Introducing Exchange Rates

In finance, an exchange rate between two currencies is the rate at which one currency will be exchanged for another.

learning objectives

- Explain the concept of a foreign exchange market and an exchange rate

In finance, an exchange rate (also known as a foreign-exchange rate, forex rate, or rate) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency. For example, an inter-bank exchange rate of 91 Japanese yen (JPY, ¥) to the United States dollar (USD, US$) means that ¥91 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥91.

Exchange Rates: In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers.

Exchange rates are determined in the foreign exchange market, which is open to a wide range of buyers and sellers where currency trading is continuous. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today, but for delivery and payment on a specific future date.

How the Foreign Exchange Market Works

In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer’s margin (or profit) in trading, or else the margin may be recovered in the form of a commission or in some other way.

Different rates may also be quoted for different kinds of exchanges, such as for cash (usually notes only), a documentary form (such as traveler’s checks), or electronic transfers (such as a credit card purchase). There is generally a higher exchange rate on documentary transactions (such as for traveler’s checks) due to the additional time and cost of clearing the document, while cash is available for resale immediately.

Finding an Equilibrium Exchange Rate

There are two methods to find the equilibrium exchange rate between currencies; the balance of payment method and the asset market model.

learning objectives

- Differentiate between the Balance of Payment and Asset Market Models

Countries have a vested interest in the exchange rate of their currency to their trading partner’s currency because it affects trade flows. When the domestic currency has a high value, its exports are expensive. This leads to a trade deficit, decreased production, and unemployment. If the currency’s value is low, imports can be too expensive though exports are expected to rise.

Purchasing Power Parity

Purchasing power parity is a way of determining the value of a product after adjusting for price differences and the exchange rate. Indeed, it does not make sense to say that a book costs $20 in the US and £15 in England: the comparison is not equivalent. If we know that the exchange rate is £2/$, the book in England is selling for $30, so the book is actually more expensive in England

If goods can be freely traded across borders with no transportation costs, the Law of One Price posits that exchange rates will adjust until the value of the goods are the same in both countries. Of course, not all products can be traded internationally (e.g. haircuts), and there are transportation costs so the law does not always hold.

The concept of purchasing power parity is important for understanding the two models of equilibrium exchange rates below.

Balance of Payments Model

The balance of payments model holds that foreign exchange rates are at an equilibrium level if they produce a stable current account balance. A nation with a trade deficit will experience a reduction in its foreign exchange reserves, which ultimately lowers, or depreciates, the value of its currency. If a currency is undervalued, its nation’s exports become more affordable in the global market while making imports more expensive. After an intermediate period, imports will be forced down and exports will rise, thus stabilizing the trade balance and bringing the currency towards equilibrium.

Asset Market Model

Like purchasing power parity, the balance of payments model focuses largely on tangible goods and services, ignoring the increasing role of global capital flows. In other words, money is not only chasing goods and services, but to a larger extent, financial assets such as stocks and bonds. The flows from transactions involving financial assets go into the capital account item of the balance of payments, thus balancing the deficit in the current account. The increase in capital flows has given rise to the asset market model.

Share of Stock: The key difference between the balance of payments and asset market models is that the former includes financial assets, such as stock, in its calculation.

The asset market model views currencies as an important element in finding the equilibrium exchange rate. Asset prices are influenced mostly by people’s willingness to hold the existing quantities of assets, which in turn depends on their expectations on the future worth of the assets. The asset market model of exchange rate determination states that the exchange rate between two currencies represents the price that just balances the relative supplies of, and demand for, assets denominated in those currencies. These assets are not limited to consumables, such as groceries or cars. They include investments, such as shares of stock that is denominated in the currency, and debt denominated in the currency.

Real Versus Nominal Rates

Real exchange rates are nominal rates adjusted for differences in price levels.

learning objectives

- Calculate the nominal and real exchange rates for a set of currencies

Currency is complicated and its value can be measured in several different ways. For example, a currency can be measured in terms of other currencies, or it can be measured in terms of the goods and services it can buy. An exchange rate between two currencies is defined as the rate at which one currency will be exchanged for another. However, that rate can be interpreted through different perspectives. Below are descriptions of the two most common means of describing exchange rates.

Nominal Exchange Rate

A nominal value is an economic value expressed in monetary terms (that is, in units of a currency). It is not influenced by the change of price or value of the goods and services that currencies can buy. Therefore, changes in the nominal value of currency over time can happen because of a change in the value of the currency or because of the associated prices of the goods and services that the currency is used to buy.

When you go online to find the current exchange rate of a currency, it is generally expressed in nominal terms. The nominal rate is set on the open market and is based on how much of one currency another currency can buy.

Real Exchange Rate

The real exchange rate is the purchasing power of a currency relative to another at current exchange rates and prices. It is the ratio of the number of units of a given country’s currency necessary to buy a market basket of goods in the other country, after acquiring the other country’s currency in the foreign exchange market, to the number of units of the given country’s currency that would be necessary to buy that market basket directly in the given country. The real exchange rate is the nominal rate adjusted for differences in price levels.

A measure of the differences in price levels is Purchasing Power Parity (PPP). The concept of purchasing power parity allows one to estimate what the exchange rate between two currencies would have to be in order for the exchange to be on par with the purchasing power of the two countries’ currencies. Using the PPP rate for hypothetical currency conversions, a given amount of one currency has the same purchasing power whether used directly to purchase a market basket of goods or used to convert at the PPP rate to the other currency and then purchase the market basket using that currency.

Groceries: Purchasing Power Parity evaluates and compares the prices of goods in different countries, such as groceries. PPP is then used to help determine real exchange rates.

If all goods were freely tradable, and foreign and domestic residents purchased identical baskets of goods, purchasing power parity (PPP) would hold for the exchange rate and price levels of the two countries, and the real exchange rate would always equal 1. However, since these assumptions are almost never met in the real world, the real exchange rate will never equal 1.

Calculating Exchange Rates

Imagine there are two currencies, A and B. On the open market, 2 A’s can buy one B. The nominal exchange rate would be A/B 2, which means that 2 As would buy a B. This exchange rate can also be expressed as B/A 0.5.

The real exchange rate is the nominal exchange rate times the relative prices of a market basket of goods in the two countries. So, in this example, say it take 10 A’s to buy a specific basket of goods and 15 Bs to buy that same basket. The real exchange rate would be the nominal rate of A/B (2) times the price of the basket of goods in B (15), and divide all that by the price of the basket of goods expressed in A (10). In this case, the real A/B exchange rate is 3.

Exchange Rate Policy Choices

A government should consider its economic standing, trade balance, and how it wants to use its policy tools when choosing an exchange rate regime.

learning objectives

- Explain the factors countries consider when choosing an exchange rate policy

When a country decides on an exchange rate regime, it needs to take several important things in account. Unfortunately, there is no system that can achieve every possible beneficial outcome; there is a trade-off no matter what regime a nation picks. Below are a few considerations a country needs to make when choosing a regime.

Stage of Economic Development

A free floating exchange rate increases foreign exchange volatility, which can be a significant issue for developing economies. Developing economies often have the majority of their liabilities denominated in other currencies instead of the local currency. Businesses and banks in these types of economies earn their revenue in the local currency but have to convert it to another currency to pay their debts. If there is an unexpected depreciation in the local currency’s value, businesses and banks will find it much more difficult to settle their debts. This puts the entire economy’s financial sector stability in danger.

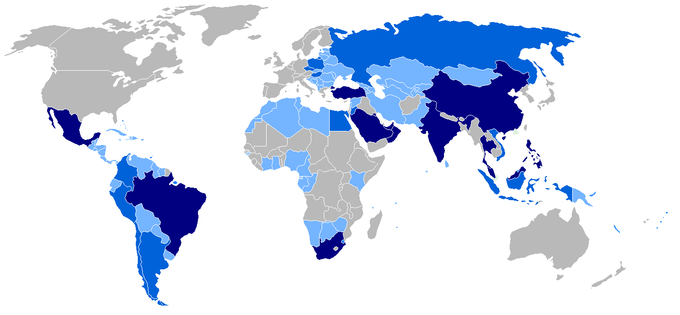

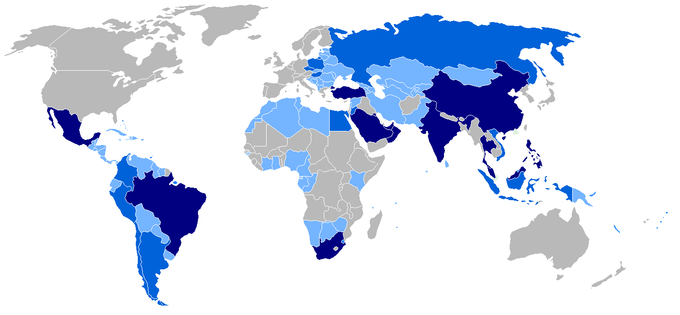

Developing Countries: The developing countries, marked in light blue, may prefer a fixed or managed exchange rate to a floating exchange rate. This is because sudden depreciation in their currency value poses a significant threat to the stability of their economies.

Balance of Payments

Flexible exchange rates serve to adjust the balance of trade. When a trade deficit occurs in an economy with a floating exchange rate, there will be increased demand for the foreign (rather than domestic) currency which will increase the price of the foreign currency in terms of the domestic currency. That in turn makes the price of foreign goods less attractive to the domestic market and decreases the trade deficit. Under fixed exchange rates, this automatic re-balancing does not occur.

Monetary and Fiscal Policy

A big drawback of adopting a fixed-rate regime is that the country cannot use its monetary or fiscal policies with a free hand. In general, fixed-rates are not established by law, but are instead maintained through government intervention in the market. The government does this through the buying and selling of its reserves, adjusting its interest rates, and altering its fiscal policies. Because the government must commit its monetary and fiscal tools to maintaining the fixed rate of exchange, it cannot use these tools to address other macroeconomics conditions such as price level, employment, and recessions resulting from the business cycle.

Exchange Rate Systems

The three major types of exchange rate systems are the float, the fixed rate, and the pegged float.

learning objectives

- Differentiate common exchange rate systems

One of the key economic decisions a nation must make is how it will value its currency in comparison to other currencies. An exchange rate regime is how a nation manages its currency in the foreign exchange market. An exchange rate regime is closely related to that country’s monetary policy. There are three basic types of exchange regimes: floating exchange, fixed exchange, and pegged float exchange.

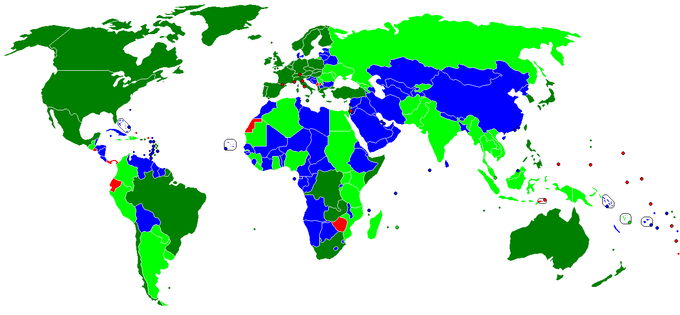

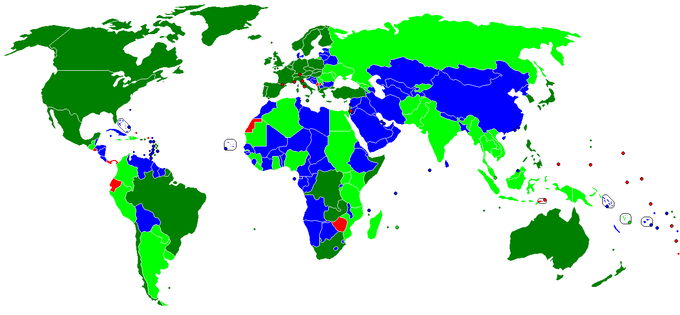

Foreign Exchange Regimes: The above map shows which countries have adopted which exchange rate regime. Dark green is for free float, neon green is for managed float, blue is for currency peg, and red is for countries that use another country’s currency.

The Floating Exchange Rate

A floating exchange rate, or fluctuating exchange rate, is a type of exchange rate regime wherein a currency’s value is allowed to fluctuate according to the foreign exchange market. A currency that uses a floating exchange rate is known as a floating currency. The dollar is an example of a floating currency.

Many economists believe floating exchange rates are the best possible exchange rate regime because these regimes automatically adjust to economic circumstances. These regimes enable a country to dampen the impact of shocks and foreign business cycles, and to preempt the possibility of having a balance of payments crisis. However, they also engender unpredictability as the result of their dynamism.

The Fixed Exchange Rate

A fixed exchange rate system, or pegged exchange rate system, is a currency system in which governments try to maintain a currency value that is constant against a specific currency or good. In a fixed exchange-rate system, a country’s government decides the worth of its currency in terms of either a fixed weight of an asset, another currency, or a basket of other currencies. The central bank of a country remains committed at all times to buy and sell its currency at a fixed price.

To ensure that a currency will maintain its “pegged” value, the country’s central bank maintain reserves of foreign currencies and gold. They can sell these reserves in order to intervene in the foreign exchange market to make up excess demand or take up excess supply of the country’s currency.

The most famous fixed rate system is the gold standard, where a unit of currency is pegged to a specific measure of gold. Regimes also peg to other currencies. These countries can either choose a single currency to peg to, or a “basket” consisting of the currencies of the country’s major trading partners.

The Pegged Float Exchange Rate

Pegged floating currencies are pegged to some band or value, which is either fixed or periodically adjusted. These are a hybrid of fixed and floating regimes. There are three types of pegged float regimes:

- Crawling bands: The market value of a national currency is permitted to fluctuate within a range specified by a band of fluctuation. This band is determined by international agreements or by unilateral decision by a central bank. The bands are adjusted periodically by the country’s central bank. Generally the bands are adjusted in response to economic circumstances and indicators.

- Crawling pegs:A crawling peg is an exchange rate regime, usually seen as a part of fixed exchange rate regimes, that allows gradual depreciation or appreciation in an exchange rate. The system is a method to fully utilize the peg under the fixed exchange regimes, as well as the flexibility under the floating exchange rate regime. The system is designed to peg at a certain value but, at the same time, to “glide” in response to external market uncertainties. In dealing with external pressure to appreciate or depreciate the exchange rate (such as interest rate differentials or changes in foreign exchange reserves), the system can meet frequent but moderate exchange rate changes to ensure that the economic dislocation is minimized.

- Pegged with horizontal bands:This system is similar to crawling bands, but the currency is allowed to fluctuate within a larger band of greater than one percent of the currency’s value.

Fixed Exchange Rates

A fixed exchange rate is a type of exchange rate regime where a currency’s value is fixed to a measure of value, such as gold or another currency.

learning objectives

- Explain the mechanisms by which a country maintains a fixed exchange rate

A fixed exchange rate, sometimes called a pegged exchange rate, is a type of exchange rate regime where a currency’s value is fixed against the value of another single currency, to a basket of other currencies, or to another measure of value, such as gold.

Reasons for Fixed Exchange Rate Regimes

A fixed exchange rate is usually used to stabilize the value of a currency against the currency it is pegged to. This makes trade and investments between the two countries easier and more predictable and is especially useful for small economies in which external trade forms a large part of their GDP.

This belief that fixed rates lead to stability is only partly true, since speculative attacks tend to target currencies with fixed exchange rate regimes, and in fact, the stability of the economic system is maintained mainly through capital control. Capital controls are residency-based measures such as transaction taxes, other limits, or outright prohibitions that a nation’s government can use to regulate flows from capital markets into and out of the country’s capital account. A fixed exchange rate regime should be viewed as a tool in capital control.

How a Fixed Exchange Regime Works

Typically a government maintains a fixed exchange rate by either buying or selling its own currency on the open market. This is one reason governments maintain reserves of foreign currencies. If the exchange rate drifts too far below the desired rate, the government buys its own currency in the market using its reserves. This places greater demand on the market and pushes up the price of the currency. If the exchange rate drifts too far above the desired rate, the government sells its own currency, thus increasing its foreign reserves.

Another, method of maintaining a fixed exchange rate is by simply making it illegal to trade currency at any other rate. This method is rarely used because it is difficult to enforce and often leads to a black market in foreign currency. Some countries, such as China in the 1990s, are highly successful at using this method due to government monopolies over all money conversion. China used this method against the U.S. dollar.

PRC Flag: China is well-known for its fixed exchange rate. It was one of the few countries that could impose a fixed rate by making it illegal to trade its currency at any other rate.

Managed Float

Managed float regimes are where exchange rates fluctuate, but central banks attempt to influence the exchange rates by buying and selling currencies.

learning objectives

- Describe a managed float exchange rate and explain why countries choose managed floats

Managed float regimes, otherwise known as dirty floats, are where exchange rates fluctuate from day to day and central banks attempt to influence their countries’ exchange rates by buying and selling currencies. Almost all currencies are managed since central banks or governments intervene to influence the value of their currencies. So when a country claims to have a floating currency, it most likely exists as a managed float.

How a Managed Float Exchange Rate Works

Generally, the central bank will set a range which its currency’s value may freely float between. If the currency drops below the range’s floor or grows beyond the range’s ceiling, the central bank takes action to bring the currency’s value back within range.

India: India has a managed float exchange regime. The rupee is allowed to fluctuate with the market within a set range before the central bank will intervene.

Management by the central bank generally takes the form of buying or selling large lots of its currency in order to provide price support or resistance. For example, if a currency is valued above its range, the central bank will sell some of its currency it has in reserve. By putting more of its currency in circulation, the central bank will decrease the currency’s value.

Why Do Countries Choose a Managed Float

Some economists believe that in most circumstances floating exchange rates are preferable to fixed exchange rates. Floating exchange rates automatically adjust to economic circumstances and allow a country to dampen the impact of shocks and foreign business cycles. This ultimately preempts the possibility of having a balance of payments crisis. A floating exchange rate also allows the country’s monetary policy to be freed up to pursue other goals, such as stabilizing the country’s employment or prices.

However, pure floating exchange rates pose some threats. A floating exchange rate is not as stable as a fixed exchange rate. If a currency floats, there could be rapid appreciation or depreciation of value. This could harm the country’s imports and exports. If the currency’s value increases too drastically, the country’s exports could become too costly which would harm the country’s employment rates. If the currency’s value decreases too drastically, the country may not be able to afford crucial imports.

This is why a managed float is so appealing. A country can obtain the benefits of a free floating system but still has the option to intervene and minimize the risks associated with a free floating currency. If a currency’s value increases or decreases too rapidly, the central bank can intervene and minimize any harmful effects that might result from the radical fluctuation.

Key Points

- Exchange rates are determined in the foreign exchange market, which is open to a wide range of buyers and sellers where currency trading is continuous.

- In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers.

- The foreign exchange rate is also regarded as the value of one country’s currency in terms of another currency.

- The balance of payment model holds that foreign exchange rates are at an equilibrium level if they produce a stable current account balance.

- The balance of payments model focuses largely on tradeable goods and services, ignoring the increasing role of global capital flows.

- The asset market model of exchange rate determination states that the exchange rate between two currencies represents the price that just balances the relative supplies of, and demand for, assets denominated in those currencies. This includes financial assets.

- The measure of the differences in price levels is Purchasing Power Parity. The concept of purchasing power parity allows one to estimate what the exchange rate between two currencies would have to be in order for the exchange to be on par with the purchasing power of the two countries’ currencies.

- If all goods were freely tradable, and foreign and domestic residents purchased identical baskets of goods, purchasing power parity (PPP) would hold for the exchange rate and price levels of the two countries, and the real exchange rate would always equal 1.

- When you go online to find the current exchange rate of a currency, it is generally expressed in nominal terms.

- Changes in the nominal value of currency over time can happen because of a change in the value of the currency or because of the associated prices of the goods and services that the currency is used to buy.

- To calculate the nominal exchange rate, simply measure how much of one currency is necessary to acquire one unit of another. The real exchange rate is the nominal exchange rate times the relative prices of a market basket of goods in the two countries.

- A free floating exchange rate increases foreign exchange volatility, which can be a significant issue for developing economies since most of their liabilities are denominated in other currencies.

- Floating exchange rates automatically adjust to trade imbalances while fixed rates do not.

- A big drawback of adopting a fixed-rate regime is that the country cannot use its monetary or fiscal policies with a free hand. Because these tools are reserved for preserving the fixed rate, countries can’t use its monetary or fiscal policies to address other economic issues.

- A floating exchange rate or fluctuating exchange rate is a type of exchange rate regime wherein a currency ‘s value is allowed to freely fluctuate according to the foreign exchange market.

- A fixed exchange-rate system (also known as pegged exchange rate system) is a currency system in which governments try to maintain their currency value constant against a specific currency or good.

- Pegged floating currencies are pegged to some band or value, either fixed or periodically adjusted. These are a hybrid of fixed and floating regimes.

- A fixed exchange rate is usually used to stabilize the value of a currency against the currency it is pegged to.

- A fixed exchange rate regime should be viewed as a tool in capital control. As a result, a fixed exchange rate can be viewed as a means to regulate flows from capital markets into and out of the country’s capital account.

- Typically, a government maintains a fixed exchange rate by either buying or selling its own currency on the open market.

- Another method of maintaining a fixed exchange rate is by simply making it illegal to trade currency at any other rate.

- Generally the central bank will set a range which its currency ‘s value may freely float between. If the currency drops below the range’s floor or grows beyond the range’s ceiling, the central bank takes action to bring the currency’s value back within range.

- Management by the central bank generally takes the form of buying or selling large lots of its currency in order to provide price support or resistance.

- A managed float regime is a hybrid of fixed and floating regimes. A managed float captures the benefits of floating regimes while allowing central banks to intervene and minimize the risk of harmful effects due to radical currency fluctuations that are a characteristic of floating regimes.

Key Terms

- exchange rate: The amount of one currency that a person or institution defines as equivalent to another when either buying or selling it at any particular moment.

- depreciate: To reduce in value over time.

- purchasing power parity: A theory of long-term equilibrium exchange rates based on relative price levels of two countries.

- real exchange rate: The purchasing power of a currency relative to another at current exchange rates and prices.

- nominal exchange rate: The amount of currency you can receive in exchange for another currency.

- fixed exchange rate: A system where a currency’s value is tied to the value of another single currency, to a basket of other currencies, or to another measure of value, such as gold.

- floating exchange rate: A system where the value of currency in relation to others is allowed to freely fluctuate subject to market forces.

- exchange rate regime: The way in which an authority manages its currency in relation to other currencies and the foreign exchange market.

- pegged float exchange rate: A currency system that fixes an exchange rate around a certain value, but still allows fluctuations, usually within certain values, to occur.

- Managed Float Regime: A system where exchange rates are allowed fluctuate from day to day within a range before the central bank will intervene to adjust it.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- exchange rate. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/exchange_rate. License: CC BY-SA: Attribution-ShareAlike

- Purchasing power parity. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Purchasing_power_parity. License: CC BY-SA: Attribution-ShareAlike

- Exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Exchange_rate. License: CC BY-SA: Attribution-ShareAlike

- South East Asia Exchange Rates (6031878489). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...031878489).jpg. License: CC BY: Attribution

- Purchasing power parity. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Purchasing_power_parity. License: CC BY-SA: Attribution-ShareAlike

- Principles of Finance/Section 1/Chapter/Financial Markets and Institutions/FX. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Princip...nstitutions/FX. License: CC BY-SA: Attribution-ShareAlike

- Exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Exchang...23cite_note-10. License: CC BY-SA: Attribution-ShareAlike

- Exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Exchange_rate. License: CC BY-SA: Attribution-ShareAlike

- Law of one price. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Law_of_one_price. License: CC BY-SA: Attribution-ShareAlike

- Purchasing power parity. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Purchasing_power_parity. License: CC BY-SA: Attribution-ShareAlike

- depreciate. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/depreciate. License: CC BY-SA: Attribution-ShareAlike

- purchasing power parity. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/purchasing_power_parity. License: CC BY-SA: Attribution-ShareAlike

- South East Asia Exchange Rates (6031878489). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...031878489).jpg. License: CC BY: Attribution

- B&O RR common stock. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:B&...mmon_stock.jpg. License: CC BY-SA: Attribution-ShareAlike

- Exchange rates. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Exchange_rates. License: CC BY-SA: Attribution-ShareAlike

- Exchange rates. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Exchange_rates. License: CC BY-SA: Attribution-ShareAlike

- Nominal (economics). Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Nominal_(economics). License: CC BY-SA: Attribution-ShareAlike

- Purchasing power parity. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Purchasing_power_parity. License: CC BY-SA: Attribution-ShareAlike

- real exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/real%20exchange%20rate. License: CC BY-SA: Attribution-ShareAlike

- nominal exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/nominal...xchange%20rate. License: CC BY-SA: Attribution-ShareAlike

- South East Asia Exchange Rates (6031878489). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...031878489).jpg. License: CC BY: Attribution

- B&O RR common stock. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:B&...mmon_stock.jpg. License: CC BY-SA: Attribution-ShareAlike

- Groceries at Boqueria market. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ria_market.JPG. License: CC BY-SA: Attribution-ShareAlike

- Floating exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Floatin...ar_of_floating. License: CC BY-SA: Attribution-ShareAlike

- Fixed exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Fixed_exchange_rate. License: CC BY-SA: Attribution-ShareAlike

- floating exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/floatin...xchange%20rate. License: CC BY-SA: Attribution-ShareAlike

- fixed exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fixed%20exchange%20rate. License: CC BY-SA: Attribution-ShareAlike

- South East Asia Exchange Rates (6031878489). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...031878489).jpg. License: CC BY: Attribution

- B&O RR common stock. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:B&...mmon_stock.jpg. License: CC BY-SA: Attribution-ShareAlike

- Groceries at Boqueria market. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ria_market.JPG. License: CC BY-SA: Attribution-ShareAlike

- Industrialized countries 2007. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...tries_2007.png. License: Public Domain: No Known Copyright

- Exchange-rate regime. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Exchange-rate_regime. License: CC BY-SA: Attribution-ShareAlike

- Fixed exchange-rate system. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Fixed_e...ge-rate_system. License: CC BY-SA: Attribution-ShareAlike

- Crawling peg. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Crawling_peg. License: CC BY-SA: Attribution-ShareAlike

- Floating exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Floating_exchange_rate. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...ge-rate-regime. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...-exchange-rate. License: CC BY-SA: Attribution-ShareAlike

- fixed exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fixed%20exchange%20rate. License: CC BY-SA: Attribution-ShareAlike

- floating exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/floatin...xchange%20rate. License: CC BY-SA: Attribution-ShareAlike

- South East Asia Exchange Rates (6031878489). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...031878489).jpg. License: CC BY: Attribution

- B&O RR common stock. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:B&...mmon_stock.jpg. License: CC BY-SA: Attribution-ShareAlike

- Groceries at Boqueria market. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Groceries_at_Boqueria_market.JPG. License: CC BY-SA: Attribution-ShareAlike

- Industrialized countries 2007. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Industrialized_countries_2007.png. License: Public Domain: No Known Copyright

- Currency Exchange regimes. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Currency_Exchange_regimes.png. License: CC BY-SA: Attribution-ShareAlike

- Capital control. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Capital_control. License: CC BY-SA: Attribution-ShareAlike

- Fixed exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Fixed_exchange_rate. License: CC BY-SA: Attribution-ShareAlike

- fixed exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fixed%20exchange%20rate. License: CC BY-SA: Attribution-ShareAlike

- South East Asia Exchange Rates (6031878489). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:South_East_Asia_Exchange_Rates_(6031878489).jpg. License: CC BY: Attribution

- B&O RR common stock. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:B&...mmon_stock.jpg. License: CC BY-SA: Attribution-ShareAlike

- Groceries at Boqueria market. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Groceries_at_Boqueria_market.JPG. License: CC BY-SA: Attribution-ShareAlike

- Industrialized countries 2007. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Industrialized_countries_2007.png. License: Public Domain: No Known Copyright

- Currency Exchange regimes. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Currency_Exchange_regimes.png. License: CC BY-SA: Attribution-ShareAlike

- Flag of the People's Republic of China. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Flag_of_the_People's_Republic_of_China.svg. License: Public Domain: No Known Copyright

- Floating exchange rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Floatin...omic_rationale. License: CC BY-SA: Attribution-ShareAlike

- Managed float. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Managed_float. License: CC BY-SA: Attribution-ShareAlike

- Managed float regime. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Managed_float_regime. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...d-float-regime. License: CC BY-SA: Attribution-ShareAlike

- South East Asia Exchange Rates (6031878489). Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:South_East_Asia_Exchange_Rates_(6031878489).jpg. License: CC BY: Attribution

- B&O RR common stock. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:B&...mmon_stock.jpg. License: CC BY-SA: Attribution-ShareAlike

- Groceries at Boqueria market. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Groceries_at_Boqueria_market.JPG. License: CC BY-SA: Attribution-ShareAlike

- Industrialized countries 2007. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Industrialized_countries_2007.png. License: Public Domain: No Known Copyright

- Currency Exchange regimes. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Currency_Exchange_regimes.png. License: CC BY-SA: Attribution-ShareAlike

- Flag of the People's Republic of China. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Flag_of_the_People's_Republic_of_China.svg. License: Public Domain: No Known Copyright

- Flag of India. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/File:Flag_of_India.svg. License: Public Domain: No Known Copyright