10.3: Monetary Policy Objectives and Instrument Targets

- Page ID

- 11846

A central bank can use the power it has over the monetary base and interest rates to pursue any one of three possible instrument targets. It might:

- Control the foreign exchange rate, or

- Control the money supply, or

- Control the inflation rate.

However, it must choose. Controlling one of these instrument targets uses all the central bank’s power, and it cannot pursue a second target at the same time.

The central bank chooses among these instrument targets based on its judgment as to which target will achieve the best results in terms of its broad monetary policy objective: to promote economic stability at potential output with low inflation. The Bank of Canada has conducted its monetary policy in terms of each of these instruments at different times in the recent past.

From our discussion of the foreign exchange market in Chapter 9, we know that changes in interest rates will result in changes in the foreign exchange rate. Wealth holders shift their financial portfolios between assets of different countries based on differences in interest rates and bond yields between countries. Rather than allow private supply and demand in the foreign exchange market to set the exchange rate, the central bank can intervene to control the rate. It buys or sells foreign exchange in the market, which affects the supply or demand for Canadian dollars in the foreign exchange market and changes the exchange rate.

Purchases or sales in the foreign exchange market change the domestic monetary base just like open market operations in domestic money market. The domestic money supply and interest rates change until the difference between domestic and foreign interest rates is eliminated. To maintain a fixed exchange rate target, the central bank matches domestic interest rates to those set in the country to which it wishes to fix its exchange rate. In Canada, for example, to fix the exchange rate between the Canadian dollar and the U. S. dollar, the Bank of Canada would set its interest rate equal to that set by the Federal Reserve.2

Exchange rate target: monetary policy maintains a fixed price for foreign currency in terms of domestic currency.

A central bank may choose to fix the exchange rate because it believes that is the best way to achieve the broader objectives of monetary policy. Canada operated with fixed exchange rates from 1962 to 1970. The Canadian-dollar price of the U.S. dollar was fixed at $1.075, and the Bank of Canada focused its monetary policy on that target. During the late 1950s and early 1960s, there was an intense debate over the monetary policy pursued by the Bank of Canada. Economic growth was slow, unemployment rates were high, and there was turmoil in financial markets. A fixed exchange rate was seen as the best solution to these economic problems. It essentially gave Canada the monetary policy of the United States, where economic performance had been stronger and more stable than in Canada. The fixed exchange rate target determined Canadian interest rates and money supply until 1970.

Rather than fixing the exchange rate, a central bank can choose to fix the size or growth rate of the domestic money supply. In Chapter 9 we discussed the money market in terms of a fixed money supply. However, central banks have found that the money multiplier, based on the desired reserve ratios of the banks and cash ratios of the public, is not stable enough to give them control of the money supply directly through their control of the monetary base. Instead, they set interest rates to get their target money supply from the demand for money. If money supply is above their target, they raise interest rates, reducing the demand for money until money holdings fall within their target range. They reduce interest rates if money holdings are less than their target.

In the 1970s, a sharp rise in inflation shifted the focus of monetary policy toward inflation control. At that time, developments in economic theory emphasized a strong link between money, money supply growth, and inflation. Central banks in many industrial countries shifted their focus to money supply control. Canada had dropped the fixed exchange rate target in 1970. In 1975, the Bank of Canada adopted money supply targets as its policy instrument and used them until 1982 in an attempt to control inflation and promote a strong economy. By adjusting interest rates based on its understanding of the demand for money balances, the Bank was able to meet the targets for the growth in the money supply M1 that it set and revised from time to time.

Money supply target: a central bank adjusts interest rates and the monetary base to control the nominal money supply, or the rate of growth of the nominal money supply.

However, controlling the money supply required wide fluctuations in interest rates and in the exchange rate. Financial markets did not like this volatility. More importantly, success in controlling M1 did not bring success in controlling inflation. The relationship between money supply, prices, and inflation turned out to be less stable than expected. The Bank abandoned its M1 control targets in 1982 and began a search for a better target for monetary policy.

In the early 1990s, the Bank of Canada and central banks in many other countries, including Australia, New Zealand, Sweden, the United Kingdom, and the European Union, decided to set explicit inflation rate targets for monetary policy. The Bank of Canada began to use interest rate setting as its monetary policy instrument, making changes in the interest rate, as necessary, to keep the Canadian inflation rate within a target range of 1 percent to 3 percent.

The shifts to formal inflation targets for monetary policy in 1991, and the adjustment to that policy shift, were sources of a substantial policy debate in Canada. Inflation was reduced as planned, but with a deep and prolonged recession in real GDP and persistently high rates of unemployment. Sustained economic growth did not resume until the mid-1990s, and by most estimates, including those by the Bank of Canada, the recessionary GDP gap persisted until the end of the decade.3 The Bank continues today to focus on an inflation rate in the 1 percent to 3 percent range as its monetary policy target. A summary of the costs and benefits of inflation that lie behind its inflation targeting are offered by the Bank of Canada at: http://goo.gl/Kh7okG.

Inflation rate target: monetary policy objective defined as an announced target inflation rate.

Monetary policy instrument: the monetary variable the central bank manipulates in pursuit of its policy target.

Bank of Canada operating techniques

In Canada, the overnight rate is now the Bank of Canada’s key policy instrument. This is the interest rate that large financial institutions receive or pay on loans from one day until the next. The Bank implements monetary policy by setting a target for the overnight rate at the midpoint of an operating band that is plus or minus one-quarter of one percentage point, or 25 basis points, from the target rate.

Overnight rate: the interest rate large financial institutions receive or pay on loans from one day until the next.

The bank rate now marks the upper end of this operating band for the overnight rate. It is still the rate at which the Bank of Canada is willing to lend to the banks. The lower end of the operating band, the deposit rate, is the interest rate the Bank of Canada pays on deposits. Because the highest cost of borrowing cash is the bank rate, and the lowest return from lending cash is the deposit rate paid by the Bank of Canada, the rate on overnight borrowing and lending among the banks falls within the target range set by the Bank of Canada.

The Bank of Canada tells financial markets the direction in which it wants interest rates to move, by making changes to its target overnight rate and operating band. Changes in the target overnight rate lead to changes in interest rates banks offer to lenders and depositors. A lower target lowers bank lending rates, encouraging more borrowing by households and businesses and a corresponding expansion in the money supply.

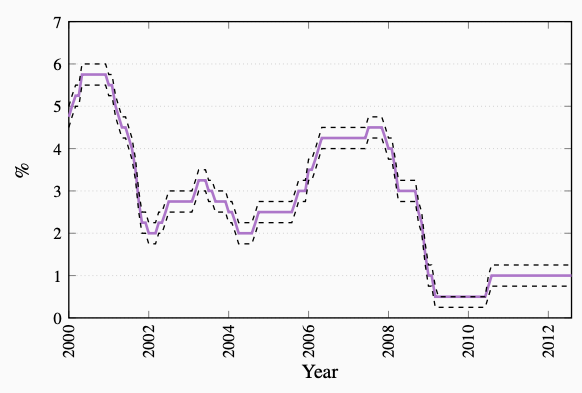

Figure 10.2 shows the Bank’s settings and changes of the overnight interest rate operating band over the past 13 years. From mid-2004 to late 2007 period, for example, the plot shows the Bank raised its overnight rate setting by steps of 0.25 percent (25 basis points) from 2.5 percent to 4.5 percent. Its intention was to reduce monetary stimulus to keep the economy working at potential output, with projected growth of real GDP at 3.0 percent and projected inflation at its target 2.0 percent.

Figure 10.2: The Bank of Canada operating band for the overnight rate

Source: Statistics Canada, CANSIM Series V39076, V39077, V39079

By contrast from July 2007 to March 2009 the Bank cut its setting for the overnight rate, in steps of 25 to 75 basis points, by a total of 400 basis points from 4.5 percent to 0.5 percent. Its intention then was to provide stimulus to and support for domestic financial markets and economic activity as the global financial crisis developed and spread. You can read a brief analysis underlying each of the Bank’s decisions to change or hold constant its overnight rate target in the press releases on the Bank’s website: http://goo.gl/w63EiJ.

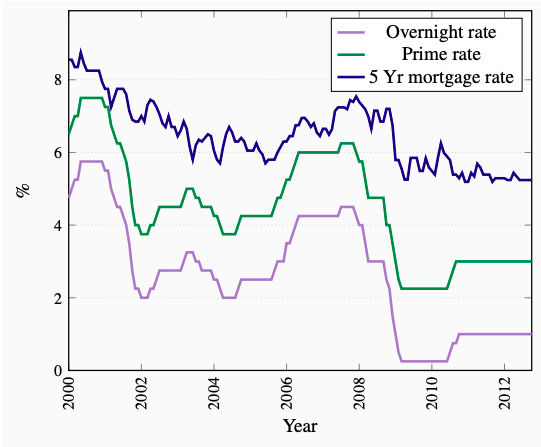

By setting the overnight interest rate the Bank has a direct impact on interest rates that are important to the monetary transmission mechanism. Banks respond to a rise in the overnight rate by raising their prime lending rate, which is the base for most of the interest rates on their lending. Rates on business and consumer lines of credit, for example, are linked to the prime rate, and move up and down with it. The connection to mortgage rates is also strong and they move with the overnight rate, although the link is not quite as tight. These interest rates cover about two thirds of bank financing in Canada. They make a strong link between the Bank of Canada’s monetary policy action, expenditure, and aggregate demand. Figure 10.3 shows the relationship between changes in the setting of the overnight rate and other interest rates.

Prime lending rate: the base for setting the interest rates charged by banks on loans and lines of credit.

Figure 10.3: The overnight rate, prime rate and 5 year mortgage rate

Source: Statistics Canada, CANSIM Series V39079, V122495, V122521.

Other countries implement monetary policy by setting similar interest rates. The overnight rate set by the Bank of Canada is comparable to the United States Federal Reserve’s target for the federal funds rate, and the Bank of England’s two-week “repo rate,” and the minimum bid rate for refinancing operations, the repo rate, set by the European Central Bank.

Institutional arrangements are the key to the Bank of Canada’s use of the overnight rate as its policy instrument. The payments made by individuals and businesses, and their receipts, flow through the banking system. Some are small paper-based transactions that involve the writing of cheques on deposit accounts. Others, and indeed the majority, are transfers of large deposits between bank customers. On any day, an individual bank may take in more deposits through these transfers than it pays out, or pay out more than it takes in. Any difference in either case is settled using balances held on deposit at the Bank of Canada. Technology now allows for same day settlement of large-value transactions, and an individual bank’s settlement balances can change quickly.

Chartered banks in Canada operate under a zero settlement balance requirement. This means that the balances they hold in their deposit accounts at the Bank of Canada cannot be less than zero at the end of the day. If a bank’s account is overdrawn from making payments to other banks, it must borrow to cover the overdraft either from another bank or from the Bank of Canada. Borrowing from other banks costs the overnight rate. Borrowing from the Bank of Canada costs the bank rate, which is set by the Bank of Canada one-quarter of a percentage point above the overnight rate. As a result, falling short of the zero-balance requirement imposes a cost on a bank, reducing its profitability, which it would like to avoid.

A positive settlement balance also imposes a cost. The Bank of Canada does pay interest on a positive balance in a bank’s account, but it pays at its deposit rate. That rate is set one-quarter of one percentage point below the overnight rate. Not lending a positive balance to another bank at the overnight rate and accepting the Bank of Canada’s deposit rate carries an opportunity cost a bank would prefer to avoid. This is a further incentive to maintain a zero settlement balance at the Bank of Canada.

This regulatory and institutional environment gives the Bank of Canada a framework for setting the interest rate to implement its monetary policy. The Bank makes eight scheduled announcements about its target for the overnight rate, and the operating band it is setting for the overnight rate. These announcements are made in press releases and include a brief explanation of the economic conditions on which the Bank’s rate-setting decision is based.

Special Purchases and Sales (SPRAs and SRAs)

To maintain the overnight interest rate within the target band, the Bank of Canada must intervene in the market to cover any shortages or remove any surpluses of funds that would push rates beyond its target. The Bank has two tools it uses for this purpose.

One tool is the special purchase and resale agreement (SPRA). This is a transaction initiated by the Bank of Canada that puts cash into the system on a very short-term basis. It is used to maintain the target overnight rate, more specifically to offset upward pressure on the rate.

In an SPRA, the Bank offers to buy Government of Canada securities from major financial institutions with an agreement to sell them back the next business day, at a predetermined price. The financial market gets an overnight injection of monetary base. The difference between the purchase and resale price determines the overnight interest rate on the transactions. Banks are willing to enter into these agreements with the Bank of Canada because they provide cash for the banks at rates of interest below what they would otherwise have to pay in the overnight market.

SPRA: A Bank of Canada purchase of securities one day combined with an agreed resale of the securities the next day.

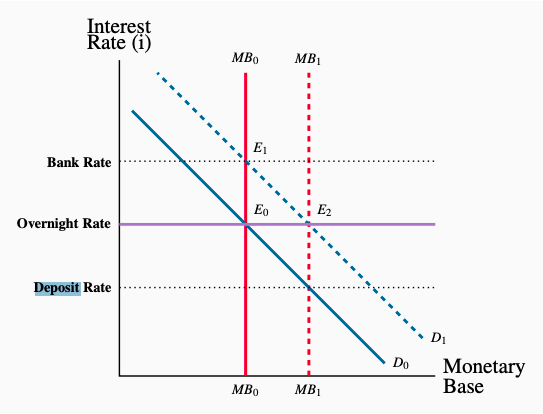

Figure 10.4 shows how this works. We start in equilibrium at E0 with the demand for cash reserves just equal to the supply of monetary base at the overnight rate set by the Bank. Suppose a change in economic and financial circumstances causes a temporary increase in the demand for cash and settlement balances. The demand for monetary base shifts to the right to D1. If the Bank took no action the overnight rate would rise to E1 above the target the Bank has set. To prevent this, the Bank provides an overnight increase in the monetary base by buying securities on the agreement that it will sell them back the next business day. This is an SPRA. It gives a temporary increase in monetary base to MB1 and reinforces the Bank’s overnight rate.

Figure 10.4: Setting the Overnight Interest Rate

In the opposite case of a fall in the demand for monetary base, the Bank makes use of a second tool to reduce the monetary base namely a sale and repurchase agreement (SRA). This is a sale of securities to major financial institutions for one day combined with a repurchase the following day. It makes a one day reduction on the monetary base to offset a drop in the demand for cash that has put downward pressure on the overnight rate.

SRA: A Bank of Canada sale of securities one day combined with an agreed repurchase of the securities the next day.

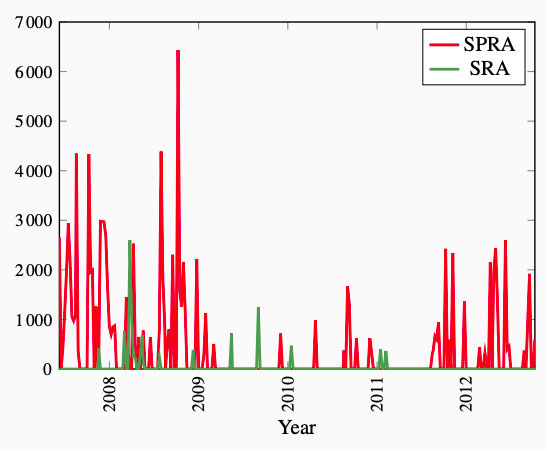

Figure 10.5 shows the pattern of Bank of Canada interventions in the overnight money market. Although these interventions occur daily, the data plotted in the graph are weekly totals of dollar amounts involved in those interventions. In the period covered by the graph, the Bank was reacting in the latter half of 2007 to upward pressure on the overnight rate. It provided overnight funds to the market using SPRAs: purchasing securities with the agreement to sell them back the next business day. Then, in the first half of 2008, the Bank used SRAs to maintain its overnight rate target by offsetting downward pressure on the rate. However, by mid-summer the developing financial crisis increased the demand for liquidity and concerns about a recession led to reductions in the overnight rate target supported by substantial SPRAs. A period of relative tranquility in the overnight market followed, involving relatively small SRA and SPRA activity. Then starting in mid-summer 2011 SPRA’s were used frequently to provide overnight funds and offset upward pressure on the overnight rate.

Figure 10.5: Bank of Canada SPRAs and SRAs (weekly totals)

Source: Statistics Canada, CANSIM Table 176-0073.

Special purchase and resale agreements, SPRAs, provide overnight in-

creases in monetary base to offset upward pressure on the overnight rate.

Sale and repurchase agreements, SRAs, make overnight reductions in mon-

etary base to offset downward pressure on the overnight rate.

The data in the graph shows Band of Canada SPRAs offsetting strong up-

ward pressure on the rate from demands for liquidity during the financial

crisis of 2007-08. A period of relative balance between supply and demand

in the overnight market followed until mid 2011. Then Bank SPRAs again

offset upward rate pressure from some excess demand for overnight funds.

What if the increased demand for monetary base is permanent, not just a one-day event? In Chapter 8 we saw how the demand for monetary base comes from public demand and from bank demand for cash and reserve balances. Increases in nominal income increase the demand for money, including cash. Let’s suppose the increased demand for monetary base we see in Figure 10.4 is permanent, the result of growth in the economy. Now, if the Bank of Canada wants to keep the overnight rate constant, it must make a permanent increase in the monetary base, not just an overnight increase. It will do this using the open-market operations we discussed earlier. An open-market purchase of government securities makes a lasting increase in the Bank of Canada’s asset holdings, permanently increasing the monetary base.

While these operations by the Bank of Canada may seem quite complex, they have a simple effect. Like open-market operations, SPRAs and SRAs increase or decrease the monetary base. In this case, however, the buyers and sellers in the market are limited to a few major financial institutions rather than the full market. Furthermore, changes in the monetary base are very short-term, just one day. The objective is to set and control short-term interest rates, the monetary policy instrument used by the Bank of Canada.

2We study different exchange rate policies in detail in Chapter 14.

3You can read about this debate in: D. Laidler, and Wm. Robson, The Great Canadian Disinflation: The Economics and Politics of Monetary Policy in Canada 1988-1993 (Toronto: C.D. Howe Institute, 1993). P. Fortin, “The Great Canadian Slump,” Canadian Journal of Economics 29, No. 4 (August 1996), pp. 1082-1092. C. Freedman and T. Macklem, “A Comment on the ’Great Canadian Slump’ ”, Canadian Journal of Economics 31, No. 3 (August 1998), pp. 646-665.