The Demand for Money

In economics, the demand for money is the desired holding of financial assets in the form of money (cash or bank deposits).

learning objectives

- Relate the level of the interest rate to the demand for money

The Demand for Money

In economics, the demand for money is generally equated with cash or bank demand deposits. Generally, the nominal demand for money increases with the level of nominal output and decreases with the nominal interest rate.

The equation for the demand for money is: \(\mathrm{M_d= P \times L(R,Y)}\). This is the equivalent of stating that the nominal amount of money demanded (Md) equals the price level (P) times the liquidity preference function L(R,Y)–the amount of money held in easily convertible sources (cash, bank demand deposits). Specific to the liquidity function, L(R,Y), R is the nominal interest rate and Y is the real output.

Money is necessary in order to carry out transactions. However inherent to the holding of money is the trade-off between the liquidity advantage of holding money and the interest advantage of holding other assets.

When the demand for money is stable, monetary policy can help to stabilize an economy. However, when the demand for money is not stable, real and nominal interest rates will change and there will be economic fluctuations.

Impact of the Interest Rate

The interest rate is the rate at which interest is paid by a borrower (debtor) for the use of money that they borrow from a lender (creditor). It is viewed as a “cost” of borrowing money. Interest-rate targets are a tool of monetary policy. The quantity of money demanded varies inversely with the interest rate. Central banks in countries tend to reduce the interest rate when they want to increase investment and consumption in the economy. However, low interest rates can create an economic bubble where large amounts of investments are made, but result in large unpaid debts and economic crisis. The interest rate is adjusted to keep inflation, the demand for money, and the health of the economy in a certain range. Capping or adjusting the interest rate parallel with economic growth protects the momentum of the economy.

Control of the Money Supply

While the demand of money involves the desired holding of financial assets, the money supply is the total amount of monetary assets available in an economy at a specific time. Data regarding money supply is recorded and published because it affects the price level, inflation, the exchange rate, and the business cycle.

Monetary policy also impacts the money supply. Expansionary policy increases the total supply of money in the economy more rapidly than usual and contractionary policy expands the supply of money more slowly than normal. Expansionary policy is used to combat unemployment, while contractionary is used to slow inflation.

In the United States, the Federal Reserve System controls the money supply. The reserves of money are kept in Federal Reserve accounts and U.S. banks. Reserves come from any source including the federal funds market, deposits by the public, and borrowing from the Fed itself. The Fed can attempt to change the money supply by affecting the reserve requirement and through other monetary policy tools.

Federal Funds Rate: This graph shows the fluctuations in the federal funds rate from 1954-2009. The Federal Reserve implements monetary policy through the federal funds rate.

Shifts in the Money Demand Curve

A shift in the money demand curve occurs when there is a change in any non-price determinant of demand, resulting in a new demand curve.

learning objectives

- Explain factors that cause shifts in the money demand curve, Explain the implications of shifts in the money demand curve

Demand for Money

In economics, the demand for money is the desired holding of financial assets in the form of money. The nominal demand for money generally increases with the level of nominal output (the price level multiplied by real output). The interest rate is the price of money. The quantity of money demanded increases and decreases with the fluctuation of the interest rate. The real demand for money is defined as the nominal amount of money demanded divided by the price level. A demand curve is used to graph and analyze the demand for money.

Factors that Cause Demand to Shift

A demand curve has the price on the vertical axis (y) and the quantity on the horizontal axis (x). The shift of the money demand curve occurs when there is a change in any non-price determinant of demand, resulting in a new demand curve. Non-price determinants are changes cause demand to change even if prices remain the same. Factors that influence prices include:

- Changes in disposable income

- Changes in tastes and preferences

- Changes in expectations

- Changes in price of related goods

- Population size

Factors that change the demand include:

- Decrease in the price of a substitute

- Increase in the price of a complement

- Decrease in consumer income if the good is a normal good

- Increase in consumer income if the good is an inferior good

The demand for money shifts out when the nominal level of output increases. It shifts in with the nominal interest rate.

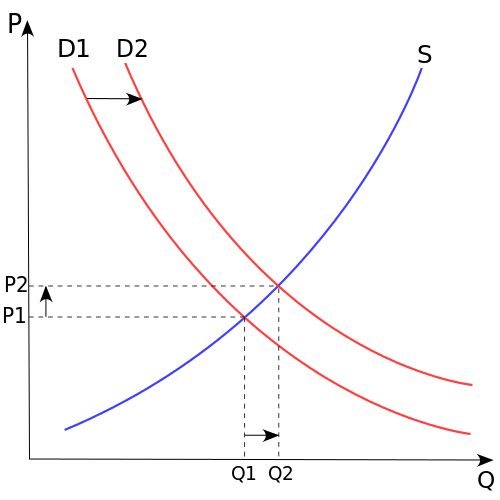

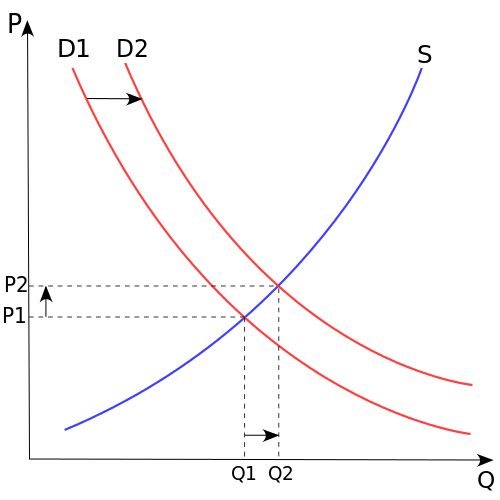

Shift of the Demand Curve: The graph shows both the supply and demand curve, with quantity of money on the x-axis (Q) and the price of money as interest rates on the y-axis (P). When the quantity of money demanded increase, the price of money (interest rates) also increases, and causes the demand curve to increase and shift to the right. A decrease in demand would shift the curve to the left.

Implications of Demand Curve Shift

The demand for money is a result of the trade-off between the liquidity advantage of holding money and the interest advantage of holding other assets. The demand for money determines how a person’s wealth should be held. When the demand curve shifts to the right and increases, the demand for money increases and individuals are more likely to hold on to money. The level of nominal output has increased and there is a liquidity advantage in holding on to money. Likewise, when the demand curve shifts to the left, it shows a decrease in the demand for money. The nominal interest rate declines and there is a greater interest advantage in holding other assets instead of money.

The Equilibrium Interest Rate

In an economy, equilibrium is reached when the supply of money is equal to the demand for money.

learning objectives

- Use the concept of market equilibrium to explain changes in the interest rate and money supply

Interest Rate

The interest rate is the rate at which interest is paid by a borrower (debtor) for the use of money that they borrow from a lender (creditor). Equilibrium is reached when the supply of money is equal to the demand for money. Interest rates can be affected by monetary and fiscal policy, but also by changes in the broader economy and the money supply.

Factors that Influence the Interest Rate

Interest rates fluctuate over time in the short-run and long-run. Within an economy, there are numerous factors that contribute to the level of the interest rate:

Fluctuation in Interest Rates: This graph shows the fluctuation in interest rates in Germany from 1967 to 2003. Interest rates fluctuate over time as the result of numerous factors. In Germany, the interest rates dropped from 14% in 1967 to almost 2% in 2003. This graph illustrates the fluctuations that can occur in the short-run and long-run. Interest rates fluctuate based on certain economic factors.

- Political gain: both monetary and fiscal policies can affect the money supply and demand for money.

- Consumption: the level of consumption (and changes in that level) affect the demand for money.

- Inflation expectations: inflation expectations affect a the willingness of lenders and borrowers to transact at a given interest rate. Changes in expectations will therefore affect the equilibrium interest rate.

- Taxes: changes in the tax code affect the willingness of actors to invest or consume, which can therefore change the demand for money.

Market Equilibrium

In economics, equilibrium is a state where economic forces such as supply and demand are balanced and without external influences, the equilibrium will stay the same. Market equilibrium refers to a condition where a market price is established through competition where the amount of goods and services sought by buyers is equal to the amount of goods and services produced by the sellers. In the case of money supply, the market equilibrium exists where the interest rate and the money supply are balanced. The money supply is the total amount of monetary assets available in an economy at a specific time. Without external influences, the interest rate and the money supply will stay in balance.

Key Terms

- money supply: The total amount of money (bills, coins, loans, credit, and other liquid instruments) in a particular economy.

- asset: Something or someone of any value; any portion of one’s property or effects so considered.

- nominal interest rate: The rate of interest before adjustment for inflation.

- equilibrium: The condition of a system in which competing influences are balanced, resulting in no net change.

- interest rate: The percentage of an amount of money charged for its use per some period of time (often a year).

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- Interest rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Interes...t_rate_changes. License: CC BY-SA: Attribution-ShareAlike

- Money supply. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_supply. License: CC BY-SA: Attribution-ShareAlike

- Money demand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_demand. License: CC BY-SA: Attribution-ShareAlike

- Expansionary policies. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Expansionary_policies. License: CC BY-SA: Attribution-ShareAlike

- asset. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/asset. License: CC BY-SA: Attribution-ShareAlike

- money supply. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/money_supply. License: CC BY-SA: Attribution-ShareAlike

- Money demand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_demand. License: CC BY-SA: Attribution-ShareAlike

- Demand curve. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Demand_curve. License: CC BY-SA: Attribution-ShareAlike

- asset. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/asset. License: CC BY-SA: Attribution-ShareAlike

- nominal interest rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/nominal...nterest%20rate. License: CC BY-SA: Attribution-ShareAlike

- Supply-and-demand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Su...and-demand.svg. License: Public Domain: No Known Copyright

- interest rate. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/interest_rate. License: CC BY-SA: Attribution-ShareAlike

- Market equilibrium. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Market_equilibrium. License: CC BY-SA: Attribution-ShareAlike

- Money supply. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_s...hange_equation. License: CC BY-SA: Attribution-ShareAlike

- Interest rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Interes...t_rate_changes. License: CC BY-SA: Attribution-ShareAlike

- equilibrium. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/equilibrium. License: CC BY-SA: Attribution-ShareAlike

- Supply-and-demand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Su...and-demand.svg. License: Public Domain: No Known Copyright