6.4: The Structure of Costs in the Long Run

- Last updated

- Save as PDF

- Page ID

- 52841

Skills to Develop

- Calculate total cost

- Identify economies of scale, diseconomies of scale, and constant returns to scale

- Interpret graphs of long-run average cost curves and short-run average cost curves

- Analyze cost and production in the long run and short run

The long run is the period of time when all costs are variable. The long run depends on the specifics of the firm in question—it is not a precise period of time. If you have a one-year lease on your factory, then the long run is any period longer than a year, since after a year you are no longer bound by the lease. No costs are fixed in the long run. A firm can build new factories and purchase new machinery, or it can close existing facilities. In planning for the long run, the firm will compare alternative production technologies (or processes).

In this context, technology refers to all alternative methods of combining inputs to produce outputs. It does not refer to a specific new invention like the tablet computer. The firm will search for the production technology that allows it to produce the desired level of output at the lowest cost. After all, lower costs lead to higher profits—at least if total revenues remain unchanged. Moreover, each firm must fear that if it does not seek out the lowest-cost methods of production, then it may lose sales to competitor firms that find a way to produce and sell for less.

Choice of Production Technology (or Production Function)

Many tasks can be performed with a range of combinations of labor and physical capital. For example, a firm can have human beings answering phones and taking messages, or it can invest in an automated voicemail system. A firm can hire file clerks and secretaries to manage a system of paper folders and file cabinets, or it can invest in a computerized recordkeeping system that will require fewer employees. A firm can hire workers to push supplies around a factory on rolling carts, it can invest in motorized vehicles, or it can invest in robots that carry materials without a driver. Firms often face a choice between buying a many small machines, which need a worker to run each one, or buying one larger and more expensive machine, which requires only one or two workers to operate it. In short, physical capital and labor can often substitute for each other.

Consider the example of a private firm that is hired by local governments to clean up public parks. Three different combinations of labor and physical capital for cleaning up a single average-sized park appear in Table \(\PageIndex{1}\). The first production technology is heavy on workers and light on machines. This is known as a labor-intensive production technique. The next two technologies substitute machines for workers. When there is significantly more capital used the production technique is known as capital-intensive. Since all three of these production methods produce the same thing—one cleaned-up park—a profit-seeking firm will choose the production technology that is least expensive, given the prices of labor and machines.

Table \(\PageIndex{1}\): Three Ways to Clean a Park

| Production technology 1 | 10 workers | 2 machines |

| Production technology 2 | 7 workers | 4 machines |

| Production technology 3 | 3 workers | 7 machines |

Production technology 1 uses the most labor and least machinery, while production technology 3 uses the least labor and the most machinery. Table \(\PageIndex{2}\) outlines three examples of how the total cost will change with each production technology as the cost of labor changes. As the cost of labor rises from example \(A\) to \(B\) to \(C\), the firm will choose to substitute away from labor and use more machinery.

Table \(\PageIndex{2}\): Total Cost with Rising Labor Costs

| Example A: Workers cost $40, machines cost $80 | |||

| Labor Cost | Machine Cost | Total Cost | |

| Cost of technology 1 | 10 × $40 = $400 | 2 × $80 = $160 | $560 |

| Cost of technology 2 | 7 × $40 = $280 | 4 × $80 = $320 | $600 |

| Cost of technology 3 | 3 × $40 = $120 | 7 × $80 = $560 | $680 |

| Example B: Workers cost $55, machines cost $80 | |||

| Labor Cost | Machine Cost | Total Cost | |

| Cost of technology 1 | 10 × $55 = $550 | 2 × $80 = $160 | $710 |

| Cost of technology 2 | 7 × $55 = $385 | 4 × $80 = $320 | $705 |

| Cost of technology 3 | 3 × $55 = $165 | 7 × $80 = $560 | $725 |

| Example C: Workers cost $90, machines cost $80 | |||

| Labor Cost | Machine Cost | Total Cost | |

| Cost of technology 1 | 10 × $90 = $900 | 2 × $80 = $160 | $1,060 |

| Cost of technology 2 | 7 × $90 = $630 | 4 × $80 = $320 | $950 |

| Cost of technology 3 | 3 × $90 = $270 | 7 × $80 = $560 | $830 |

Example \(A\) shows the firm’s cost calculation when wages are \(\$40\) and machines costs are \(\$80\). In this case, technology 1 is the low-cost production technology. In example \(B\), wages rise to \(\$55\), while the cost of machines does not change, in which case technology 2 is the low-cost production technology. If wages keep rising up to \(\$90\), while the cost of machines remains unchanged, then technology 3 clearly becomes the low-cost form of production, as shown in example \(C\).

This example shows that as an input becomes more expensive (in this case, the labor input), firms will attempt to conserve on using that input and will instead shift to other inputs that are relatively less expensive. This pattern helps to explain why the demand curve for labor (or any input) slopes down; that is, as labor becomes relatively more expensive, profit-seeking firms will seek to substitute the use of other inputs. When a multinational employer like Coca-Cola or McDonald’s sets up a bottling plant or a restaurant in a high-wage economy like the United States, Canada, Japan, or Western Europe, it is likely to use production technologies that conserve on the number of workers and focuses more on machines. However, that same employer is likely to use production technologies with more workers and less machinery when producing in a lower-wage country like Mexico, China, or South Africa.

Returns to Scale

The concept of returns to scale describes the rate of increase in production relative to the associated increase in the factors of production in the long run. In other words, it describes how effectively and efficiently—or, profitably—a firm is producing its goods or services. In the long run, all factors of production are variable (not fixed) and can scale up. Therefore, the scale of production can be changed by changing the quantity of all factors of production.

Conceptualizing returns to scale is an effort to specifically understand how production increases relative to factors contributing to production. Production functions typically include capital as well as labor. Our production function is noted Q=F(K,L).

The difference between economies of scale and returns to scale is that economies of scale show the effect of an increased output level on unit costs, while the return to scale focus only on the relation between input and output quantities.

Increasing Returns to Scale

Increasing returns to scale take place when all the factors of production increase in a given proportion and the output increases at a greater rate than that of the increase in factors of production.

For example, if the factors of production are doubled, then the output will be more than doubled.

Constant Returns to Scale

Constant returns to scale occurs when the output increases in exactly the same proportion as the factors of production. In other words, when inputs (i.e. capital and labor) increase by 50%, outputs likewise increase by 50% as a result.

For example, if the factors of production are doubled, then the output will also be exactly doubled.

Diminishing (or Decreasing) Returns to Scale

Diminishing or decreasing returns to scale takes place when all the factors of production increase in a given proportion, but the output increases at a lesser rate than that of the increase in factors of production.

For example, if the factors of production are doubled, then the output will be less than doubled.

Economies of Scale

Once a firm has determined the least costly production technology, it can consider the optimal scale of production, or quantity of output to produce. Many industries experience economies of scale. Economies of scale refers to the situation where, as the quantity of output goes up, the cost per unit goes down. This is the idea behind “warehouse stores” like Costco or Walmart. In everyday language: a larger factory can produce at a lower average cost than a smaller factory.

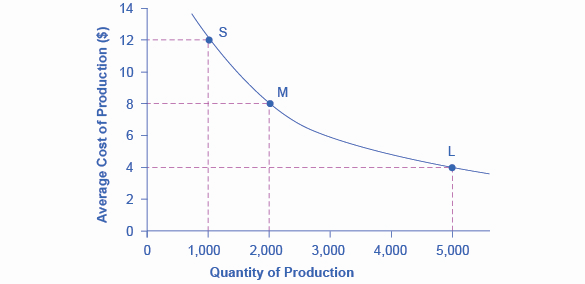

Figure \(\PageIndex{1}\) illustrates the idea of economies of scale, showing the average cost of producing an alarm clock falling as the quantity of output rises. For a small-sized factory like \(S\), with an output level of \(1,000\), the average cost of production is \(\$12\) per alarm clock. For a medium-sized factory like \(M\), with an output level of \(2,000\), the average cost of production falls to \(\$8\) per alarm clock. For a large factory like \(L\), with an output of \(5,000\), the average cost of production declines still further to \(\$4\) per alarm clock.

Economies of Scale

Figure \(\PageIndex{1}\): A small factory like \(S\) produces 1,000 alarm clocks at an average cost of $12 per clock. A medium factory like \(M\) produces 2,000 alarm clocks at a cost of $8 per clock. A large factory like \(L\) produces 5,000 alarm clocks at a cost of $4 per clock. Economies of scale exist because the larger scale of production leads to lower average costs.

The average cost curve in Figure \(\PageIndex{1}\) may appear similar to the average cost curves presented earlier in this chapter, although it is downward-sloping rather than U-shaped. But there is one major difference. The economies of scale curve is a long-run average cost curve, because it allows all factors of production to change. The short-run average cost curves presented earlier in this chapter assumed the existence of fixed costs, and only variable costs were allowed to change.

One prominent example of economies of scale occurs in the chemical industry. Chemical plants have a lot of pipes. The cost of the materials for producing a pipe is related to the circumference of the pipe and its length. However, the volume of chemicals that can flow through a pipe is determined by the cross-section area of the pipe. The calculations in Table \(\PageIndex{3}\) show that a pipe which uses twice as much material to make (as shown by the circumference of the pipe doubling) can actually carry four times the volume of chemicals because the cross-section area of the pipe rises by a factor of four (as shown in the Area column).

Table \(\PageIndex{3}\): Comparing Pipes: Economies of Scale in the Chemical Industry

| Circumference (\(2\pi r\)) | Area (\(\pi r^2\)) | |

|---|---|---|

| 4-inch pipe | 12.5 inches | 12.5 square inches |

| 8-inch pipe | 25.1 inches | 50.2 square inches |

| 16-inch pipe | 50.2 inches | 201.1 square inches |

A doubling of the cost of producing the pipe allows the chemical firm to process four times as much material. This pattern is a major reason for economies of scale in chemical production, which uses a large quantity of pipes. Of course, economies of scale in a chemical plant are more complex than this simple calculation suggests. But the chemical engineers who design these plants have long used what they call the “six-tenths rule,” a rule of thumb which holds that increasing the quantity produced in a chemical plant by a certain percentage will increase total cost by only six-tenths as much.

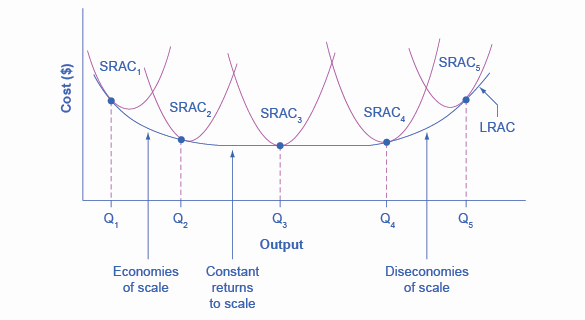

Shapes of Long-Run Average Cost Curves

While in the short run firms are limited to operating on a single average cost curve (corresponding to the level of fixed costs they have chosen), in the long run when all costs are variable, they can choose to operate on any average cost curve. Thus, the long-run average cost (LRAC) curve is actually based on a group of short-run average cost (SRAC) curves, each of which represents one specific level of fixed costs. More precisely, the long-run average cost curve will be the least expensive average cost curve for any level of output. Figure \(\PageIndex{2}\) shows how the long-run average cost curve is built from a group of short-run average cost curves. Five short-run-average cost curves appear on the diagram. Each \(SRAC\) curve represents a different level of fixed costs. For example, you can imagine \(SRAC_1\) as a small factory, \(SRAC_2\) as a medium factory, \(SRAC_3\) as a large factory, and \(SRAC_4\) and \(SRAC_5\) as very large and ultra-large. Although this diagram shows only five \(SRAC\) curves, presumably there are an infinite number of other \(SRAC\) curves between the ones that are shown. This family of short-run average cost curves can be thought of as representing different choices for a firm that is planning its level of investment in fixed cost physical capital—knowing that different choices about capital investment in the present will cause it to end up with different short-run average cost curves in the future.

Figure \(\PageIndex{2}\): The five different short-run average cost (SRAC) curves each represents a different level of fixed costs, from the low level of fixed costs at \(SRAC_1\) to the high level of fixed costs at \(SRAC_5\). Other \(SRAC\) curves, not shown in the diagram, lie between the ones that are shown here. The long-run average cost (\(LRAC\)) curve shows the lowest cost for producing each quantity of output when fixed costs can vary, and so it is formed by the bottom edge of the family of \(SRAC\) curves. If a firm wished to produce quantity \(Q_3\), it would choose the fixed costs associated with \(SRAC_3\).

The long-run average cost curve shows the cost of producing each quantity in the long run, when the firm can choose its level of fixed costs and thus choose which short-run average costs it desires. If the firm plans to produce in the long run at an output of \(Q_3\), it should make the set of investments that will lead it to locate on \(SRAC_3\), which allows producing \(Q_3\) at the lowest cost. A firm that intends to produce \(Q_3\) would be foolish to choose the level of fixed costs at \(SRAC_2\) or \(SRAC_4\). At \(SRAC_2\) the level of fixed costs is too low for producing \(Q_3\) at lowest possible cost, and producing q3 would require adding a very high level of variable costs and make the average cost very high. At \(SRAC_4\), the level of fixed costs is too high for producing \(Q_3\) at lowest possible cost, and again average costs would be very high as a result.

The shape of the long-run cost curve, as drawn in Figure \(\PageIndex{2}\), is fairly common for many industries. The left-hand portion of the long-run average cost curve, where it is downward- sloping from output levels \(Q_1\) to \(Q_2\) to \(Q_3\), illustrates the case of economies of scale. In this portion of the long-run average cost curve, larger scale leads to lower average costs. This pattern was illustrated earlier in Figure \(\PageIndex{1}\).

In the middle portion of the long-run average cost curve, the flat portion of the curve around \(Q_3\), economies of scale have been exhausted. In this situation, allowing all inputs to expand does not much change the average cost of production. In this range of the \(LRAC\) curve, the average cost of production does not change much as scale rises or falls. The following Clear it Up feature explains where diminishing marginal returns fit into this analysis.

How do economies of scale compare to diminishing marginal returns?

The concept of economies of scale, where average costs decline as production expands, might seem to conflict with the idea of diminishing marginal returns, where marginal costs rise as production expands. But diminishing marginal returns refers only to the short-run average cost curve, where one variable input (like labor) is increasing, but other inputs (like capital) are fixed. Economies of scale refers to the long-run average cost curve where all inputs are being allowed to increase together. Thus, it is quite possible and common to have an industry that has both diminishing marginal returns when only one input is allowed to change, and at the same time has increasing or constant economies of scale when all inputs change together to produce a larger-scale operation.

Finally, the right-hand portion of the long-run average cost curve, running from output level \(Q_4\) to \(Q_5\), shows a situation where, as the level of output and the scale rises, average costs rise as well. This situation is called diseconomies of scale. A firm or a factory can grow so large that it becomes very difficult to manage, resulting in unnecessarily high costs as many layers of management try to communicate with workers and with each other, and as failures to communicate lead to disruptions in the flow of work and materials. It is difficult for overly large factories to exist in the real world, because with their very high production costs, they are unable to compete for long against plants with lower average costs of production.

Diseconomies of scale can also be present across an entire firm, not just a large factory. The leviathan effect can hit firms that become too large to run efficiently, across the entirety of the enterprise. Firms that shrink their operations are often responding to finding itself in the diseconomies region, thus moving back to a lower average cost at a lower output level.

The Size and Number of Firms in an Industry

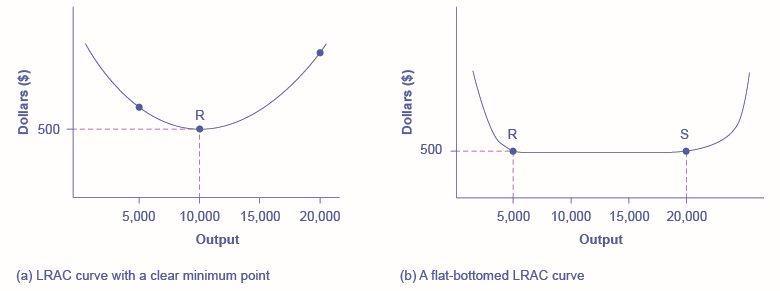

The shape of the long-run average cost curve has implications for how many firms will compete in an industry, and whether the firms in an industry have many different sizes, or tend to be the same size. For example, say that one million dishwashers are sold every year at a price of \(\$500\) each and the long-run average cost curve for dishwashers is shown in Figure \(\PageIndex{3}\) (a). In Figure \(\PageIndex{3}\) (a), the lowest point of the \(LRAC\) curve occurs at a quantity of \(10,000\) produced. Thus, the market for dishwashers will consist of \(100\) different manufacturing plants of this same size. If some firms built a plant that produced \(5,000\) dishwashers per year or \(25,000\) dishwashers per year, the average costs of production at such plants would be well above \(\$500\), and the firms would not be able to compete.

The LRAC Curve and the Size and Number of Firms

Figure \(\PageIndex{3}\): (a) Low-cost firms will produce at output level R. When the \(LRAC \)curve has a clear minimum point, then any firm producing a different quantity will have higher costs. In this case, a firm producing at a quantity of 10,000 will produce at a lower average cost than a firm producing, say, 5,000 or 20,000 units. (b) Low-cost firms will produce between output levels \(R\) and \(S\). When the \(LRAC\) curve has a flat bottom, then firms producing at any quantity along this flat bottom can compete. In this case, any firm producing a quantity between 5,000 and 20,000 can compete effectively, although firms producing less than 5,000 or more than 20,000 would face higher average costs and be unable to compete.

How can cities be viewed as examples of economies of scale?

Why are people and economic activity concentrated in cities, rather than distributed evenly across a country? The fundamental reason must be related to the idea of economies of scale—that grouping economic activity is more productive in many cases than spreading it out. For example, cities provide a large group of nearby customers, so that businesses can produce at an efficient economy of scale. They also provide a large group of workers and suppliers, so that business can hire easily and purchase whatever specialized inputs they need. Many of the attractions of cities, like sports stadiums and museums, can operate only if they can draw on a large nearby population base. Cities are big enough to offer a wide variety of products, which is what many shoppers are looking for.

These factors are not exactly economies of scale in the narrow sense of the production function of a single firm, but they are related to growth in the overall size of population and market in an area. Cities are sometimes called “agglomeration economies.”

These agglomeration factors help to explain why every economy, as it develops, has an increasing proportion of its population living in urban areas. In the United States, about \(80\%\) of the population now lives in metropolitan areas (which include the suburbs around cities), compared to just \(40\%\) in 1900. However, in poorer nations of the world, including much of Africa, the proportion of the population in urban areas is only about \(30\%\). One of the great challenges for these countries as their economies grow will be to manage the growth of the great cities that will arise.

If cities offer economic advantages that are a form of economies of scale, then why don’t all or most people live in one giant city? At some point, agglomeration economies must turn into diseconomies. For example, traffic congestion may reach a point where the gains from being geographically nearby are counterbalanced by how long it takes to travel. High densities of people, cars, and factories can mean more garbage and air and water pollution. Facilities like parks or museums may become overcrowded. There may be economies of scale for negative activities like crime, because high densities of people and businesses, combined with the greater impersonality of cities, make it easier for illegal activities as well as legal ones. The future of cities, both in the United States and in other countries around the world, will be determined by their ability to benefit from the economies of agglomeration and to minimize or counterbalance the corresponding diseconomies.

A more common case is illustrated in Figure \(\PageIndex{3}\) (b), where the \(LRAC\) curve has a flat-bottomed area of constant returns to scale. In this situation, any firm with a level of output between \(5,000\) and \(20,000\) will be able to produce at about the same level of average cost. Given that the market will demand one million dishwashers per year at a price of \(\$500\), this market might have as many as \(200\) producers (that is, one million dishwashers divided by firms making \(5,000\) each) or as few as \(50\) producers (one million dishwashers divided by firms making \(20,000\) each). The producers in this market will range in size from firms that make \(5,000\) units to firms that make \(20,000\) units. But firms that produce below \(5,000\) units or more than \(20,000\) will be unable to compete, because their average costs will be too high. Thus, if we see an industry where almost all plants are the same size, it is likely that the long-run average cost curve has a unique bottom point as in Figure \(\PageIndex{3}\) (a). However, if the long-run average cost curve has a wide flat bottom like Figure \(\PageIndex{3}\) (b), then firms of a variety of different sizes will be able to compete with each other.

The flat section of the long-run average cost curve in Figure \(\PageIndex{3}\) (b) can be interpreted in two different ways. One interpretation is that a single manufacturing plant producing a quantity of \(5,000\) has the same average costs as a single manufacturing plant with four times as much capacity that produces a quantity of \(20,000\). The other interpretation is that one firm owns a single manufacturing plant that produces a quantity of \(5,000\), while another firm owns four separate manufacturing plants, which each produce a quantity of \(5,000\). This second explanation, based on the insight that a single firm may own a number of different manufacturing plants, is especially useful in explaining why the long-run average cost curve often has a large flat segment—and thus why a seemingly smaller firm may be able to compete quite well with a larger firm. At some point, however, the task of coordinating and managing many different plants raises the cost of production sharply, and the long-run average cost curve slopes up as a result.

In the examples to this point, the quantity demanded in the market is quite large (one million) compared with the quantity produced at the bottom of the long-run average cost curve (\(5,000\), \(10,000\) or \(20,000\)). In such a situation, the market is set for competition between many firms. But what if the bottom of the long-run average cost curve is at a quantity of 10,000 and the total market demand at that price is only slightly higher than that quantity—or even somewhat lower?

Return to Figure \(\PageIndex{3}\) (a), where the bottom of the long-run average cost curve is at \(10,000\), but now imagine that the total quantity of dishwashers demanded in the market at that price of \(\$500\) is only \(30,000\). In this situation, the total number of firms in the market would be three. A handful of firms in a market is called an “oligopoly,” and the chapter on Monopolistic Competition and Oligopoly will discuss the range of competitive strategies that can occur when oligopolies compete.

Alternatively, consider a situation, again in the setting of Figure \(\PageIndex{3}\) (a), where the bottom of the long-run average cost curve is \(10,000\), but total demand for the product is only \(5,000\). (For simplicity, imagine that this demand is highly inelastic, so that it does not vary according to price.) In this situation, the market may well end up with a single firm—a monopoly—producing all \(5,000\) units. If any firm tried to challenge this monopoly while producing a quantity lower than \(5,000\) units, the prospective competitor firm would have a higher average cost, and so it would not be able to compete in the longer term without losing money. The chapter on Monopoly discusses the situation of a monopoly firm.

Thus, the shape of the long-run average cost curve reveals whether competitors in the market will be different sizes. If the \(LRAC\) curve has a single point at the bottom, then the firms in the market will be about the same size, but if the \(LRAC\) curve has a flat-bottomed segment of constant returns to scale, then firms in the market may be a variety of different sizes.

The relationship between the quantity at the minimum of the long-run average cost curve and the quantity demanded in the market at that price will predict how much competition is likely to exist in the market. If the quantity demanded in the market far exceeds the quantity at the minimum of the \(LRAC\), then many firms will compete. If the quantity demanded in the market is only slightly higher than the quantity at the minimum of the \(LRAC\), a few firms will compete. If the quantity demanded in the market is less than the quantity at the minimum of the \(LRAC\), a single-producer monopoly is a likely outcome.

Shifting Patterns of Long-Run Average Cost

New developments in production technology can shift the long-run average cost curve in ways that can alter the size distribution of firms in an industry.

For much of the twentieth century, the most common change has been to see alterations in technology, like the assembly line or the large department store, where large-scale producers seemed to gain an advantage over smaller ones. In the long-run average cost curve, the downward-sloping economies of scale portion of the curve stretched over a larger quantity of output.

However, new production technologies do not inevitably lead to a greater average size for firms. For example, in recent years some new technologies for generating electricity on a smaller scale have appeared. The traditional coal-burning electricity plants needed to produce \(300\) to \(600\) megawatts of power to exploit economies of scale fully. However, high-efficiency turbines to produce electricity from burning natural gas can produce electricity at a competitive price while producing a smaller quantity of \(100\) megawatts or less. These new technologies create the possibility for smaller companies or plants to generate electricity as efficiently as large ones. Another example of a technology-driven shift to smaller plants may be taking place in the tire industry. A traditional mid-size tire plant produces about six million tires per year. However, in 2000, the Italian company Pirelli introduced a new tire factory that uses many robots. The Pirelli tire plant produced only about one million tires per year, but did so at a lower average cost than a traditional mid-sized tire plant.

Controversy has simmered in recent years over whether the new information and communications technologies will lead to a larger or smaller size for firms. On one side, the new technology may make it easier for small firms to reach out beyond their local geographic area and find customers across a state, or the nation, or even across international boundaries. This factor might seem to predict a future with a larger number of small competitors. On the other side, perhaps the new information and communications technology will create “winner-take-all” markets where one large company will tend to command a large share of total sales, as Microsoft has done in the production of software for personal computers or Amazon has done in online bookselling. Moreover, improved information and communication technologies might make it easier to manage many different plants and operations across the country or around the world, and thus encourage larger firms. This ongoing battle between the forces of smallness and largeness will be of great interest to economists, businesspeople, and policymakers.

Amazon

Traditionally, bookstores have operated in retail locations with inventories held either on the shelves or in the back of the store. These retail locations were very pricey in terms of rent. Amazon has no retail locations; it sells online and delivers by mail. Amazon offers almost any book in print, convenient purchasing, and prompt delivery by mail. Amazon holds its inventories in huge warehouses in low-rent locations around the world. The warehouses are highly computerized using robots and relatively low-skilled workers, making for low average costs per sale. Amazon demonstrates the significant advantages economies of scale can offer to a firm that exploits those economies.

Key Concepts and Summary

A production technology refers to a specific combination of labor, physical capital, and technology that makes up a particular method of production.

In the long run, firms can choose their production technology, and so all costs become variable costs. In making this choice, firms will try to substitute relatively inexpensive inputs for relatively expensive inputs where possible, so as to produce at the lowest possible long-run average cost.

Economies of scale refers to a situation where as the level of output increases, the average cost decreases. Constant returns to scale refers to a situation where average cost does not change as output increases. Diseconomies of scale refers to a situation where as output increases, average costs increase also.

The long-run average cost curve shows the lowest possible average cost of production, allowing all the inputs to production to vary so that the firm is choosing its production technology. A downward-sloping \(LRAC\) shows economies of scale; a flat \(LRAC\) shows constant returns to scale; an upward-sloping \(LRAC\) shows diseconomies of scale. If the long-run average cost curve has only one quantity produced that results in the lowest possible average cost, then all of the firms competing in an industry should be the same size. However, if the \(LRAC\) has a flat segment at the bottom, so that a range of different quantities can be produced at the lowest average cost, the firms competing in the industry will display a range of sizes. The market demand in conjunction with the long-run average cost curve determines how many firms will exist in a given industry.

If the quantity demanded in the market of a certain product is much greater than the quantity found at the bottom of the long-run average cost curve, where the cost of production is lowest, the market will have many firms competing. If the quantity demanded in the market is less than the quantity at the bottom of the \(LRAC\), there will likely be only one firm.

Glossary

- constant returns to scale

- expanding all inputs proportionately does not change the average cost of production

- diseconomies of scale

- the long-run average cost of producing each individual unit increases as total output increases

- long-run average cost (LRAC) curve

- shows the lowest possible average cost of production, allowing all the inputs to production to vary so that the firm is choosing its production technology

- production technologies

- alternative methods of combining inputs to produce output

- short-run average cost (SRAC) curve

- the average total cost curve in the short term; shows the total of the average fixed costs and the average variable costs