10.1: Central Banking and the Bank of Canada

- Page ID

- 11844

Most countries have a central bank. Some of these central banks, like the Bank of England, were private firms originally, in business for profit, but began to operate in part to promote stability in financial market conditions. The focus of their business shifted to take on an informal role in what is now called monetary policy. As governments also became interested in monetary policy, central banking institutions were established in countries where none previously existed. The Federal Reserve System, the United States central bank, was created under federal law in 1913. It is a system of 12 regional banks, each owned by the commercial banks that are its members. Canada’s central bank, the Bank of Canada, was set up and started operations in 1935 as a privately owned institution, but was nationalized in 1938. In the United Kingdom, the Bank of England was founded as a private bank in 1694, acted as a central bank for many years, and was nationalized in 1947.

Central bank: an institution that conducts monetary policy using its control of monetary base and interest rates.

In every case, the important distinction between a private bank and a central bank is the purpose that drives the institution’s operations. Private banks are profit-oriented businesses providing financial services to businesses and households. Central banks conduct their operations to influence the behaviour of other banks and intermediaries in the financial system. Profits are not the motive behind central banks’ operations, although they do make profits. They also serve as banker to the government and to the banks. But their primary role and responsibility is to conduct monetary policy: to control the monetary base and interest rates, and perhaps the foreign exchange rate.

Monetary policy: central bank action to control money supply, interest rates, and exchange rates to change aggregate demand and economic performance.

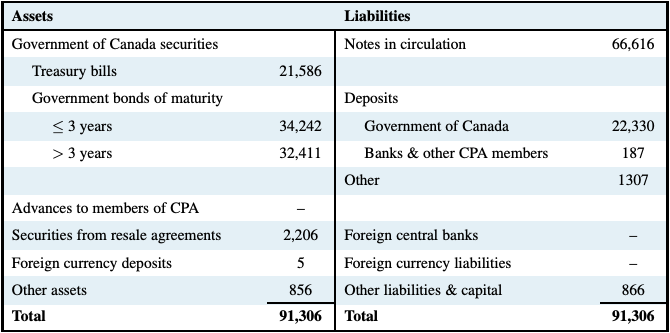

The Bank of Canada is Canada’s central bank. We can describe its operations, as we did with the commercial banks in the previous chapter, by looking at the Bank’s balance sheet in Table 10.1.

Table 10.1: The balance sheet of the Bank of Canada, 2013 (year-end, millions of dollars)

Source: Statistics Canada, CANSIM Table 176-0010 and author's calcula-

tions. Figures have been rounded.

Bank notes in circulation, the main component of the monetary base, are liabilities of the Bank of Canada. The total of notes in circulation is a result of two factors. First, the Bank of Canada makes a decision about the appropriate size of the monetary base and the interest rate. Second is the demand for cash, relative to deposits. These are the banks’ reserve ratio (rr), and the public’s cash ratio (cr) we saw in the last chapter.

Government securities are the main assets held by the Bank. When the Bank of Canada buys these securities on the open financial market, it pays for them by issuing cash to the non-bank public, or by making deposits in the Bank of Canada for banks and other members of the Canadian Payments Association. Cash and deposits issued by the Bank of Canada increase the monetary base. A larger monetary base allows the banks to expand their lending, according to the deposit multiplier we discussed in Chapter 8.

As bank lending and deposits expand, both the banks and the public demand more cash to meet their desired reserve, and currency ratios. The commercial banks meet these demands for cash by drawing Bank of Canada notes from their deposits in the Bank of Canada. These notes are in turn supplied to the banks’ customers, over the counter or through automatic banking machines.

The Bank also has a responsibility to promote stability in financial markets. In the summer of 2008, a credit crisis arising in the short term wholesale deposit and mortgage markets in the United States created a significant increase in the demand for cash in the banking sector. Part of the Bank of Canada’s response was to provide funds to the banks through “purchase and resale agreements”. These are short-term transactions, usually 28 days, used to provide extra cash to the banks by buying some of the government securities they hold, with the agreement to sell them back at a specific date and price in the near future. Any securities held as a result of these transactions would be shown on the asset side of the Bank’s balance sheet. The corresponding increase in cash is an increase in liabilities.

You will notice that the Bank of Canada’s balance sheet differs from that of the commercial banks in a couple of important ways. The Bank of Canada does not have a cash reserve ratio. The Bank itself is the source of cash and can issue more on demand. The size of the Bank’s balance sheet, measured as the total of either assets or liabilities, is the responsibility of the Governor of the Bank.

The current governor, Stephen Poloz, like governors before him, manages the Bank’s balance sheet to implement monetary policy. He can expand the Bank’s asset holdings and pay for that expansion by creating new Bank of Canada liabilities, which are additions to the monetary base. Alternatively, he can sell some of the Bank’s assets, destroying an equal amount of liabilities and monetary base. No reserve requirements limit these operations. The management of the Bank’s balance sheet and the monetary base depends on the wisdom and judgment of the Governor and management of the Bank. They work to get the monetary base and interest rates that are appropriate for the economy.

There is a further interesting difference between the commercial and central bank balance sheets. Private banks concentrate on their deposit base and loan operations. These are the main entries in their balance sheets and the source of their banking profits. The Bank of Canada, by contrast, does very little direct lending, and any it does is of very short duration. Indeed, in Table 10.1 we see that advances to members of the payments association, which would be central bank loans, were zero at the end of 2013.

Nor does the Bank of Canada hold many deposits. It does not need deposits as a source of funds. Deposit facilities are provided to the commercial banks and other members of the Payments Association for their use in settling cheque-clearing balances among the banks, and to the Government of Canada. Cheques issued by the Government of Canada, like income tax refunds, Old Age Security payments, and Employment Insurance benefits, are drawn on the government’s account in the Bank of Canada. This difference in the structure of operations again shows the difference between profit-oriented commercial banks and a central bank with responsibility for monetary policy.

Having the power to conduct monetary policy is one thing; how you use it is another. The Bank of Canada’s responsibilities are set out in the Bank of Canada Act, the act of Parliament that established the Bank in 1934. According to the Act, the Bank is to conduct its policy in ways that support the economy by reducing fluctuations in output, prices, and employment while protecting the external value of the currency. In terms of our study of the economy, we can describe these goals of monetary policy as the pursuit of potential output and low, stable inflation rates.

Exactly how the Bank is to achieve those objectives has been, and continues to be, a topic for discussion and debate. Over the years, our understanding of what monetary policy can and cannot do has evolved, as have the Bank’s interpretation of its mandate and the techniques it uses to conduct monetary policy. The Canadian economist Robert Mundell has been a major contributor to this work. His explanations of the transmission mechanism and the strength of monetary policy under different foreign exchange rate systems were recognized by his Nobel Prize in economics.

Currently, the Bank works to maintain inflation within a target range of 1 percent to 3 percent, but that has not always been its explicit policy objective. Gordon Thiessen, a recent Governor of the Bank of Canada, provides an interesting overview of the evolution of monetary policy in Canada from the 1930s to the end of the 1990s.1

1Thiessen, G., “Can a Bank Change?” Bank of Canada Review, Winter 2000/2001, pp. 35-46, and also available at http://www.bankofcanada.ca/2000/10/can-a-bank-change/