10.2: Central Bank Operating Techniques

- Page ID

- 11845

The money supply—currency in circulation plus the deposits of the commercial or chartered banks—is partly a liability of the central bank (currency) and partly a liability of the commercial banks (deposits). In Chapter 8 we discussed the monetary base supplied by the central bank. You will recall that the money multiplier ties the size of the money supply to the size of the monetary base. The money multiplier is larger when

- the reserve ratio (rr) banks hold is smaller; and

- the currency ratio (cr) the non-bank public wishes to hold is smaller

If these two ratios are constant, the central bank can change the size of the money supply by changing the size of the monetary base.

In general, central banks have three main techniques for the control of the monetary base and the money supply. These are:

- Establishing reserve requirements

- Using open-market operations

- Adjusting central bank lending rates

Not all central banks use all three techniques, but we will examine each of them. Later we will see that the Bank of Canada has some additional operating techniques it uses to influence interest rates in the short run.

In the financial crisis and deep recession of 2008-2009, central banks developed additional techniques to support the banking system, the availability of credit, and the money supply. The ‘Quantitative Easing’ techniques used in the US are examples of these techniques discussed later in this chapter.

Reserve Requirements

In some cases, commercial banks operate under a legal required reserve ratio. They are required by law to hold cash reserves and central bank deposits not less than some specified percentage of their deposit liabilities.

Required reserve ratio: a legal minimum ratio of cash reserves to deposits.

Banks can hold more than the required reserves but not less. If their reserves fall below the required amount, they must borrow cash, from the central bank, to restore their required reserve ratio. Since a loan from the central bank carries an interest rate, usually higher than the market interest rate, borrowing imposes a cost on the bank and lowers profitability. Banks usually hold slightly larger reserves than required to avoid the costs of falling short.

A required reserve ratio is essentially a regulation used to give the central bank control of the money supply. The reserve ratio is a key determinant of the money multiplier. If a central bank has the power to change the commercial banks’ required reserve ratio, it can use it to change the money supply. For a given monetary base, a rise in the required reserve ratio reduces the size of the money multiplier and the money supply. A reduction in the reserve ratio has the opposite effect.

However, required reserve ratios are blunt techniques for monetary control. Changes in reserve ratios simultaneously affect the reserve positions of all banks in a system and require large adjustments in financial markets. As a result, changes in reserve ratios are not widely used as techniques for money supply control.

Required reserve ratios are different in different national banking systems. In the United States, for example, the Federal Reserve is authorized to impose reserve requirements of 8 percent to 14 percent on chequable deposits, and up to 9 percent on non-personal time deposits. As of February 2002, the ratios were set at 10 percent for chequable deposits and 0 percent for time deposits. The European Central Bank also imposes reserve requirements. In 2012, both India and China reduced deposit reserve ratios on several occasions to encourage monetary expansion in the face of declining GDP growth rates.

Until 1994, banks in Canada were subject to legal minimum reserve requirements. These have now been phased out, as have reserve requirements in many other countries. In Canada, the banks hold reserves made up of very small settlement balances in the Bank of Canada, in addition to their cash holdings. The banks decide the size of their reserve ratios based on their own assessments of their reserve needs, rather than a legal requirement. We will see later that reserve holdings, and the Bank of Canada’s management of the available cash reserves, are important to the implementation of monetary policy in Canada.

The absence of legal reserve requirements in Canada means that reserve ratios in the banking system change from time to time. They may change as the banks change their outlook on financial conditions and their evaluation of banker’s risk. These changes are linked to the profit motive of the banks rather than the control interests of the central bank. Whether they come from central bank action or commercial bank asset management, changes in the banks’ reserve ratio change the money multiplier and the money supply.

Open Market Operations

Open market operations are the main technique used by central banks to manage the size of the monetary base. Whereas reserve requirements affect the money supply through control of the money multiplier, open market operations work directly on the monetary base. Since the money supply is the monetary base multiplied by the money multiplier, open market operations alter the money supply.

Open market operation: central bank purchases or sales of government securities in the open financial market.

Central banks use open market operations to provide the monetary base needed to support the demand for money and the increase in the demand for money as the economy grows. If monetary policy is conducted by setting interest rates, as discussed later in the chapter, open market operations are passive. They provide the monetary base needed to meet the demand for money at the interest rate set by the central bank. An open market purchase makes a permanent addition to the central bank’s assets and monetary base.

There are times when monetary policy is conducted through control of the money supply. If the money multiplier is constant, a central bank can control the size of the money supply by controlling the monetary base using open market operations. Open market purchases increase the monetary base and increased bank lending increases the money supply. Open market sales have the opposite effect.

In times of financial and economic crisis, as in 2008 and 2009, open market operations are used along with interest rate setting. High uncertainty in financial markets and falling demand in goods-and-services markets increase the demand for liquid cash balances. If interest rates are reduced close to zero without increasing lending and spending and asset demand, the central bank may undertake “quantitative easing,” using open market purchase to increase the monetary base and offset a shortage of liquidity in the economy. This topic comes up again after we look at monetary policy in more normal times.

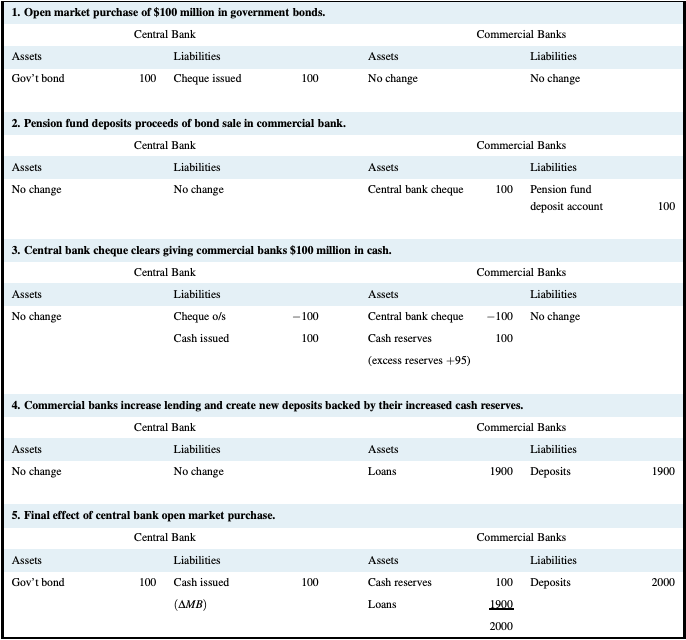

Table 10.2 illustrates an open market purchase and its effect on bank reserves and the money supply. To keep the example simple, we will assume the banks hold reserves equal to 5 percent of their deposits, \(rr = 0.05\), but the public’s currency ratio is zero, \(cr = 0\). This means a simple money multiplier is equal to \(1/rr = 1/0.05 = 20\).

Table 10.2: An open market purchase and the money supply

In the example, the central bank buys $100 million of government bonds on the open market. We’ll assume a large pension fund sold these bonds, and received in payment a cheque for $100 million issued by the central bank. This transaction is recorded (as $100) under item 1 in the table.

Item 2 in the table records the pension fund’s deposit of the central bank cheque in the commercial banking system. The commercial bank issues a deposit to the pension fund in return for the cheque drawn on the central bank.

The commercial bank does not want to hold the central bank cheque. It presents it for payment and receives, in this example, cash in the form of central bank notes. Cash is a reserve asset for the commercial bank. In item 3 in the table, the central bank has created new monetary base, which has increased the cash reserves of the commercial bank by $100. The commercial bank now has new reserves of $100 against its increased deposit liabilities of $100. Based on its reserve ratio \(rr = 0.05\), it has excess reserves of $95.

Excess reserves in the commercial banking system support an increase in lending and the creation of new bank deposits. Item 4 in the table shows the final results of this loan and deposit expansion, for the entire banking system. Based on a simple money multiplier of 20, we know that the increase in the monetary base in the form of new cash reserves by $100 will result in an increase in the money supply of $2000. Bank lending and deposit creation continue until total deposits have increased by $2000, based on an initial deposit of $100 and increased lending of $1900. Item 5 in the table shows these final results.

In this example, an open-market purchase increased the monetary base and the money supply. The purchase was paid for by the creation of new monetary base. An open market sale would have the opposite effect. The monetary base and the money supply would be reduced. An open market operation is a technique a central bank can use to shift the money supply function and affect equilibrium conditions in the money market.

Open market operations are today the principal channel by which central banks, including the Bank of Canada, manage the longer-term growth of the monetary base.

The Bank Rate

The bank rate is the interest rate the central bank charges the commercial banks if the commercial banks borrow reserves. The bank rate or lending rate is set by central banks as a part of their monetary policy operations.

Bank rate: the interest rate the central bank charges on its loans to commercial banks.

Suppose the banks think the minimum safe ratio of reserves to deposits is 5 percent. It does not matter whether this figure is a commercial judgment, as in Canada, or a legal requirement, as in the United States. Banks may also hold a little extra cash to cover day-to-day ups and downs in deposits and withdrawals, but maximum profit requires minimum cash holdings.

One way in which an individual bank can cover a shortage in its reserves is to borrow from other banks that have unexpected excess reserves. This creates a market for monetary base. In Canada, this borrowing and lending takes place on an overnight basis—you borrow today and repay tomorrow, at the overnight interest rate. In the United States, the rate for similar lending and borrowing among banks is the federal funds rate.

If it happens that no other bank in the system has excess reserves to lend, a bank that is short of reserves borrows from the central bank. The interest rate charged is the bank rate, which is set higher than the overnight rate by the central bank, to encourage banks to borrow and lend reserves in the overnight market.

The bank rate is used in different ways by different central banks. There is a long tradition of using changes in the rate as a signal of changes in monetary policy. A cut in the bank rate signals the central bank’s intention to increase the monetary base. A rise in the bank rate signals tighter monetary conditions. We will examine in detail the role the bank rate currently plays in Canada later in this chapter.

Government Deposit Accounts

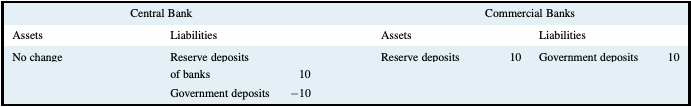

In Canada, the federal government holds some of its funds on deposit in the Bank of Canada and some in the commercial banks. The government also gives the Bank the authority to manage the distribution of its deposits between the central bank and the commercial banks. This arrangement provides another technique for short-term central bank management of the monetary base.

The Bank can increase the reserves of the commercial banks by transferring government deposits from the central bank to the commercial banks. The commercial banks then have increased government deposit liabilities and an equal increase in their reserve deposits in the Bank of Canada. Because their desired reserves increase by only a small fraction of their increased deposits, the commercial banks have excess reserves. Bank lending and bank deposits can increase. Table 10.3 illustrates a transfer of government deposits.

Table 10.3: A transfer of government deposits

In this example, the Bank of Canada has moved $10 in government funds from government accounts in the Bank of Canada (−10) and placed them on deposit in the commercial banks (+10). In payment for these increased deposit liabilities, the banks receive an increase in their reserve deposits in the Bank of Canada.

If the desired reserve ratio of the banks is 5 percent, the banks now have excess reserves of $9.50, which they will lend.

A transfer of government deposits from the commercial banks to government accounts in the Bank of Canada would have the opposite effect. Commercial bank reserves would be reduced and they would have to reduce their lending and deposit liabilities.

Government deposit transfers were the main tool the Bank of Canada used during the 1990s to manage the cash reserve position of the banking system. The Bank was setting the overnight rate and using government deposit transfers to offset short-term pressure on its rate target. A change in the technology of the payments system in the late 1990s reduced the effectiveness of this technique. SPRA and SRA transactions (explained below) replaced government deposits as the main tool of cash management.

The Bank does still manage government deposits, but the primary objective of that management has changed. Now the banks bid against one another by in terms of the interest rate they are willing to pay on government deposits. As a result transfers play a minor role in offsetting the effects of government receipts and payments on the reserve positions of the commercial banks.

Money Supply versus Interest Rates

Control of the monetary base through open-market operations and stable desired reserve and cash ratios for the banks and the public give the central bank control of the money supply. This is easy in theory but not in practice.

There are several problems. Can the central bank control the monetary base precisely? The commercial banks can borrow from the central bank at the bank rate when they are short of reserves. Borrowings increase the monetary base. In more difficult financial market circumstances, like those of 2007 to 2009, orderly financial markets may call for large changes in the monetary base to offset extraordinary demands for cash. Meeting these demands takes time and adds to turmoil in markets.

What is the size of the money multiplier? Are desired reserve ratios and cash ratios stable and predictable or do they fluctuate? If they fluctuate, the size of the money multiplier is difficult to predict. The money supply function may be unstable.

What money supply measure should the central bank control: MB, M1B+, M2, M2+, or some other aggregate? Households and businesses can shift among the different deposits with different these terms and interest rates. Furthermore, the banks are imaginative and competitive in developing new types of deposits.

In short, precise control of the money supply is difficult. Most central banks no longer try. Instead, they set interest rates. The television news and financial press report decisions by the central bank about interest rates, not decisions about money supply. The Bank of Canada and the United States Federal Reserve make regular announcements about their settings of the overnight rate and the federal funds rate, respectively.

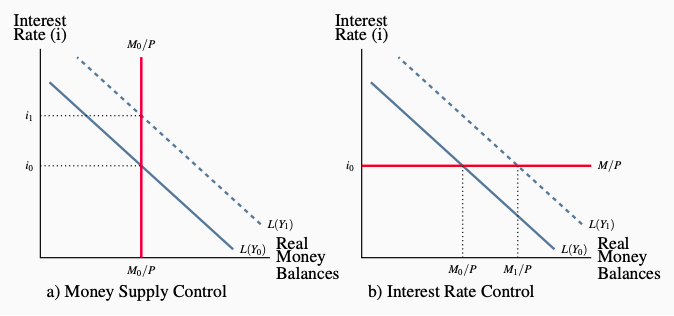

Figure 10.1 shows the money market under two different conditions. In both cases we draw the demand for money function L(Y0) for a given level of real GDP. If the central bank can control money supply, then, for a given level of prices, it fixes the money supply at M0/P. The equilibrium interest rate is i0. This is the case in Panel a) of the figure.

Figure 10.1: Money Supply Control vs. Interest Rate Control

a) We assume the central bank can fix the money supply at M0/P and the

equilibrium rate is i0. An increase in Y increases demand for money from

L(Y0) to L(Y1). With a fixed money supply, the interest rate rises to i1.

Alternatively, if the central bank knows the demand for money it can control

money supply using interest rates. When Y increases it increases i to i1 to

reduce the demand for money to its money supply target. A fall in Y would

call for a fall in interest rates to control money supply.

b) We assume the Bank sets the interest rate at i0. To do this it must supply

whatever quantity of money is demanded at i0. An increase in Y increases

L and results in an increase in M/P. Now the money supply is demand

determined.

Alternatively, the central bank can fix the interest rate at i0 and supply whatever money is needed to clear the market at this rate. This is the case in Panel b). In equilibrium, the central bank supplies exactly the quantity of money demanded at interest rate i0. The quantity of money supplied is still M0/P, but the money supply function is horizontal at the interest rate i0.

The central bank can fix either the money supply or the interest rate but not both. If it fixes the money supply, it must accept the equilibrium interest rate implied by the demand for money. If it fixes the interest rate, it must accept the equilibrium money supply implied by the demand for money equation. Central banks now do the latter.