Money has four functions: a medium of exchange or means of payment, a store of value, a unit of account, and a standard of deferred payment. The medium of exchange function distinguishes money from other assets.

In a barter economy, trading is costly because there must be a double coincidence of wants. Money, a medium of exchange, reduces the costs of exchange and allows resources to be used for other things.

A token money is a convertible claim on commodity money. Because its monetary value greatly exceeds its production costs, token money economizes on the resource costs of transactions.

Fiat money is money the government has declared legal tender. The central bank controls the supply of legal tender.

The Canadian money supply is the sum of currency in circulation outside the banks and bank deposits.

The monetary base is comprised of notes and coins in circulation plus cash held by banks.

The Canadian banking system is made up of a central bank and a number of commercial banks and other institutions called near banks.

Banks are financial intermediaries. Bank deposits, which can be transferred by cheque or debit card, provide a convenient means of payment. Bank services plus interest payments on deposits attract funds into the bank. Banks use these funds to make loans, purchase securities, and finance expenditures. The general acceptance of bank deposits as money, and well-developed financial markets, allow modern banks to operate with very low cash reserve ratios.

Banks create money by making loans and creating deposits based on a fractional cash reserve ratio, rr. The banks' reserve ratio involves a trade-off between earnings and bankers' risk.

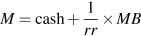

The monetary base MB is currency in circulation plus banks' cash reserves. The money multiplier is a ratio of a change in the money supply to the change in the monetary base that caused it,  . The money multiplier is larger the smaller is the cash reserve ratio of the banks, rr.

. The money multiplier is larger the smaller is the cash reserve ratio of the banks, rr.

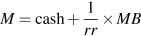

The money supply, M, is currency in circulation plus bank deposits. The size of the money supply is determined by the monetary base, MB, the banks' cash reserve ratio, rr, and the private sector's cash holdings, when cash holdings are constant. From Equation 8.5:

. The money multiplier is larger the smaller is the cash reserve ratio of the banks, rr.

. The money multiplier is larger the smaller is the cash reserve ratio of the banks, rr.