10.1: The Scope and Size of the Federal Government

- Page ID

- 134559

“Paleontologist Robert Gay’s quest to find the fossilized remains of an ancient phytosaur, a primitive ancestor to crocodiles, turned into something much larger last summer when he came upon a major trove of Triassic fossils on public lands recently stripped from Utah’s Bears Ears National Monument.”

–Brian Maffly (1)

“While a discovery of this magnitude certainly is a welcome surprise, protecting such resources was the very purpose of Bears Ears National Monument.”

–Scott Miller (2)

The federal government is quite large in both scope and size. It spends trillions of dollars each year, with operations spanning from providing Social Security to protecting fossils and archeological sites on public lands, from engaging with other countries diplomatically to funding mass transit projects.

Scope of the Federal Government

Scope refers to the range of things that the federal government does. People categorize these activities in numerous different ways.

Social Welfare encompasses programs such as Social Security, Medicare, Medicaid, and the Supplemental Nutrition Assistance Program. These types of programs are located throughout the federal bureaucracy.

War-Making—The Department of Defense encompasses the branches of the armed services (e.g., Army, Navy, Air Force) and represents the United States’ ability to project armed destruction around the globe. It is also responsible for the more than 700 military bases that the Defense Department maintains in the United States and around the world.

Diplomacy—The Department of State is responsible for diplomacy and for carrying out U.S’s non-military foreign policy.

Justice and Law Enforcement—The Department of Justice handles all federal criminal prosecutions and civil suits in which the U.S. government has an interest. Several agencies include the Federal Bureau of Investigation (FBI); the Drug Enforcement Agency (DEA); the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF); and the U.S. Marshall Service. The Department of Homeland Security oversees Immigration and Customs Enforcement (ICE); Customs and Border Protection; and the Federal Emergency Management Agency (FEMA); among many others.

Commerce—A number of federal agencies exist to promote commerce of one sort or another: The Commerce Department, the Department of Agriculture, and the Department of the Interior are the most prominent.

Fiscal and Monetary Issues—The Treasury Department manages the federal government’s finances, manages tax collection through the Internal Revenue Service (IRS), services the federal debt, supervises financial institutions, and goes after counterfeiters. The Federal Reserve System, a quasi-public, quasi-private central banking system for the United States, is charged with stabilizing prices and maximizing employment—two functions that can be at loggerheads. These tasks can be accomplished by adjusting interest rates.

Infrastructure—The Department of Transportation promotes and regulates transportation, including the Federal Highway Administration (FHWA), the Federal Aviation Administration (FAA), and the National Highway Traffic Safety Administration (NHTSA). The Department of Energy regulates nuclear power stations and the country’s national electricity grids. Finally, the Department of Housing and Urban Development (HUD) belongs in this category.

Human Services—The Department of Health and Human Services contains the Centers for Disease Control and Prevention (CDC), the National Institutes of Health (NIH), and the Food and Drug Administration (FDA). It administers Medicare and Medicaid. The Department of Education and the Environmental Protection Agency fit in this category. The Department of Veterans Affairs straddles two categories, since its expenses are a direct result of war-making. The Department of Labor deals with worker safety, compensation, and working conditions.

Another way to understand the federal government’s scope and size is through a historical lens.

| Department | Year Established |

| State | 1789 |

| Treasury | 1789 |

| Justice | 1789 |

| War/Defense | 1789/1949 |

| Interior | 1849 |

| Agriculture | 1889 |

| Commerce | 1913 |

| Labor | 1913 |

| Health and Human Services | 1953 |

| Housing and Urban Development | 1965 |

| Transportation | 1966 |

| Energy | 1967 |

| Environmental Protection Agency | 1970 (elevated to cabinet-level in 1990) |

| Education | 1979 |

| Veterans Affairs | 1987 |

| Homeland Security | 2002 |

Size of the Federal Government

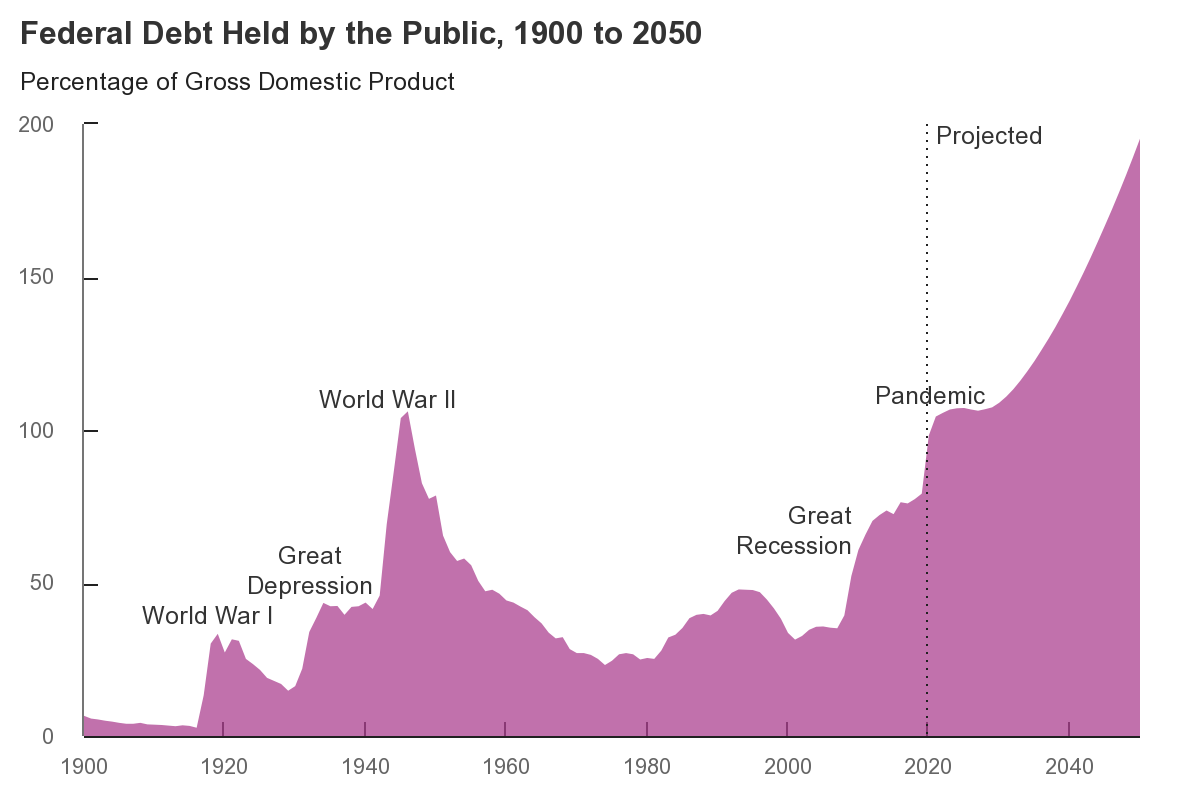

How much does the federal government spend? According to the Treasury Department, in 2021, the federal government spent about $6.8 trillion and took in about $4.0 trillion in revenue. The annual deficit—the shortfall between revenue and spending—is $2.8 trillion dollars. Debt held by the public is all debt owed by the federal government to those outside it such as businesses, banks, foreign governments, and individuals. This image shows how debt has changed over the past 70 years. Notice how historical events have affected debt.

Source: Wikipedia

Economists and political scientists look at the Gross Domestic Product (GDP)—the total value of goods and services produced in a country in one year. This information can be used and compared to other countries. Notice that in 2020, at the height of the Covid-19 Pandemic, GDP went down among many countries. (EU stands for European Union, a political and economic union of 27 member states that are located primarily in Europe. Euro area (EA) is a monetary union of 19 member states of the European Union that have adopted the euro as their primary currency and sole legal tender.)

._NA2021.png?revision=1&size=bestfit&width=745&height=534)

Source: European Union

How many people does the federal government employ? According to the Office of Personnel Management, there are about 2.1 million federal government civilian employees, (6), and an additional 1.3 million active-duty military and Coast Guard employees. (7) The government conducts much work using private contractors—employing people as diverse as private sector soldiers engaged in war zones and janitors hired to maintain federal buildings. Paul Light, New York University public service professor, estimates that the federal government employs some 3.7 million private contractors, plus nearly 500,000 Postal Service employees who are not counted in our federal civilian employee tally. (8) Altogether, 7 and 8 million people receive a federal government paycheck—out of a population of over 330 million people.

What is the size and impact of federal regulations? According to the Federal Register, the federal regulations code totaled 9,745 pages in 1950 and had grown to 185,484 pages by 2018. (9) These regulations range from the Fair Labor Standards Act requirement for companies to pay overtime for nonexempt employees who work more than forty hours per week, to the Affordable Care Act’s provision banning private health insurance companies from denying coverage to people who have pre-existing medical conditions.

The U.S. tax code is several thousand pages long and so complex that the Internal Revenue Service Taxpayer Advocate publishes an annual tax system roadmap. Tax compliance is a multibillion-dollar business in the United States, compared to a country like Japan, whose government collects withholdings so precisely that most workers don’t even have to file a tax return. (12) (Tax compliance costs refer to the time, accountants, software, lawyers, and other expenses that individuals, families, nonprofit organizations, and businesses need to complete their taxes.) Obviously, low and middle-income families who take the standard deduction have less tax compliance costs, But wealthy families and businesses go to considerable lengths to exploit the loopholes built into the tax code. That takes time and the employment specialists who know the code. In terms of time alone, U.S. tax-system compliance may run as high as 8 billion hours of work, even after the 2017 tax bill’s simplifications. (13)

Historical Evolution of the Federal Government

During its first 80 years, the federal government delivered the mail, fought wars and conducted foreign policy, created its own bank, taxed imports, regulated the money supply, and granted patents. Its peacetime military was minuscule compared to the size of the country. Of course, the industrial and technological revolutions were far into the future.

Pre-Civil War-era per-capita federal government spending hovered around $30. In the years following World War I, federal government spending had risen to about $129 per person. By 2004, it had reached $7,100 per capita. (14) The federal government generally balanced its budget during peacetime until the 1930s. In other words, spending matched revenues, i.e. tax receipts. That all changed after World War II. With the exception of the Clinton administration, the budget has been out of balance and the government finances its annual deficits by selling Treasury notes to domestic and international investors.

The federal government has grown due to four main reason

- War--Federal spending spiked during the Civil War, World War I, World War II, the Korean War, the Cold War, the Vietnam War, and the War on Terror. Military equipment had to be built; troops trained, paid, and veterans cared for; and oil had to be purchased so that the U.S. could project power to conflict zones. (The U.S. military has long been one of the world’s largest emitters of greenhouse gases.) Civil liberties were curtailed, and propaganda was used to maintain civilian morale and sufficiently demonize the enemy. To finance the war, it had to raise taxes and sell war bonds and other financial instruments. During World War I, the United States government established the War Industries Board, the War Finance Corporation, and the National War Labor Board to coordinate industrial production and labor relations—a set of government operations that didn’t just fade away after the war ended. (16) Similar government economic regulations ramped up during World War II. Cold War competition with the Soviet Union stimulated everything from atomic weapons and power development to the interstate highway system, commercial airlines, GPS and weather satellites, to the internet

- Corporate demand--Government and businesses are in a symbiotic relationship. While businesses chafe from time to time at “too much” government regulation, on the whole, businesses benefit from the stability and predictability afforded by the government regulating the economy. For example, commercial drone regulation allowed their use in a way that was standardized, predictable, and economically viable. (17) Similar things happen with electricity, automobiles, airlines, pharmaceuticals, cellular communications, and every other large, complex industry. On a more basic level, businesses benefit from publicly financed infrastructure, including roads, bridges, schools, sanitation systems, etc.

- Popular demand--People have demanded national efforts to clean the water and air; to ensure that people have equal employment opportunities regardless of sex, race, religion, or national origin; to fight the scandal of old-age poverty and ill-health; to counter the monopoly power of railroads, steel companies, and internet platforms; to provide health coverage; to protect national parks and public lands; to interdict and disrupt domestic and international terrorists, etc. Government is good when it responds to problems articulated by the general population. People can argue about the government response—whether this healthcare policy is better than that or whether air pollution is best fought via specific regulations or fossil fuel taxes—while recognizing that collective action through government is the best chance to avoid the brutal and nasty conditions of anarchy, which is literally the absence of government. Political Scientist Douglas Amy stated:

[B]ig government is not something that has been forced on Americans by liberal elitists and power-hungry bureaucrats. We have it because we ourselves have demanded big government to deal with the many big problems we have faced in our society. We have called for big government programs when it has been obvious that there are serious problems that cannot be solved through individual effort or by the natural workings of the free market. (18)

- Societal density and complexity. For thousands of years, government size has reflected the types of societies they governed. In 1880, fully 50 percent of the U.S. population worked on farms. By 1920, only 25 percent did, with the majority of Americans living and working in urban centers. (19) According to a 2021 report by the U.S. Department of Agricultural, 83% of the U.S. population lived in urban areas and 14 percent were located in rural regions. In a society with a geographically dispersed population, people simply come into conflict with each other less often, so there is not as much need for police, courts, laws, and regulations. However, complexity and social density act together to promote bigger government because of the rising number and scope of individual and group conflicts. As anthropologist Joseph Tainter indicated, complexity in society gives rise to ever more sophisticated and robust problem-solving mechanisms and processes—most of which involve government. (20)

War, corporate demands, popular demands, and social density and complexity operate on governments all over the world, and can be found in liberal democracies and authoritarian regimes alike.

References

- Brian Maffly, “A Search for an Ancient Crocodile in Utah’s Bears Ears Leads to a Major Discovery of Triassic Fossils,” The Salt Lake Tribune. February 24, 2018.

- Noel Kirkpatrick, “Ancient Fossils Found on Lands Once Part of Bears Ears National Monument,” Mother Nature Network. February 26, 2018.

- Thomas A. Garrett and Russell M. Rhine, “On the Size and Growth of Government,” Federal Reserve Bank of St. Louis Review. January/February 2006.

- USAspending.gov.

- The Office of Management and Budget.

- Congressional Research Service, Federal Workforce Statistics Sources: OPM and OMB. October 24, 2019. Page 4.

- The Department of Defense.

- Paul C. Light, The True Size of Government. The Volcker Alliance Issue Paper. October 2017. Page 3.

- Statistics from the Federal Register.

- Pew Charitable Trusts, Government Regulation: Costs Lower, Benefits Greater than Industry Estimates. May 2015. Page 1.

- The Office of Management and Budget, 2016 Draft Report to Congress on the Benefits and Costs of Federal Regulations and Agency Compliance with the Unfunded Mandates Reform Act.

- Taxpayer Advocate Service Roadmap. Selena Maranjian, “You Won’t Believe How Complex Our Tax System Is—Here’s How to Make Sense of It,” The Motley Fool. July 21, 2019. Demian Brady, “U.S. Tax System Lags in International Comparison,” National Taxpayer Union Foundation. May 1, 2017.

- Demian Brady, “Trump Tax Cuts Eased Complexity and Compliance Burden on American Taxpayers,” Townhall. April 16, 2019.

- Thomas A Garrett and Russell M. Rhine, “On the Size and Growth of Government,” Federal Reserve Bank of St. Louis Review. January/February 2006.

- James C. Scott, Against the Grain. A Deep History of the Earliest States. New Haven, CT: Yale University Press, 2018. Pages 150-182. Paul Kennedy, The Rise and Fall of the Great Powers: Economic Change and Military Conflict from 1500 to 2000. New York: Random House, 1987.

- Paul Johnson, A History of the American People. New York: Harper Collins, 1997. Pages 646-647.

- Dave Marcontell and Steve Douglas, “Why the Use of Drones Still Faces Big Regulatory Hurdles,” Forbes. September 10, 2018. Traci Browne, “Police Drones Market Increases with FAA Rules, Test Cases,” Robotics Business Review. May 8, 2017.

- Douglas J. Amy, “The Real Reason for Big Government,” Huffington Post. August 8, 2012.

- Jill Lepore, These Truths. A History of the United States. New York: W. W. Norton & Co. 2018. Page 375.

- Joseph A. Tainter, The Collapse of Complex Societies. Cambridge, UK: Cambridge University Press, 1988. Note that Tainter’s thesis is that as complexity increases and resources are stretched thin, there is a diminishing marginal return on increased investments in complexity, leading to societal collapse.