8.3: Banking in Canada Today

- Page ID

- 11832

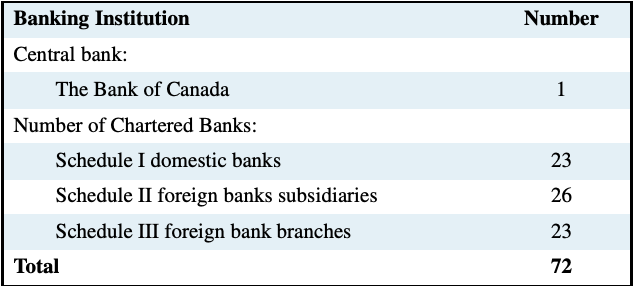

In Canada today, and in other industrial countries, the banking system is made up of a central bank and a number of commercial banks and other deposit-taking institutions called near banks. Table 8.2 illustrates the structure of the banking industry in Canada. The industry is defined broadly to include deposit-taking institutions, not just those that operate under the federal Bank Act.

Table 8.2: The Canadian banking system in 2012

Source: Canadian Bankers' Association, www.cba.ca

Banks are financial intermediaries. They borrow money from the public, crediting them with a deposit. The deposit is a liability of the bank. It is money owed to depositors. The money raised from depositors provides the funds to support the bank loans made to businesses, households, and governments.

Financial intermediary: a business that specializes in bringing borrowers and lenders together.

Banks are not the only financial intermediaries. Trust companies, credit unions, caisses populaires, insurance companies, securities dealers, mutual fund companies, and independent financial advisors all play a role in this industry. But banks hold more than 70 percent of the assets in the financial services sector, and the six largest Canadian banks account for over 90 percent of the assets of the banking industry. Trust companies, credit unions, and caisses populaires also accept deposits that are used as money, but those deposits are a small fraction of the total of deposit money. As a result, bank deposits are the focus of our discussion of money in Canada.

The Bank of Canada is Canada’s central bank. It is the source of the bank notes used to make payments and held as cash reserves by commercial banks. Established by the government in 1935, it has the responsibility to regulate the national money supply and support the operation of financial markets. The Bank’s power to meet these responsibilities comes from its monopoly on the issuance of bank notes.

Bank of Canada: Canada’s central bank.

The Bank of Canada also is the provider of:

- Banking services for the commercial banks in the system

- Banking services for the federal government

- Lender-of-last-resort facilities in times of liquidity crises and reserve shortfalls

Commercial banks hold some of their reserves as deposits in the Bank of Canada, and make payments among themselves using their Bank of Canada deposits. These interbank payments arise from wire transfers, direct deposits, pre-authorized debits, bill payments, point-of-sale debits, and online payments made by bank customers. For example, cheques written by customers at one bank, say Scotiabank, but paid to and deposited by customers of the Royal Bank result in transfers of deposits between these banks. To settle these transfers, Scotiabank must pay the Royal Bank. Funds held by Scotiabank on deposit in the Bank of Canada are used for this purpose. They are called “settlement balances.” In 2011, the Canadian Payments Association, which co-ordinates this clearing of interbank transactions, handled more than 864 million cheques and 3.4 billion point-of-sale debits.

The government holds some deposits in the Bank of Canada. Government receipts, like income taxes paid to the Receiver General, are deposited in government accounts in the Bank of Canada. Government payments like Old Age Security, Employment Insurance benefits, bond interest, and income tax refunds are paid with government cheques or transfers drawn on its Bank of Canada account. Government funds over and above those needed to make regular payments are held on deposit in the commercial banks, and earn interest income for the government.

The key difference between a central bank and the commercial banks in the banking system is the profit motive. Central banks do not pursue profits. Their operations focus on the management of the cash reserves available to the public and the banks. The supply of cash reserves affects the behaviour of other banks and financial markets more generally. This is the monetary policy role of the central bank. We will examine it in detail in Chapter 10.

Commercial banks, on the other hand, are profit-oriented businesses. They operate, as we will see shortly, to maximize the profit they earn for their owners. To this end, they offer banking services to the public. Using the notes and deposits issued by the Bank of Canada as reserves, they issue bank deposits to their customers—which are widely used as the medium of exchange—and they make loans to finance purchases made by businesses and households.

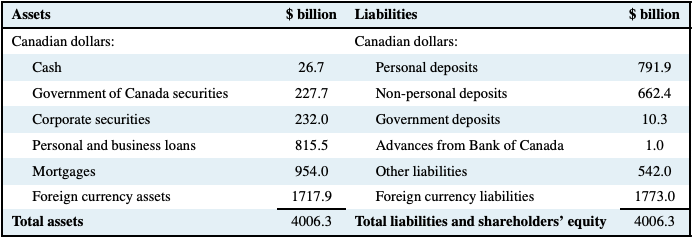

To illustrate the business of these banks, Table 8.3 shows the consolidated balance sheet of Canadian chartered banks in November 2013. In the table we see that the banks held small cash balances as reserves against their deposit liabilities. Their other Canadian assets were mainly loans to households and businesses, including mortgage loans, and their holdings of financial securities. Because cash and many of their financial securities have high liquidity, banks can lend long and still have cash and funds available if depositors withdraw their money.

Liquidity: the cost, speed, and certainty with which asset values can be converted into cash.

Table 8.3: Balance sheet of Canadian chartered banks, November 2013

Source: Bank of Canada, Banking and Financial Statistics, February 2014,

Tables C3 and C4 and author's calculations. Figures have been rounded to

one decimal place.

However, many loans to businesses and households are quite illiquid. The bank cannot easily get its money back in a hurry. This is not really a cause for concern when people and businesses have confidence in the banks and make widespread use of bank deposits as money. Payments and receipts are both in bank deposit form, which are cleared quickly and efficiently through the cheque-clearing and transfer facilities. Banks need only small cash balances to cover the net clearings and net public demand for cash. In Table 8.3, the banks are holding only $26.7 billion against deposit liabilities of $1,454.3 billion.

Canadian banks also carry on important international banking operations, as do banks in many other countries. We see this business recorded on the balance sheet as foreign currency assets and liabilities. The foreign currency assets are mainly loans to customers and holdings of foreign financial securities. Foreign currency deposits of customers are the main foreign currency liabilities. These foreign currency operations are similar to the banks’ domestic currency operations. The banks provide loan financing to customers needing foreign currency to make payments in other countries, and they provide deposit facilities for customers using foreign currency for international transactions.

Competition and co-operation are important to the efficient operation of the banking system. Banks compete among themselves for customer deposits and customer loans. Some of the competition for deposits is based on the location, convenience, and quality of bank branches, some on the offers of service packages including personal financial advice and wealth management, and some on the interest rates offered on deposit balances. If you watch TV, you are probably aware that some small banks like President’s Choice Financial and Tangerine Bank offer you a relatively high interest rate and will make no service charges if you would put some of your funds on deposit with them. Success in attracting deposits is very important to size and growth of a bank’s business.

Credit-worthy customers willing to borrow funds are equally important to a bank’s operations. Interest income earned on customer loans is the major source of bank revenue. As a result, banks compete in the personal and business loan markets, using both the terms of loans and the interest rates charged on loans to attract borrowers. The market for mortgage funds is one of the most competitive areas of bank operations. Mortgage rates and terms are advertised widely in the media and in displays in bank offices and even in supermarkets.

Despite this competition for deposits and loans, the banking system depends on the co-operation among banks that makes deposits the medium of exchange. Co-operation in the cheque-clearing system and the debit card Interac system are two important examples of banks working jointly to provide the payments system. A cheque book or a debit card is not very useful if it can make payments only to other people or businesses that do business with the same bank you use. Joint interests in VISA and MASTERCARD are a second important part of inter-bank co-operation that makes these cards widely acceptable as a source of credit.

There are also important areas of bank co-operation on the lending side of their operations. It often happens that businesses and industries have projects that need more financing than any one bank can or wants to provide. However, several banks might agree to provide funding jointly, increasing their lending capacity and spreading the risks associated with the project among them.

These dimensions of competition and co-operation among banks, and their contribution to the efficient functioning of the money and financial sector of the economy, appear regularly in the debate over bank mergers in Canada.

Banking operations and profits

A commercial bank is a profit-oriented business. Its profits come from the difference between what it costs it to raise funds and the revenues it earns from lending. To bring deposits in, the bank offers customers a range of banking services, including safekeeping, record keeping, access to banking offices or bank machines, chequing, Internet banking and debit card facilities, and interest income on some types of deposits. Service charges or fees cover the costs of some of these services. The interest payments to depositors are the main net cost of funds to the bank.

To be profitable, banks have to find ways to lend, at acceptable levels of risk, the funds they have attracted from depositors. Table 8.3 shows how banks lend their money. In Canadian dollars, most is lent to households and businesses at interest rates established for different types of personal, business, and mortgage lending. Some is used to buy government securities and other financial assets, usually with a short time to maturity. These assets pay a lower rate of interest than loans, but they are more liquid and provide the banks with funds if people decide to withdraw a lot of money from their deposit accounts. Notice that the banks also hold some cash, on which no interest is earned, to cover the day-to-day clearing balances that come from the withdrawals, deposits, and transfers made by their customers.

Bank profits come from the difference or spread between the interest cost of raising funds from depositors and the interest income earned on bank assets. If, for example, the banks pay, on average, 4 percent on their deposit liabilities of all types and earn, on average, 6 percent on their assets of all types, their net interest income would be 2 percent. To take an actual example, the Scotiabank Annual Report for 2013 reports net interest income of 2.32 percent of average assets in 2013. Scotiabank net interest income was higher than the same quarter of the previous year as a result of asset growth in residential mortgages, consumer auto and commercial lending, which increased deposit to lending interest rate spreads. The other large banks report net interest income of the same order of magnitude but there are variations among them. The key to profitability is choosing the right mix of high-quality (low-risk) loans and investments while at the same time controlling the costs of raising funds.

Net interest income: the excess of loan interest earned over deposit interest paid.

As we saw in Table 8.3 Canadian banks held only $26.7 billion in cash against $1,454.3 billion in personal and non-personal deposit liabilities. Their cash reserve assets were about 1.8 percent of their total deposits. The skill in running a bank entails being able to judge just how much must be held in liquid assets, including cash, and how much can be lent out in less liquid forms that earn higher interest income. The profit motive pushes the bank toward riskier, higher interest paying assets and higher net interest income. Banker’s risk, the risk that customers will withdraw their deposits and demand cash, pushes the bank toward holding higher cash balances. But cash balances earn no interest income and reduce the bank’s net interest income.

Bankers risk: the risk that customers may demand cash for their deposits.