9.7: The Transmission Mechanism

- Page ID

- 16443

We can now summarize and illustrate the relationships that transmit changes in money, financial markets, and interest rates to aggregate demand, output, and employment. There are four linkages in the transmission mechanism:

- With prices constant, changes in money supply change interest rates.

- Changes in interest rates change consumption expenditure through the wealth effect and the cost and availability of credit.

- Changes in interest rates also cause changes in planned investment expenditure through the cost and availability of credit to finance the purchase of capital equipment and to carry inventories.

- Changes in interest rates also cause changes in exchange rates, which change the price competitiveness and profitability of trade goods and services.

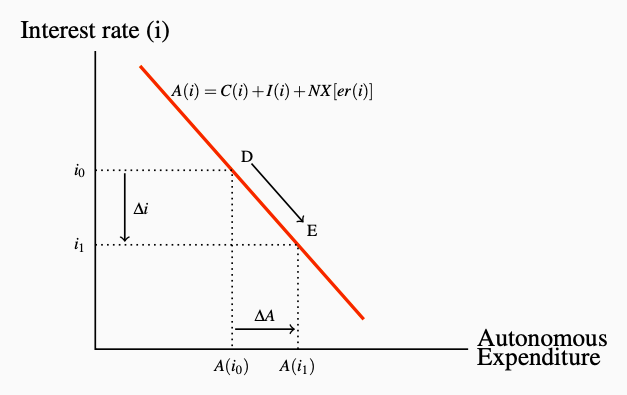

Figure 9.6: Interest Rates & Autonomous Expenditure

Working through these linkages, the effects of changes in money and interest rates on aggregate demand and equilibrium real GDP is illustrated as follows:

\(\Delta M \to \Delta i \to

\left(

\begin{array}{c}

\Delta C + \Delta I\\

\Delta er \to \Delta NX

\end{array}

\right) \to \Delta AE \times \textbf{multiplier} \to \Delta AD \to \Delta Y\)

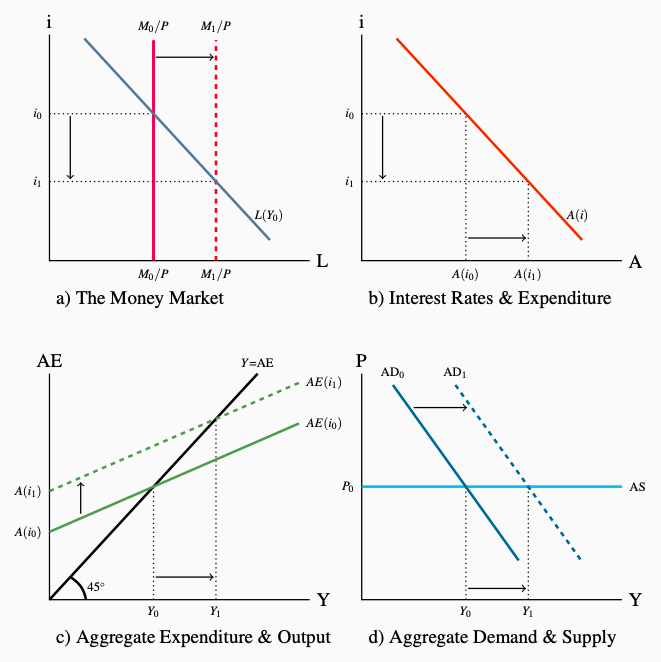

Figure 9.7 shows the transmission mechanism using four interrelated diagrams: a) the money market, b) interest rates and planned expenditure, c) aggregate expenditure and equilibrium output, and d) aggregate demand and supply, output, and prices. We continue to assume a constant price level, as the diagrams show. Changes in the money and financial sector affect aggregate demand and output, to add another dimension to our understanding of the sources of AD and fluctuations in AD.

Figure 9.7: The Monetary Transmission Mechanism

To see the linkages in the transmission mechanism start in Panel a) with an equilibrium interest rate i0 determined by the initial money supply M0/P and demand for money L(Y0). This interest rate i0 induces autonomous expenditure A(i0) in Panel b). That autonomous expenditure determines the vertical intercept A(i0) of the aggregate expenditure function AE(i0) in Panel c), and through the multiplier the equilibrium GDP, Y0. In Panel d) the corresponding aggregate demand curve AD0 crosses the horizontal AS curve at the equilibrium real GDP Y0.

An increase in the money supply in Panel a) lowers equilibrium i to i1. This induces an increase in autonomous expenditure to A(i1) in Panel b) and an upward shift in the AE function on Panel c). Increased autonomous expenditure and the multiplier increase equilibrium real GDP and shift the AD curve to the right by the increase in A times the multiplier.

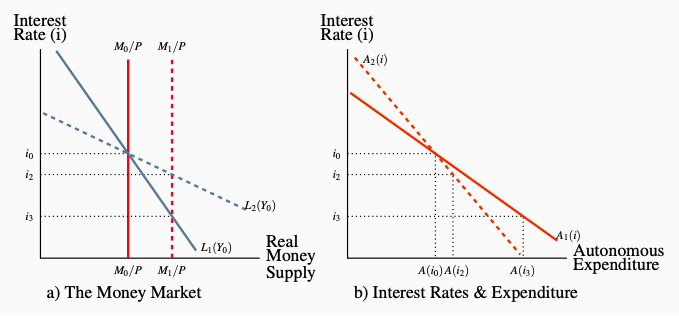

There are several key aspects to these linkages between money, interest rates, and expenditure. The effect of changes in the money supply on interest rates in the money market depends on the slope of the demand curve for real money balances. A steep curve would show that portfolio managers do not react strongly to changes in market interest rates. It would take relatively large changes in rates to get them to hold higher money balances. Alternatively, if their decisions were very sensitive to the interest rates, the L function would be quite flat. The difference is important to the volatility of financial markets and interest rates, which in turn affect the volatility of expenditure. Panel a) in Figure 9.8 shows the effects of an increase in money supply under different money demand conditions. The sensitivity of expenditure to interest rates and financial conditions is a second important aspect of the transmission mechanism. If the interest rate/expenditure function, in Panel b), is steep, changes in interest rates will have only small effects on expenditure, aggregate demand, and output. A flatter expenditure function has the opposite implication.

Figure 9.8: The Transmission Mechanism Under Different Conditions

a) The change in interest rates caused by a change in money supply depends

on the interest rate elasticity of the demand for money. L2 is more elastic

than L1. A small change in interest rates under L2 induces portfolio man-

agers to increase their money holdings.

b) The change in autonomous expenditure caused by a change in interest

rates depends on the rate elasticity of autonomous expenditure. Under A2(i)

changes in interest rates have very small effects on expenditures.

Business cycles, output gaps, and policy issues

The effect of money and financial markets on expenditure, output, and employment raises two issues for macroeconomic policy. First, fluctuations in money supply and financial conditions are an important source of business cycle fluctuations in output and employment. These effects are particularly strong and important when the small changes in money supply have big impacts on interest rates and expenditure. A steep L(i) function and a flat expenditure/interest rate function would create these conditions. Stabilization policy would then need to control and stabilize the money supply, a policy approach advocated by monetarists, who see money supply disturbances as the major source of business cycles. If you can fix money supply at M0 in Figure 9.7, and the demand for money L(Y,i) and the interest rate/expenditure function are stable, you remove monetary disturbances as a source of business cycles.

This Monetarist approach to money and the financial sector concentrates on the “automatic” stabilization effects of money supply control. With the money supply fixed, any tendency for the economy to experience a recessionary or inflationary gap changes the demand for money, and interest rates change in an offsetting direction. A fall in real output that creates a recessionary gap reduces the demand for money L(Y,i) and, with a fixed money supply, interest rates fall to induce additional expenditure. An inflationary gap would produce an automatic rise in interest rates. The monetary sector automatically resists fluctuations in expenditure and output.

The second policy issue is the alternative to this approach. Discretionary monetary policy would attempt to manage money supply or interest rates or financial conditions more broadly. The objective would be to counter persistent autonomous expenditure and financial disturbances that create output gaps. The intent is to manage aggregate demand in an active way. In other words, if business cycles were caused by shifts and fluctuations in the interest rate/expenditure function in Panel b) of Figure 9.7, monetary policy would react by changing interest rates and money supply and move the economy along the new expenditure function to stabilize autonomous expenditure and aggregate demand. Keynesian and New-Keynesian economists advocate this active approach to policy in the money and financial sector, based on a different and broader view of the sources of business cycles in the economy.

Recent experience extends beyond these two policy concerns. A collapse in the financial sector on the supply side was a major cause of the recession of 2009. Banks and other financial institutions suffered losses on large denomination deposits and financial lending. Uncertainty on the part of many lenders about the quality of assets and the risks of lending reduced the availability of credit. Uncertainty on the part of households and businesses reduced their confidence in financial institutions. Although central banks worked to keep interest rates low and bank reserves strong, shifts in the availability of credit and the willingness to borrow shifted the A(i) curve in Figure 9.7 sharply to the left, expenditure fell, and AD shifted left, opening a strong recessionary gap that has been persistent in many industrial countries.

This recent experience has led to serious debates about the role and effectiveness of monetary policy and the objectives of fiscal policy. These are issues we examine in more detail in the chapters that follow.

NEXT

In this chapter, we have made the link between money, interest rates, aggregate demand, and output in our model of the economy. We have also shown that monetary policy, working through the monetary transmission mechanism, provides a second policy channel, in addition to fiscal policy, which government might use to stabilize business cycle fluctuations. Chapter 10 studies in detail the monetary policy operations of central banks, including the Bank of Canada.