Present Value and the Time Value of Money

The time value of money is the principle that a certain amount of money today has a different buying power (value) than in the future.

learning objectives

- Calculate the present and future value of money

The time value of money is the principle that a certain amount of money today has a different buying power (value) than the same currency amount of money in the future. The value of money at a future point of time would take account of interest earned or inflation accrued over a given period of time. This notion exists both because there is an opportunity to earn interest on the money and because inflation will drive prices up, thus changing the “value” of the money.

For example, assume that an investor has $100 today and can invest this money at a 5% return for one year. A year from now the original investment will equal $105, \((100) \times (1.05)\). The return of $5 represents the time value of money over the one year interval.

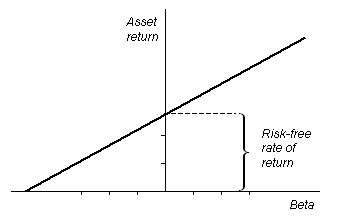

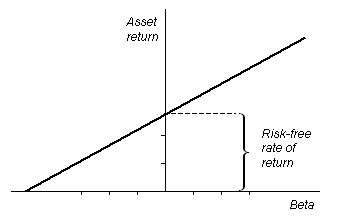

Money: Assuming a 5% interest rate, $100 invested today will be worth $105 in one year ($100 multiplied by 1.05). Conversely, $100 received one year from now is only worth $95.24 today ($100 divided by 1.05), assuming a 5% interest rate.

Time value of money:\((1+r)^t x \; (\text{the value of the initial investment})=\text{future value}\); where \(r\) is the annual interest rate and \(t\) is the number of years.

Alternatively, if an investment is valued at $125 and this value includes the 7% return generated over a one year time horizon, the original value of the investment or its present value is equal to \(\frac{(125)}{(1.07)}\) or 117.

Present value: \(\frac{(\text{the value of the investment at a future time})}{(1+r)^n}\); where \(r\) is the annual interest rate and \(n\) is the number of years the investment has occurred.

The time value of money is the central concept in finance theory. However, the explanation of the concept typically looks at the impact of interest and assumes, for simplicity, that inflation is neutral.

Measuring and Managing Risk

Risk is pervasive in the economy and is an essential component in the derivation of an asset’s investment return.

learning objectives

- Explain the relationship between time, money, and risk

Assets can have varying maturity dates and potential for default, the attribution of time to maturity and timely payments involve an assessment of risk. Risk is pervasive in the economy and is an essential component in the derivation of an asset’s investment return.

Time and Risk

Time is a component of risk for varying reasons; however, the two most common are related to the increase in general uncertainty rising with the time horizon and reinvestment risk.

In our everyday lives, we are faced with momentary uncertainties that become increasingly harder to predict as we move from a five minute horizon to a five day, five month, or even five year period. This same phenomenon is true of financial assets. Though the attribution of acceptable inflation can be incorporated into an investment return, the actual pricing and resulting purchasing power of the investment at maturity is unknown and the uncertainty increases with time. Therefore, investment returns compensate holders for the time to maturity via a risk premium.

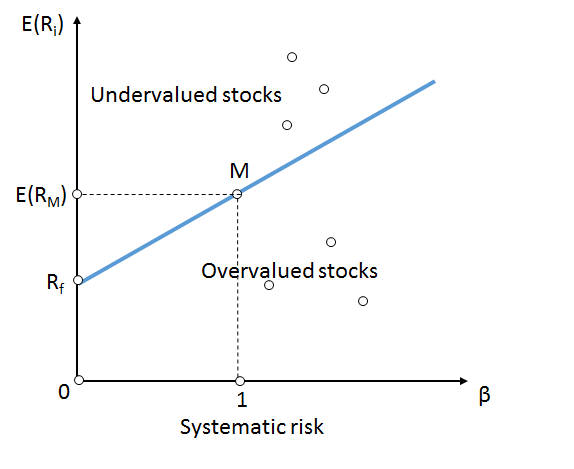

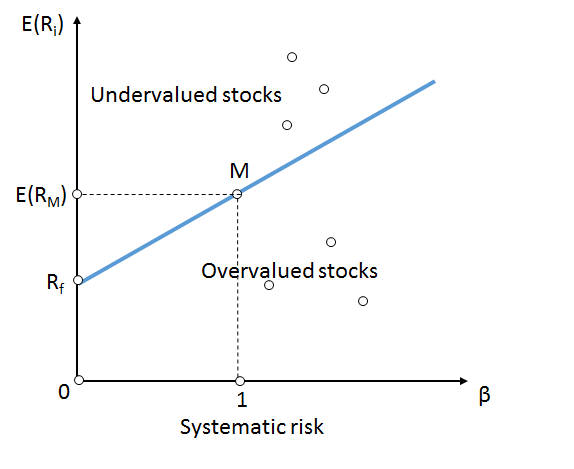

Return expectations are based on risk analysis: In finance and economics, as depicted in the graph above of the capital asset pricing model, risk is evaluated to set the boundary for acceptable return.

Risk premium compensates holders for risks inherent to an investment and are incorporated in the rate of return quoted for an investment. For example, if asset A and asset B both pay a 5% coupon on an annual basis, but asset B matures in 5 years and asset A matures in 1 year, all else equal (asset quality and issuer solvency), we would expect asset A to trade at a higher price than asset B. Remembering that yield and price are inversely related, the higher price on A implies that it has a lower yield than B. The differential in yield can be attributed to a risk premium for time to maturity.

Another aspect of time horizon is reinvestment risk. For some investments, there is a potential for an issuer to call or redeem a security prior to maturity. Given that at the time that the investment is called prevailing rates may be lower than at the purchase of the asset, the holder is taking a reinvestment risk at the time of purchase. To compensate investors for taking on this type of risk, the issuer will provide a risk premium to incentivize the investor to purchase the investment.

The Value of Diversification

The compensation adjustment for holding an asset of a given risk profile can be further enhanced through asset diversification.

learning objectives

- Explain the rationale for diversification

Each asset class has specific investment objectives; these are typically stated in a prospectus or investment description. However, all investments have some degree of risk in meeting the stated investment objectives or return.

The risks that are inherent to a specific investment can be compensated for by a market-assessed risk premium, whereby market participants adjust the price of an asset, impacting its overall return, based on the risk characteristics of the asset. However, the compensation adjustment for holding an asset of a given risk profile can be further enhanced through asset diversification.

The Value of Diversification

Diversification strategies can be as simple as not “placing all your eggs in one basket.” It can also be as complex as a routine evaluation of investment correlation and risk, and dynamic rebalancing of investment holdings. However, whether a common sense or a highly quantitative approach is taken, the benefit of diversification is to limit risk and enhance consistency of return.

By holding varying investments, even if they are within the same company or sector, an investor still has the benefit of reducing risk inherent from the default of one asset. For example, stock and bonds provide different returns; while a stock may exhibit no growth for a period of time, the bond may continue to pay its coupon and provide a return. Through diversification, an investor’s entire portfolio can perform better than its worst-performing asset.

In general, most asset managers would advocate holdings that are diversified across sectors and asset classes to further the benefit of growth and reduce the risk of performance volatility that may be attributable to a company, sector, or asset class. In some cases where the return on investment needs to be met, managers may advocate for the use of hedging instruments to transfer risk of return objectives being met to another party in lieu of a consistent return.

Hedging strategies can be relatively complex but, in general, they serve the role of insuring that an investor is able to meet investment performance objectives. Typically, an investor pays a fee and enters into the hedging strategy, which transfer the risk inherent in an investment for a constant return. The party on the opposite side of the hedge absorbs both the upside and downside return potential of the asset, along with the fee for taking on the risk of uncertainty, and pays the first party a constant return as part of the agreement.

Systematic Risk

It’s important to note that diversification does not remove all of the risk from the portfolio. Diversification can reduce the risk of any single asset, but there will still be systematic risk (or undiversifiable risk). Systematic risk arises from market structure or dynamics which produce shocks or uncertainty faced by all agents in the market. For example, government policy, international economic forces, or acts of nature can shock the entire market. Systematic risk will affect the portfolio, regardless of how diversified it is.

The Relationship Between Risk and Return and the Security Market Line

The security market line is useful to determine if an asset being considered for a portfolio offers a reasonable expected return for risk.

learning objectives

- Explain how the security market line relates risk and return

Investment assets are typically characterized as having two performance risks: systematic (or market risk) and non- systematic risk. Systematic risk arises from market structure or dynamics, which produce shocks or uncertainty faced by all agents in the market. Non-systematic risk is unique to a specific company and can be reduced through diversification.

Capital Asset Pricing Model (CAPM)

In finance, the capital asset pricing model (CAPM) is used to determine the required rate of return of an asset, taking into account an asset’s sensitivity to non-diversifiable or systematic risk. Non-diversifiable risk is noted by the variable beta (β), where beta is greater than one if the asset’s price sensitivity is greater than the market; equal to one when the asset’s sensitivity is equal to the market; and less than one if the asset exhibits less pricing volatility than the market.

The CAPM is a model for pricing an individual security or portfolio. The expected return of an asset is equal to the risk free rate plus the excess return of the market above the risk-free rate, adjusted for the asset’s overall sensitivity to market fluctuations or its beta. Mathematically, the capital asset pricing model can be written as: \(E(R_i)=R_f+β(E(R_m)–R_f)\), where \(R\) is the return, \(E(R)\) is the expected return, \(i\) denotes any asset, \(f\) is the risk-free asset, and \(m\) is the market.

Security Market Line (SML)

For individual securities, the security market line (SML) and its relation to expected return and systematic risk (beta) depicts an individual security in relation to their security risk class. The SML essentially graphs the results from the capital asset pricing model formula. The x-axis represents the risk (beta), and the y-axis represents the expected return. The market risk premium is determined from the slope of the SML. The relationship between β and required return is plotted on the SML, which shows expected return as a function of β. The intercept is the nominal risk-free rate available for the market, while the slope is the market premium, \(E(R_m)−R_f\).

Security market line: The security market line depicts the the return on a security relative to its own risk.

The SML is a useful tool in determining if an asset being considered for a portfolio offers a reasonable expected return for risk. Individual securities are plotted on the SML graph. If the security’s expected return versus risk is plotted above the SML, it is undervalued since the investor can expect a greater return for the inherent risk. A security plotted below the SML is overvalued since the investor would be accepting a smaller return for the amount of risk assumed.

Key Points

- Time value of money: \((1+r)^t x \; (\text{the value of the initial investment})=\text{future value}\); where \(r\) is the annual interest rate and \(t\) is the number of years.

- The time value of money is the central concept in finance theory. However, the explanation of the concept typically looks at the impact of interest and assumes, for simplicity, that inflation is neutral.

- The time value of money is the principle that a certain amount of money today has a different buying power (value) than the same currency amount of money in the future.

- Investment returns compensate holders for the time to maturity via a risk premium.

- Risk premium compensates holders for risks inherent to an investment and are incorporated in the rate of return quoted for an investment.

- To compensate investors for taking on reinvestment risk, issuers will provide a risk premium to incentivize the investor to purchase the investment.

- Diversification strategies can be as simple as not “placing all your eggs in one basket” or be as complex as routine evaluation of investment correlation and risk and dynamic rebalancing of investment holdings.

- Whether a common sense or highly quantitative approach is taken, the benefit of diversification is to limit risk and enhance consistency of return. A diversified portfolio will earn a return that is always higher than its lowest performing asset.

- Most asset managers would advocate holdings that are diversified across sectors and asset classes to further the benefit of growth and reduce the risk of performance volatility that may be attributable to a company, sector, or asset class.

- Investors may enter into hedging strategies in order to ensure a constant return over market volatility. For a fee, a hedging strategy offers a constant return on an investment. The party on the other side of the hedge absorbs the volatility of the investment and pays out a consistent return.

- In finance, the capital asset pricing model (CAPM) is used to determine the required rate of return of an asset taking into account an asset’s sensitivity to non-diversifiable risk.

- The security market line essentially graphs the results from the capital asset pricing model formula. The intercept of the SML is the nominal risk-free rate available for the market, while the slope is the market premium.

- If the security’s expected return versus risk is plotted above the SML, it is undervalued since the investor can expect a greater return for the inherent risk. A security plotted below the SML is overvalued since the investor would be accepting less return for the amount of risk assumed.

Key Terms

- time value of money: The principle that a certain currency amount of money today has a different buying power (value) than the same currency amount of money in the future.

- present value: The value of an asset in today’s dollars after adjusting for an increase in the asset values as a result of interest earned during the period.

- risk premium: The minimum amount of money by which the expected return on a risky asset must exceed the known return on a risk-free asset

- time horizon: A fixed point of time in the future where certain processes will be evaluated or assumed to end.

- prospectus: A document, distributed to prospective members, investors, buyers, or participants, which describes an institution (such as a university), a publication, or a business and what it has to offer.

- asset class: A group of economic resources sharing similar characteristics, such as riskiness and return.

- systematic risk: The risk associated with an asset that is correlated with the risk of asset markets generally, often measured as its beta.

- non-systematic risk: Risk that is unique to a specific company; can be reduced through diversification.

- capital asset pricing model: Used to determine the required rate of return of an asset taking into account an asset’s sensitivity to non-diversifiable risk (also known as systematic risk or market risk).

- security market line: A line representing the relationship between expected return and systematic risk; thus a graphical representation of the capital asset pricing model.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- Time value of money. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Time_value_of_money. License: CC BY-SA: Attribution-ShareAlike

- time value of money. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/time%20...e%20of%20money. License: CC BY-SA: Attribution-ShareAlike

- Present value. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Present_value. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...s_of_money.jpg. License: CC BY-SA: Attribution-ShareAlike

- time horizon. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/time_horizon. License: CC BY-SA: Attribution-ShareAlike

- Risk premium. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Risk_premium. License: CC BY-SA: Attribution-ShareAlike

- risk premium. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/risk%20premium. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...s_of_money.jpg. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...SecMktLine.png. License: CC BY-SA: Attribution-ShareAlike

- Diversification (finance). Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Diversi...tion_(finance). License: CC BY-SA: Attribution-ShareAlike

- Systematic risk. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Systematic_risk. License: CC BY-SA: Attribution-ShareAlike

- asset clas. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/asset%20clas. License: CC BY-SA: Attribution-ShareAlike

- risk premium. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/risk%20premium. License: CC BY-SA: Attribution-ShareAlike

- prospectus. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/prospectus. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...s_of_money.jpg. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...SecMktLine.png. License: CC BY-SA: Attribution-ShareAlike

- systematic risk. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/systematic_risk. License: CC BY-SA: Attribution-ShareAlike

- Capital asset pricing model. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Capital..._pricing_model. License: CC BY-SA: Attribution-ShareAlike

- Security market line. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Security_market_line. License: CC BY-SA: Attribution-ShareAlike

- non-systematic risk. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/non-systematic%20risk. License: CC BY-SA: Attribution-ShareAlike

- capital asset pricing model. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/capital...ricing%20model. License: CC BY-SA: Attribution-ShareAlike

- security market line. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/security_market_line. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...s_of_money.jpg. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...SecMktLine.png. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi.../SML-chart.png. License: CC BY-SA: Attribution-ShareAlike