8.3: Policy Arenas

- Page ID

- 147655

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Social Welfare Policy

Social welfare policy is designed to ensure some level of equity in a democratic political system based on competitive, free-market economics. It also creates an automatic stimulus for a society by building a safety net that can catch members of society who are suffering economic hardship through no fault of their own. For an individual family, this safety net makes the difference between eating and starving. For an entire economy, it could prevent an economic recession from sliding into a broader and more damaging depression.

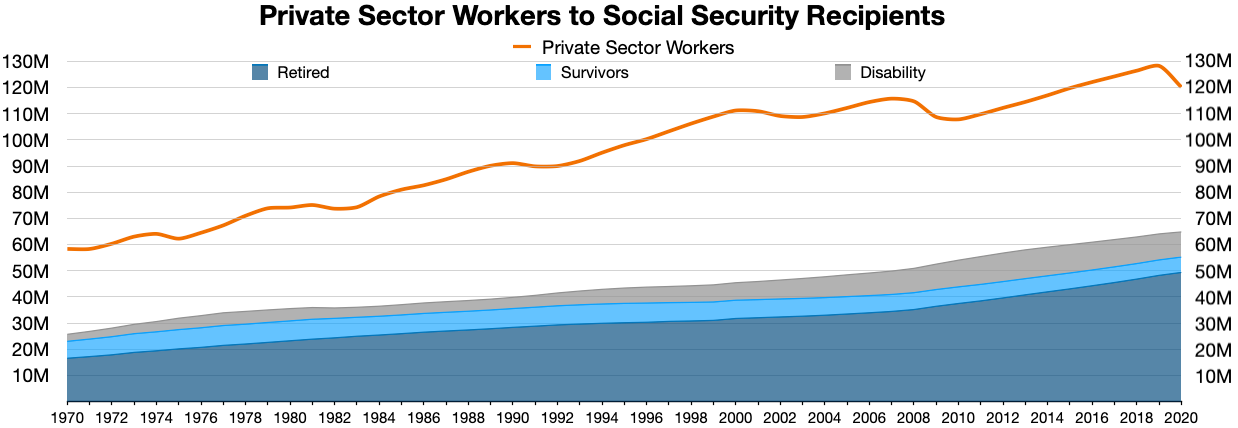

One of the oldest and largest pieces of social welfare policy is Social Security. Employers and workers pay a portion of their paycheck to this fund. (In 2022, the rate was 6.20%.)

Source: Wikipedia

- Retirement benefit--After completing a minimum number of years of work, U.S. workers may claim a form of pension upon reaching retirement age. Often called an entitlement program it guarantees benefits to a particular group, and virtually everyone will eventually qualify for the plan given the relatively low requirements for enrollment. In 2022, the full retirement age was 66 if you were born from 1943 to 1954. The full retirement age increased gradually if you were born from 1955 to 1960. For anyone born 1960 or later, full retirement benefits were payable at age 67. A valuable added benefit is that, under certain circumstances, social security may also be claimed by the survivors of qualifying workers, such as spouses and minor children, even if they themselves did not have a wage income.

- Disability payout--The government distributes funds to workers who become unable to work due to physical or mental disability. To qualify, workers must demonstrate that the injury or incapacitation will last at least twelve months.

- Supplemental Security Income--This program provides supplemental income to adults or children with considerable disability or to the elderly who fall below an income threshold.

Many economists predict that due to slower population growth and an aging population, the amount of revenue generated from payroll taxes will no longer be sufficient to cover costs in 2033.

Two other programs are designed to provide cash payments to sustain the aged and disabled.

- Also an entitlement program, Medicare is intended to ensure that senior citizens and retirees have access to low-cost health care they might not otherwise have. Medicare provides three major forms of coverage: a guaranteed insurance benefit that helps cover major hospitalization, fee-based supplemental coverage that retirees can use to lower costs for doctor visits and other health expenses, and a prescription drug benefit. Medicare faces many of the same long-term challenges as Social Security, due to the same demographic shifts. In addition, health care costs are rising significantly faster than inflation.

- Medicaid is a formula-based, health insurance program, which means beneficiaries must demonstrate they fall within a particular income category. Individuals in this program receive a fairly comprehensive set of health benefits, although access to health care may be limited because fewer providers accept payments from the program.

Science, Technology, and Education

After World War II ended, the United States quickly realized that it had to address two problems to secure its fiscal and national security future: how to reintegrated millions of servicemen and women into the workforce, and how to rapidly develop a new, highly technical military-industrial complex to compete with the Soviet Union. To confront these challenges, the U.S. government passed several important pieces of legislation to provide education assistance to workers and research dollars to the industry. Many of these programs have evolved from their original purposes, but they still remain important pieces of the public policy debate.

Much of the nation’s science and technology policy benefits its military in the form of research and development funding for a range of defense projects. The federal government still promotes research for civilian uses, mostly through the National Science Foundation, the National Institutes of Health, the National Aeronautics and Space Administration (NASA), and the National Oceanic and Atmospheric Administration. Some politicians debate whether government funding is necessary or if private entities would be better suited. For example, although NASA continues to develop a replacement for the now-defunct U.S. space shuttle program, much of its workload is currently being performed by private companies working to develop their own space launch, resupply, and tourism programs.

Historically, education has largely been the job of the states. As such, the national government has never moved to create an equivalent system of national higher education academies or universities as many other countries have done. The overwhelming portion of federal education money is spent on student loans, grants, and work-study programs. In addition, resources are set aside to cover job-retraining programs for individuals who lack private-sector skills or who need to be retrained to meet changes in the economy’s demands for the labor force. National policy toward elementary and secondary education programs has typically focused on increasing resources available to school districts for nontraditional programs (such as preschool and special needs), or helping poorer schools stay competitive with wealthier institutions.

Business Stimulus and Regulation

A final key aspect of domestic policy is the growth and regulation of business. The size and strength of the economy is very important to politicians whose jobs depend on citizens’ belief in their own future prosperity. At the same time, people want to live in a world where they feel safe from unfair or environmentally damaging business practices. These desires have forced the government to perform a delicate balancing act between programs that help grow the economy by providing benefits to the business sector and those that protect consumers, often by curtailing or regulating the business sector.

Two of the largest recipients of government aid are agriculture and energy. Both are multi-billion dollar industries concentrated in rural and/or electorally influential states. The U.S. government has chosen to provide significant agriculture and energy subsidies to cover the risks inherent in the unpredictability of the weather and oil exploration. These costs are typically seen in groceries bills, such as lower milk prices. Government subsidies also protect these industries’ profitability.

When it comes to regulation, the federal government has created several agencies responsible for providing for everything from worker safety (OSHA, the Occupational Safety and Health Administration), to food safety (FDA), to consumer protection, where the recently created Bureau of Consumer Protection ensures that businesses do not mislead consumers with deceptive or manipulative practices. Another prominent federal agency, the EPA, is charged with ensuring that businesses do not excessively pollute the nation’s air or waterways. A complex array of additional regulatory agencies governs specific industries such as banking and finance, which are detailed later in this chapter.

- American Government 2e. Authored by: OpenStax. Located at: https://cnx.org/contents/nY32AU8S@5.1:xJJkKaSK@5/Preface. License: CC BY: Attribution. License Terms: Download for free at http://cnx.org/contents/9d8df601-4f1...50bf739e5f@5.1