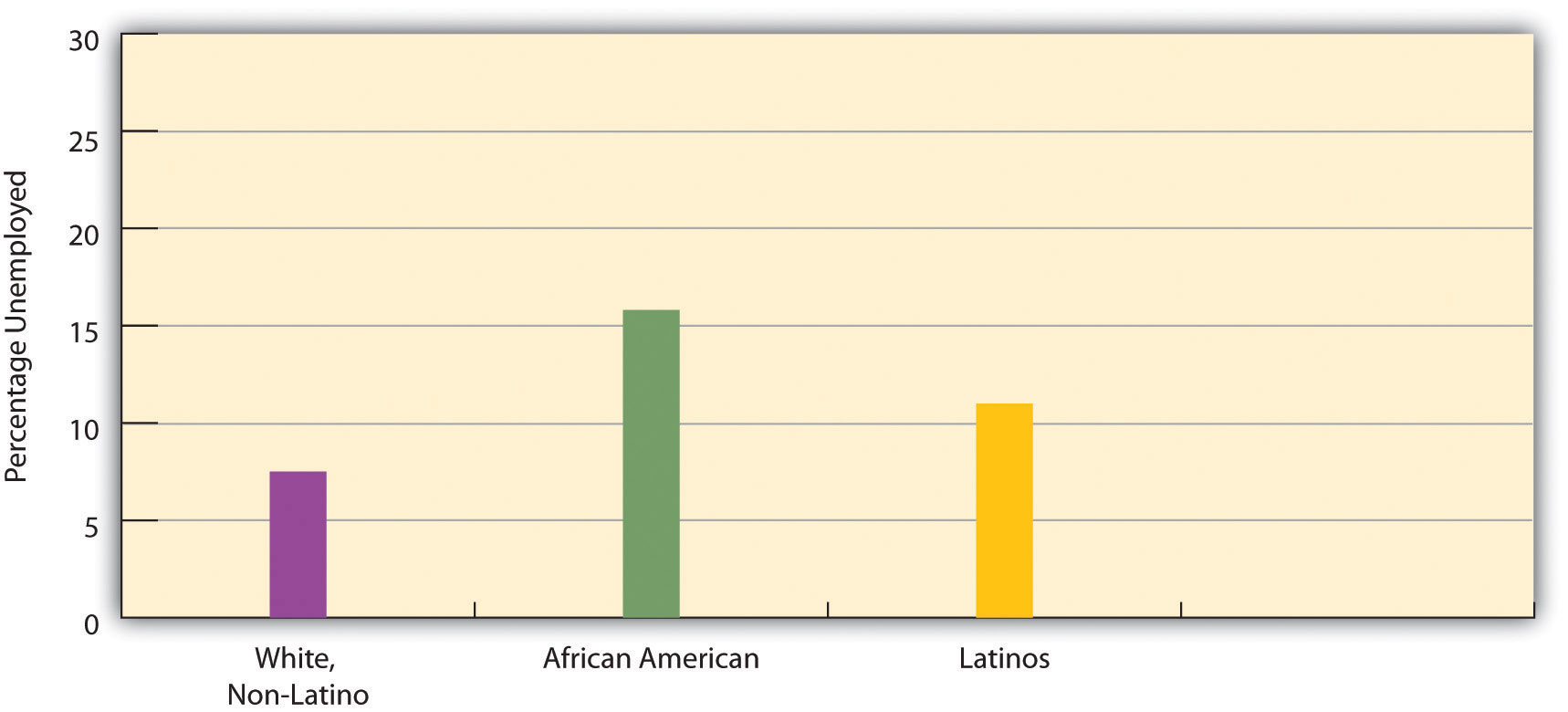

As the text discusses, people of color are more likely than whites to be unemployed or underemployed. While a relative lack of education helps explain these higher rates for people of color, other kinds of problems are also apparent.

One problem is racial discrimination on the part of employers, regardless of how conscious employers are of their discriminatory behavior. Chapter 4 recounted a study by sociologist Devah Pager (2003),Pager, D. (2003). The mark of a criminal record. American Journal of Sociology, 108, 937–975. who had young white and African American men apply independently in person for various jobs in Milwaukee. These men wore the same type of clothing and reported similar levels of education and other qualifications. Some said they had a criminal record, while others said they had not committed any crimes. In striking evidence of racial discrimination in hiring, African American applicants without a criminal record were hired at the same low rate as white applicants with a criminal record.

Pager and sociologists Bruce Western and Bart Bonikowski also investigated racial discrimination in another field experiment in New York City (Pager, Bonikowski, & Western, 2009).Pager, D., Bonikowski, B., & Western, B. (2009). Discrimination in a low-wage labor market: A field experiment. American Sociological Review, 74(5), 777–799. They had white, African American, and Latino “testers,” all of them “well-spoken, clean-cut young men” (p. 781), apply in person to low-level service jobs (e.g., retail sales and delivery drivers) requiring no more than a high school education; all the testers had similar (hypothetical) qualifications. Almost one-third (31 percent) of white testers received a call back or job offer, compared to only 25.2 percent of Latino testers and 15.2 percent of African American testers. The researchers concluded that their findings “add to a large research program demonstrating the continuing contribution of discrimination to racial inequality in the post-civil rights era” (p. 794).

Other kinds of evidence also reveal racial discrimination in hiring. Two scholars sent job applications in response to help-wanted ads in Boston and Chicago (Bertrand & Mullainathan, 2003).Bertrand, M., & Mullainathan, S. (2003). Are Emily and Greg more employable than Lakisha and Jamal? A field experiment on labor market discrimination (Working Paper No. 9873). Cambridge, MA: National Bureau of Economic Research. Retrieved from http://papers.nber.org/papers/w9873.pdf. They randomly assigned the applications to feature either a “white-sounding” name (e.g., Emily or Greg) or an “African American–sounding” name (e.g., Jamal and Lakisha). White names received 50 percent more callbacks than African American names for job interviews.

Racial differences in access to the informal networks that are often so important in finding a job also contribute to the racial/ethnic disparity in employment. In a study using data from a nationwide survey of a random sample of Americans, sociologist Steve McDonald and colleagues found that people of color and women are less likely than white males to receive informal word of vacant, high-level supervisory positions (McDonald, Nan, & Ao, 2009).McDonald, S., Nan, L., & Ao, D. (2009). Networks of opportunity: Gender, race, and job leads. Social Problems, 56(3), 385–402.

As these studies indicate, research by sociologists and other social scientists reveals that race and ethnicity continue to make a difference in employment prospects for Americans. This body of research reveals clear evidence of discrimination, conscious or unconscious, in hiring and also of racial/ethnic differences in access to the informal networks that are often so important for hiring. By uncovering this evidence, these studies underscore the need to address discrimination, access to informal networks, and other factors that contribute to racial and ethnic disparities in employment.

The Impact of Unemployment

Although the news article that began this chapter gave us a moving account of unemployed people at food banks, survey data also provide harsh evidence of the social and psychological effects of being unemployed. In July 2010, the Pew Research Center issued a report based on a survey of 810 adults who were currently unemployed or had been unemployed since the Great Recession began in December 2007 and 1,093 people who had never been unemployed during the recession (Morin & Kochhar, 2010).Morin, R., & Kochhar, R. (2010). Lost income, lost friends—and loss of self-respect: The impact of long-term unemployment. Washington, DC: Pew Research Center. The report’s title, Lost Income, Lost Friends—and Loss of Self-Respect, summarized its major findings.

Of those who had been unemployed for at least six months (long-term unemployment), 44 percent said that the recession had caused “major changes” in their lives, versus only 20 percent of those who had never been unemployed. More than half of the long-term unemployed said their family income had declined, and more than 40 percent said that their family relations had been strained and that they had lost contact with close friends. In another finding, 38 percent said they had “lost some self-respect” from being unemployed. One-third said they were finding it difficult to pay their rent or mortgage, compared to only 16 percent of those who had never been unemployed during the recession. Half had borrowed money from family or friends to pay bills, versus only 18 percent of the never unemployed. Of all the people who had been unemployed, almost half had experienced sleep difficulties, and 5 percent had experienced drug or alcohol problems. All these numbers paint a distressing picture of the social and psychological impact of unemployment during the Great Recession that began in late 2007.

Unemployment also has a significant impact on children whose parent or parents are unemployed. The box discusses this impact.

As unemployment soared in the wake of the Great Recession that began in 2007, many more children lived in a household where a parent had become unemployed. By early 2010, 11 percent of American children, or 8.1 million children overall, had an unemployed parent. Just slightly more than two years earlier, this number had been much smaller, 4.8 million. In just over two years, then, the number of children with an unemployed parent grew by two-thirds.

After their parents became unemployed, these children began to suffer various psychological effects. One news report summarized this psychological impact as follows: “For many families across the country, the greatest damage inflicted by this recession has not necessarily been financial, but emotional and psychological. Children, especially, have become hidden casualties, often absorbing more than their parents are fully aware of. Several academic studies have linked parental job loss—especially that of fathers—to adverse impacts in areas like school performance and self-esteem.”

The emotional and psychological effects for children occur for at least two reasons. First, unemployed parents tend to experience extra stress and to become withdrawn. Second, married parents and unmarried partners often experience interpersonal conflict when one of them becomes unemployed. Both of these consequences of unemployment in turn affect children in a household where at least one parent is unemployed.

Children have suffered in other ways from the rise in unemployment. More children have become homeless as their households fell into poverty. In addition, children of an unemployed parent are more likely to repeat a grade or, if they are adolescents, to drop out of school. Child abuse has probably also increased in families where a parent became unemployed.

In view of all these consequences for the children of the unemployed, the United States should do everything possible to put parents and other adults back to work and to help the children of unemployed parents deal with the devastating effects of the Great Recession.

Sources: Lovell & Isaacs, 2010; Luo, 2009Lovell, P., & Isaacs, J. B. (2010). Families of the recession: Unemployed parents & their children. Washington, DC: Brookings Institution; Luo, M. (2009, November 12). Job woes exacting a toll on family life. New York Times, p. A1.

Corporations

One of the most important but controversial features of modern capitalism is the corporation, a formal organization that has a legal existence, including the right to sign contracts, that is separate from that of its members.

Adam Smith, the founder of capitalism, envisioned that individuals would own the means of production and compete for profit, and this is the model the United States followed in its early stage of industrialization. After the Civil War, however, corporations quickly replaced individuals and their families as the owners of the means of production and as the competitors for profit. As corporations grew following the Civil War, they quickly tried to control their markets by, for example, buying up competitors and driving others out of business. To do so, they engaged in bribery, kickbacks, and complex financial schemes of dubious ethics. They also established factories and other workplaces with squalid conditions. Their shady financial practices won their chief executives the name “robber barons” and led the federal government to pass the Sherman Antitrust Act of 1890 designed to prohibit restraint of trade that raised prices (Hillstrom & Hillstrom, 2005).Hillstrom, K., & Hillstrom, L. C. (Eds.). (2005). The industrial revolution in America. Santa Barbara, CA: ABC-CLIO.

More than a century later, corporations have increased in both number and size. Although several million US corporations exist, most are fairly small. Each of the largest five hundred, however, has an annual revenue exceeding $4.3 billion (2011 data) and employs thousands of workers. Their total assets run into the trillions of dollars (Fortune, 2011).Fortune. (2011). Fortune 500. Retrieved January 14, 2012, from money.cnn.com/magazines/fortune/fortune500/2011/full_list. It is no exaggeration to say they control the nation’s economy, as together they produce most of the US private sector output, employ millions of people, and have revenues equal to most of the US gross domestic product. In many ways, the size and influence of corporations stifle the competition that is one of the hallmarks of capitalism. For example, several markets, including that for breakfast cereals, are controlled by four or fewer corporations. This control reduces competition because it reduces the number of products and competitors, and it thus raises prices to the public (Parenti, 2011).Parenti, M. (2011). Democracy for the few (9th ed.). Belmont, CA: Wadsworth.

The last few decades have seen the proliferation and rise of the multinational corporation, a corporation with headquarters in one nation but with factories and other operations in many other nations (Wettstein, 2009).Wettstein, F. (2009). Multinational corporations and global justice: Human rights obligations of a quasi-governmental institution. Stanford, CA: Stanford Business Books. Multinational corporations centered in the United States and their foreign affiliates have more than $17 trillion in assets and employ more than 31 million people (US Census Bureau, 2012).US Census Bureau. (2012). Statistical abstract of the United States: 2012. Washington, DC: US Government Printing Office. Retrieved from www.census.gov/compendia/statab. The assets of the largest multinational corporations exceed those of many of the world’s nations. Often their foreign operations are in poor nations, whose low wages make them attractive sites for multinational corporation expansion. Many multinational employees in these nations work in sweatshops at very low pay and amid substandard living conditions. Critics of this practice say multinationals not only mistreat workers in poor nations but also exploit these nations’ natural resources. In contrast, defenders of the practice say multinationals are bringing jobs to poor nations and helping them achieve economic growth. As this debate illustrates, the dominance of multinational corporations will certainly continue to spark controversy.

As we first discussed in Chapter 8, another controversial aspect of corporations is the white-collar crime in which they engage (Rosoff, Pontell, & Tillman, 2010).Rosoff, S. M., Pontell, H. N., & Tillman, R. (2010). Profit without honor: White collar crime and the looting of America (5th ed.). Upper Saddle River, NJ: Prentice Hall. Price fixing by corporations costs the US public some $60 billion annually (Simon, 2008).Simon, D. R. (2008). Elite deviance (9th ed.). Boston, MA: Allyn and Bacon. Workplace-related illnesses and injuries that could have been prevented if companies had safe workplaces kill about 50,000 workers each year (American Federation of Labor and Congress of Industrial Organizations, 2011).American Federation of Labor and Congress of Industrial Organizations. (2011). Death on the job: The toll of neglect. Washington, DC: Author. An estimated 10,000 US residents die annually from unsafe products, including contaminated food (Consumer Product Safety Commission, 2010; Young, 2010).US Consumer Product Safety Commission. (2010, April 15). 2010 annual report to the president and the Congress. Washington, DC: Author; Young, S. (2010, April 15). E. coli cases down in 2009, CDC says. CNN Health. Retrieved from articles.cnn.com/2010-04-15/health/foodborne.illness.cdc_1_foodnet-cases-of-e-coli-hemolytic-uremic-syndrome?_s= PM:HEALTH. All in all, corporate lawbreaking and neglect probably result in almost 100,000 deaths annually and cost the public more than $400 billion (Barkan, 2012).Barkan, S. E. (2012). Criminology: A sociological understanding (5th ed.). Upper Saddle River, NJ: Prentice Hall.

In sum, corporations are the dominant actors in today’s economy. They provide most of our products and many of our services and employ millions of people. It is impossible to imagine a modern industrial system without corporations. Yet they often stifle competition, break the law, and, according to their critics, exploit people and natural resources in developing nations.

Economic Inequality

In 2011, the Occupy Wall Street movement gave national attention to economic inequality by emphasizing the differences between the “1%” and the “99%.” Proclaiming “We are the 99%,” they decried the concentration of wealth in the richest of the rich and the growing inequality of the last few decades. (See Note 12.24 "People Making a Difference".) The issue of economic inequality merits further attention here.

Before 2011, economic inequality in the United States certainly existed and in fact had increased greatly since the 1970s. However, although economic inequality was a topic of concern to social scientists, it was not a topic of concern to the general news media. Because the news media generally ignored economic inequality, it was also not a topic of concern to the general public.

That all changed beginning on September 17, 2011, when hundreds of people calling themselves “Occupy Wall Street” marched through the financial district in New York City before dozens encamped overnight and for weeks to come. Occupy Wall Street took these actions to protest the role of major banks and corporations in the economic collapse of 2007 and 2008 and to call attention to their dominance over the political process. Within weeks, similar Occupy encampments had spread to more than one hundred cities in the United States and hundreds more across the globe. “We are the 99%,” they said again and again, as “occupy” became a verb heard repeatedly throughout the United States.

By winter, almost all Occupy encampments had ended either because of legal crackdowns or because of the weather conditions. By that time, however, the Occupy protesters had won news media attention everywhere. In a December 2011 poll by the Pew Research Center, 44 percent of Americans supported the Occupy Wall Street movement, while 35 percent opposed it. Almost half (48 percent) said they agreed with the concerns raised by the movement, compared to 30 percent who said they disagreed with these concerns. In the same poll, 61 percent said the US economic system “unfairly favors the wealthy,” while 36 percent said it was fair to all Americans. In a related area, 77 percent said “there is too much power in the hands of a few rich people and corporations.” In all these items, there was a notable difference by political party preference. For example, 91 percent of Democrats agreed that a few rich people and corporations have too much power, compared to 80 percent of Independents and only 53 percent of Republicans.

Regardless of these political differences, Occupy Wall Street succeeded in bringing economic inequality and related issues into the national limelight. In just a few short months in 2011, it made a momentous difference.

Sources: Pew Research Center, 2011; vanden Heuvel, 2012Pew Research Center. (2011, December 15). Frustration with congress could hurt republican incumbents. Retrieved January 19, 2012, from www.people-press.org/files/legacy-pdf/12-15-11%20Congress%20and%20Economy%20release.pdf; vanden Heuvel, K. (2012, January 26) The occupy effect. The Nation. Retrieved from http://www.thenation.com/blog/165883/occupy-effect?rel=emailNation.

Let’s start by defining economic inequality, which refers to the extent of the economic difference between the rich and the poor. Because most societies are stratified, there will always be some people who are richer or poorer than others, but the key question is how much richer or poorer they are. When the gap between them is large, we say that much economic inequality exists; when the gap between them is small, we say that relatively little economic inequality exists.

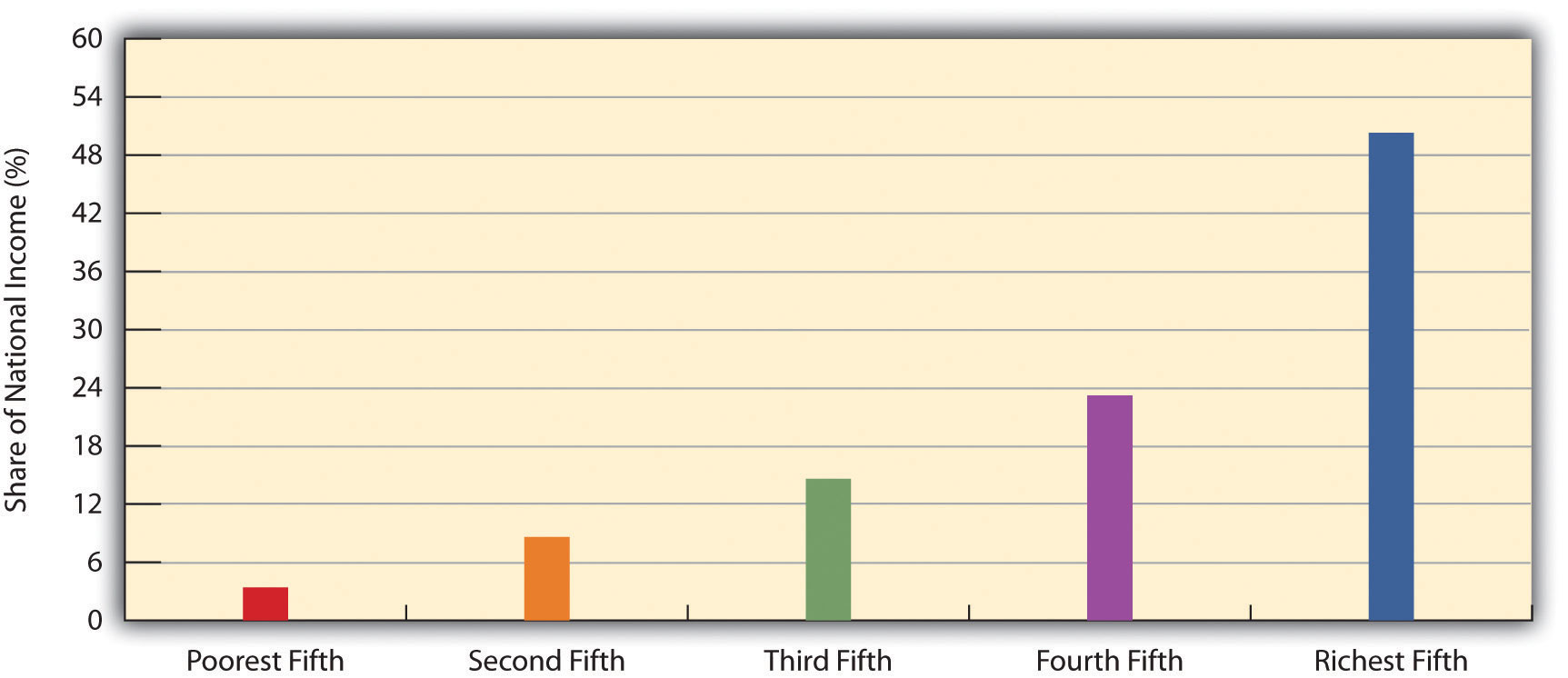

Considered in this light, the United States has a very large degree of economic inequality. A common way to examine inequality is to rank the nation’s families by income from lowest to highest and then to divide this distribution into fifths. Thus we have the poorest fifth of the nation’s families (or the 20 percent of families with the lowest family incomes), a second fifth with somewhat higher incomes, and so on until we reach the richest fifth of families, or the 20 percent with the highest incomes. We then can see what percentage each fifth has of the nation’s entire income. Figure 12.4 shows such a calculation for the United States. The poorest fifth enjoys only 3.3 percent of the nation’s income, while the richest fifth enjoys 50.2 percent. Another way of saying this is that the richest 20 percent of the population have as much income as the remaining 80 percent of the population.

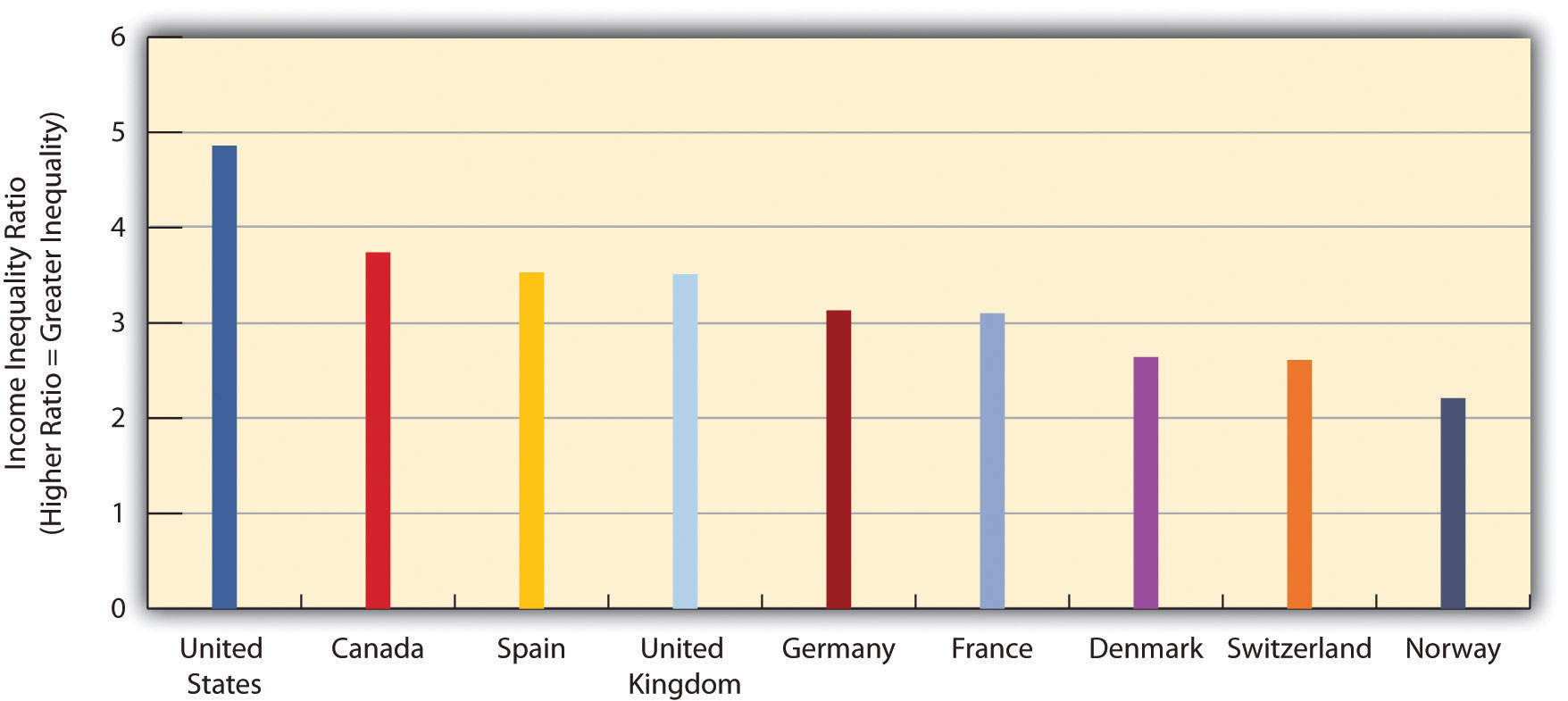

This degree of inequality is the largest in the industrialized world. Figure 12.5 compares the inequality among several industrialized nations by dividing the median income of households in the ninetieth percentile (meaning they have more income than 90 percent of all households) by the median income of households in the tenth percentile (meaning they have more income than only 10 percent of all households); the higher this resulting ninetieth percentile/tenth percentile ratio, the greater a nation’s inequality. The ratio for the United States far exceeds that for any other nation.

The Role of Tax Policy

Economic inequality in the United States has increased during the last three decades. The loss of manufacturing jobs and unions accounts for some of this increase. However, a primary reason for the rising inequality has been tax policy. More specifically, the federal government has implemented steep cuts in the highest tax rates for income from salaries and wages and especially in tax rates for income from dividends and capital gains (Hacker & Pierson, 2011).Hacker, J. S., & Pierson, P. (2011). Winner-take-all politics: How Washington made the rich richer—and turned its back on the middle class. New York, NY: Simon & Schuster. This latter cut is especially important because dividends and capital gains account for a much larger share of the income of wealthy families than the income of ordinary families. To be more specific, dividends and capital gains account for only 0.7 percent of the income of the bottom four-fifths of the nation’s families, but for 18.8 percent of the income of the top fifth, 38.2 percent of the top 1 percent, and a striking 51.9 percent of the top 0.1 percent (Hungerford, 2011).Hungerford, T. L. (2011). Changes in the distribution of income among tax filers between 1996 and 2006: The role of labor income, capital income, and tax policy. Washington, DC: Congressional Research Service. In a related statistic, three-fourths of all capital gains are received by the top 1 percent (Krugman, 2012).Krugman, P. (2012, January 20). Taxes at the top. New York Times, p. A27. Relative to its national wealth, the United States is the lowest-taxed industrial democracy in the world (Leonhardt, 2012).Leonhardt, D. (2012, January 20). Why taxes aren’t as high as they seem. New York Times, p. A15.

Keep this context in mind as we note that tax cuts in 2003 lowered the tax rate for dividends and capital gains from 28 percent to 15 percent. Meanwhile, the top tax rate for income from salaries and wages is 35 percent. Thus many very wealthy families and individuals pay a lower percentage of their income in taxes than many middle- and upper-middle-class families do because so much of the wealthy families’ income is from dividends and capital gains. In fact, the four hundred wealthiest families and individuals in the country pay only about 18 percent of their income in federal tax (Krugman, 2012).Krugman, P. (2012, January 20). Taxes at the top. New York Times, p. A27. As the director of Citizens for Tax Justice explained, “The low taxes on capital gains and dividends are why people who make a ton of money, which is largely from investment income, do awfully well. The Warren Buffetts, the hedge fund managers—they pay really low tax rates” (Confessore, Kocieniewski, & Parker, 2011, p. A1).Confessore, N., Kocieniewski, D., & Parker, A. (2011, January 18). Romney shares some tax data; critics pounce. New York Times, p. A1. This fact prompts a critical question from Paul Krugman, winner of the Nobel Prize in economics: “Is there a good reason why the rich should bear a startlingly light tax burden?” His answer: “Such low taxes on the very rich are indefensible” (Krugman, 2012, p. A27).Krugman, P. (2012, January 20). Taxes at the top. New York Times, p. A27.

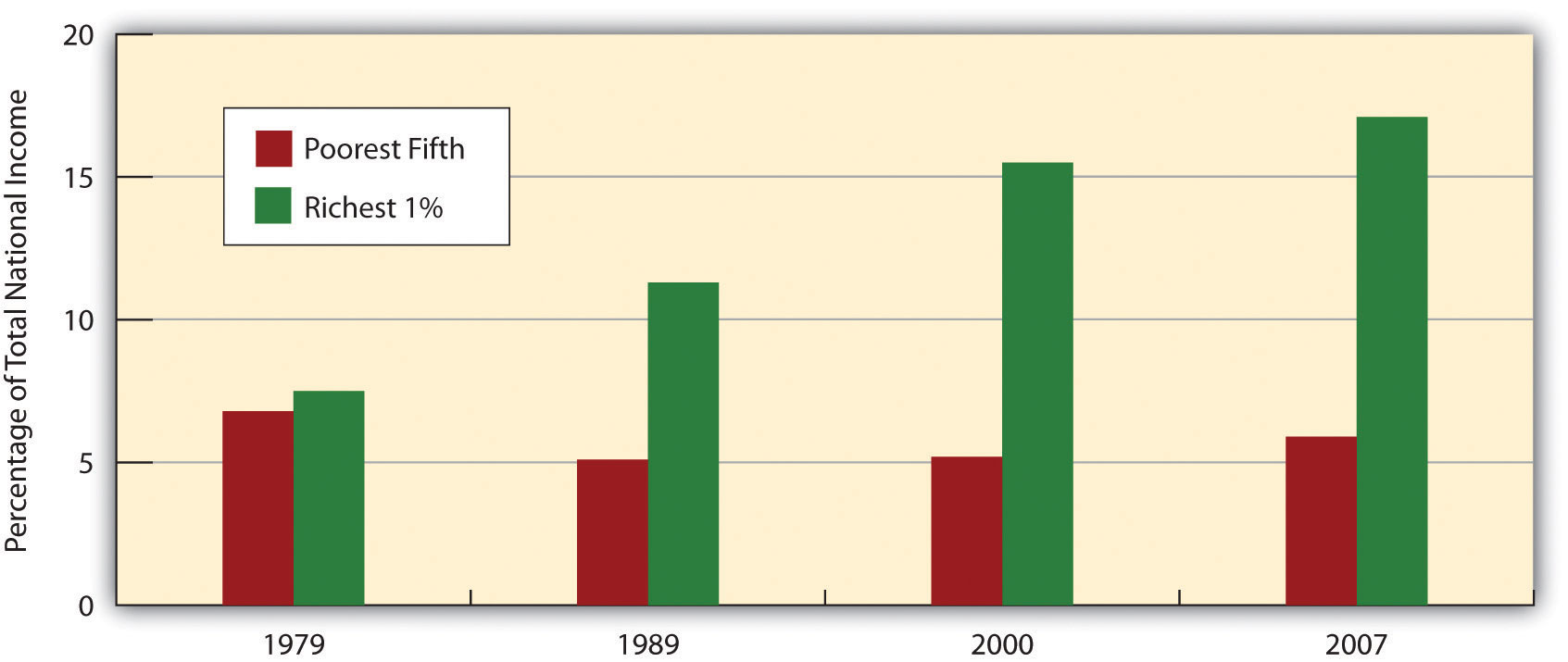

The lowering of tax rates has helped make the nation’s wealthiest families even wealthier. After adjusting for inflation, their after-tax income grew by a much greater amount than that for the poorest families from 1979 to 2007. Income grew by only 18 percent for the poorest fifth but by 65 percent for the wealthiest fifth (excluding the top 1 percent), and it also grew by a whopping 275 percent for families in the top 1 percent (Congressional Budget Office, 2011).Congressional Budget Office. (2011). Trends in the distribution of household income between 1979 and 2007. Retrieved from www.cbo.gov/ftpdocs/124xx/doc12485/WebSummary.pdf. As a result, economic inequality increased. Figure 12.6 shows that wealthiest 1 percent now have a much larger share of the nation’s total posttax income than they did in 1979, while the poorest fifth have a lower share. As the saying goes, the rich get richer, and the poor get poorer.

The Impact of Economic Inequality

Why should we care if economic inequality has increased and if the United States has the highest degree of inequality of all industrial democracies? One answer is that it is a matter of fairness. The United States is not only the wealthiest nation in the world; it is also a nation that historically has stressed that everyone is created equal and that everyone has an equal opportunity to pursue the “American dream” by becoming economically successful. Against this backdrop, a high degree of economic inequality is simply “un-American” and unfair.

Beyond this rather philosophical critique are more practical considerations. First, a high degree of economic inequality is strongly associated with a high degree of poverty and near poverty: If the rich are getting richer, there is normally less wealth to “go around,” and the poor get poorer. For the same reason, high economic inequality is also associated with a shrinking of the middle class. In the United States, as both poverty (and near poverty) and wealth have increased, the size of the middle class has reduced, as the chair of the Council of Economic Advisers has emphasized (Krueger, 2012).Krueger, A. B. (2012). The rise and consequences of inequality in the United States. Retrieved January 19, 2012, from http://www.americanprogress.org/events/2012/01/pdf/krueger.pdf.

Second, a high degree of economic inequality is also associated with low economic mobility (the movement of people up or down the socioeconomic ladder) (Krueger, 2012).Krueger, A. B. (2012). The rise and consequences of inequality in the United States. Retrieved January 19, 2012, from http://www.americanprogress.org/events/2012/01/pdf/krueger.pdf. As noted earlier, the United States is the most economically unequal of all industrial democracies. It also has lower economic mobility: Americans born into poverty or near poverty are less likely than their counterparts in other democracies to be able to move up the socioeconomic ladder (DeParle, 2012).DeParle, J. (2012, January 5). Harder for Americans to rise from lower rungs. New York Times, p. A1.

Next, high economic inequality may slow economic growth. This possible effect occurs for at least three reasons (Krueger, 2012).Krueger, A. B. (2012). The rise and consequences of inequality in the United States. Retrieved January 19, 2012, from http://www.americanprogress.org/events/2012/01/pdf/krueger.pdf. First, the wealthy tend to save their money rather than spend it. Second, a shrinking middle class means there is less spending by the middle class to stimulate the economy. Third, workers’ morale is likely to be lower in a society with higher economic inequality, and their lower morale decreases their productivity. As the chair of the Council of Economic Advisers has stated, “The evidence suggests that a growing middle class is good for the economy, and that a more fair distribution of income would hasten economic growth. Businesses would benefit from restoring more fairness to the economy by having more middle class customers, more stable markets, and improved employee morale and productivity” (Krueger, 2012).Krueger, A. B. (2012). The rise and consequences of inequality in the United States. Retrieved January 19, 2012, from http://www.americanprogress.org/events/2012/01/pdf/krueger.pdf.

Finally, many social scientists consider nations with high degrees of economic inequality to be “unhealthy societies,” to quote the title of a book on this issue (Wilkinson, 1996).Wilkinson, R. G. (1996). Unhealthy societies: The afflictions of inequality. New York, NY: Routledge. Economic inequality is thought to undermine social cohesion and increase polarization, and also to cause other problems (Barash, 2012; Wilkinson & Pickett, 2011).Barash, D. (2012, January 13). The wanton wages of income inequality. The Chronicle of Higher Education. Retrieved from http://chronicle.com/blogs/brainstorm/the-wages-of-inequality/43020?sid=pm&utm_source=pm&utm_medium=en; Wilkinson, R., & Pickett, K. (2011). The spirit level: Why greater equality makes societies stronger. New York, NY: Bloomsbury Press. Among the world’s industrial nations, higher degrees of economic inequality are associated with worse physical and mental health, lower life expectancy, and higher rates of violent crime. High economic inequality, then, is a matter not only of fairness but also of life and death.

Tax Evasion

Another significant problem in the American economy is tax evasion. The Internal Revenue Service (IRS) periodically estimates the amount of tax evasion and derives a figure it calls the tax gap: the difference between what Americans owe in federal taxes and what they actually pay. Much of the annual tax gap results from the failure of professionals such as physicians and attorneys to report self-employment income and from the claiming of false deductions by wealthy individuals and families (Braithwaite, 2009).Braithwaite, V. (2009). Tax evasion. In M. Tonry (Ed.), The Oxford handbook of crime and public policy (pp. 381–405). New York, NY: Oxford University Press.

In January 2012, the IRS released its estimate of the tax gap for 2006. The initial tax gap was $450 billion. After payment of late taxes and certain enforcement efforts, this gap was reduced to $385 billion, still an astronomical figure; tax evasion by corporations amounted for about $70 billion of this amount. The total tax gap is about twenty times greater than the annual economic loss from property crimes such as burglary and motor vehicle theft. In 2006, the federal budget deficit was $248 billion. If everyone had paid the taxes they owed, there would have been no deficit at all, and the federal government in fact would have had a surplus of $137 billion (Pizzigati, 2012).Pizzigati, S. (2012). Law and order 24/7, except at tax time. Retrieved January 14, 2012, from http://toomuchonline.org/tax-gap-law-and-order.

Despite the huge problem of tax evasion, budget cuts in 2011 weakened the ability of the IRS to enforce the tax code. In 2012, the IRS had 3,000 fewer employees working in enforcement than it had in 2010 (Pizzigati, 2012).Pizzigati, S. (2012). Law and order 24/7, except at tax time. Retrieved January 14, 2012, from http://toomuchonline.org/tax-gap-law-and-order.

Crime in the Workplace

An unfortunate fact about work in the United States is crime in the workplace, which is the last problem in work and the economy that we will examine. Two major types of such crime exist: employee theft and workplace violence.

Employee Theft

Employee theft takes two forms: pilferage and embezzlement. Pilferage involves the stealing of goods, while embezzlement involves the stealing of money in its various dimensions (cash, electronic transactions, etc.). Whichever form it takes, employee theft is so common that is has been called a “widespread, pervasive, and costly form of crime” (Langton, Piquero, & Hollinger, 2006, p. 539).Langton, L., Piquero, N. L., & Hollinger, R. C. (2006). An empirical test of the relationship between employee theft and low self-control. Deviant Behavior, 27, 537–565. It is estimated that about 75 percent of employees steal at least once from their employers and that the annual amount of employee theft is $19.5 billion (National Retail Federation, 2007).National Retail Federation. (2007, June 11). Retail losses hit $41.6 billion last year, according to national retail security survey [Press release]. Retrieved from http://www.nrf.com/modules.php?name=News&op=viewlive&sp_id=318.

Employee theft occurs for many reasons, but a common reason is worker dissatisfaction with various aspects of their job. They may think their wages or salaries are too low, they may feel they have been treated unfairly by their employer, and so forth. As the estimates of the amount of employee theft suggest, this form of theft is not condemned by many people, and, indeed, many workplaces have informal norms that approve of certain forms of theft—for example, it is OK to steal inexpensive objects such as (depending on the workplace) utensils, food, pencils and pens, or toilet paper. Not surprisingly, embezzlement is often more costly to an employer than pilferage; although it can involve just a few dollars from a cash register, it can also involve hundreds of thousands or millions of dollars acquired through more sophisticated means.

When we think of employee theft, we probably usually think of theft by blue-collar or lower white-collar employees. However, physicians, attorneys, and other professionals also steal from their patients/clients or from the government, even if their form of theft is often much more complex and sophisticated than what the term “employee theft” may usually imply. Attorneys may bill their clients for work that was never done, and physicians may bill Medicare or private insurance for patients they never saw or for procedures that were never performed. We call this form of “employee” theft professional fraud. Fraud by physicians and other health-care professionals (including nursing homes and medical testing laboratories) is thought to amount to $100 billion every year (Rosoff et al., 2010),Rosoff, S. M., Pontell, H. N., & Tillman, R. (2010). Profit without honor: White collar crime and the looting of America (5th ed.). Upper Saddle River, NJ: Prentice Hall. a figure that far exceeds the $19.5 billion in “conventional” employee theft and the similar figure lost to property crime (robbery, burglary, larceny, and motor vehicle theft).

Workplace Violence

In January 2012, a lumber company employee in North Carolina entered the company’s warehouse armed with a twelve-gauge shotgun. He shot and killed three coworkers and critically wounded another coworker. He then returned home, shot himself in the head, and later died at a hospital. A news report described the gunman as a “disgruntled” employee (Muskal, 2012).Muskal, M. (2012). Man Shoots 4 Co-Workers, Killing 3, Authorities Say. Los Angeles times, January 12, A12.

Many people die or are injured by acts of violence at their workplaces every year in the United States. In 2008, 517 people were slain at their workplaces, according to the US Bureau of Labor Statistics. As disturbing as this number was, it represented a sharp drop from the numbers that prevailed a decade earlier, when 1,080 workplace homicides occurred in 1994. From 2003 through 2008, an average of 497 workplace homicides occurred every year (Needleman, 2010).Needleman, S. E. (2010, August 10). When violence strikes the workplace. The Wall Street Journal. Retrieved from http://online.wsj.com/article/SB10001424052748704164904575421560153438240.html?mod=googlenews_wsj.

In terms of who is involved and the reasons for their involvement, three kinds of workplace homicides are the most common. The first and by far the most common type is homicide as the result of robbery. This category includes the many store clerks, gas station attendants, taxi drivers, and other employees who are slain during a robbery, as well as police who are killed as they try to stop a robbery or apprehend the offender. The second category is homicide committed as an act of domestic violence; in this type, the offender, almost always a man, seeks out his wife or girlfriend (or ex-wife or ex-girlfriend) at her workplace and kills her. The third category involves disgruntled workers, such as the North Carolina lumber employee just discussed, who kill one or more people at their workplace whom they blame for problems the killers have been having. Although this type of homicide is the type that the phrase “workplace violence” or “workplace killings” usually brings to mind, it is actually the least common of the three types listed here (Fox, 2010).Fox, J. A. (2010). Workplace homicide: What is the risk? Retrieved from http://boston.com/community/blogs/crime_punishment/2010/08/workplace_homicide_the_risks.html.