Learning Objectives

- Identify how you are spending your money and what optional expenditures you can cut back on.

- Develop a positive attitude for spending less while still enjoying a full college experience.

- Create and manage a workable budget by tracking expenditures to reach your financial goals.

- Recognize if you are getting in financial trouble and know what to do about it.

- List the benefits of saving money even while in college.

Where Does the Money Go?

Most people aren’t really sure where a lot of their money goes. Take this survey to see how much you remember about how you have spent money recently.

Do your best to remember how much you have spent in the last thirty days in each of the following categories:

| Category |

Amount in Dollars (Per Month) |

| Coffee, soft drinks, bottled water |

|

| Newspapers, magazines |

|

| Movies, music concerts, sports events, night life |

|

| Fast food lunches, snacks, gum, candy, cookies, and so on |

|

| Social dining out with friends (lunch, dinner) |

|

| Music, DVDs, other personal entertainment |

|

| Ringtones and mobile phone applications |

|

| Bank account fees, ATM withdrawal fees |

|

| Credit card finance charges |

|

| Lottery tickets |

|

| Cigarettes, smokeless tobacco |

|

| Beer, wine, liquor purchased in stores |

|

| Beer, wine, liquor purchased in restaurants and bars |

|

| Gadgets, video or computer games, and so on |

|

| Gifts |

|

| Hobbies |

|

| Travel, day trips |

|

| Total: |

|

Now be honest with yourself: is this really all you spent on these items? Most of us forget small, daily kinds of purchases or underestimate how much we spend on them—especially when we pay with cash.

You’ll notice also that this list does not include essential spending for things like room and board or an apartment and groceries, utilities, college tuition and books, and so on. The greatest potential for cutting back on spending is in the area of optional things.

Spending on Essentials, Spending on Optionals

More people get into financial trouble because they’re spending too much than because they’re making (or receiving) too little. While spending may seem a simple matter—“I need to buy this, I’d like to buy that”—it’s actually very complex. America is a consumer society, and we’re deluged by advertisements promising that we’ll be happier, more successful, better liked by more people, sexier, and everything else if only we buy this. Companies have spent billions of dollars researching how to manipulate our buying behavior. No wonder it’s so tough to resist these pressures!

Why does a person feel compelled to buy fast food for lunch, or a new CD with a song they just heard on the radio, or a new video game a friend says is so good, or a new article of clothing? We owe it to ourselves to try to understand our own attitudes about money and spending. Here’s a good place to start:

- Having money or not having money doesn’t define who you are. Your real friends will think no less of you if you make your own lunch and eat it between classes or take the bus to campus rather than drive a new car. You are valued more by others for who you are as a person, not for what things you have.

- You don’t have to spend as much as your friends to be one of the group. Some people always have more money than others and spend more. Resist any feeling that your friends who are big spenders are the norm. Don’t feel you have to go along with whatever expensive activities they propose just so you fit in.

- A positive attitude leads to success. Learn to relax and not get stressed out about money. If you need to make changes in how you spend money, view this as an exciting accomplishment, not a depressing fact. Feel good about staying on a budget and being smart about how you spend your money.

- Be realistic about what you can accomplish. Most students have financial problems, and they don’t just go away by waving a magic wand of good intentions. If your budget reveals you don’t have enough money even while working and carefully controlling your spending, you may still need a student loan or larger changes in your lifestyle to get by. That’s OK—there are ways to deal with that. But if you unrealistically set your sights so high about spending less and saving a lot, you may become depressed or discouraged if you don’t meet your goals.

Before you can make an effective budget, you need to look at what you’re spending money on now and consider what’s essential and what’s optional. Essential costs are the big things:

- Room and board or rent/mortgage, utilities, and groceries

- College tuition, fees, textbooks, supplies

- Transportation

- Insurance (health insurance, car insurance, etc.)

- Dependent care if needed

- Essential personal items (some clothing, hygiene items, etc.)

These things are sometimes called fixed costs, but that term can be misleading. If you have the option to move to a less expensive apartment that is smaller or a few blocks farther away, you can partly control that cost, so it’s not really “fixed.” Still, for most people, the real savings come from spending less on optional things.

Look back at the amounts you wrote in the earlier exercise “Where Does the Money Go?” These things are “optional” expenses—you can spend more or less on them as you choose. Most people spend by habit, not really thinking about where their money goes or how quickly their spending adds up. If you knew you were spending more than a thousand dollars a year on coffee you buy every day between classes, would that make you think twice? Or another thousand on fast food lunches rather than taking a couple minutes in the morning to make your lunch? When people actually start paying attention to where their money goes, most are shocked to see how the totals grow. If you can save a few thousand dollars a year by cutting back on just the little things, how far would that go to making you feel much better about your finances?

Following are some general principles for learning to spend less. The “Tips for Success” then lists specific ways you can try to follow these principles in your daily life. Remember, spending money doesn’t define who you are!

- Be aware of what you’re spending. Carry a small notebook and write down everything—everything—you spend for a month. You’ll see your habits and be able to make a better budget to take control.

- Look for alternatives. If you buy a lot of bottled water, for example, you may feel healthier than people who drink soft drinks or coffee, but you may be spending hundreds of dollars a year on something that is virtually free! Carry your own refillable water bottle and save the money.

- Plan ahead to avoid impulse spending. If you have a healthy snack in your backpack, it’s much easier to not put a dollar in a vending machine when you’re hungry on the way to class. Make a list before going grocery shopping and stick to it. Shopping without a list usually results in buying all sorts of unneeded (and expensive) things that catch your eye in the store.

- Be smart. Shop around, compare prices, and buy in bulk. Stopping to think a minute before spending is often all it takes.

Tips for Success: Spending Less

- Make your own lunches and snacks.

- Read newspapers and magazines online or in the library.

- Cancel cable television and watch programs online for free.

- Use free campus and local Wi-Fi spots and cancel your home high-speed Internet connection.

- Buy generic products instead of name brands.

- Shop at thrift stores and yard sales.

- Pay with cash instead of a credit card.

- Cancel your health club membership and use a free facility on campus.

- Compare prices online.

- Avoid ATM fees by finding a machine on your card’s network (or change banks); avoid checking account monthly fees by finding a bank with free checking.

- Get cash from an ATM in small amounts so you never feel “rich.”

- With larger purchases, postpone buying for a couple days (you may find you don’t “need” it after all).

- Look for free fun instead of movies and concerts—most colleges have frequent free events.

- If you pay your own utility bills, make it a habit to conserve: don’t leave lights burning or your computer on all night.

- Use good study skills to avoid failing a class—paying to retake a course is one of the quickest ways to get in financial trouble!

Managing a Budget

Budgeting involves analyzing your income and expenses so you can see where your money is going and making adjustments when needed to avoid debt. At first budgeting can seem complex or time consuming, but once you’ve gone through the basics, you’ll find it easy and a very valuable tool for controlling your personal finances.

Why create and manage a budget? Going to college changes your financial situation. There are many new expenses, and you likely don’t know yet how your spending needs and habits will work out over the long term. Without a budget, it’s just human nature to spend more than you have coming in, as evidenced by the fact that most Americans today are in debt. Debt is a major reason many students drop out of college. So it’s worth it to go to the trouble to create and manage a budget.

Managing a budget involves three steps:

- Listing all your sources of income on a monthly basis.

- Calculating all your expenditures on a monthly basis.

- Making adjustments in your budget (and lifestyle if needed) to ensure the money isn’t going out faster than it’s coming in.

Tracking Income

Many college students receive money or financial assistance from a number of sources. To track income in a monthly budget, consider all your sources of funds and convert them to a monthly number. For example, you may receive a student loan once during the year or you may work more in the summer and save up money then. To calculate your monthly projected income, add up your income sources and divide that number by the number of months you will be using the income. For example, if you have saved $4,800 that you can spend over two years of college, divide the $4,800 by twenty-four months to arrive at a monthly income of $200 from those savings. Do the same with scholarship grants, student loans, monetary gifts, and so on.

If some of your college costs are being paid directly by parents or others, do not include that money in your budget as either income or an expense. Base your monthly budget on just those funds and expenses that involve you directly.

Use Table 11.1 “Monthly Income and Funds” to record and total all your income on a monthly basis. If you must estimate some sources, estimate low rather than high; it’s a bad trap to assume you’ll have more money coming in than you actually do—that’s a real budget buster.

Table 11.1 Monthly Income and Funds

| Source of Income/Funds |

Amount in Dollars |

| Job income/salary (take-home amount) |

|

| Funds from parents/family/others |

|

| Monthly draw from savings |

|

| Monthly draw from financial aid |

|

| Monthly draw from student/other loans |

|

| Other income source: ________________ |

|

| Other income source: ________________ |

|

| Other income source: ________________ |

|

| Total Monthly Incoming: |

|

Tracking Expenses

Tracking expenditures is more difficult than tracking income. Some fixed expenses (tuition, rent, etc.) you should already know, but until you’ve actually written down everything you spend in a typical month, it’s hard to estimate how much you’re really spending on cups of coffee or smoothies between class, groceries, entertainment, and the like. The best way to itemize this side of your budget is to write down everything you spend—everything, every bottle of water and cookie, coins into parking meters, and so forth—for a full month. Then you can total up the different categories of expenses more realistically. We urge you to immediately start writing everything down in a small notebook you carry with you. You may be astonished how small purchases add up.

While you’re writing this down for a month, go ahead and work through the expenditure half of your budget, using Table 11.2 “Monthly Expenditures”. Set aside an hour or two to look through your past financial records, checkbook register and debit card transactions, past utility bills, credit card statements, and so on to get the numbers to put in your expenses budget. Make estimates when you have to, but be honest with yourself and don’t underestimate your usual spending. There will be plenty of time down the road to adjust your budget—but don’t start out with an unrealistic plan. Write “est” (for estimated”) next to numbers in your budget that you’re guessing at.

Once you have listed your routine expenditures using Table 11.2 “Monthly Expenditures”, write out your own budget categories that fit how you actually spend money. Everyone is unique, and you want your budget to be easy to use for your own life and habits.

As noted previously with income, if some of your expenses are paid directly by others, do not include them here. Base your monthly budget on just those funds and expenses that involve you directly.

Table 11.2 Monthly Expenditures

| Expenditures |

Amount in Dollars |

| Tuition and fees (1/12 of annual) |

|

| Textbooks and supplies (1/12 of annual) |

|

| Housing: monthly mortgage, rent, or room and board |

|

| Home repairs |

|

| Renter’s insurance |

|

| Property tax |

|

| Average monthly utilities (electricity, water, gas, oil) |

|

| Optional utilities (cell phone, Internet service, cable television) |

|

| Dependent care, babysitting |

|

| Child support, alimony |

|

| Groceries |

|

| Meals and snacks out (including coffee, water, etc.) |

|

| Personal expenses (toiletries, cosmetics, haircuts, etc.) |

|

| Auto expenses (payments, gas, tolls) plus 1/12 of annual insurance premium—or public transportation costs |

|

| Loan repayments, credit card pay-off payments |

|

| Health insurance (1/12 of annual) |

|

| Prescriptions, medical expenses |

|

| Entertainment (movies, concerts, nightlife, sporting events, purchases of CDs, DVDs, video games, etc.) |

|

| Bank account fees, ATM withdrawal fees, credit card finance charges |

|

| Newspapers, magazines, subscriptions |

|

| Travel, day trips |

|

| Cigarettes, smokeless tobacco |

|

| Beer, wine, liquor |

|

| Gifts |

|

| Hobbies |

|

| Major purchases (computer, home furnishings) (1/12 of annual) |

|

| Clothing, dry cleaning |

|

| Memberships (health clubs, etc.) |

|

| Pet food, veterinary bills, and so on |

|

| Other expenditure: |

|

| Other expenditure: |

|

| Other expenditure: |

|

| Other expenditure: |

|

| Other expenditure: |

|

| Total Monthly Outgoing: |

|

Balancing Your Budget

Now comes the moment of truth: compare your total monthly incoming with your total monthly outgoing. How balanced is your budget at this point? Remember that you estimated some of your expenditures. You can’t know for sure until you actually track your expenses for at least a month and have real numbers to work with.

What if your spending total is higher than your income total? The first step is to make your budget work on paper. Go back through your expenditure list and see where you can cut. Remember, college students shouldn’t try to live like working professionals. Maybe you are used to a nice haircut every month or two—but maybe you can go to a cheaper place or cut it yourself. There are dozens of ways to spend less, as suggested earlier. The essential first step is to make your budget balance on paper.

Then your job is to live within the budget. It’s normal to have to make adjustments at first. Just be sure to keep the overall budget balanced as you make adjustments. For example, if you find you must spend more for textbooks, you may decide you can spend less on eating out—and subtract the amount from that category that you add to the textbook category. Get in the habit of thinking this way instead of reaching for a credit card when you don’t have enough in your budget for something you want or need.

Don’t be surprised if it takes several months to make the budget process work. Be flexible, but stay committed to the process and don’t give up because it feels like to too much work to keep track of your money. Without a budget, you may have difficulty reaching your larger goal: taking control of your life while in college.

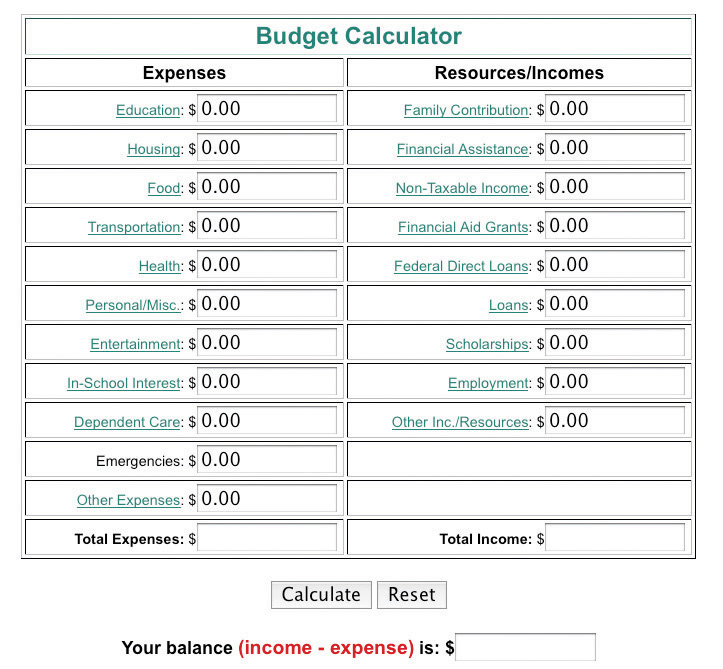

Budgeting on Your Computer

If you are good at Excel or another spreadsheet program, you can create your own budget in a spreadsheet that allows you to monitor your income and expenditures month to month, with the calculations done for you. Other budget calculators can be found online. Figure 11.3 “Simple Online Budget Calculator” shows a simple online budget calculator. The categories are general, but you can add up your numbers from Table 11.2 “Monthly Expenditures” in these categories and enter them in the online budget form, which then does the calculations for you.

Most college students can do well with a simple budget that helps you track monthly income and expenditures so that you can make adjustments as needed. If your financial life is more complicated or you would enjoy full financial tracking and control using your computer, a software program like Quicken has all the power you need and can download your banking and credit card records to easily track categories of expenses over time. A free online budget and tracking system is available at Mint.com.

What If Your Budget Doesn’t Work?

Your budget may be unbalanced by a small amount that you can correct by reducing spending, or it may have a serious imbalance. If your best efforts fail to cut your expenditures to match your income, you may have a more serious problem, unless you plan in advance to manage this with student loans or other funds.

First, think about how this situation occurred. When you decided to go to college, how did you plan to finance it? Were you off in your calculations of what it would cost, or did you just hope for the best? Are you still committed to finding a way to continue in college?

If you are motivated to reach your college goal, good! Now look closely at your budget to determine what’s needed. If you can’t solve the budget shortfall by cutting back on “optional” expenses, then you need more dramatic changes. Are you paying a high rent because your apartment is spacious or near campus? Can you move a little farther away and get by temporarily in a smaller place, if the difference in rent makes a big difference in your overall finances? If you’re spending a lot on your car, can you sell it and get by with public transportation for a year or two? Play with the numbers for such items in your budget and see how you can cut expenses to stay in college without getting deeply in debt. If you worry you won’t be as happy if you change your lifestyle, remember that money problems are a key source of stress for many college students and that stress affects your happiness as well as how well you do in college. It’s worth the effort to work on your budget and prevent this stress.

If all else fails, see a financial aid counselor at your college. Don’t wait until you’re in real financial trouble before talking to someone who may be able to offer help.

Why People Spend Too Much, Even on a Budget

- Old habits die hard. Keep monitoring your spending habits and watch for things you’re spending money on without really thinking about it.

- Credit cards. Never use them if at all possible. They make it easy to spend too much or not see how much you’re spending. Save them for emergencies.

- Easy access to cash. Just put your card in an ATM and get some cash! It’s so easy to do, and an automatic habit for so many, that it’s easy to bust your budget with small amounts daily.

- Temptations are everywhere. Even when we’re careful, we’re often easily influenced by friends to go out or spend in other ways. Remember why you made your budget in the first place and keep your priorities in mind. The guilt you’ll feel tomorrow about spending a whole week’s food budget on one expensive dinner out probably isn’t worth the pleasure of it!

- We buy things to feel good. If that’s been a longtime habit for you, it will be hard to break. Often it’s better to find small things that make you feel good rather than trying to go without everything. Rewarding yourself with an ice cream treat for a week’s budgeting success won’t break your budget.

What If You Get in Financial Trouble?

People often don’t admit to themselves that they have a problem until it becomes unmanageable. We human beings are very good at rationalizing and making excuses to ourselves! Here are some warning signs of sliding into financial trouble:

- For two or three months in a row, your budget is unbalanced because you’re spending more than you are bringing in.

- You’ve begun using your savings for routine expenses you should be able to handle with your regular budget.

- You’ve missed a deadline for a bill or are taking credit card cash advances or overdrawing your checking account.

- You have a big balance on your credit card and have paid only the required minimum payment for the last two months.

- You have nothing in the bank in case of an emergency need.

- You don’t even know how much total debt you have.

- You’re trying to cut expenses by eliminating something important, such as dropping health insurance or not buying required textbooks.

If you are experiencing any of these warning signs, first acknowledge the problem. It’s not going to solve itself—you need to take active steps before it gets worse and affects your college career.

Second, if you just cannot budget your balance, admit that you need help. There’s no shame in that. Start with your college counselor or the financial aid office; if they can’t help you directly, they can refer you to someone who can. Take your budget and other financial records with you so that they can see what’s really involved. Remember that they’re there to help—their goal is to ensure you succeed in college.

Balance Your Checkbook!

Lots of people don’t balance their checkbook every month, thinking it’s just too much trouble. But it’s important to keep your checkbook balanced for several reasons:

- Banks sometimes make errors, and you can’t catch one without checking your record against your monthly bank statement.

- If you make a math error or forget to record a check or ATM withdrawal, you may have to pay overdraft fees.

- If you balance your checkbook only every few months, it can take many hours to examine records and find a problem.

If you’re not sure how exactly to balance your checkbook, ask a teller at your bank or get instructions online. This takes only a few minutes each month and is well worth it to avoid the stress and lost hours caused by an inevitable problem.

Saving for the Future

If you’re having problems just getting by on your budget, it may seem pointless to even think about saving for the future. Still, if you can possibly put aside some money every month into a savings plan, it’s worth the effort:

- An emergency or unexpected situation may occur suddenly. Having the savings to cope with it is much less stressful than having to find a loan or run up your credit cards.

- Saving is a good habit to develop. Saving for the future will prepare you well for the increasing financial complexities of life after graduation.

- You may need your savings to help launch your career after graduation. If you’re broke when you graduate, you may feel you have to take the first job that comes along, but with some savings you may have time to find the job that’s perfect for you.

- You may change your mind about future plans. Maybe you now think that you’ll go to work at a good job right after graduation, so you’re not concerned about saving—but maybe in a couple years you’ll decide to go to graduate school, law school, or business school—or to start your own business, or to join a volunteer program. Your savings may allow you to pursue a new goal.

Start by saving in a savings account at your bank or credit union. You can have a certain amount transferred from your checking account every month into a savings account—that makes it easier and more routine. A savings account allows withdrawal anytime but pays lower interest than other accounts. Ask at your bank about money market accounts and certificates of deposit (CDs), which generally pay higher interest but have restrictions on minimum balances and withdrawals. Savings bonds are another option. All of these options are federally insured, so your money stays safe. Risky investments like the stock market are generally not appropriate for college students on a budget.

Key Takeaways

- Financial success while in college depends on understanding and controlling your expenditures.

- There are many ways you can spend less on optional expenses, and even essentials, and still have a full life and enjoy your college experience.

- A detailed monthly budget that lists all income sources and expenditures makes it easier to track expenses and avoid sliding into financial trouble.

- Spending too much can quickly lead to financial problems. If you see the signs that you’re starting to have money problems, take steps quickly to prevent trouble before it snowballs out of control.

- While it may seem difficult just to make ends meet, make it a goal also to attempt to save something for future needs.

Checkpoint Exercises

-

List the top three optional expenditures you usually make every week.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

-

List three tips for spending less that you feel you will be able to use routinely to avoid running out of money while in college.

__________________________________________________________________

__________________________________________________________________

__________________________________________________________________

-

For each of the following statements, circle T for true or F for false:

| T |

F |

It’s OK to miss a deadline for paying your phone bill as long as you pay on time at least half of the time. |

| T |

F |

There’s really nothing wrong with not having any money in the bank as long as you have a credit card for emergencies and major purchases. |

| T |

F |

You should balance your checkbook every month when you receive your bank statement. |

| T |

F |

A good way to save money is to try to get by without buying expensive textbooks. |

| T |

F |

You only need to write up a budget if you’ve gotten deeply into debt and need to see a financial advisor to get out of debt. |

References

Federal Student Aid, “Budget Calculator,” Federal Student Aid Direct Loans, www.ed.gov/offices/OSFAP/Dire...lc/budget.html (accessed July 13, 2010).