1.3: Interaction of Individuals, Firms, and Societies

- Last updated

- Save as PDF

- Page ID

- 3430

- Boundless

- Boundless

Introducing the Firm

Firms allow an economy to operate more efficiently and reduce the transaction costs of coordinating production.

Learning objectives

Explain the importance of private companies and firms in the economy

“Firm” is simply another word for company or business. The basic economic marketplace consists of transactions between households and firms. Firms use factors of production – land, labor, and capital – to produce goods that are consumed by households. They may be organized in many different ways – corporations, partnerships, sole proprietorships, and collectives are all examples of firms. Economists who study the theory of the firm attempt to describe, explain, and predict the nature of a firm, including its existence, behavior, structure, and relationship to the market.

The Evolution of the Firm

Not all markets and societies involve firms. In many medieval cities, most production was done by individual craftsmen who were loosely organized into guilds, or by tenant farmers who rented family-sized plots of land. Transactions took place primarily between individuals.

Firms generally appear and become prevalent as an alternative to individual trade when it is more efficient to produce in a non-market environment. For example, in a labor market, it might be too difficult or costly for firms or organizations to engage in production when they have to hire and fire their workers depending on demand/supply conditions. While the advantages of consolidation for efficiency are potentially many and varied, the underlying concept is that integrating operational paradigms enables potential synergy via the construct of a firm.

Firms also allow economic growth, not only for the firm but for the broader society in which it resides. Through separating the business from the individual(s) who starts it, the funding, insurance and liability of a firm can function independently of a person. The separation of a firm from the individual also allows more specifically applicable regulations and laws, broader accumulation of investment capital and more complex strategic alliances. While the detailed implications of a firm and it’s relationship with individuals and society are complex, the important takeaway is that firms play an integral role in economic structure.

The Firm: Organizing production under firms reduces the transaction costs of coordinating production in the market.

The Transaction Theory of the Firm

According to Ronald Coase, people begin to organize their production in firms when the transaction cost of coordinating production through the market exchange is greater than within the firm. He notes that a firm’s interactions with the market may not be under its control (for instance because of sales taxes), but its internal allocation of resources are: “Within a firm, … market transactions are eliminated and in place of the complicated market structure with exchange transactions is substituted the entrepreneur … who directs production.” He asks why alternative methods of production (such as the price mechanism and economic planning), could not either achieve all production, so that either firms use internal prices for all their production, or one big firm runs the entire economy.

For Coase the main reason to establish a firm is to avoid some of the transaction costs of using the price mechanism. These include discovering relevant prices (which can be reduced but not eliminated by purchasing this information through specialists), as well as the costs of negotiating and writing enforceable contracts for each transaction (which can be large if there is uncertainty). Moreover, contracts in an uncertain world will necessarily be incomplete and have to be frequently re-negotiated. The costs of haggling about division of surplus, particularly if there is asymmetric information and asset specificity, may be considerable. Organization into a firm can considerably reduce these costs.

Trade Leads to Gains

Producers and consumers trade because the exchange makes both parties better off.

Learning objectives

Explain why parties trade.

Producers and consumers trade because the exchange makes both parties better off. The benefit of exchange to producers is measured by the amount of profit – that is, the difference between the average cost of producing an item and the price received for that item. The benefit of exchange to a consumer is measured by net utility gained. This is measured by taking the difference between the maximum price a consumer is willing to pay and the actual price they do pay. To understand this, imagine purchasing a car. You would be willing to pay up to $15,000 for a car in good condition, but you are able to buy one for only $12,000. Since you value the car at $3,000 more than you paid for it, $3,000 is the benefit that you gained from the transaction.

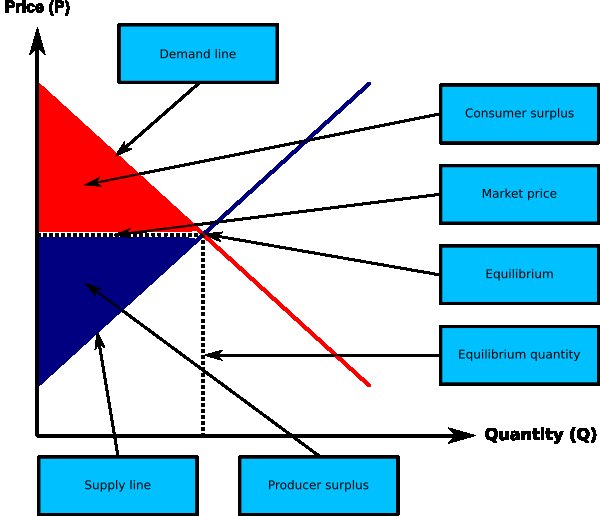

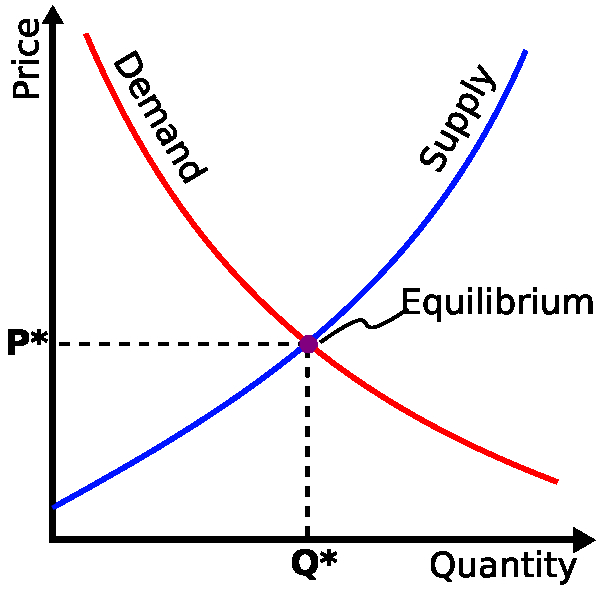

Economists refer to these benefits from exchange as producer and consumer surplus. Consumer surplus is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest price that they would be willing to pay. Producer surplus is the amount that producers benefit by selling at a market price that is higher than the least that they would be willing to sell for.

The amount of consumer and producer surplus that is gained from a transaction can be seen on a standard supply and demand graph. Consumer surplus is the area (triangular if the supply and demand curves are linear) above the equilibrium price of the good and below the demand curve. This reflects the fact that consumers would have been willing to buy a single unit of the good at a price higher than the equilibrium price, a second unit at a price below that but still above the equilibrium price, etc., yet they in fact pay just the equilibrium price for each unit they buy.

Likewise, in the supply-demand diagram, producer surplus is the area below the equilibrium price but above the supply curve. This reflects the fact that producers would have been willing to supply the first unit at a price lower than the equilibrium price, the second unit at a price above that but still below the equilibrium price, etc., yet they in fact receive the equilibrium price for all the units they sell. The sum of consumer and producer surplus is called economic, or social, surplus, and reflects the total amount of benefit received by society when consumers and producers trade.

Consumer and Producer Surplus: Consumer surplus is the area between the demand line and the equilibrium price, and producer surplus is the area between the supply line and the equilibrium price.

Exchange and Pareto Optimality

An allocation of resources is Pareto efficient when it is impossible to make any one individual better off without making at least one individual worse off. For example, imagine that two individuals prefer peanut butter and jelly sandwiches to a sandwich with only peanut butter or only jelly. A distribution in which Individual A has all of the peanut butter and individual B has all of the jelly is not Pareto efficient, because both parties would be better off if they shared their resources.

Similarly, an action that makes at least one party better off without making any individual worse off is called a Pareto improvement. Any transaction in a free market always produces a Pareto improvement because it makes consumers and/or producers better off without making either party worse off (if this were not the case, the consumer and/or the producer would refuse to participate in the transaction in the first place). It is commonly assumed that outcomes that are not Pareto efficient are to be avoided, and if a Pareto improvement is possible it should always be implemented.

One way to look at whether a transaction is a Pareto improvement is to ask whether it increases consumer or producer surplus without decreasing either party’s surplus. Lowering an item’s price without changing the quantity sold, for example, may increase consumer surplus, but is not a Pareto improvement because producers suffer negative consequences.

Thinking about Efficiency

An efficient market maximizes total consumer and producer surplus.

Learning objectives

Define economic efficiency.

Every economic transaction has a buyer and a seller who will only participate is she is receiving at least a minimum benefit. These benefits are represented as consumer surplus and producer surplus, respectively. In the illustration below, both types of surpluses are displayed graphically. An efficient market maximizes total consumer and producer surplus.

Consumer and Producer Surplus: Consumer and producer surplus are maximized at the market equilibrium – that is, where supply and demand intersect.

The market shown in is one without any distortions such as regulations, taxes, or an inability for buyers to meet sellers. It is subject to what Adam Smith described as the invisible hand: if the price is anything except the equilibrium price, market forces will eventually return the market price to equilibrium.

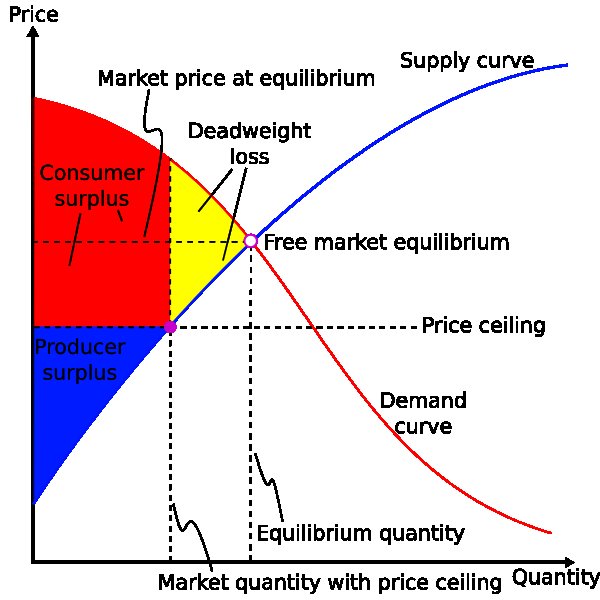

Not all markets are efficient. There are a number of reasons why a market may be inefficient. Perhaps most well known is inefficiency caused by government intervention. Governments can institute any number of policies that prevent markets from achieving the free market equilibrium price and quantity: taxes raise prices, quotas limit the quantity sold, and regulations affect the supply and demand curves. Market inefficiency can also be caused by things such as irrational market actors and barriers to transactions, such as an inability for buyers and sellers to find one another.

Economists often seek to maximize efficiency, but it is important to contextualize such aims. Efficiency is but one of many vying goals in an economic system, and different notions of efficiency may be complementary or may be at odds. Most commonly, efficiency is contrasted or paired with morality, particularly liberty, and justice. Some economic policies may be seen as increasing efficiency at a cost to other goals or values, though this is certainly not a universal tradeoff. For example, taxation will always cause some inefficiency in markets, but many individuals believe that the benefits of programs such as Social Security and public schooling are worth the loss in efficiency.

The Function and Nature of Markets

In a free market, the price and quantity of an item are determined by the supply and demand for that item.

Learning objectives

Summarize the defining characteristics of a free market economy

In economics, a market is defined as a system or institution whereby parties engage in exchange. A market economy is an economy in which decisions regarding investment, production, and distribution are based on supply and demand, and prices of goods and services are determined in a free price system. The major defining characteristic of a market economy is that decisions on investment and the allocation of producer goods are mainly made through markets. This is the opposite of a planned economy, where investment and production decisions are embodied in a plan of production.

A free market is a market structure that is not controlled by a designated authority. Free markets may have different structures: perfect competition, oligopolies, monopolistic competition, and monopolies are all types of markets that may exist in a capitalist economy. The most basic models in economics assume that markets are free and experience perfect competition – there are many buyers and sellers so no individual actor may affect a good’s price; there are no barriers to exit or entry; products are homogeneous; and all actors in the economy have perfect information.

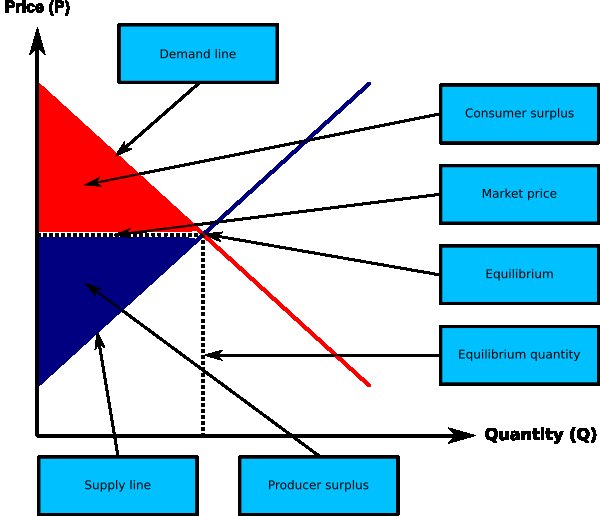

Market Equilibrium

In a free market, the price and quantity of an item is determined by the supply and demand for that item. The market demand function describes the amount of a good that all consumers will purchase at a given price, while the market supply function expresses the amount that producers will supply at a given price. Consider the market for computers. At a price of $1,200, the market may demand 8,000 computers, while producers are willing to supply 15,000 computers. This is not the equilibrium price because at $1,200, supply exceeds demand. In order to reach equilibrium, the price must drop, causing demand to rise and supply to fall until the two are equal. This can be expressed graphically by drawing the market supply function and the market demand function and finding the point where the two curves intersect.

Market Supply and Demand: The market equilibrium exists where the market demand curve and the market supply curve intersect.

Changes to the market supply and market demand will cause changes in the equilibrium price and quantity of the good produced. For example, if a new technology is invented that allows producers to manufacture cars more efficiently, supply will rise and the market supply curve will shift to the right. The new market equilibrium will have a higher number of cars sold at a lower price. When markets are perfectly competitive, the equilibrium outcome of trade in the market is economically efficient. This means that the market is producing the largest net gain possible for society, given consumers’ utility functions and producers’ production functions.

Markets are Typically Efficient

A perfectly competitive market with full property rights is typically efficient.

Learning objectives

Define efficient markets.

An efficient market maximizes total consumer and producer surplus; there is no deadweight loss. An economic system is said to be more efficient than another (in relative terms) if it can provide more goods and services for society without using more resources. In absolute terms, a situation can be called economically efficient if:

Economic Inefficiency: A sign of economic inefficiency in a market is the presence of deadweight loss.

- No one can be made better off without making someone else worse off (commonly referred to as Pareto efficiency),

- No additional output can be obtained without increasing the amount of inputs, and

- Production proceeds at the lowest possible per-unit cost.

Economists refer to two types of market efficiency. A market has productive efficiency when units of goods are being supplied at the lowest possible average cost. This condition is satisfied if the equilibrium quantity is at the minimum point of the average total cost curve. For example, if a farm can produce 10,000 bushels of corn with 20 employees, but is currently producing 10,000 bushels with 25 employees, it is not achieving productive efficiency.

A market has allocative efficiency if the price of a product that the market is supplying is equal to the value consumers place on it. This is equivalent to saying that the marginal cost of an item is equal to its price. If a market is not allocatively efficient, then it is creating too much of something that consumers value less than other goods, or not enough of something that consumers value more. A market that produces 500 loaves of bread but only one gallon of milk is probably not allocatively efficient.

As you study economics further, it is usually safe to assume that markets are efficient unless you’re dealing with a distortion (e.g. regulations, imperfect information sharing).

It is important to note that achieving economic efficiency is not always the most important goal for a society. A market can be perfectly efficient but highly unequal, for example. If 1% of the population controls virtually all the income, then the market will efficiently allocate virtually all of its production to those same people. While this is economically efficient, many would argue that it is not desirable. Efficient markets may have negative effects on those that exist outside of the market; for example, the energy market may cause environmental harm that is not captured in the economic notion of efficiency.

Government Intervention May Fix Inefficient Markets

Governments can intervene to make a market more efficient when a market failure, such as externalities or asymmetric information, exists.

Learning objectives

Discuss the role of government in addressing common market failures

In an efficient market, firms can produce goods at the lowest possible cost while individuals can access the goods and services they desire, all while utilizing the least resources possible. A market can be said to be economically efficient if it has certain qualities:

- perfectly competitive

- mobile resources

- accurate and freely available information

- individuals directly receive the costs and benefits of their transactions

Market failure is the name for when a market is not efficient; that is, when it deviates from one or more of the above conditions. However, in reality no market is perfectly efficient. In general, minor inefficiencies do not dramatically affect society. But when society is adversely affected by economic inefficiency, such as when a monopoly firm raises prices to a point where people cannot afford a basic good, the government will sometimes intervene.

Consider the problem of externalities, the phenomenon of when a transaction occurs that affects people who were not directly involved. For example, when a coal plant producing electricity causes pollution, there is a transaction between the company and the resident who purchases the product. But if you live near the coal plant and suffer from asthma due to the smog it produces, you are encountering a negative externality. You had no choice in the transaction, but are experiencing its effects.

Externalities are an example of economic inefficiency, since those involved in the economic transaction do not bear the full costs of the transaction. In this case, governments can intervene by taxing the transaction and using the money to negate the harmful effects or to compensate those affected by the negative externality. Similarly, when a transaction produces positive externalities, efficiency is achieved when the government subsidizes the transaction. Education is an example of a transaction that has a positive effect on society.

Another case in which markets do not operate efficiently on their own is the market for public goods. Public goods are nonrival, which means that more than one (and sometimes many!) individual can use the good at one time. They are also nonexcludable, which means that their use cannot be prevented. For example, consider a beautiful fountain in a public park. The company that built the fountain cannot force people to pay money in order to enjoy it, since its in a public area; and since one person looking at the fountain doesn’t prevent others from looking at it, it is a nonrival good.

Free markets will generally produce less than the optimal amount when a good is nonexcludable and nonrivalrous, which means that a government can make the market more efficient by producing the public good itself. By using tax revenue, governments can avoid the problem of free riders and produce an efficient quantity of public goods even when the free market cannot.

National Defense as a Public Good: National defense is a classic example of a good that is nonexcludable and nonrivalrous. It will be under-produced unless the government provides it.

Full Economy Interactions

Variables that describe the full economy, such as GDP and unemployment, are determined by the decisions of individual economic actors.

Learning objectives

Explain how the macroeconomy is the sum of many individual economic actors’ decisions.

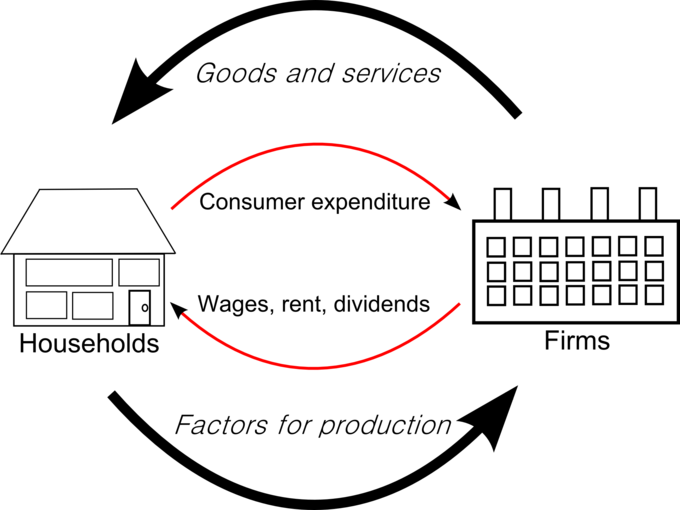

In the most basic economic model, the economy consists of interactions between households, which provide labor and purchase goods, and firms, which employ labor and produce goods. Macroeconomics studies the aggregate effects of the actions of many individual households and firms. While microeconomists might study how a market with one producer and one consumer reaches equilibrium, macroeconomists combine the demand of all consumers in a market (aggregate demand) and the supply from all producers in a market (aggregate supply) to look at the way these groups interact on a large scale.

Circular Flow: The economy consists of interactions between firms and households.

Consider the market for CDs. Each individual consumer has a demand function for CDs that determines how many he will buy at a particular price – for example, one consumer may only buy a single album if they cost $15 each, but would buy two if the price dropped to $10 each. Likewise, each producer has a production function that determines how many CDs it will produce at a given price; it may produce 10,000 CDs if they can be sold for $10, but will increase production to 12,000 if the price rises to $15. In order to understand the entire market for CDs, economists add the demand of all consumers at each possible price, creating an aggregate demand curve, and the total quantity supplied by producers at each possible price, creating an aggregate supply curve. The point at which these two curves intersect shows the market equilibrium for CDs.

The Macroeconomy

Just as the choices made by individual consumers and producers can be aggregated to describe an entire industry, their combined effects can also influence a nation’s overall economic activity. Macroeconomists study a variety of these effects, but three are central to macroeconomic research:

- Gross domestic product (GDP) – the size of an entire economy’s output – is measured by adding together all the production undertaken by a nation’s firms. Individual firms affect GDP every time they choose to produce more or less. Consumers affect GDP whenever they increase or decrease demand for goods.

- Inflation occurs when many individual consumers increase demand for a good, raising the equilibrium price for the economy as a whole.

- Unemployment rises when firms choose to produce less or when consumers decrease their demand at a given price.

Key Points

- Firms generally appear and become prevalent as an alternative to individual trade when it is more efficient to produce in a non-market environment.

- Limited liability separates the management of a firm from its ownership, allowing companies to raise money easily because owners do not need to risk everything in the case of bankruptcy.

- Most industries experience increasing returns to scale up to a point, which means that more goods can be produced using fewer resources.

- According to Ronald Coase, the main reason to establish a firm is to avoid some of the transaction costs of using the price mechanism.

- The benefit of exchange to producers is measured by the profit the producer makes. The benefit of exchange to a consumer is measured by net utility gained.

- Consumer surplus is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest price that they would be willing to pay.

- Producer surplus is the amount that producers benefit by selling at a market price that is higher than the least that they would be willing to sell for.

- An allocation of resources is Pareto efficient when it is impossible to make any one individual better off without making at least one individual worse off.

- Economists assume that firms seek to maximize their profits – defined as the difference between total revenue and total cost – while consumers seek to maximize their utility – which is roughly defined as the total satisfaction gained from goods, services, or actions.

- An efficient allocation of resources maximizes total consumer and producer surplus.

- Because they produce efficient outcomes, the seemingly haphazard workings of the marketplace can promote the common good.

- Efficiency is but one of many vying goals in an economic system, and different notions of efficiency may be complementary or may be at odds.

- A market is defined as a system or institution whereby parties engage in exchange. A market economy is an economy in which decisions regarding investment, production, and distribution are based on supply and demand, and prices of goods and services are determined in a free price system.

- In a perfectly competitive market there are many buyers and sellers so no individual actor may affect a good’s price; there are no barriers to exit or entry; products are homogeneous; and all actors in the economy have perfect information.

- Changes to the market supply and market demand will cause changes in the equilibrium price and quantity of the good produced.

- When markets are perfectly competitive, the equilibrium outcome of trade in the market is economically efficient. This means that the market is producing the largest net gain possible for society, given consumers’ utility functions and producers’ production functions.

- A market has productive efficiency when units of goods are being supplied at the lowest possible average cost.

- A market has allocative efficiency if the price of a product that the market is supplying is equal to the value consumers place on it.

- It is important to note that achieving economic efficiency is not always the most important goal for a society. A market can be perfectly efficient but highly unequal.

- A smoothly functioning market requires that producers possess property rights to the goods and services they produce and that consumers possess property rights to the goods and services they buy.

- Economic efficiency occurs under the following conditions: competitive markets with accurate exchange of information and mobile resources, in which individuals bear the full costs and benefits of their transactions.

- The criteria for economic efficiency are rarely fully met.

- If a transaction affects individuals not involved in the transaction (either positively or negatively), that transaction is said to have an externality.

- Governments can intervene by taxing negative externalities or subsidizing positive externalities.

- Free markets will generally produce less than the optimal amount when a good is nonexcludable and nonrivalrous, which means that a government can make the market more efficient by producing the public good itself.

- Macroeconomists combine the demand of all consumers in a market ( aggregate demand ) and the supply from all producers in a market ( aggregate supply ) to look at the way these groups interact on a large scale.

- Just as the choices made by individual consumers and producers can be aggregated to describe an entire industry, their combined effects can also influence a nation’s overall economic activity.

- GDP is measured by adding together all the production undertaken by a nation’s firms. Individual firms affect GDP every time they choose to produce more or less. Consumers affect GDP whenever they increase or decrease demand for goods.

Key Terms

- increasing returns to scale: The characteristic of production in which output increases by more than the proportional increase in inputs.

- firm: A business enterprise, however organized.

- utility: The ability of a commodity to satisfy needs or wants; the satisfaction experienced by the consumer of that commodity.

- consumer surplus: The difference between the maximum price a consumer is willing to pay and the actual price they do pay.

- producer surplus: The amount that producers benefit by selling at a market price that is higher than the lowest price at which they would be willing to sell.

- producer surplus: The amount that producers benefit by selling at a market price that is higher than the lowest price at which they would be willing to sell.

- consumer surplus: The difference between the maximum price a consumer is willing to pay and the actual price they do pay.

- market economy: An economy in which goods and services are exchanged in a free market, as opposed to a state-controlled or socialist economy; a capitalistic economy.

- equilibrium: The condition of a system in which competing influences are balanced, resulting in no net change.

- Pareto efficiency: The state in which no one can be made better off by making another worse off.

- public good: A good that is both non-excludable and non-rivalrous in that individuals cannot be effectively excluded from use and where use by one individual does not reduce availability to others.

- externality: An impact, positive or negative, on any party not involved in a given economic transaction or act.

- free rider: One who obtains benefit from a public good without paying for it directly.

- inflation: An increase in the general level of prices or in the cost of living.

- aggregate: A mass, assemblage, or sum of particulars; something consisting of elements but considered as a whole.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- IB Economics/Microeconomics/Theory of the Firm (HL). Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/IB_Econ..._the_Firm_(HL). License: CC BY-SA: Attribution-ShareAlike

- Theory of the firm. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Theory_of_the_firm. License: CC BY-SA: Attribution-ShareAlike

- firm. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/firm. License: CC BY-SA: Attribution-ShareAlike

- increasing returns to scale. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/increas...s%20to%20scale. License: CC BY-SA: Attribution-ShareAlike

- RICOH Company Head Office Building 2007-1. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ing_2007-1.jpg. License: CC BY-SA: Attribution-ShareAlike

- Economic surplus. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_surplus. License: CC BY-SA: Attribution-ShareAlike

- Pareto efficiency. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Pareto_efficiency. License: CC BY-SA: Attribution-ShareAlike

- producer surplus. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/producer%20surplus. License: CC BY-SA: Attribution-ShareAlike

- utility. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/utility. License: CC BY-SA: Attribution-ShareAlike

- consumer surplus. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/consumer%20surplus. License: CC BY-SA: Attribution-ShareAlike

- RICOH Company Head Office Building 2007-1. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ing_2007-1.jpg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Economic efficiency. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_efficiency. License: CC BY-SA: Attribution-ShareAlike

- Invisible hand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Invisible_hand. License: CC BY-SA: Attribution-ShareAlike

- Economic surplus. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_surplus. License: CC BY-SA: Attribution-ShareAlike

- Economic efficiency. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_efficiency. License: CC BY-SA: Attribution-ShareAlike

- producer surplus. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/producer%20surplus. License: CC BY-SA: Attribution-ShareAlike

- consumer surplus. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/consumer%20surplus. License: CC BY-SA: Attribution-ShareAlike

- RICOH Company Head Office Building 2007-1. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ing_2007-1.jpg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Free market. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Free_market. License: CC BY-SA: Attribution-ShareAlike

- Market economy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Market_economy. License: CC BY-SA: Attribution-ShareAlike

- equilibrium. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/equilibrium. License: CC BY-SA: Attribution-ShareAlike

- market economy. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/market_economy. License: CC BY-SA: Attribution-ShareAlike

- RICOH Company Head Office Building 2007-1. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ing_2007-1.jpg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Supply-demand-equilibrium. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...quilibrium.svg. License: CC BY-SA: Attribution-ShareAlike

- Economic efficiency. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_efficiency. License: CC BY-SA: Attribution-ShareAlike

- Pareto efficiency. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Pareto_efficiency. License: CC BY-SA: Attribution-ShareAlike

- Allocative efficiency. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Allocat...y%23Conditions. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...eto-efficiency. License: CC BY-SA: Attribution-ShareAlike

- RICOH Company Head Office Building 2007-1. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ing_2007-1.jpg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Supply-demand-equilibrium. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...quilibrium.svg. License: CC BY-SA: Attribution-ShareAlike

- Deadweight-loss-price-ceiling. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ce-ceiling.svg. License: CC BY: Attribution

- free rider. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/free_rider. License: CC BY-SA: Attribution-ShareAlike

- externality. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/externality. License: CC BY-SA: Attribution-ShareAlike

- public good. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/public%20good. License: CC BY-SA: Attribution-ShareAlike

- RICOH Company Head Office Building 2007-1. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:RICOH_Company_Head_Office_Building_2007-1.jpg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Consumer_producer_surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Consumer_producer_surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Supply-demand-equilibrium. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Supply-demand-equilibrium.svg. License: CC BY-SA: Attribution-ShareAlike

- Deadweight-loss-price-ceiling. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Deadweight-loss-price-ceiling.svg. License: CC BY: Attribution

- F-15C. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:F-15C.jpg. License: Public Domain: No Known Copyright

- IB Economics/Introduction to Economics/Basic Definitions. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/IB_Economics/Introduction_to_Economics/Basic_Definitions. License: CC BY-SA: Attribution-ShareAlike

- Macroeconomics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Macroeconomics. License: CC BY-SA: Attribution-ShareAlike

- inflation. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/inflation. License: CC BY-SA: Attribution-ShareAlike

- aggregate. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/aggregate. License: CC BY-SA: Attribution-ShareAlike

- RICOH Company Head Office Building 2007-1. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:RICOH_Company_Head_Office_Building_2007-1.jpg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Consumer_producer_surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Consumer producer surplus en. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Consumer_producer_surplus_en.svg. License: CC BY-SA: Attribution-ShareAlike

- Supply-demand-equilibrium. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Supply-demand-equilibrium.svg. License: CC BY-SA: Attribution-ShareAlike

- Deadweight-loss-price-ceiling. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Deadweight-loss-price-ceiling.svg. License: CC BY: Attribution

- F-15C. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:F-15C.jpg. License: Public Domain: No Known Copyright

- Circular flow of goods income. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Circular_flow_of_goods_income.png. License: CC BY-SA: Attribution-ShareAlike