5.6: Adjustments to Output Gaps?

- Page ID

- 11814

Potential output is real GDP when all markets are in equilibrium. Output gaps indicate disequilibrium in some markets. If we leave the short run and drop the assumption that factor prices are constant, we can ask:

How does the economy react to persistent output gaps?

The answer to this question depends in part on the flexibility of wage rates and prices and in part on how planned expenditure responds to the flexibility in wage rates and prices.

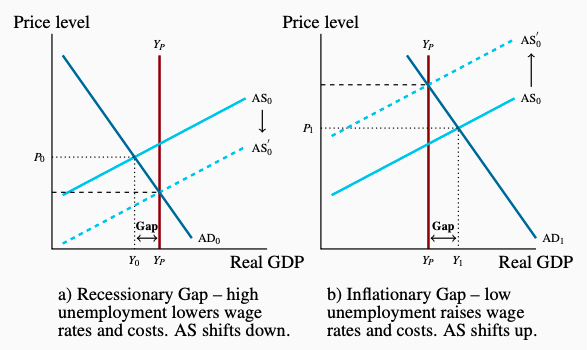

Figure 5.9 shows that the labour market is one of the markets not in equilibrium when there is an output gap. We also know from national accounts that labour costs are the largest part of factor costs of production, and labour costs per unit of output are the largest part of prices. If the labour market is not in equilibrium—which means unemployment rates not equal to the natural rate— result in changes in money wage rates, persistent output gaps will change wage rates and other factor prices and costs. Changes in costs will change prices, shifting the short-run AS curve. The economy may have an adjustment mechanism that tries to eliminate output gaps over time.

Figure 5.10 illustrates the changes in real output as the economy adjusts over time to output gaps. In Panel (a), the high unemployment of a recessionary gap at Y0 lowers wage rates and other factor prices. A change in factor costs changes the entire AS curve. In this case it shifts down to AS'0 . With lower costs, producers are willing to produce and sell at lower prices. The change in factor costs and AS conditions continues, moving the economy along the AD curve until the recessionary gap is eliminated and output is at YP.

Figure 5.10: Adjustments to Output Gaps

This adjustment process assumes that the AD curve is not changed by the fall in wage rates that shifts the AS curve. There are good reasons for skepticism here. In a money economy, with debt and financial contracts denominated in nominal terms, a general fall in money incomes can cause financial distress, extensive insolvencies and reductions in AD. As a result, economists generally agree that deflation, a persistent fall in the general price level, is contractionary, not expansionary as the simple adjustment process suggests. This is reflect in the current concerns that deflation may return to Japan and emerge in Europe as growth stagnates and inflation rates have fallen persistently below 1 percent.