20.5: The Impact of Policy on Growth

- Last updated

- Save as PDF

- Page ID

- 3565

- Boundless

- Boundless

Incentivizing Saving and Investment

The government can incentivize savings and investment by changing the relative cost of taking each action.

learning objectives

- Explain how the governments incentivize saving and investment

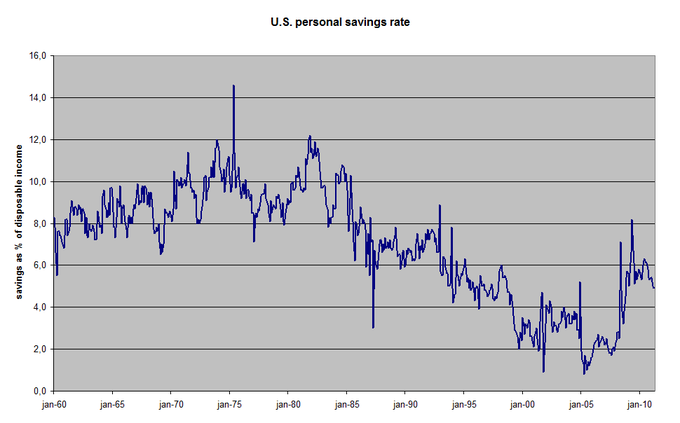

Governments have a strong interest in affecting the savings and investments in an economy. Both savings and investment affect the overall economy. For example, if an economy is overheating, a government might want to disincentivize investment or consumption, and would therefore be interested in increasing the savings rate. If an economy is in a recession, a government would want to encourage savers to start spending or investing their money.

US Savings Rate: The US government may want to increase the savings rate if the economy is in a downturn, and increase it if the economy is overheating.

There are a number of ways in through which a government can incentivize savings and investment. Broadly, each incentive adjusts the cost of saving or investing. We will discuss two main ways to affect the savings and investment rates here.

Monetary Policy

One of the main tools of central banks is the interest rate that it charges banks to hold their money overnight. This rate is ultimately passed on to the bank’s depositors. Depositors, in turn, adjust their levels of savings and investment based on that rate.

Take, for example, a high interest rate. At a high interest rate, it is very expensive to borrow money: investors will not want to invest because they have to pay a lot of interest on their loans. Savers, on the other hand, love high interest rates: they earn a lot simply by keeping their cash in the bank. High interest rates encourage savings and discourage investment.

The precise opposite is true for low interest rates. When rates are low, investors know they can borrow money to finance investments cheaply. At the same time, savers aren’t earning much by keeping their money in the bank. Low interest rates encourage investment and discourage savings.

Much of a central bank’s actions are focused on adjusting how much people save and invest.

Taxes

The government can also incentivize savings and investment in a number of ways. The most common way of doing so is by adjusting tax rates. Governments offer individuals and firms who take the action it desires. For example, a government can offer a tax break to companies that are investing in a desirable area (e.g. medicine). It can also encourage savings through tax breaks. Roth IRAs are an instrument for saving for retirement that the US has made tax exempt (under certain conditions). In the first example, the government uses tax reductions to encourage investment for companies. In the second, the government encourages saving by helping savers earn more of the interest they earn over time in the savings vehicle.

Improving Education and Health Outcomes

A country can impact its long-term growth by affecting human capital through education and healthcare investments.

learning objectives

- Analyze the long-run implications on growth from education and healthcare policies

Both education and healthcare are important because they have short- and long-term costs, and significantly affect the level of human capital in an economy. If a country can set up its education and healthcare systems to maximize the growth of human capital, it can also significantly impact its long-term economic growth prospects.

Education Economics and Policies

Education economics studies economic issues related to education, such as the demand for education and the financial cost of education. It studies the relationship between schooling and the labor market. By making educational policies and spending money now, a country ensures that it will have the necessary human capital to expand its economy.

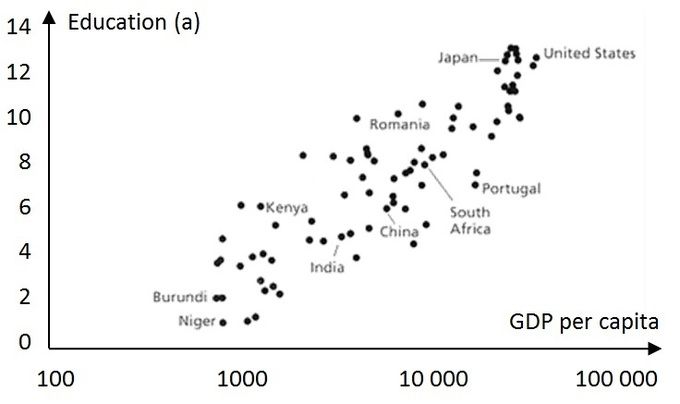

Human capital requires investment, but also provides economic returns. As education increases human capital increases, countries will also expect to see higher productivity, wages, and the GDP.

Impact of Education on GDP: This graph shows the positive relationship between education and per capita GDP of a country. As the number of years of education within a country increase, so does the per capita GDP.

Economics is one field of study that researches the effectiveness of education policies. Education policies are designed to cover all education fields from early childhood education through college graduate programs. Policies focus on school size, class size, school choice, tracking, teacher education and certification, teacher pay, teaching methods, curricular content, and graduation requirements. To ensure economic growth, a country must have strong education policies.

Health Economics and Policies

Health economics is the branch of economics that focuses on issues relating to the efficiency, effectiveness, value, and behavior in the production and consumption of health and healthcare. In this field, economists study the function of healthcare systems and public health-affecting behaviors. Health economics focuses on the following topics:

- What influences health

- What is health and what is its value

- What is the demand for healthcare

- What is the supply for healthcare

- Macro-economic evaluation at treatment level

- Market equilibrium

- Evaluation of the whole healthcare system

- Planning, budgeting, and monitoring the system

Although health is not directly related to human capital, it is obvious that without health and life human capital will be impacted negatively. Health policies are the decisions, plans, and actions that are undertaken in a country to achieve specific healthcare goals. According to the World Health Organization, a successful health policy defines a vision for the future, it outlines national priorities regarding health, and it builds a consensus and informs the public.

Health policies can have positive long-run effects on not only human capital, but also economic growth as a whole. Health policies are designed to educate society and improve the current and long-term health of a country. Examples of health policy topics include: vaccination policies, tobacco control, and pharmaceutical policies.

Furthermore, healthcare can constitute a large part of a country’s expenditures. Determining the structure of the healthcare system (private, public, regulated, etc.) can have large economic consequences, and therefore is of great interest to the government.

Defining and Defending Property Rights

Property rights are theoretical constructs that determine how a resource is used and owned.

learning objectives

- Explain the economic consequences of property rights

Property Rights

Property rights are theoretical constructs that determine how a resource is used and owned. Resources can be owned and used by governments, collective bodies, or individuals. There are four broad components of property rights. They are the right to:

- use the good,

- earn income from the good,

- transfer the good to others, and

- enforce the property rights.

Property usually refers to ownership and control over a good or resource. Ownership means that the entity or individual has the rights to the proceeds of the output that the property generates.

Types of Property Rights

Property rights are determined based on the level of transaction costs associated with the rights. The transaction costs are the costs of defining, monitoring, and enforcing the property rights. The four types of property rights are:

- Open access property: this type of property is not owned by anyone. For this reason, no one can exclude anyone else from using it. It is possible though that one’s person use of the property will reduce the quantity available to others. Open access property is not managed by anyone and access to it is not controlled. Examples include the atmosphere or ocean fisheries.

- State property: also known as public property, this type of property is owned by all, but its access and use is controlled by the state. An example would be a national park.

- Common property: also called collective property, this type of property is owned by a group of individuals. The joint owners control the access, use, and exclusion of the property.

- Private property: use of this type of property is exclude. Private property use and access is managed and controlled by a private owner or a legal group of owners.

Defending Property Rights

For any good, property rights must be monitored and the possession of the rights must be enforced. The rights are put in place to control, monitor, and exclude the use of the stated property. Property rights protect not only land, but also goods, services, and finances associated with the land itself. Corruption impacts the private and public sectors because it increases the cost of doing business and distorts markets.

The concept of property rights are closely related to the law in terms of defending the rights. There is a difference between an economist’s view of property rights and the view of the law, but both work together to reach the final goal of securing and maintaining the rights. For example, suppose a thief steals a good. The thief has economic property right to the good because it is in his possession – he has the ability to use the good. However, the thief does not have legal property right to use the good – by law he is not permitted to have access to or use of the good. Economics sets the property rights and the law is used to enforce the rights. Each of the four types of property rights differ in the amount of money and defense needed to ensure that the rights are upheld. The greater the restrictions that property rights place, the more likely that defense of the rights will be needed.

Yosemite National Park: This picture is a view at Yosemite National Park. National parks in the United States are state property. Access and use of the park is controlled and enforced by the state.

Promoting Free Trade

Government can promote free trade by reducing tariffs, quotas, and non-tariff barriers.

learning objectives

- Describe the effects of free trade and trade barriers on long run growth

Free trade is a policy by which a government does not discriminate against imports or interfere with exports by applying tariffs (to imports), subsidies (to exports), or quotas. According to the law of comparative advantage, the policy permits trading partners mutual gains from trade of goods and services.

Government Barriers to Free Trade

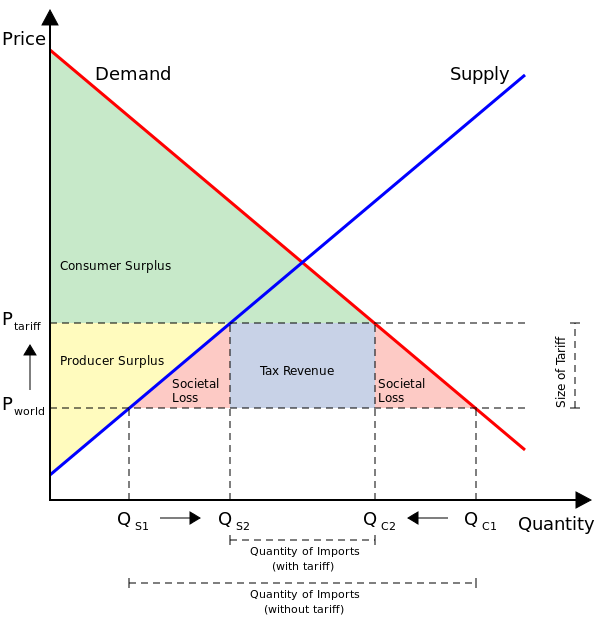

There are a number of barriers to free trade that governments can mitigate, most importantly, tariffs (government imposed import taxes) and quotas (government imposed limits on the quantity of a good that can be imported). Tariffs and quotas are explicit government policies that are designed to protect domestic producers, even if they are not the most efficient producers.

Loss Due to Tariffs: There are a number of reasons why governments place tariffs or other barriers to free trade, but they necessarily reduce overall societal welfare. Governments can promote free trade and impact economic growth.

In addition to tariffs and quotas, there are a number of other barriers to free trade that countries use. Broadly, they are categorized as non-tariff barriers (NTBs). NTBs come in a variety of forms. One example of an NTB are product standard requirements. A country can set high quality standards for a product, knowing that not all foreign producers will be able to meet the standard. Another way that countries can implement NTBs is through customs procedures. Countries can force foreign exporters to fill out arduous paperwork over the course of months, and perhaps in a language the foreign producer does not speak. NTBs act just like tariffs and quotas in that they are barriers to free trade.

Government Promotion of Free Trade

Countries that recognize the benefits for growth from promoting free trade can take unilateral, bilateral, or multilateral action to reduce some of these barriers to trade.

Unilateral promotion of free trade is when a country decides to reduce its own trade barriers without any promise of action from its trading partners. This would lead to a reduction in import prices, but could be unpopular with domestic industries who are not afforded lower barriers in the countries with which they wish to trade.

Bilateral promotion of free trade is when two countries come to an agreement to reduce barriers together. This solves the problem of one country giving the benefit of reduced barriers to foreign exporters without any promise of similar benefits in return.

Multilateral promotion of free trade is when a group of countries agree to reduce their barriers together. Examples of multilateral promotion of free trade are trade agreements such as the North American Free Trade Agreement (NAFTA) in which the US, Mexico, and Canada agreed to allow free trade among one another.

Reducing barriers to free trade may be politically difficult, but due to the law of comparative advantage, will allow for increased overall surplus for each trading partner in the long run.

Investing in Research and Development

The government can establish intellectual property laws, directly conduct research, or finance research and development.

learning objectives

- Describe the appropriate role of government in research and development

The government has the ability to encourage or discourage research and development. The government can do so by creating a good structure of intellectual property protection, called, broadly, patent law. It can also directly intervene and encourage or discourage research and development in a specific area of interest to the government or society that is not currently being addressed by the market.

Investing in research and development is important because it can result in new products, technologies, or processes. Thus, research and development can improve productivity or simply improve the welfare of society.

This atom will first discuss how the government can establish a patent system, and then ways in which it can directly affect the level of research and development in an economy.

Patents

Patents are temporary monopolies granted to inventors by the government, in exchange for public disclosure of how the invention works. They are one of the basic forms of intellectual property. Essentially, a patent gives the holder the right to exclude others from, among other things, using, selling, and making the claimed invention.

Patents and, more broadly, intellectual property rights, are important because they encourage investment in research. Without intellectual property protection, researchers would be worried that, once they make a breakthrough, competitors would simply sell their product. The original researcher would have made the investment in the research, but would have to compete with others once the research becomes able to generate revenue.

Direct Government Research

When the government directly conducts research, it hires its own scientists, engineers, etc. to study a particular issue. For example, NASA is a government agency that also does research.

Indirect Government Research

The government also finances research and development that it does not directly conduct. Such financing often takes the form of grants given to researchers in companies or organizations by the government. The government incentivizes the researches by making the research financially affordable (or more affordable). Not all research is financed, however. The grants are given to projects that are valuable either to the government or to society as a whole. Such grants can be viewed through the lens of market failure: the open market is not financing a socially or government-desirable project, so the government steps in to correct the failure.

NASA’s Research and Development: The moon landing was the result of research and development conducted directly by a government agency.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- monetary policy. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/monetary_policy. License: CC BY-SA: Attribution-ShareAlike

- 11 Investment incentive scheme information | Office of the Information Commissioner Queensland. Provided by: Queensland Government. Located at: www.oic.qld.gov.au/annotated-...me-information. License: CC BY-SA: Attribution-ShareAlike

- The Maryland Entrepreneur's Guide/Tax Credit and Incentive Programs. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/The_Mar...ntive_Programs. License: CC BY-SA: Attribution-ShareAlike

- Monetary policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Monetary_policy. License: CC BY-SA: Attribution-ShareAlike

- Interest rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Interest_rate. License: CC BY-SA: Attribution-ShareAlike

- Savings. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Savings. License: CC BY-SA: Attribution-ShareAlike

- Roth IRA. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Roth_IRA. License: CC BY-SA: Attribution-ShareAlike

- US personal savings rate. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...vings_rate.png. License: CC BY-SA: Attribution-ShareAlike

- economic growth. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/economic_growth. License: CC BY-SA: Attribution-ShareAlike

- Health economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Health_economics. License: CC BY-SA: Attribution-ShareAlike

- Healthcare policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Healthcare_policy. License: CC BY-SA: Attribution-ShareAlike

- Education policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Education_policy. License: CC BY-SA: Attribution-ShareAlike

- Education economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Education_economics. License: CC BY-SA: Attribution-ShareAlike

- Economic growth. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_growth. License: CC BY-SA: Attribution-ShareAlike

- human capital. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/human%20capital. License: CC BY-SA: Attribution-ShareAlike

- US personal savings rate. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...vings_rate.png. License: CC BY-SA: Attribution-ShareAlike

- Average years of schooling versus GDP per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Av...per_capita.jpg. License: Public Domain: No Known Copyright

- Property rights (economics). Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Propert...ts_(economics). License: CC BY-SA: Attribution-ShareAlike

- resource. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/resource. License: CC BY-SA: Attribution-ShareAlike

- property rights. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/property_rights. License: CC BY-SA: Attribution-ShareAlike

- US personal savings rate. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...vings_rate.png. License: CC BY-SA: Attribution-ShareAlike

- Average years of schooling versus GDP per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Av...per_capita.jpg. License: Public Domain: No Known Copyright

- Yosemite National Park. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ional_Park.jpg. License: Public Domain: No Known Copyright

- Free trade. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Free_trade. License: CC BY-SA: Attribution-ShareAlike

- Understanding Global Trade Policy. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Underst...l_Trade_Policy. License: CC BY-SA: Attribution-ShareAlike

- Tariff. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Tariff. License: CC BY-SA: Attribution-ShareAlike

- Trade agreement. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Trade_agreement. License: CC BY-SA: Attribution-ShareAlike

- Import quota. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Import_quota. License: CC BY-SA: Attribution-ShareAlike

- Non-tariff barriers to trade. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Non-tar...riers_to_trade. License: CC BY-SA: Attribution-ShareAlike

- tariff. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/tariff. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//business/d...tive-advantage. License: CC BY-SA: Attribution-ShareAlike

- US personal savings rate. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...vings_rate.png. License: CC BY-SA: Attribution-ShareAlike

- Average years of schooling versus GDP per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Av...per_capita.jpg. License: Public Domain: No Known Copyright

- Yosemite National Park. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ional_Park.jpg. License: Public Domain: No Known Copyright

- EffectOfTariff. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:EffectOfTariff.svg. License: CC BY: Attribution

- Grant (money). Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Grant_(money). License: CC BY-SA: Attribution-ShareAlike

- US Patent Law. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/US_Patent_Law. License: CC BY-SA: Attribution-ShareAlike

- List of federally funded research and development centers. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/List_of...opment_centers. License: CC BY-SA: Attribution-ShareAlike

- Funding of science. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Funding...unded_research. License: CC BY-SA: Attribution-ShareAlike

- Market failure. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Market_failure. License: CC BY-SA: Attribution-ShareAlike

- NASA. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/NASA. License: CC BY-SA: Attribution-ShareAlike

- research and development. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/researc...%20development. License: CC BY-SA: Attribution-ShareAlike

- intellectual property. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/intellectual_property. License: CC BY-SA: Attribution-ShareAlike

- US personal savings rate. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...vings_rate.png. License: CC BY-SA: Attribution-ShareAlike

- Average years of schooling versus GDP per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Av...per_capita.jpg. License: Public Domain: No Known Copyright

- Yosemite National Park. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ional_Park.jpg. License: Public Domain: No Known Copyright

- EffectOfTariff. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:EffectOfTariff.svg. License: CC BY: Attribution

- Buzz salutes the U.S.nFlag. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Bu..._U.S._Flag.jpg. License: Public Domain: No Known Copyright