Institutions, Markets, and Intermediaries

A financial intermediary is an institution that facilitates the flow of funds between individuals or other economic entities.

learning objectives

- Review the purpose and types of financial intermediaries

A financial intermediary is an institution that facilitates the flow of funds between individuals or other economic entities having a surplus of funds (savers) to those running a deficit of funds (borrowers). Banks are a classic example of financial institutions.

Banks provide a safe and accessible environment for individuals and economic entities to deposit excess funds Additionally, banks also provide a service by packaging deposits into loans that are made available to economic agents (individuals and entities) in need of funds.

Banks are the most common financial intermediaries: Banks convert deposits to loans and thereby increase access to capital by serving as a financial intermediary between savers and borrowers.

Though, perhaps the most well-known of financial intermediaries, banks represent only one intermediary within a larger group. Other financial intermediaries include: credit unions, private equity, venture capital funds, leasing companies, insurance and pension funds, and micro-credit providers.

Major functions of financial intermediaries

As noted, financial intermediaries provide access to capital. However, in conjunction with increasing access to funds, through their ability to aggregate funds, intermediaries also reduce the transaction and search costs between lenders and borrowers.

By repurposing funds from savers to borrowers financial intermediaries are able to promote economic growth by providing access to capital. Through diversification of loan risk, financial intermediaries are able to mitigate risk through pooling of a variety of risk profiles and through creating loans of varying lengths from investor monies or demand deposits, these intermediaries are able to convert short-term liabilities to assets of varying maturities.

Returning to the example of a bank used above, banks convert short-term liabilities (demand deposits) into long-term assets by providing loans; thereby transforming maturities. Additionally, through diversified lending practices, banks are able to lend monies to high-risk entities and by pooling with low-risk loans are able to gain in yield while implementing risk management.

Role in Matching Savings and Investment Spending

Savings are income after-consumption and investment is what is facilitated by saving.

learning objectives

- Explain the connection between savers and investors

A popular national income accounting framework for discussing the economy is the GDP expenditure equation:

\(Y=C+I+G+(X−M),\) where \(C\) refers to consumption spending, II references investment spending, \(G\) is government spending, and \(X−M\) is net imports (\(X\), exports;\(M\), imports). Savings is defined as income that is not consumed. \(C\) is consumption. Investment, \(I\), is made into capital (plant and machinery, also ‘ human capital ‘ – training and education), with intent to increase productivity, efficiency and output of goods and services. \(I\) can be generally defined as purchases of good that will be used to produce more goods and services in the future. In national accounting terms, stocks, bonds, mutual funds, and other cash equivalents, are not classified as investments but rather are classified as savings. Savings from this perspective facilitates capital purchase which are included in investments

Saving is what households (participants in the consumption account) do. The level of saving in the economy depends on a number of factors:

- A higher real interest rates increases returns to saving.

- Poor expectations for future economic growth, increase households’ savings as a precaution.

- More disposable income after fixed expenditures (such as mortgage, heating bill, basic goods purchases) have been made increases saving.

- Perceived likelihood of reduced return through regulation or taxation on savings will make saving less attractive.

Marginal propensity to save

The factors as stated affect the marginal propensity to save (MPS), the percentage of after-tax income that an economic agent will choose to save. The greater the MPS, the more saving households will do as a proportion of each additional increment of income. Stocks and bonds are considered to be important intermediary forms of savings as these get transformed into a capital investment that produces value.

Bonds are a type of savings: Savings are used to fund investments, where investments are defined as expenditures on factory plants, equipment and homes.

Savings and Investment

Assuming a closed economy, one where there is no export or impart activity to interfere with the domestic savings level, on an aggregate basis individual savings creates the supply of loanable funds available for investment purposes. The amount of savings available in the economy is equal to the amount of funding available for investment activity. The higher the level of savings, typically the lower the relative interest rate, ceteris paribus. On a macroeconomic theory basis, a higher the savings rate promotes business activity my lessening the cost of money and increasing risk taking activities to facilitate growth or production of goods and services.

Financial intermediaries can assist with increasing the incentive to save through developing financial products that offer ease of liquidation but provide a higher return than a savings account. In this manner, financial intermediaries are a significant component to the transformation of savings into investment. Mutual funds, pension obligations, insurance annuities, and other forms of savings marketed by financial intermediaries all consist of stocks, bonds, and cash balances, which in turn pay for the investment capital that increases productivity, efficiency and output of goods and services.

Role in Providing a Market for Loanable Funds

The loanable funds market is a conceptual market where savers (suppliers) and borrowers (demanders) are able to establish a market clearing.

learning objectives

- Summarize the mechanics of the loanable funds market.

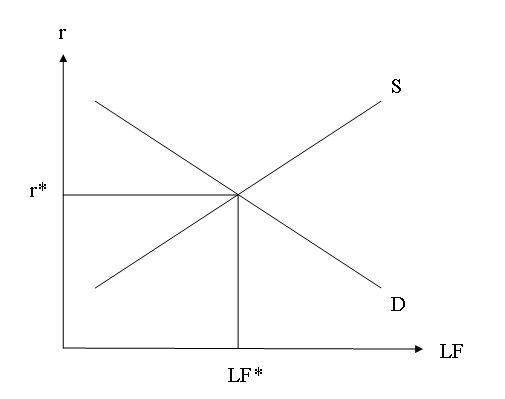

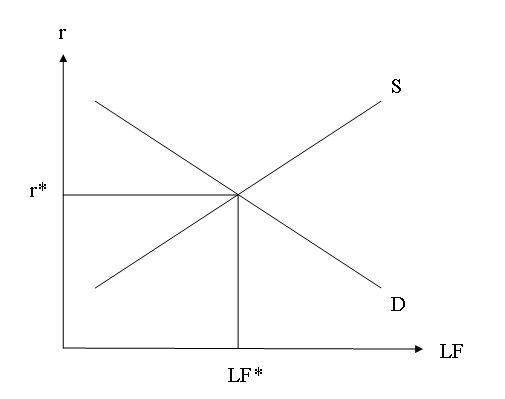

In economics, the loanable funds market is a conceptual market where savers (suppliers) and borrowers (demanders) are able to establish a market clearing quantity and price (interest rate). In the loanable funds market, market clearing is defined as the interest rate/loanable funds quantity where savings equal investment (the amount of capital needed for property, plant, and equipment based investments). Loanable funds are typically cash, but can also include other financial assets to serve as an intermediary.

Equilibrium in the loanable funds market: When the supply and demand for loanable funds are equal, savings is equal to investment and the loanable funds market is in equilibrium at the prevailing interest rate.

For instance, buying bonds will transfer savers’ money to the institution issuing the bond, which can be a firm or government. In return, the borrower’s (institution issuing the bond) demand for loanable funds is satisfied when the institution receives cash in exchange for the bond.

Loanable funds are often used to invest in new capital goods. Therefore, the demand and supply of capital is usually discussed in terms of the demand and supply of loanable funds.

Interest rate

The interest rate is the cost of borrowing or demanding loanable funds and is the amount of money paid for the use of a dollar for a year. The interest rate can also describe the rate of return from supplying or lending loanable funds.

As an example, consider this: a firm that borrows $10,000 in funds for one year, at an annual interest rate of 10%, will have to pay the lender $11,000 at the end of the year. This amount includes the original $10,000 borrowed plus $1,000 in interest; in mathematical terms, this can be written as \( \$10,000 \times 1.10 = \$ 11,000\).

Key Points

- Financial intermediaries provide access to capital.

- Banks convert short-term liabilities ( demand deposits ) into long-term assets by providing loans; thereby transforming maturities.

- Through diversification of loan risk, financial intermediaries are able to mitigate risk through pooling of a variety of risk profiles.

- The marginal propensity to save (MPS), the percentage of after-tax income that an economic agent will choose to save.

- Savings marketed by financial intermediaries, all consist of stocks, bonds, and cash balances, which in turn pay for the investment capital that increases productivity, efficiency and output of goods and services.

- Financial intermediaries are a significant component to the transformation of savings into investment.

- In the loanable funds market, market clearing is defined as the interest rate /loanable funds quantity where savings equal investment (the amount of capital needed for property, plant, and equipment based investments).

- The interest rate is the cost of borrowing or demanding loanable funds and is the amount of money paid for the use of a dollar for a year.

- Loanable funds are often used to invest in new capital goods. Therefore, the demand and supply of capital is usually discussed in terms of the demand and supply of loanable funds.

Key Terms

- pooling: grouping together of various resources or assets

- financial intermediary: A financial institution that connects surplus and deficit agents.

- real interest rates: The rate of interest an investor expects to receive after allowing for inflation.

- loanable funds: Money available to be issued as debt.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- Financial intermediary. Provided by: Wikipedia. Located at: http://en.Wikipedia.org/wiki/Financial_intermediary. License: CC BY-SA: Attribution-ShareAlike

- pooling. Provided by: Wiktionary. Located at: http://en.wiktionary.org/wiki/pooling. License: CC BY-SA: Attribution-ShareAlike

- financial intermediary. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/financial%20intermediary. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ngton,_D.C.JPG. License: CC BY-SA: Attribution-ShareAlike

- Macroeconomics/Savings and Investment. Provided by: Wikibooks. Located at: http://en.wikibooks.org/wiki/Macroec...and_Investment. License: CC BY-SA: Attribution-ShareAlike

- real interest rates. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/real%20interest%20rates. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ngton,_D.C.JPG. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...vings_Bond.jpg. License: CC BY-SA: Attribution-ShareAlike

- Loanable funds. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Loanable_funds. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...loanable-funds. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ngton,_D.C.JPG. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...vings_Bond.jpg. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...nds_market.JPG. License: CC BY-SA: Attribution-ShareAlike