9.5: Interest Rates and Foreign Exchange Rates

- Page ID

- 11841

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)The interest rates determined in the money market have important effects on the foreign exchange rate. With free international trade in financial assets, portfolio managers, having chosen to hold some part of their portfolios in bonds, have an additional choice. They can hold some bonds issued by domestic borrowers and some issued by foreign borrowers. They might, for example, hold some bonds issued by the Government of Canada, some issued by the United States Treasury and some issued by other governments. Similarly, residents of other countries can choose to include bonds issued by the Government of Canada in their holdings. These choices are made on the basis of the yields on bonds established by conditions in different national money and bond markets.

Foreign exchange rate: the domestic currency price of a unit of foreign currency.

To achieve the highest return on the bond portion of their portfolios, managers buy bonds that offer the highest rate of return for a given level of risk. If interest rates are constant in other financial markets, a rise in Canadian interest rates and bond yields makes Canadian bonds more attractive to both domestic and foreign bondholders. The demand for Canadian bonds increases. A fall in Canadian interest rates has the opposite effect.

Bonds are issued and priced in national currency. Most Government of Canada bonds are denominated in Canadian dollars. U.S. Treasury bonds are denominated in U.S. dollars, and bonds issued by European governments are denominated in euros. If Canadians want to purchase bonds on foreign bond markets they need foreign currency to make payment. Similarly, if residents of other countries want to purchase Canadian bonds they need Canadian dollars to make payment. These foreign exchange requirements for trading in financial assets are the same as those for trading in goods and services. The foreign exchange market is the market in which currencies of different countries are bought and sold and foreign exchange rates are determined.

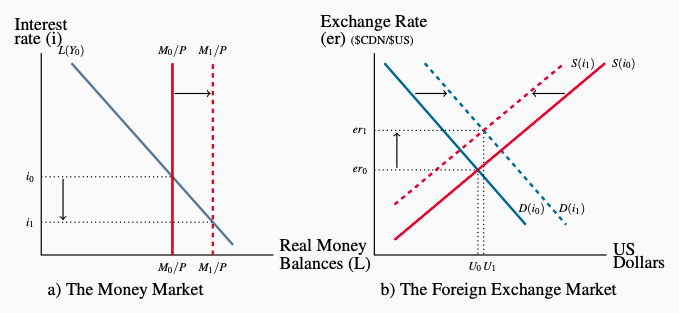

Figure 9.5 shows both the domestic money and foreign exchange markets. The domestic money market is the same as in Figure 9.3 and 9.4. The foreign exchange market shows the supply and demand for foreign exchange, in this case of the U.S. dollar, and the exchange rate which is the Canadian dollar price of one U.S. dollar. The intersection of the supply and demand curves in the foreign exchange market determines the equilibrium foreign exchange rate.

Figure 9.5: Interest Rates and Foreign Exchange Rates

The supply of U.S. dollars on the foreign exchange market comes from the export of goods, services, and financial assets to U.S. residents. Sales of crude oil, lumber, potash, auto parts, financial services, financial assets, and other exports generate receipts in U.S. dollars. Canadian exporters with costs denominated in Canadian dollars sell their U.S. dollar receipts on the Canadian foreign exchange market for Canadian dollars. This is the supply of U.S. dollars on the market.

In Figure 9.5 Panel b) the upward sloping supply curve shows quantities of U.S. dollars coming to the market at different exchange rates, all other things held constant. It slopes upward because higher exchange rates lower the prices of Canadian goods and services in foreign markets. As a result, exports of goods and services, and total receipts from export sales increase, giving a positive slope.

The downward sloping demand curve is also drawn on the assumption that all things except the exchange rate are constant. It is derived from Canadian demand for imports of U.S. goods, services, and financial assets. A fall in the exchange rate lowers the Canadian dollar price of imported goods and services and increases Canadian expenditure on imports. As a result the demand curve for U.S. dollars is downward sloping.

The link between the foreign exchange rate and the money market comes from the interest rate. Demand and supply curves are drawn on the assumption that interest rates, among other things, are constant. This assumption determines the positions of the supply and demand curves in the foreign exchange market. However, if the domestic interest rate changes, the supply and demand curves in the foreign exchange market will shift and change the equilibrium exchange rate. Figure 9.5 gives an example.

The solid lines in Figure 9.5 give the initial equilibrium conditions in both the money market and the foreign exchange market. With interest rate i0 in the money market, the supply and demand curves are S(i0) and D(i0) in the foreign exchange market. The intersection of the supply and demand curves determines the equilibrium exchange rate er1. This exchange rate is the Canadian dollar price of a U.S. dollar. It was about $1.13 Cdn = $1.00 U.S. in late-2014 as energy and commodity prices declined. It had been about $0.98 Cdn = $1.00 U.S. in early 2011.

A change in the domestic money market changes interest rates and, in turn, the foreign exchange rate. The dotted lines in the diagram show the effect of an increase in the domestic money supply. Money and bond market adjustments to the increased money supply lower the interest rate from i0 to i1. At these lower interest rates domestic bond yields are lower relative to foreign bond yields than they were before. This provides the incentive for domestic portfolio managers to switch their purchases from domestic bonds to foreign (U.S.) bonds. To pay for foreign bonds they need foreign currency. The demand for U.S. dollars increases to D(i1) in Panel b) of the diagram.

Simultaneously, bond holders in the U.S. shift their purchases from the now relatively low-yield Canadian bonds to U.S. bonds. Lower exports of securities to the U.S. market reduce the supply of U.S. dollars to S(i1) in Panel b) of the diagram. This negative shift in supply combined with the positive shift in demand results in a depreciation of the Canadian currency. If the exchange rate er0 was $1.02 Cdn = $1.00 U.S., the exchange rate er1 would be somewhat higher, say $1.03 Cdn = $1.00 U.S.

Depreciation of the national currency: a decline in the value of the currency relative to other national currencies, which results in a rise in the domestic price of foreign currencies.

In this example a fall in domestic interest rates, other things constant, causes depreciation in the domestic currency relative to foreign currencies. This interest rate-exchange rate linkage is symmetrical. Rises in domestic interest rates cause appreciation of the national currency.

Appreciation of the national currency: an increase in the value of the currency relative to other national currencies, which results in a fall in the domestic currency price of foreign currencies.

A decrease in the money supply or a change in the demand for money with a fixed money supply would affect the foreign exchange rate through the same linkages. Changes in domestic financial markets and foreign exchange markets happen simultaneously. With current communications and information technology these markets adjust very rapidly and continuously. The changes in interest rates and foreign exchange rates that result from changes in domestic money market conditions have important effects on aggregate expenditure and aggregate demand.