Learning Objectives

- Understand the importance of researching and applying for financial aid every year even if you don’t think you qualify for assistance.

- Identify key differences among scholarships and grants, student loans, and work study programs.

- Avoid excessive student loans and setting yourself up for future financial difficulties.

You may already be receiving financial aid or understand what types of financial aid are available. Even if you are not receiving financial aid, however, you should understand the basics because your financial situation may change and you may need help paying for college. You owe it to yourself to learn about potential types of aid you might receive.

Every college has a financial aid office that can give you information about standard financial aid programs. Certain kinds of financial aid, however, such as private scholarships, are not administered by the college, so you may need to do some research. There are three main categories of financial aid:

- Scholarships and grants (money or tuition waivers that do not need to be repaid)

- Student loans (money that does need to be repaid, usually starting after graduation)

- Work study programs (money that is earned for tuition or other expenses)

These three types of aid are described in the following sections. Remember that this section only introduces these types of financial aid—be sure to get more information from your college’s financial aid office and the online sources listed here.

Applying for Financial Aid

For financial aid administered by your college, often only one general application form is required, along with detailed information on your financial situation (and those of your parents or guardians, if you are receiving their support) provided by filling out the FAFSA (Free Application for Federal Student Aid). If you have not already done this application, learn more at www.fafsa.ed.gov. Virtually all colleges require the FAFSA.

Outside loans and scholarships are generally applied for separately. Follow these general rules to ensure you receive any aid for which you are qualified:

- Apply to your college for financial aid every year, even if you do not receive financial aid in your first year or term. Your situation may change, and you want to remain eligible at all times in the future by filing the application.

- Talk to the financial office immediately if you (or your family) have any change in your circumstances.

- Complete your application accurately, fully, and honestly. Financial records are required to verify your data. Pay attention to the deadlines for all applications.

- Research possible outside financial aid based on other criteria. Many private scholarships or grants are available, for example, for the dependents of employees of certain companies, students pursuing a degree in a certain field, or students of a certain ethnic status or from a certain religious or geographical background, and the like.

- Do not pay for financial aid resource information. Some online companies try to profit from the anxieties of students about financial aid by promising to find financial aid for you for a fee. Legitimate sources of financial aid information are free.

Scholarships and Grants

Scholarships and grants are “free” money—you do not have to pay them back, unlike student loans. A scholarship is generally based on merit rather than demonstrated financial need—based on past grades, test scores, achievements, or experiences, including personal qualifications such as athletic ability, skills in the arts, community or volunteer experiences, and so on. Don’t make the mistake of thinking scholarships go only to students with high grades. Many scholarships, for example, honor those with past leadership or community experience or the promise of future activities. Even the grades and test scores needed for academic scholarships are relative: a grade point average (GPA) that does not qualify for a scholarship at one college may earn a scholarship at another. Never assume that you’re not qualified for any kind of scholarship or grant.

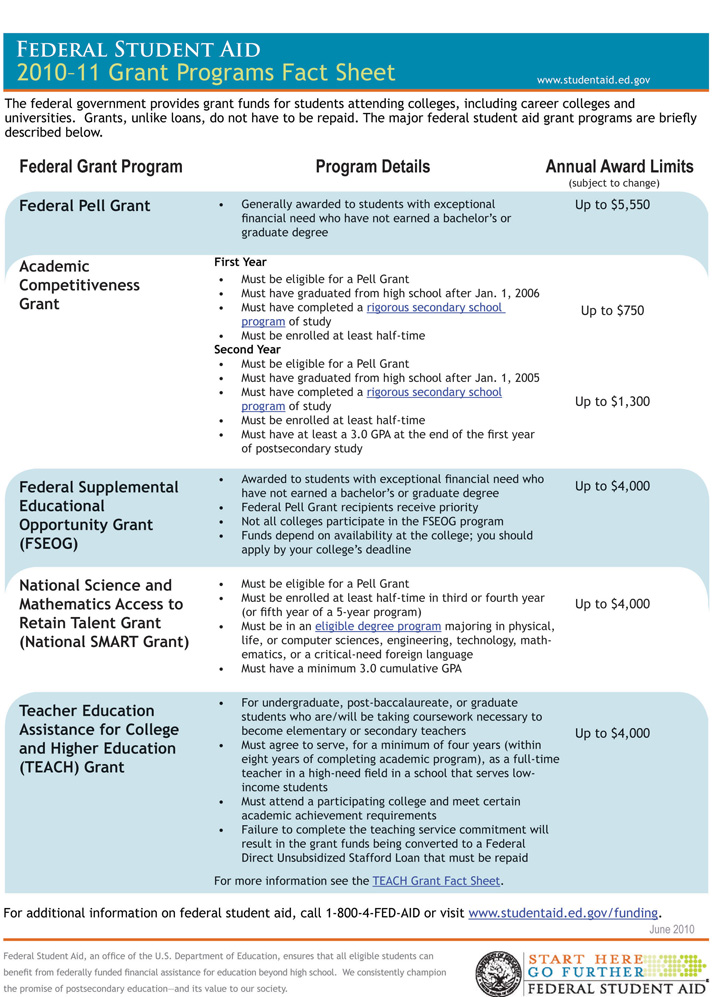

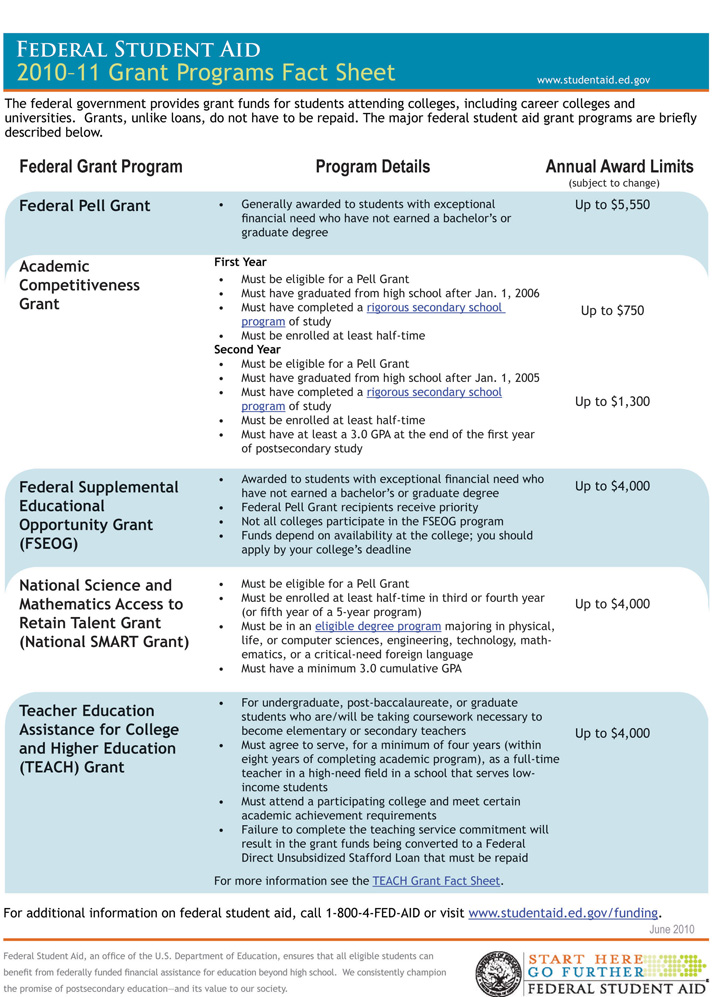

A grant also does not need to be paid back. Most grants are based on demonstrated financial need. A grant may be offered by the college, a federal or state program, or a private organization or civic group. The largest grant program for college students is the federal government’s Pell Grants program (Figure 11.5 “Student Grant Programs from the Federal Government”). Learn more about Pell Grants and other scholarship and grant programs from your college’s financial aid office or the online resources listed later.

Figure 11.5 Student Grant Programs from the Federal Government

Student Loans

Many different student loan programs are available for college students. Because many colleges do not have sufficient funds to offer full grants to students with financial need, financial aid packages often include a combination of grant and loan money. Ideally, one would like to graduate without having loan balances to repay later on. However, almost two-thirds of full-time college students do need student loans to pay for college. The amount of money students borrow has risen in recent years because tuition and fees have risen faster than inflation. The total amount owed now averages over $20,000 for students at four-year colleges and over $10,000 at two-year colleges.

Unfortunately this is a necessary reality for many students. For most, graduating from college owing some money is preferable to not going to college at all. With smart choices about the type of loan and a structured repayment program for your working years after graduation, there’s no reason to fear a loan. Just remember that the money eventually has to be repaid—it’s not “free” money even though it may feel that way while you’re in school.

All student loans are not the same. Interest terms vary widely, and with most private loans the interest starts building up immediately. The best loan generally is a subsidized federal Stafford loan. “Subsidized” in this case means the interest does not begin on the loan until after graduation. If you borrowed $20,000 over four years and interest accrued during this time, you could owe as much as $25,000 upon graduation. Be sure to talk with your college financial office first about getting a federal subsidized Stafford loan. Since the current maximum of this type of loan for most students is over $30,000, you ideally should not have to consider other types of loans—if you qualify for the Stafford with demonstrated financial need.

How Much Should You Borrow?

Many financial analysts urge college students not to borrow more than about $5,000 per year, or about $10,000 for two years of college, or $20,000 for four years. Even if you qualify for more, that doesn’t mean you should take it, and in fact, you may want to borrow much less. Think about this seriously before jumping to any conclusions about your future earning potential and how much you may have to struggle then to pay off your student loans. During an economic downturn, for example, many students have difficulty finding a job that pays well enough to cover their loan payments without hardship.

First learn the repayment rate for a loan amount. Then research the starting salary you can realistically expect after graduation. You can find this information online at many sites (such as the USNews salary finder wizard at usnews.salary.com/salarywizar..._newsearch.asp). Assume the starting salary will be at the low end of the salary range for any given career. Finally, make sure that your loan payments do not total more than 10 percent of your starting salary. If the payment amount is more than 10 percent, you are setting yourself up for future financial problems. Try to find ways to cut back on expenses instead. Many experts advise attending a less expensive college, if necessary, rather than risking your future well-being.

Work Study Programs

Work study programs are the third type of financial aid. They are administered by colleges and are a common part of the financial aid package for students with financial need. You work for what you earn, but work study programs often have advantages over outside jobs. The college runs the program, and you don’t have to spend valuable time looking for a job. Work study students usually work on or near campus, and work hours are controlled to avoid interfering with classes and study time. Work study students are more engaged with the academic community than students working off campus.

Some students who enter college already working or who have special skills or job experience can make a higher hourly rate than a work study program pays. If so, you might make the same income working fewer hours, leaving more for studying and other college activities. If this is your situation, carefully weigh the pros and cons before deciding about a work study program.

Tips for Success: Applying for Financial Aid

- Talk to your college’s financial aid office early and get the appropriate forms.

- Start your application early to ensure you make the deadline.

- Do online research to learn about additional private scholarships you may be qualified for.

- Evaluate student loans carefully and do not borrow more than you need or can repay without hardship after graduation.

Resources

Start with your local college offices to gather information about financial aid. Do additional research to make sure you’re considering all available options. Even though this takes some effort, it will prove worthwhile if you find other sources of funds for your college years. Start with the online resources listed here.

Additional Resources

Federal government information about federal grants and student loans. See studentaid.ed.gov.

Federal government scholarship information.studentaid.ed.gov/sa/types/grants-scholarships/finding-scholarships.

FinAid.org. See this private information Web site on scholarships, grants, and student loans at www.finaid.org.

CollegeScholarships.org. See this private information Web site on scholarships, grants, and student loans at http://www.collegescholarships.org.

Salary Wizard. To estimate future earning potential, use this tool available at http://www.salary.com/category/salary/.

Key Takeaways

- Many forms of financial aid are available for college students. Apply every year and notify the college financial aid office if you have a significant change in circumstances.

- Consider all forms of financial aid—not just the aid managed by your college. Look into private scholarships and grants.

- Carefully consider how much to borrow in student loans.

Checkpoint Exercises

-

What is the best kind of college financial aid to seek?

___________________________________________________

-

For each of the following statements, circle T for true or F for false:

- As a general rule, your future payments on a student loan should not be more than _____ percent of what you expect to make with your starting salary.

References

Federal Student Aid, “Federal Student Aid Grant Programs Fact Sheet,” studentaid.ed.gov/students/at...et_04_2009.pdf (accessed July 13, 2010).