The Impact of Monetary Policy on Aggregate Demand, Prices, and Real GDP

Changes in a country’s money supply shifts the country’s aggregate demand curve.

learning objectives

- Recognize the impact of monetary policy on aggregate demand

Aggregate demand (AD) is the total demand for final goods and services in the economy at a given time and price level. It is the combination of consumer spending, investments, government spending, and net exports within a given economic system (often written out as \(\mathrm{AD = C + I + G + nX}\)). As a result of this, increases in overall capital within an economy impacts the aggregate spending and/or investment. This creates a relationship between monetary policy and aggregate demand.

This brings us to the aggregate demand curve. It specifies the amounts of goods and services that will be purchased at all possible price levels. This is the demand for the gross domestic product of a country. It is also referred to as the effective demand.

The aggregate demand curve illustrates the relationship between two factors – the quantity of output that is demanded and the aggregated price level. Another way of defining aggregate demand is as the sum of consumer spending, government spending, investment, and net exports. The aggregate demand curve assumes that money supply is fixed. Altering the money supply impacts where the aggregate demand curve is plotted.

Contractionary Monetary Policy

Contractionary monetary policy decreases the money supply in an economy. The decrease in the money supply is mirrored by an equal decrease in the nominal output, otherwise known as Gross Domestic Product (GDP). In addition, the decrease in the money supply will lead to a decrease in consumer spending. This decrease will shift the aggregate demand curve to the left. This reduction in money supply reduces price levels and real output, as there is less capital available in the economic system.

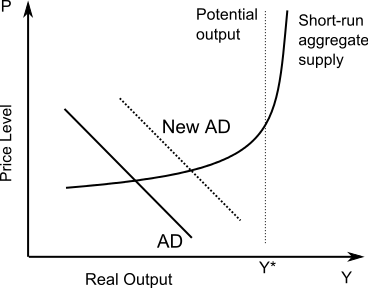

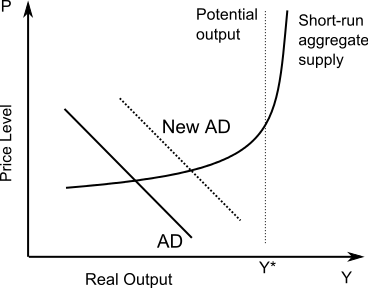

Aggregate Demand Graph: This graph shows the effect of expansionary monetary policy, which shifts aggregate demand (AD) to the right.

Expansionary Monetary Policy

Expansionary monetary policy increases the money supply in an economy. The increase in the money supply is mirrored by an equal increase in nominal output, or Gross Domestic Product (GDP). In addition, the increase in the money supply will lead to an increase in consumer spending. This increase will shift the aggregate demand curve to the right.

In addition, the increase in money supply would lead to movement up along the aggregate supply curve. This would lead to a higher prices and more potential real output.

The Effect of Expansionary Monetary Policy

An expansionary monetary policy is used to increase economic growth, and generally decreases unemployment and increases inflation.

learning objectives

- Analyze the effects of expansionary monetary policy

Monetary policy is referred to as either being expansionary or contractionary. Expansionary policy seeks to accelerate economic growth, while contractionary policy seeks to restrict it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. This is done by increasing the money supply available in the economy.

Expansionary policy attempts to promote aggregate demand growth. As you may remember, aggregate demand is the sum of private consumption, investment, government spending and imports. Monetary policy focuses on the first two elements. By increasing the amount of money in the economy, the central bank encourages private consumption. Increasing the money supply also decreases the interest rate, which encourages lending and investment. The increase in consumption and investment leads to a higher aggregate demand.

It is important for policymakers to make credible announcements. If private agents (consumers and firms) believe that policymakers are committed to growing the economy, the agents will anticipate future prices to be higher than they would be otherwise. The private agents will then adjust their long-term plans accordingly, such as by taking out loans to invest in their business. But if the agents believe that the central bank’s actions are short-term, they will not alter their actions and the effect of the expansionary policy will be minimized.

The Basic Mechanics of Expansionary Monetary Policy

A central bank can enact an expansionary monetary policy several ways. The primary means a central bank uses to implement an expansionary monetary policy is through open market operations. Commonly, the central bank will purchase government bonds, which puts downward pressure on interest rates. The purchases not only increase the money supply, but also, through their effect on interest rates, promote investment.

Because the banks and institutions that sold the central bank the debt have more cash, it is easier for them to make loans to its customers. As a result, the interest rate for loans decrease. Businesses then, presumably, use the money it borrowed to expand its operations. This leads to an increase in jobs to build the new facilities and to staff the new positions.

The increase in the money supply is inflationary, though it is important to note that, in practice, different monetary policy tools have different effects on the level of inflation.

Other Methods of Enacting Expansionary Monetary Policy

Another way to enact an expansionary monetary policy is to increase the amount of discount window lending. The discount window allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by internal or external disruptions. Decreasing the rate charged at the discount window, the discount rate, will not only encourage more discount window lending, but will put downward pressure on other interest rates. Low interest rates encourage investment.

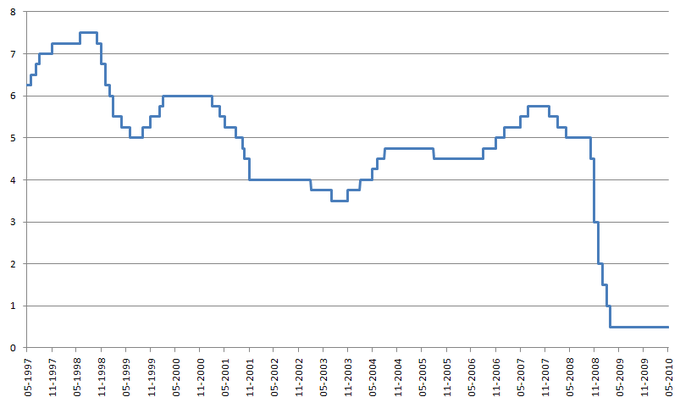

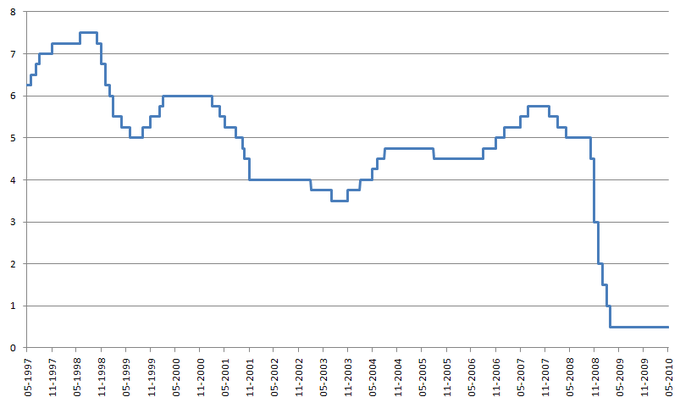

Bank of England Interest Rates: The Bank of England (the central bank in England) undertook expansionary monetary policy and lowered interest rates, promoting investment.

Another method of enacting a expansionary monetary policy is by decreasing the reserve requirement. All banks are required to have a certain amount of cash on hand to cover withdrawals and other liquidity demands. By decreasing the reserve requirement, more money is made available to the economy at large.

The Effect of Restrictive Monetary Policy

A restrictive monetary policy will generally increase unemployment and decrease inflation.

learning objectives

- Analyze the effects of restrictive monetary policy

Monetary policy is can be classified as expansionary or restrictive (also called contractionary). Restrictive monetary policy expands the money supply more slowly than usual or even shrinks it, while and expansionary policy increases the money supply. It is intended to slow economic growth and/or inflation in order to avoid the resulting distortions and deterioration of asset values

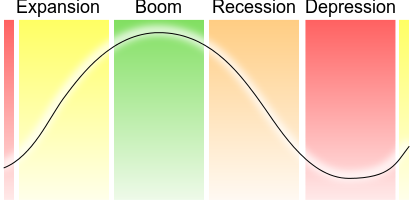

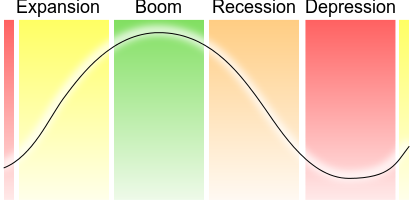

Business cycle: Restrictive monetary policy is used during expansion and boom periods in the business cycle to prevent the overheating of the economy.

Contractionary policy attempts to slow aggregate demand growth. As you may remember, aggregate demand is the sum of private consumption, investment, government spending and imports. Monetary policy focuses on the first two elements. By decreasing the amount of money in the economy, the central bank discourages private consumption. Increasing the money supply also increase the interest rate, which discourages lending and investment. The higher interest rate also promotes saving, which further discourages private consumption. The decrease in consumption and investment leads to a decrease in growth in aggregate demand.

It is important for policymakers to make credible announcements. If private agents (consumers and firms) believe that policymakers are committed to limiting inflation through restrictive monetary policy, the agents will anticipate future prices to be lower than they would be otherwise. The private agents will then adjust their long-term strategies accordingly, such as by putting plans to expand their operations on hold. But if the agents believe that the central bank’s actions will soon be reversed, they may not alter their actions and the effect of the contractionary policy will be minimized.

The Basic Mechanics of Expansionary Monetary Policy

A central bank can enact a contractionary monetary policy several ways. The primary means a central bank uses to implement an expansionary monetary policy is through open market operations. The central bank can issue debt in exchange for cash. This results in less cash being in the economy.

Because the banks and institutions that purchased the debt from the central bank have less cash, it is harder for them to make loans to its customers. As a result, the interest rate for loans increase. Businesses then, presumably, have less money to use to expand its operations or even maintain its current levels. This could lead to an increase in unemployment.

The higher interest rates also can slow inflation. Consumption and investment are discouraged, and market actors will choose to save instead of circulating their money in the economy. Effectively, the money supply is smaller, and there is reduced upward pressure on prices since demand for consumption goods and services has dropped.

Other Methods of Enacting Restrictive Monetary Policy

Another way to enact a contractionary monetary policy is to decrease the amount of discount window lending. The discount window allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by internal or external disruptions

A final method of enacting a contractionary monetary policy is by increasing the reserve requirement. All banks are required to have a certain amount of cash on hand to cover withdrawals and other liquidity demands. By increasing the reserve requirement, less money is made available to the economy at large.

Limitations of Monetary Policy

Limitations of monetary policy include liquidity traps, deflation, and being canceled out by other factors.

learning objectives

- Describe obstacles to the Federal Reserve’s monetary policy objectives

Monetary policy is the process by which the monetary authority of a country controls the supply of money with the purpose of promoting stable employment, prices, and economic growth. Monetary policy can influence an economy but it cannot control it directly. There are limits as to what monetary policy can accomplish. Below are some of the factors that can make monetary policy less effective.

Multiple Factors Influencing Economy

While monetary policy can influence the elements listed above, it is not the only thing that does. Fiscal policy can also directly influence employment and economic growth. If these two policies do not work in concert, they can cancel each other out. This is an especially significant problem when fiscal policy and monetary policy are controlled by two different parties. One party might believe that the economy is teetering on recession and may pursue an expansionary policy. The other group may believe the economy is booming and pursue a contractionary policy. The result is that the two would cancel each other, so that neither would influence the direction of the economy.

Liquidity Trap

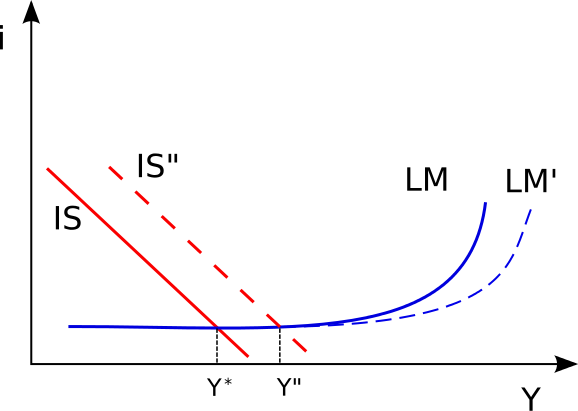

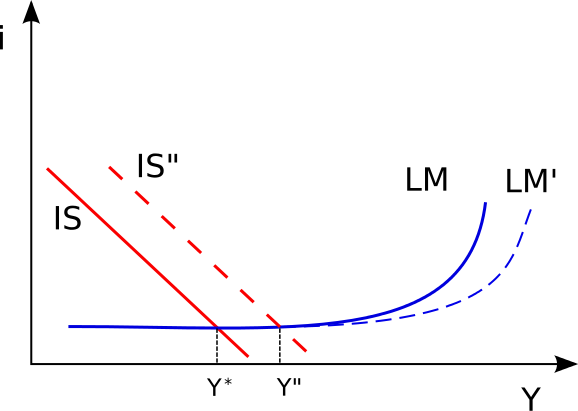

A liquidity trap is a situation where injections of cash into the private banking system by a central bank fail to lower interest rates and therefore fail to stimulate economic growth. Usually central banks try to lower interest rates by buying bonds with newly created cash. In a liquidity trap, bonds pay little to no interest, which makes them nearly equivalent to cash. Under the narrow version of Keynesian theory in which this arises, it is specified that monetary policy affects the economy only through its effect on interest rates. Thus, if an economy enters a liquidity trap, further increases in the money stock will fail to further lower interest rates and, therefore, fail to stimulate.

Liquidity Trap: Sometimes, when the money supply is increased, as shown by the Liquidity Preference-Money Supply (LM) curve shift, it has no impact on output (GDP or Y) or on interest rates. This is a liquidity trap.

A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels.

Deflation

Deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0%. This should not be confused with disinflation, a slowdown in the inflation rate. Inflation reduces the real value of money over time; conversely, deflation increases the real value of money. This allows one to buy more goods with the same amount of money over time.

From a monetary policy perspective, deflation occurs when there is a reduction in the velocity of money and/or the amount of money supply per person. The velocity of money is the frequency at which one unit of currency is used to purchase domestically-produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

Deflation is a problem in a modern economy because it increases the real value of debt and may aggravate recessions and lead to a deflationary spiral. If monetary policy is too contractionary for too long, deflation could set in.

Using Monetary Policy to Target Inflation

Inflation targeting occurs when a central bank attempts to steer inflation towards a set number using monetary tools.

learning objectives

- Assess the use of inflation targets and goals in monetary policy

Inflation targeting is an economic policy in which a central bank estimates and makes public a projected, or “target”, inflation rate and then attempts to steer actual inflation towards the target through the use of interest rate changes and other monetary tools.

Fed Reserve Seal: The United States Federal Reserve uses a form of inflation targeting when coordinating its monetary policy.

Because interest rates and the inflation rate tend to be inversely related, the likely moves of the central bank to raise or lower interest rates become more transparent under the policy of inflation targeting. Examples include:

- if inflation appears to be above the target, the bank is likely to raise interest rates. This usually has the effect over time of cooling the economy and bringing down inflation;

- if inflation appears to be below the target, the bank is likely to lower interest rates. This usually has the effect over time of accelerating the economy and raising inflation.

Under the policy, investors know what the central bank considers the target inflation rate to be and therefore may more easily factor in likely interest rate changes in their investment choices. This is viewed by inflation targeters as leading to increased economic stability.

The United States Federal Reserve, the country’s central bank, practices a version of inflation targeting. Instead of setting a specific number, the Fed sets a target range.

Criticisms of Inflation Targeting

Increases in inflation, measured by changes in the consumer price index (CPI), are not necessarily coupled to any factor internal to country’s economy. Strictly or blindly adjusting interest rates will potentially be ineffectual and restrict economic growth when it was not necessary to do so.

It has been argued that focusing on inflation may inhibit stable employment and exchange rates. Supporters of a nominal income target also criticize the tendency of inflation targeting to ignore output shocks by focusing solely on the price level. They argue that a nominal income target is a better goal.

Key Points

- Aggregate demand (AD) is the sum of consumer spending, government spending, investment, and net exports.

- The AD curve assumes that money supply is fixed.

- The decrease in the money supply is mirrored by an equal decrease in the nominal output, otherwise known as Gross Domestic Product ( GDP ).

- The decrease in the money supply will lead to a decrease in consumer spending. This decrease will shift the AD curve to the left.

- The increase in the money supply is mirrored by an equal increase in nominal output, or Gross Domestic Product (GDP).

- The increase in the money supply will lead to an increase in consumer spending. This increase will shift the AD curve to the right.

- Increased money supply causes reduction in interest rates and further spending and therefore an increase in AD.

- The primary means a central bank uses to implement an expansionary monetary policy is through purchasing government bonds on the open market.

- Another way to enact an expansionary monetary policy is to increase the amount of discount window lending.

- A third method of enacting a expansionary monetary policy is by decreasing the reserve requirement.

- Another way to enact a restrictive monetary policy is to decrease the amount of discount window lending.

- A final method of enacting a restrictive monetary policy is by increasing the reserve requirement.

- The primary means a central bank uses to implement an expansionary monetary policy is through open market operations. The central bank can issue or resell its debt in exchange for cash. It can also sell off some of its reserves in gold or foreign currencies.

- A liquidity trap is a situation where injections of cash into the private banking system by a central bank fail to lower interest rates and therefore fail to stimulate economic growth.

- Deflation is a decrease in the general price level of goods and services. Deflation is a problem in a modern economy because it increases the real value of debt and may aggravate recessions and lead to a deflationary spiral.

- Fiscal policy can also directly influence employment and economic growth. If these two policies do not work in concert, they can cancel each other out.

- Because interest rates and the inflation rate tend to be inversely related, the likely moves of the central bank to raise or lower interest rates become more transparent under the policy of inflation targeting.

- If inflation appears to be above the target, the bank is likely to raise interest rates; if inflation appears to be below the target, the bank is likely to lower interest rates.

- Increases in inflation, measured by the consumer price index (CPI), are not necessarily coupled to any factor internal to country’s economy and strictly or blindly adjusting interest rates will potentially be ineffectual and restrict economic growth when it was not necessary to do so.

Key Terms

- aggregate demand: The the total demand for final goods and services in the economy at a given time and price level.

- expansionary monetary policy: Traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding.

- unemployment: The state of being jobless and looking for work.

- contractionary monetary policy: Central bank actions designed to slow economic growth.

- deflation: A decrease in the general price level, that is, in the nominal cost of goods and services.

- consumer price index: A statistical estimate of the level of prices of goods and services bought for consumption purposes by households.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- Aggregate demand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Aggregate_demand. License: CC BY-SA: Attribution-ShareAlike

- Macroeconomics/Monetary Policy. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Macroec...onetary_Policy. License: CC BY-SA: Attribution-ShareAlike

- Gross domestic product. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Gross_domestic_product. License: CC BY-SA: Attribution-ShareAlike

- aggregate demand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/aggregate%20demand. License: CC BY-SA: Attribution-ShareAlike

- AS AD graph. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:AS_+_AD_graph.svg. License: CC BY-SA: Attribution-ShareAlike

- Monetary policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Monetar...licy%23General. License: CC BY-SA: Attribution-ShareAlike

- Open market operations. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Open_market_operations. License: CC BY-SA: Attribution-ShareAlike

- Inflation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Inflation. License: CC BY-SA: Attribution-ShareAlike

- Interest rates. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Interest_rates. License: CC BY-SA: Attribution-ShareAlike

- Repurchase agreement. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Repurchase_agreement. License: CC BY-SA: Attribution-ShareAlike

- Aggregate demand. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Aggregate_demand. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...n/unemployment. License: CC BY-SA: Attribution-ShareAlike

- expansionary monetary policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/expansi...etary%20policy. License: CC BY-SA: Attribution-ShareAlike

- AS AD graph. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:AS_+_AD_graph.svg. License: CC BY-SA: Attribution-ShareAlike

- Interest rates (1997-2010). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...1997-2010).png. License: CC BY-SA: Attribution-ShareAlike

- Monetary policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Monetar...icy%23Overview. License: CC BY-SA: Attribution-ShareAlike

- Cpi. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Cpi. License: CC BY-SA: Attribution-ShareAlike

- Open market operations. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Open_market_operations. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...onetary-policy. License: CC BY-SA: Attribution-ShareAlike

- AS AD graph. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:AS_+_AD_graph.svg. License: CC BY-SA: Attribution-ShareAlike

- Interest rates (1997-2010). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...1997-2010).png. License: CC BY-SA: Attribution-ShareAlike

- Economic cycle. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...omic_cycle.svg. License: Public Domain: No Known Copyright

- Liquidity trap. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Liquidity_trap. License: CC BY-SA: Attribution-ShareAlike

- Deflation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Deflation. License: CC BY-SA: Attribution-ShareAlike

- Velocity of money. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Velocity_of_money. License: CC BY-SA: Attribution-ShareAlike

- Monetary policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Monetary_policy. License: CC BY-SA: Attribution-ShareAlike

- deflation. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/deflation. License: CC BY-SA: Attribution-ShareAlike

- AS AD graph. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:AS_+_AD_graph.svg. License: CC BY-SA: Attribution-ShareAlike

- Interest rates (1997-2010). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...1997-2010).png. License: CC BY-SA: Attribution-ShareAlike

- Economic cycle. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...omic_cycle.svg. License: Public Domain: No Known Copyright

- Liquidity trap IS-LM. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Li...trap_IS-LM.svg. License: CC BY-SA: Attribution-ShareAlike

- Inflation targeting. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Inflation_targeting. License: CC BY-SA: Attribution-ShareAlike

- Cpi. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Cpi. License: CC BY-SA: Attribution-ShareAlike

- consumer price index. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/consumer_price_index. License: CC BY-SA: Attribution-ShareAlike

- AS AD graph. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:AS_+_AD_graph.svg. License: CC BY-SA: Attribution-ShareAlike

- Interest rates (1997-2010). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...1997-2010).png. License: CC BY-SA: Attribution-ShareAlike

- Economic cycle. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...omic_cycle.svg. License: Public Domain: No Known Copyright

- Liquidity trap IS-LM. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Li...trap_IS-LM.svg. License: CC BY-SA: Attribution-ShareAlike

- US-FederalReserveSystem-Seal. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:US...ystem-Seal.svg. License: Public Domain: No Known Copyright