3.5: Monopoly Power

- Last updated

- Save as PDF

- Page ID

- 43164

In this section, the determinants and measurement of monopoly power are examined.

The Lerner Index of Monopoly Power

Economists use the Lerner Index to measure monopoly power, also called market power. The index is the percent markup of price over marginal cost.

\[L = \dfrac{P – MC}{P} \label{3.8}\]

The Lerner Index is a positive number \((L \geq 0)\), increasing in the amount of market power. A perfectly competitive firm has a Lerner Index equal to zero \((L = 0)\), since price is equal to marginal cost \((P = MC)\). A monopolist will have a Lerner Index greater than zero, and the index will be determined by the amount of market power that the firm has. A larger Lerner Index indicates more market power. In Section 3.3.3, a Pricing Rule was derived: \(\dfrac{P – MC}{P} = –\dfrac{1}{E^d}\), where \(E^d\) is the price elasticity of demand. Substitution of this pricing rule into the definition of the Lerner Index provides the relationship between the percent markup and the price elasticity of demand.

\[L = \dfrac{P – MC}{P} = – \dfrac{1}{E^d} \label{3.9}\]

An example of a Lerner Index might be Big Macs. There are substitutes available for Big Macs, so if the price increases, consumers can buy a competing brand such as Whoppers. In the case of a good with close substitutes, the price elasticity of demand is larger (more elastic), causing the percent markup to be smaller: the Lerner Index is relatively small. A monopoly is defined as a single seller in an industry with no close substitutes. Therefore, a monopoly that produces a good with no close substitutes would have a higher Lerner Index.

A second pricing rule can be derived from Equation \ref{3.9}, if we assume that the firm maximizes profits \((MR = MC)\). In that case, the relationship between price and marginal revenue is equal to: \(MR = P(1 + \frac{1}{E^d})\). If profit-maximization \((MR = MC)\) is assumed, then:

\[MC = P \left(1 + \dfrac{1}{E^d} \right) \label{3.10}\]

Rearranging:

\[P = \dfrac{MC}{1 + \dfrac{1}{E^d}} \label{3.11}\]

This is a useful equation, as it relates price to marginal cost. For example, a perfectly competitive firm has a perfectly elastic demand curve (\(E^d =\) negative infinity). Substitution of this elasticity into the pricing rule yields \(P = MC\). For a monopoly that has a price elasticity equal to –2, \(P = 2MC\). The price is two times the production costs in this case. To summarize:

- if \(E^d\) is large, the firm has less market power, and a small markup

- if \(E^d\) is small, the firm has more market power, and a large markup.

A monopoly example is useful to review monopoly and the Lerner Index. Suppose that the inverse demand curve facing a monopoly is given by: \(P = 500 – 10Q\). The monopoly production costs are given by: \(C(Q) = 10Q^2 + 100Q\). Profit-maximization yields the optimal monopoly price and quantity.

\[\begin{align*} \max π &= TR – TC\\[4pt] &= P(Q)Q – C(Q)\\[4pt] &= (500 – 10Q)Q – (10Q^2 + 100Q)\\[4pt] &= 500Q – 10Q^2 – 10Q^2 – 100Q\\[4pt] \frac{∂π}{∂Q} &= 500 – 20Q – 20Q – 100 = 0\\[4pt] 40Q &= 400\\[4pt] Q^* &= 10 \text{ units}\\[4pt] P^* &= 500 – 10Q^* = 500 – 100 = 400 \text{ USD/unit}.\end{align*}\]

To calculate the value of the Lerner Index, price and marginal cost are needed (Equation \ref{3.9}).

\[\begin{align*} MC &= C’(Q) = 20Q + 100.\\[4pt] MC^* &= 20(10) + 100 = 300 \text{ units}\\[4pt] L &= \frac{P – MC}{P} = \frac{400 – 300}{400} = \frac{100}{400} = 0.25\end{align*}\]

This result can be checked with the pricing rule: \(\dfrac{P – MC}{P} = – \dfrac{1}{E^d}\).

\[E^d = \left(\frac{∂Q}{∂P}\right)\left(\frac{P}{Q}\right)\nonumber\]

For this monopoly, \(\dfrac{∂P}{∂Q} = –10\). This is the first derivative of the inverse demand function. Therefore, \(\dfrac{∂Q}{∂P} = – \dfrac{1}{10}\).

\[\begin{align*} E^d &= \left(\frac{∂Q}{∂P}\right)\left(\frac{P}{Q}\right) = \left(– \frac{1}{10}\right)\left(\frac{400}{10}\right) = – \frac{400}{100} = – 4.\\[4pt] L &= \frac{P – MC}{P} = – \frac{1}{E^d} = \frac{–1}{–4} = 0.25.\end{align*}\]

The same result was achieved using both methods, so the Lerner Index for this monopoly is equal to 0.25.

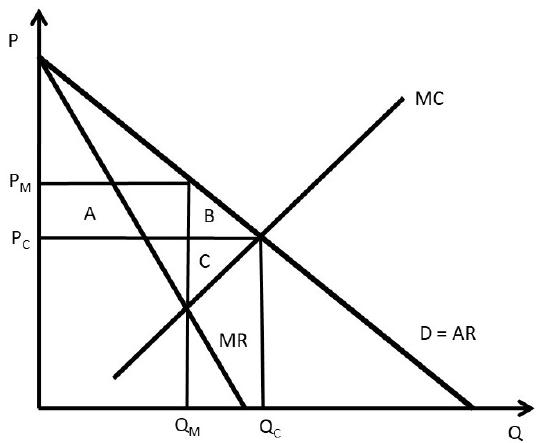

Welfare Effects of Monopoly

The welfare effects of a market or policy change are summarized as, “who is helped, who is hurt, and by how much.” To measure the welfare impact of monopoly, the monopoly outcome is compared with perfect competition. In competition, the price is equal to marginal cost \((P = MC)\), as in Figure \(\PageIndex{1}\). The competitive price and quantity are \(P_c\) and \(Q_c\). The monopoly price and quantity are found where marginal revenue equals marginal cost \((MR = MC)\): \(P_M\) and \(Q_M\). The graph indicates that the monopoly reduces output from the competitive level in order to increase the price \((P_M > P_c\) and \(Q_M < Q_c)\). The welfare analysis of a monopoly relative to competition is straightforward.

\[\begin{align*} ΔCS &= – AB\\[4pt] ΔPS &= +A – C \\[4pt] ΔSW &= – BC\\[4pt] DWL &= BC \end{align*}\]

Consumers are losers, and the benefits of monopoly depend on the magnitudes of areas \(A\) and \(C\). Since a monopolist faces an inelastic supply curve (no close substitutes), area \(A\) is likely to be larger than area \(C\), making the net benefits of monopoly positive.

The monopoly example from the previous section 3.5.1 shows the magnitude of the welfare changes. From above, the inverse demand curve is given by \(P = 500 – 10Q\), and the costs are given by \(C(Q) = 10Q^2 + 100Q\). In this case, \(P_M = 400\) USD/unit and \(Q_M = 10\) units (see section 3.5.1 above). The competitive solution is found where the demand curve intersects the marginal cost curve.

\[\begin{align*} 500 – 10Q &= 20Q + 100\\[4pt] 30Q &= 400\\[4pt] Q_c &= 13.3 \text{ units}\\[4pt] P_c &= 500 – 10(13.3) = 500 – 133 = 367 \text{ USD/unit}\\[4pt] ΔCS &= – AB = –(400 – 367)10 – (0.5)(400 – 367)(13.3 – 10) = – 330 –54.5 = – 384.5 \text{ USD}\\[4pt] ΔPS &= +A – C = +330 – (0.5)(367 – 300)(13.3 – 10) = +330 – 110.5 = +219.5 \text{ USD}\\[4pt] ΔSW &= – BC = (0.5)(100)(3.3) = – 165 \text{ USD}\\[4pt] DWL &= BC = 165 \text{ USD}\end{align*}\]

The welfare analysis of monopoly has been used by the government to justify breaking up monopolies into smaller, competing firms. In food and agriculture, many individuals and groups are opposed to large agribusiness firms. One concern is that these large firms have monopoly power, which results in a transfer of welfare from consumers to producers, and deadweight loss to society. It will be shown below that outlawing or banning monopolies would have both benefits and costs. There is some economic justification for the existence of large firms due to economies of scale and natural monopoly, as will be explored below. Next, the sources of monopoly power will be listed and explained.

Sources of Monopoly Power

There are three major sources of monopoly power:

- the price elasticity of demand \((E^d)\),

- the number of firms in a market, and

- interaction among firms.

The price elasticity of demand is the most important determinant of market power, due to the pricing rule: \(L = \frac{P – MC}{P} = – \frac{1}{E^d}\). When the price elasticity is large \((\mid E^d\mid > 1)\), demand is relatively elastic, and the firm has less market power. When the price elasticity is small \((\mid E^d\mid < 1)\), demand is relatively inelastic, and the firm has more market power.

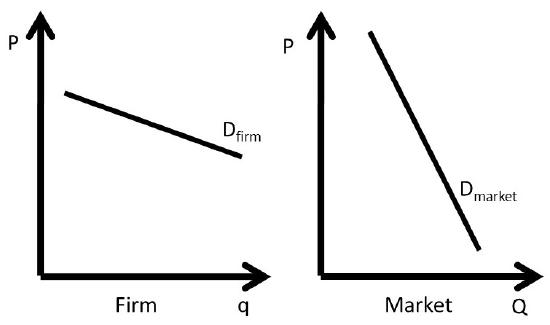

The price elasticity of demand depends on how large the firm is relative to the market. The firm’s price elasticity of demand is always more elastic than the market demand:

\[\mid E^d_{firm}\mid > \mid E^d_{market}\mid.\]

If the price of the firm’s output is increased, consumers can substitute into outputs produced by other firms. However, if all firms in the market increase the price of the good, consumers have no close substitutes, so must pay the higher price (Figure \(\PageIndex{2}\)). Therefore, the firm’s price elasticity of demand is more elastic than the market demand. The firm’s price elasticity of demand depends on how large the firm is relative to the other firms in the market.

The second determinant of market power is the number of firms in an industry. This is related to Figure \(\PageIndex{2}\). If a firm is the only seller in an industry, then the firm is the same as the market, and the price elasticity of demand is the same for both the firm and the market. The more firms there are in a market, the more substitutes a consumer has available, making the price elasticity of demand more elastic as the number of firms increases. In the extreme case, a perfectly competitive firm has numerous other firms in the industry, causing the demand curve to be perfectly elastic, \(P = MC\), and \(L = 0\). To summarize, the more firms there are in an industry, the less market power the firm has.

The number of firms in an industry is determined by the ease or difficulty of entry. This market feature is captured by the concept of, “Barriers to Entry.” Barriers to entry include:

- patents,

- copyrights,

- contracts,

- economies to scale (natural monopoly),

- excess capacity, and

- licenses.

Each of these barriers to entry increases the difficulty of entering a market when positive economic profits exist. Economies to scale and natural monopoly are defined and described in the next section. The number of firms is important, but the number of “major firms” is also important. Some industries are characterized by one or two dominant firms. These large firms often exert market power.

The third source of market power is interaction among firms. This will be extensively discussed in Chapter 5, “Oligopoly.” If firms compete aggressively with each other, less market power results. On the other hand, if firms cooperate and act together, the firms can have more market power. When firms join together, they are said to “collude,” or act as if they were a single firm. These strategic interactions between firms form the heart of the discussion in Chapter 5, and the foundation for game theory, explored in Chapters 6 and 7.

Natural Monopoly

A natural monopoly is a firm that has a high level of costs that do not vary with output.

Natural Monopoly = A firm characterized by large fixed costs.

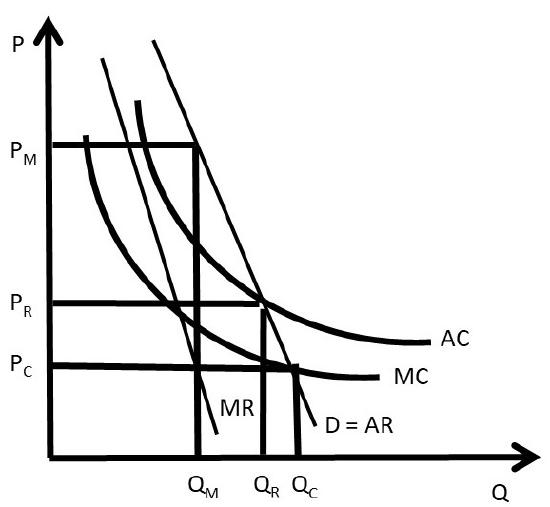

Recall that total costs are the sum of total variable costs and total fixed costs \((TC = TVC + TFC)\). The fixed costs are those costs that do not vary with the level of output. When fixed costs are high, then average total costs are declining, as seen in Figure \(\PageIndex{3}\).

Another way of describing high fixed costs is the term, “economies of scale.”

Economies of Scale = Per-unit costs of production decrease when output is increased.

Figure \(\PageIndex{3}\) shows the defining characteristic of a natural monopoly: declining average costs \((AC)\). This means that the demand curve intersects the \(AC\) curve while it is declining. At some point, the average costs will increase, but for firms characterized by economies of scale, the relevant range of the \(AC\) curve is the declining portion, of the left side of a typical “U-shaped” cost function.

The reason for the name, “natural monopoly” can also be found in Figure \(\PageIndex{3}\). The demand curve has a portion above the \(AC\) curve, so positive profits are possible. Suppose that the monopoly was making positive economic profits, and attracted a competitor into the industry. The second firm would cause the demand facing each of the two firms to be cut in half. This possibility can be seen in Figure \(\PageIndex{3}\): if two firms served the customers, each firm would have a demand curve equal to the \(MR\) curve. This is because for a linear demand curve, the \(MR\) curve has the same y-intercept and twice the slope. Notice the position of the \(MR\) curve for a natural monopoly: it lies everywhere below the \(AC\) curve. Therefore, positive profits are not possible for two firms serving this market. The demand is not large enough to cover the fixed costs.

The fixed costs are typically large investments that must be made before the good can be sold. For example, an electricity company must build both a huge generating plant and a distribution network that connects all residences and businesses to the power grid. These enormous costs do not vary with the level of output: they must be paid whether the firm sells zero kilowatt hours or one million kilowatt hours. The average fixed costs decline as they are spread out over larger quantities \((AFC = \dfrac{TFC}{Q})\). As the output \((Q)\) increases, average costs \((AC = \dfrac{TC}{Q})\) decline.

This feature is true for many large businesses, and provides economic justification for large firms: the per-unit costs of production are smaller, providing lower costs to consumers. There is a tradeoff for consumers who purchase goods from large firms: the cost is lower due to economies of scale, but the firm may have market power, which can result in higher prices. This tradeoff makes the economic analysis of large firms both fascinating and important to society. Current examples include the giant technology companies Microsoft, Apple, Google, and Amazon.

Natural monopolies have important implications for how large businesses provide goods to consumers, as is explicitly shown in Figure \(\PageIndex{3}\). The industry in Figure \(\PageIndex{3}\) is a natural monopoly, since demand intersects average costs while they are declining. If a single firm was in the depicted industry, it would set marginal costs equal to marginal revenues \((MR = MC)\), and produce and sell \(Q_M\) units of output at a price equal to \(P_M\). The price is high: consumers lose welfare and society is faced with deadweight losses.

If competition were possible, price would be set at marginal cost \((P = MC)\). The resulting price and quantity under competition would be \(P_C\) and \(Q_C\) (Figure \(\PageIndex{3}\). This is a desirable outcome for the consumers. However, there is a major problem with this outcome: price is below average costs, and any business firm that charged the competitive price \(P_C\) would be forced out of business. In this case, the firm does not have enough revenue to cover the fixed costs. The natural monopoly is considered a “market failure” since there is no good market-based solution. A single monopoly firm could earn enough revenue to stay in business, but consumers would pay a high monopoly price \(P_M\). If competition occurred, the consumers would pay the cost of production \((PC)\), but the firms would not cover their costs.

One solution to a natural monopoly is government regulation. If the government intervened, it could set the regulated price equal to average costs \((P_R = AC)\), and the regulated quantity equal to \(Q_R\). This solves the problem of natural monopoly with a compromise: consumers pay a price just high enough to cover the firm’s average costs. This analysis explains why the government regulates many public utilities for electricity, natural gas, water, sewer, and garbage collection.

The next section will investigate monopsony, or a single buyer with market power.