The Fractional Reserve System

A fractional reserve system is one in which banks hold reserves whose value is less than the sum of claims outstanding on those reserves.

learning objectives

- Examine the impact of fractional reserve banking on the money supply

Banks operate by taking in deposits and making loans to lenders. They are able to do this because not every depositor needs her money on the same day. Thus, banks can lend out some of their depositors’ money, while keeping some on hand to satisfy daily withdrawals by depositors. This is called the fractional-reserve banking system: banks only hold a fraction of total deposits as cash on hand.

Reserve Ratio

The fraction of deposits that a bank must hold as reserves rather than loan out is called the reserve ratio (or the reserve requirement) and is set by the Federal Reserve. If, for example, the reserve requirement is 1%, then a bank must hold reserves equal to 1% of their total customer deposits. These assets are typically held in the form of physical cash stored in a bank vault and in reserves deposited with the central bank.

Banks can also choose to hold reserves in excess of the required level. Any reserves beyond the required reserves are called excess reserves. Excess reserves plus required reserves equal total reserves. In general, since banks make less money from holding excess reserves than they would lending them out, economists assume that banks seek to hold no excess reserves.

Money Creation

Because banks are only required to keep a fraction of their deposits in reserve and may loan out the rest, banks are able to create money. To understand this, imagine that you deposit $100 at your bank. The bank is required to keep $10 as reserves but may lend out $90 to another individual or business. This loan is new money; the bank created it when it issued the loan. In fact, the vast majority of money in the economy today comes from these loans created by banks. Likewise when a loan is repaid, that money disappears from the economy until the bank issues another loan.

Money Creation in a Fractional Reserve System: The diagram shows the process through which commercial banks create money by issuing loans.

Thus, there are two ways that a central bank can use this process to increase or decrease the money supply. First, it can adjust the reserve ratio. A lower reserve ratio means that banks can issue more loans, increasing the money supply. Second, it can create or destroy reserves. Creating reserves means that commercial banks have more reserves with which they can satisfy the reserve ratio requirement, leading to more loans and an increase in the money supply.

Why Have Reserve Requirements?

Fractional-reserve banking ordinarily functions smoothly. Relatively few depositors demand payment at any given time, and banks maintain a buffer of reserves to cover depositors’ cash withdrawals and other demands for funds. However, banks also have an incentive to loan out as much money as possible and keep only a minimum buffer of reserves, since they earn more on these loans than they do on the reserves. Mandating a reserve requirement helps to ensure that banks have the ability to meet their obligations.

Example Transactions Showing How a Bank Can Create Money

The amount of money created by banks depends on the size of the deposit and the money multiplier.

learning objectives

- Calculate the change in money supply given the money multiplier, an initial deposit and the reserve ratio

To understand the process of money creation, let us create a hypothetical system of banks. We will focus on two banks in this system: Anderson Bank and Brentwood Bank. Assume that all banks are required to hold reserves equal to 10% of their customer deposits. When a bank’s excess reserves equal zero, it is loaned up.

Anderson and Brentwood both operate in a financial system with a 10% reserve requirement. Each has $10,000 in deposits and no excess reserves, so each has $9,000 in loans outstanding, and $10,000 in deposit balances held by customers.

Suppose a customer now deposits $1,000 in Anderson Bank. Anderson will loan out the maximum amount (90%) and hold the required 10% as reserves. There are now $11,000 in deposits in Anderson with $9,900 in loans outstanding.

The debtor takes her $900 loan and deposits it in Brentwood bank. Brentwood’s deposits now total $10,900. Thus, you can see that total deposits were $20,000 before the initial $1,000 deposit, and are now $21,900 after. Even though only $1,000 were added to the system, the amount of money in the system increased by $1,900. The $900 in checkable deposits is new money; Anderson created it when it issued the $900 loan.

Mathematically, the relationship between reserve requirements (\(rr\)), deposits, and money creation is given by the deposit multiplier (m). The deposit multiplier is the ratio of the maximum possible change in deposits to the change in reserves. When banks in the economy have made the maximum legal amount of loans (zero excess reserves), the deposit multiplier is equal to the reciprocal of the required reserve ratio (\(m=1/rr\)).

In the above example the deposit multiplier is 1/0.1, or 10. Thus, with a required reserve ratio of 0.1, an increase in reserves of $1 can increase the money supply by up to $10.

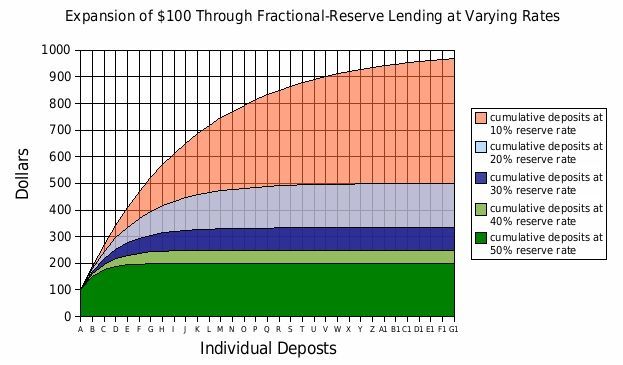

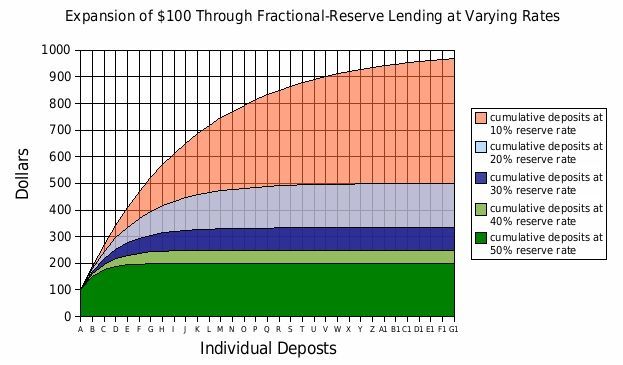

Money Creation and Reserve Requirements: The graph shows the total amount of money that can be created with the addition of $100 in reserves, using different reserve requirements as examples.

The Money Multiplier in Theory

The money multiplier measures the maximum amount of commercial bank money that can be created by a given unit of central bank money.

learning objectives

- Explain how the money multiplier works in theory

In order to understand the money multiplier, it’s important to understand the difference between commercial bank money and central bank money. When you think of money, what you probably imagine is commercial bank money. This consists of the dollars in your bank account – the money that you use when you write a check or use a debit or credit card. This money is created when commercial banks make loans to companies or individuals. Central bank money, on the other hand, is the money created by the central bank and used within the banking system. It consists of bank reserves held in accounts with the central bank, as well as physical currency held in bank vaults.

The money multiplier measures the maximum amount of commercial bank money that can be created by a given unit of central bank money. That is, in a fractional-reserve banking system, the total amount of loans that commercial banks are allowed to extend (the commercial bank money that they can legally create) is a multiple of reserves; this multiple is the reciprocal of the reserve ratio. We can derive the money multiplier mathematically, writing M for commercial bank money (loans), R for reserves (central bank money), and RR for the reserve ratio. We start with the reserve ratio requirement that the the fraction of deposits that a bank keeps as reserves is at least the reserve ratio:

\[\dfrac{R}{M}≥RR\]

Taking the reciprocal:

\[\dfrac{M}{R}≤\dfrac{1}{RR}\]

Therefore:

\[M≤R \times (\dfrac{1}{RR})\]

The above equation states that the total supply of commercial bank money is, at most, the amount of reserves times the reciprocal of the reserve ratio (the money multiplier).

Money Creation and the Money Multiplier: The graph shows the theoretical amount of money that can be created with different reserve requirements.

If banks lend out close to the maximum allowed by their reserves, then the inequality becomes an approximate equality, and commercial bank money is central bank money times the multiplier. If banks instead lend less than the maximum, accumulating excess reserves, then commercial bank money will be less than central bank money times the theoretical multiplier. In theory banks should always lend out the maximum allowed by their reserves, since they can receive a higher interest rate on loans than they can on money held in reserves.

Theoretically, then, a central bank can change the money supply in an economy by changing the reserve requirements. A 10% reserve requirement creates a total money supply equal to 10 times the amount of reserves in the economy; a 20% reserve requirement creates a total money supply equal to five times the amount of reserves in the economy.

The Money Multiplier in Reality

In reality, it is very unlikely that the money supply will be exactly equal to reserves times the money multiplier.

learning objectives

- Explain factors that prevent the money multiplier from working empirically as it does theoretically

The money multiplier in theory makes a number of assumptions that do not always necessarily hold in the real world. It assumes that people deposit all of their money and banks lend out all of the money they can (they hold no excess reserves). It also assumes that people instantaneously spend all of their loans. In reality, not all of these are true, meaning that the observed money multiplier rarely conforms to the theoretical money multiplier.

Excess Reserves

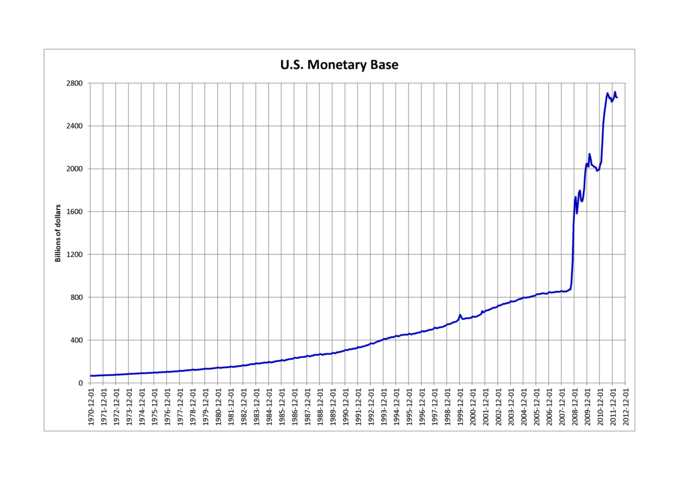

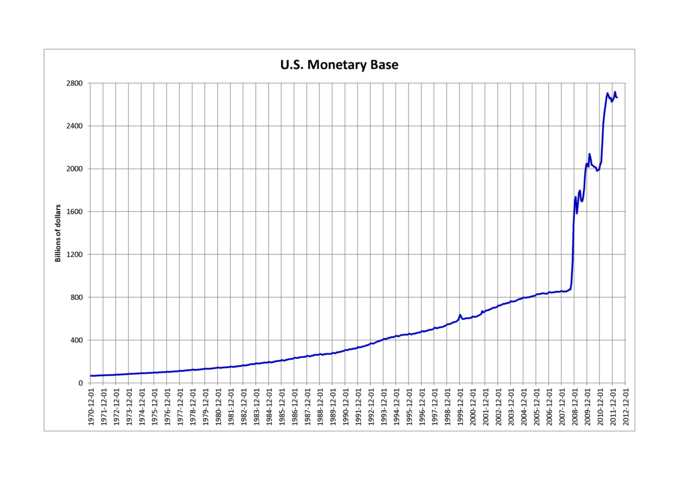

First, some banks may choose to hold excess reserves. In the decades prior to the financial crisis of 2007-2008, this was very rare – banks held next to no excess reserves, lending out the maximum amount possible. During this time, the relationship between reserves, reserve requirements, and the money supply was relatively close to that predicted by economic theory. After the crisis, however, banks increased their excess reserves dramatically, climbing above $900 billion in January of 2009 and reaching $2.3 trillion in October of 2013. The presence of these excess reserves suggests that the reserve requirement ratio is not exerting an influence on the money supply.

U.S. Monetary Base: The monetary base is the sum of currency and reserves held in accounts at the central bank. After the financial crisis the monetary base increased dramatically: the result of banks starting to hold excess reserves as well as the central bank increasing the supply of reserves.

Cash

Second, customers may hold their savings in cash rather than in bank deposits. Recall that when cash is stored in a bank vault it is included in the bank’s supply of reserves. When it is withdrawn from the bank and held by consumers, however, it no longer serves as reserves and banks cannot use it to issue loans. When people hold more cash, the total supply of reserves available to banks goes down and the total money supply falls.

Loan Proceeds

Third, some loan proceeds may not be spent. Imagine that the reserve requirement ratio is 10% and a customer deposits $1,000 into a bank. The bank then uses this deposit to make a $900 loan to another one of its customers. If the customer fails to spend this money, it will simply sit in the bank account and the full multiplier effect will not apply. In this case, the $1,000 deposit allowed the bank to create $900 of new money, rather than the $10,000 of new money that would be created if the entire loan proceeds were spent.

Key Points

- The main way that banks earn profits is through issuing loans. Because their depositors do not typically all ask for the entire amount of their deposits back at the same time, banks lend out most of the deposits they have collected.

- The fraction of deposits that a bank keeps in cash or as a deposit with the central bank, rather than loaning out to the public, is called the reserve ratio.

- A minimum reserve ratio (or reserve requirement ) is mandated by the Fed in order to ensure that banks are able to meet their obligations.

- Because banks are only required to keep a fraction of their deposits in reserve and may loan out the rest, banks are able to create money.

- A lower reserve requirement allows banks to issue more loans and increase the money supply, while a higher reserve requirement does the opposite.

- When a deposit is made at a bank, that bank must keep a portion the form of reserves. The proportion is called the required reserve ratio.

- Loans out a portion of its reserves to individuals or firms who will then deposit the money in other bank accounts.

- Theoretically, this process will until repeat until there are no excess reserves left.

- The total amount of money created with a new bank deposit can be found using the deposit multiplier, which is the reciprocal of the reserve requirement ratio. Multiplying the deposit multiplier by the amount of the new deposit gives the total amount of money that may be created.

- The total supply of commercial bank money is, at most, the amount of reserves times the reciprocal of the reserve ratio (the money multiplier ).

- When banks have no excess reserves, the supply of total money is equal to reserves times the money multiplier. Theoretically, banks will never have excess reserves.

- According to the theory, a central bank can change the money supply in an economy by changing the reserve requirements.

- Some banks may choose to hold excess reserves, leading to a money supply that is less than that predicted by the money multiplier.

- Customers may withdraw cash, removing a source of reserves against which banks can create money.

- Individuals and businesses may not spend the entire proceeds of their loans, removing the multiplier effect on money creation.

Key Terms

- deposit: Money placed in an account.

- reserves: Banks’ holdings of deposits in accounts with their central bank, plus currency that is physically held in the bank’s vault.

- deposit multiplier: The maximum amount of commercial bank money that can be created by a given unit of reserves.

- currency: Paper money.

- central bank: The principal monetary authority of a country or monetary union; it normally regulates the supply of money, issues currency and controls interest rates.

- money multiplier: The maximum amount of commercial bank money that can be created by a given unit of central bank money.

- commercial bank: A type of financial institution that provides services such as accepting deposits, making business loans, and offering basic investment products to the public.

- reserve requirement: The minimum amount of deposits each commercial bank must hold (rather than lend out).

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- Fractional reserve banking. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Fractio...eserve_banking. License: CC BY-SA: Attribution-ShareAlike

- reserves. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/reserves. License: CC BY-SA: Attribution-ShareAlike

- deposit. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/deposit. License: CC BY-SA: Attribution-ShareAlike

- Money-creation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Money-creation.gif. License: CC BY-SA: Attribution-ShareAlike

- Money Creation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_creation. License: CC BY-SA: Attribution-ShareAlike

- Money Multiplier. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_multiplier. License: CC BY-SA: Attribution-ShareAlike

- currency. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/currency. License: CC BY-SA: Attribution-ShareAlike

- deposit multiplier. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/deposit%20multiplier. License: CC BY-SA: Attribution-ShareAlike

- Money-creation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Money-creation.gif. License: CC BY-SA: Attribution-ShareAlike

- Fractional-reserve banking with varying reserve requirements. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...quirements.gif. License: Public Domain: No Known Copyright

- Money multiplier. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_multiplier. License: CC BY-SA: Attribution-ShareAlike

- money multiplier. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/money%20multiplier. License: CC BY-SA: Attribution-ShareAlike

- commercial bank. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/commercial%20bank. License: CC BY-SA: Attribution-ShareAlike

- central bank. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/central_bank. License: CC BY-SA: Attribution-ShareAlike

- Money-creation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Money-creation.gif. License: CC BY-SA: Attribution-ShareAlike

- Fractional-reserve banking with varying reserve requirements. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...quirements.gif. License: Public Domain: No Known Copyright

- Fractional reserve lending varyingrates 100base. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fr...es_100base.jpg. License: Public Domain: No Known Copyright

- Money multiplier. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_multiplier. License: CC BY-SA: Attribution-ShareAlike

- reserve requirement. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/reserve%20requirement. License: CC BY-SA: Attribution-ShareAlike

- money multiplier. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/money%20multiplier. License: CC BY-SA: Attribution-ShareAlike

- Money-creation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Money-creation.gif. License: CC BY-SA: Attribution-ShareAlike

- Fractional-reserve banking with varying reserve requirements. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...quirements.gif. License: Public Domain: No Known Copyright

- Fractional reserve lending varyingrates 100base. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fr...es_100base.jpg. License: Public Domain: No Known Copyright

- U.S.nMonetary base. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...etary_base.png. License: CC BY-SA: Attribution-ShareAlike