2.5: Ethics, Efficiency and Beliefs

- Page ID

- 11792

Positive economics studies objective or scientific explanations of how the economy functions. Its aim is to understand and generate predictions about how the economy may respond to changes and policy initiatives. In this effort economists strive to act as detached scientists, regardless of political sympathies or ethical code. Personal judgments and preferences are (ideally) kept apart. In this particular sense, economics is similar to the natural sciences such as physics or biology.

In contrast, normative economics offers recommendations based partly on value judgments. While economists of different political persuasions can agree that raising the income tax rate would lead to a general reduction in the number of hours worked, they may yet differ in their views on the advisability of such a rise. One may believe that the additional revenue that may come in to government coffers is not worth the disincentives to work; another may think that, if such monies can be redistributed to benefit the needy or provide valuable infrastructure, the negative impact on the workers paying the income tax is worth it.

Positive economics studies objective or scientific explanations of how the economy functions.

Normative economics offers recommendations that incorporate value judgments.

Scientific research can frequently resolve differences that arise in positive economics—not so in normative economics. For example, if we claim that “the elderly have high medical bills, and the government should cover all of the bills”, we are making both a positive and a normative statement. The first part is positive, and its truth is easily established. The latter part is normative, and individuals of different beliefs may reasonably differ. Some people may believe that the money would be better spent on the environment and have the aged cover at least part of their own medical costs. Economics cannot be used to show that one of these views is correct and the other false. They are based on value judgments, and are motivated by a concern for equity. Equity is a vital guiding principle in the formation of policy and is frequently, though not always, seen as being in competition with the drive for economic growth. Equity is driven primarily by normative considerations. Few economists would disagree with the assertion that a government should implement policies that improve the lot of the poor and dispossessed—but to what degree?

Economic equity is concerned with the distribution of well-being among members of the economy.

Most economists hold normative views, sometimes very strongly. They frequently see their role as not just to analyze economic issues from a positive perspective, but also to champion their normative cause in addition. Conservative economists see a smaller role for government than left-leaning economists. A scrupulous economist will distinguish her positive from her normative analysis.

Many economists see a conflict between equity and the efficiency considerations that we developed in Chapter 1. For example, high taxes may provide disincentives to work in the marketplace and therefore reduce the efficiency of the economy: plumbers and gardeners may decide to do their own gardening and their own plumbing because, by staying out of the marketplace where monetary transactions are taxed, they can avoid the taxes. And avoiding the taxes may turn out to be as valuable as the efficiency gains they forgo.

In other areas the equity efficiency trade-off is not so obvious: if taxes (that may have disincentive effects) are used to educate individuals who otherwise would not develop the skills that follow education, then economic growth may be higher as a result of the intervention.

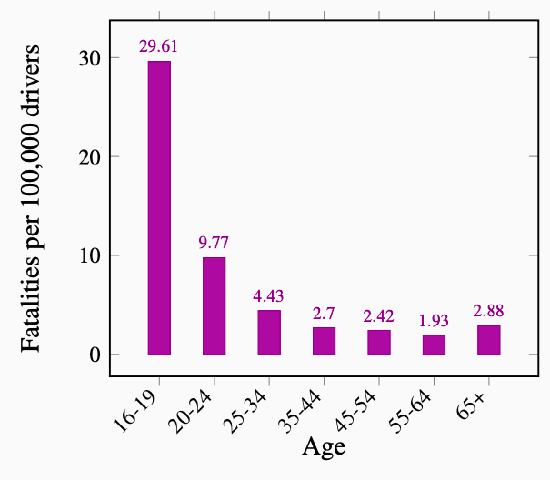

Data are an integral part of policy making in the public domain. A good example of this is in the area of road safety. Road fatalities have fallen dramatically in recent decades in Canada, in large measure due to the introduction of safety measures such as speed limits, blood-alcohol limits, seat belt laws, child-restraint devices and so forth. Safety policies are directed particularly strongly towards youth: they have a lower blood-alcohol limit, a smaller number of permitted demerit points before losing their license, a required period of learning (driver permit) and so forth. While fatalities among youth have fallen in line with fatalities across the age spectrum, they are still higher than for other age groups. Figure 2.7 presents data on fatalities per licensed driver by age group in Canada relative to the youngest age group. Note the strong non-linear pattern to the data – fatalities decline quickly, then level off and again increase for the oldest age group.

In keeping with these data, drivers are now required to pass a driving test in most provinces once they attain a certain age – usually 80, because the data indicate that fatalities increase when drivers age.

See:

CANADIAN MOTOR VEHICLE TRAFFIC COLLISION STATISTICS 2009, Transport Canada.

Application Box 2.1: Statistics for Policy Makers

Figure 2.7: Non-Linearity: Driver Fatality Rates Canada, 2009

Fatality rates vary non-linearly with age: at first they decline, then increase

again, relative to the youngest age group.

Revisiting the definition of economics

This is an appropriate point at which to return to the definition of economics in Chapter 1 that we borrowed from Nobel Laureate Christopher Sims: economics is a set of ideas and methods for the betterment of society.

If economics is concerned about the betterment of society, clearly there are ethical as well as efficiency considerations at play. And given the philosophical differences among scientists (including economists), can we define an approach to economics that is shared by most of the economics profession? Most economists would answer that the profession shares a set of beliefs, and that differences refer to the extent to which one consideration may collide with another.

First of all we believe that markets are critical because they facilitate exchange and therefore encourage efficiency. Before the arrival of Man Friday, Robinson Crusoe had to hunt, cook, make fire, and sustain shelter. The arrival of Man Friday enabled Crusoe to specialize in the tasks where he was relatively more productive. More generally, trade creates benefits for the trading parties. For example, Canada has not the appropriate climate for growing coffee beans, and Colombia has not the terrain for wheat. If Canada had to be self-sufficient, we might have to grow coffee beans in green-houses—a costly proposition. But with trade we can simply exchange some of our wheat for Colombian coffee. Similar benefits arise for the Colombians.

A frequent complaint against globalization is that it does not benefit the poor. For example, workers in the Philippines may earn only a few dollars per day manufacturing clothing for Western markets. What these voices are really trying to say is that, in their opinion, most of the gains from trade go to the Western consumers, and a lesser part to the Asian worker.

A corollary of the centrality of markets is that incentives matter. If the price of business class seats on your favourite airline is reduced, you may consider upgrading. Economists believe strongly that the price mechanism influences behaviour, and therefore favour the use of price incentives in the marketplace and public policy more generally. Environmental economists, for example, frequently advocate the use of tradable pollution permits—a type of permission slip that can be traded (at a price) between users, or carbon taxes on the emission of greenhouse gases such as carbon dioxide. We will develop such ideas in Microeconomics Chapter 5 more fully.

In saying that economists believe in incentives, we are not proposing that human beings are purely mercenary. People have many motivations: a sense of public duty, kindness, noblesse oblige, etc. Acting out of a sense of self-interest does not imply that people are morally empty or have no sense of altruism. It is just recognition of one important motivating factor in an individual’s life.

Whether conservative or liberal, economists believe universally in the importance of the rule of law, and a set of legal institutions that govern contracts. If goods and services are to be supplied in a market economy, the suppliers must be guaranteed that they will be remunerated. And this requires a developed legal structure with penalties imposed on individuals or groups who violate contracts. Markets alone will not function efficiently.

The development of markets in less developed economies was viewed as essential by many development economists in the nineteen eighties. The focus on ‘freeing up’ productive resources from the hand of the state was a central idea in what became known as the ‘Washington Consensus’. This emphasis represented a turning point in development philosophy – away from believing in the efficacy of the mega project, protectionism and state-led development. While the latter approach rarely produced the desired result on account of the missing incentives, the Washington Consensus did not produce the hoped-for results either. This was because the supposed ‘free markets’ were not always accompanied by property rights, or enforceable contracts – markets and contracts do not work well in a legal vacuum. Oxford economist Marcel Fafchamps has described these supposed ‘free markets’ as ‘flea markets’.

Not surprisingly, economists have found a high correlation between economic growth and national wealth on the one hand and the rule of law on the other. The consequence on the world stage is fascinating: numerous ‘economic’ development projects now focus upon training jurists, police officers and bureaucrats in the rule of law!

Finally economists believe in the importance of government policy. Governments can solve a number of problems that arise in market economies that cannot be addressed by the private market place. For example, governments can best address the potential abuses of monopoly power. Monopoly power, as we shall see in Microeconomics Chapter 10, not only has equity impacts it may also reduce economic efficiency. Governments are best positioned to deal with what economists term externalities – the impact of economic activity on sectors of the economy that re not directly involved in the activity under consideration. A good example is environmental policy. Governments may also wish to impose standards on products – consumers might not know if a bicycle helmet is effective unless safety standards are put in place.

In summary, governments have a variety of roles to play in the economy. These roles apply not only to making the economy a more equitable place (which governments achieve by their tax and redistribution policies), governments can also make the marketplace more efficient.