28.2: Monetary Policy Tools

- Last updated

- Save as PDF

- Page ID

- 4553

- Boundless

- Boundless

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)The Reserve Ratio

The reserve ratio is the percentage of deposits that a bank is required to hold in reserves, or funds that are not allowed to be loaned.

learning objectives

- Identify the effects of reserve requirements on monetary policy

Banks assume responsibility for consumer deposits and make money by loaning out deposited finds. Therefore, banks with relatively higher deposits are able to supply a larger amount of loanable funds. The supply of loanable funds directly impacts growth and interest rates in an economy. Typically, an increase in the supply of loanable funds is associated with a decrease in interest rates. The greater the accessibility of loanable funds, as conferred by access and cost, the greater opportunity for businesses and consumers to make investment purchases and increase production and labor supply, respectively.

However, in economic downturns the amount of outstanding loans may be counter to a bank’s longevity, as depositors may seek to cash-out holdings. In order to reduce the risk of a panic or “run on bank” from the perception that a bank may not have adequate liquidity to meet depositor access to cash deposits, central banks have adopted policies to ensure that banks use prudent judgement when assessing the amount of deposits to loan.

Reserve Ratio

The reserve ratio is a central bank regulatory tool employed by most, but not all, of the world’s central banks. The ratio is a set percentage of customer deposits that a bank is required to hold in reserves, or funds that are not allowed to be loaned. Required reserves are normally in the form of cash stored physically in a bank vault (vault cash) or deposits made with a central bank. The required reserve ratio is a tool in monetary policy, given that changes in the reserve ratio directly impact the amount of loanable funds available.

Federal Reserve-US Central Bank: The Federal Reserve is charged with maintaining sustainable economic growth. To carry out its responsibilities, the “Fed” uses policies including the reserve ratio to adjust the money supply to either incentivize growth or slow down growth, as needed.

Monetary policy tool

Money growth in the economy can occur through the multiplier effect resulting from the reserve ratio. For example, a reserve ratio of 20% will result in 80% of any given initial deposit being loaned out and if the process of loaning is assumed to continue, the maximum increase in money expansion specific to an initial deposit at a 20% reserve ratio will be equal to the reserve multiplier \(\mathrm{\frac{1}{(reserve \; ratio)} \times the \; initial \; deposit}\).

For example, with the reserve ratio (RR) of 20 percent, the money multiplier, mm, will be calculated as:

\[\mathrm{m=\dfrac{1}{RR}}\]

\[\mathrm{m=\dfrac{1}{0.20}=5}\]

This then signifies that any initial deposit will contribute to an expansion in money supply up to 5 times its original value.

The conventional view in economic theory is that a reserve requirement can act as a tool of monetary policy. The higher the reserve requirement is set, the theory supposes, the less the amount of funds banks will have to loan out, leading to lower money creation. Alternatively, the higher the reserve requirement the, lower the supply of loanable funds, the higher the interest rate and the slower the resulting economic growth.

The Discount Rate

The rate that member banks charge each other is the federal funds rate and the rate the Fed charges is referred to as the discount rate.

learning objectives

- Illustrate the effects of the discount rate on monetary policy

The central bank of the United States is the Federal Reserve (the Fed). The Fed employs monetary policy through direct controls on the money supply through open market operations to achieve economic stability and growth.

Open market operations entail Fed intervention in the buying and selling of government bonds to achieve a change in the money supply and the corresponding change in the interest rate. The Fed sells bonds to reduce the money supply and increase the prevailing interest rate and buys bonds to increase the money supply and reduce the prevailing interest rate. The interest rate is an active target and is set as a target rate range by the Fed; it is conveyed to the public by the Federal Reserve Open Market Committee (FOMC) as the fed funds target rate (short for the Federal Funds rate).

Coincident with the Fed’s open market operations is the Fed’s selection of a reserve requirement which corresponds to a required percentage of deposits (reserves) that banks must keep on site or at the Fed on a daily basis. Given their daily activities, banks may fall short of their required daily reserve requirement. When this occurs, banks may either turn to the Fed or Fed member banks for overnight or short-term loans to satisfy their liquidity short-fall. The rate that member banks charge each other is referred to as the federal funds rate and the rate the Fed charges banks is referred to as the discount rate.

This distinction is particularly important. The discount rate is the rate that the central bank actual controls. It is the rate the central bank charges its member banks to borrow overnight. However, the rate that the central bank actually cares about is the fed funds rate. That is the rate banks charge each other, and is influenced by the discount rate.

The Fed targets the rate for federal funds via its open market operations and seeks to be the lender of last resort by charging banks a higher rate than the federal funds rate.

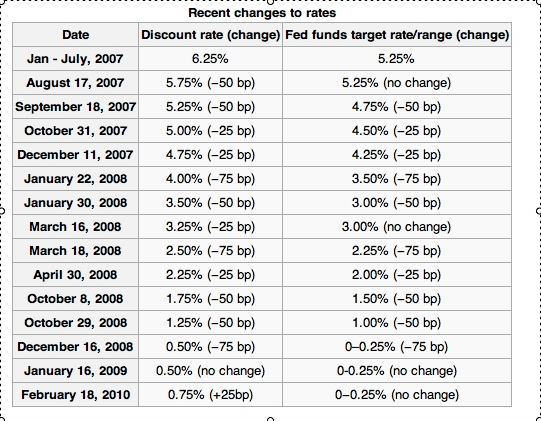

Historical discount and fed fund target rates: The discount rate is higher than the fed funds target rate and the variance serves as a disincentive for banks to seek funds or short-term borrowings from the Fed.

For example, the difference or spread of the primary credit rate (rate to member banks in solid financial standing) over the FOMC’s target federal funds rate was initially 1 percent. During the financial crisis, this spread was reduced to one-half of one percent on August 17, 2007, and was further reduced, to a quarter of 1 percent, on March 16, 2008.

Typically, the discount rate along with the fed funds target rate are mechanisms that the Fed uses to discourage banks from excess lending, as part of a contractionary or restrictive policy scheme. Given that lending has an expansionary effect, to the extent that the fed funds target rate and discount rate diminish the profitability of excess loaning, these parameters place limits to the expansion of the money supply via the loanable funds market. However, as noted in the aforementioned historical example, the discount rate, in conjunction with the fed funds target rate, may be purposely maintained at a lower interest level to encourage borrowing and increase growth when the economy is showing signs of either slowing or contracting. In this manner, the discount rate in tandem with the fed funds target rate are part of an expansionary policy mechanism.

The Federal Funds Rate

The Federal Funds rate is the interest rate at which depository institutions actively trade balances held at the Federal Reserve.

learning objectives

- Discuss the importance of the Federal Funds Rate as a monetary policy tool

The Federal Funds rate (or fed funds rate) is the interest rate at which depository institutions (primarily banks) actively trade balances held at the Federal Reserve. In the US, banks are obligated to maintain certain levels of reserves, either in the form of reserves with the Fed or as vault cash. Each day, banks receive deposits, which contribute to a bank’s reserves, and issue loans, which are liabilities against the bank. These daily activities change their ratio of reserves to liabilities. If, by the end of the day, the bank’s reserve ratio has dropped below the legally required minimum, it must add to its reserves in order to remain compliant with the law. Banks do this by borrowing reserves from other banks with excess reserves, and the weighted average of these interest rates paid by borrowing banks determines the federal funds rate.

The Federal Funds rate is directly related to the interest rate paid by firms and individuals. If a bank can borrow reserves cheaply, it can afford to offer loans to the public at lower rates and still make a profit. On the other hand, if the Federal Funds rate is high, banks will not borrow reserves in order to issue low-interest loans to the public. In fact, many mortgages and credit card interest rates are indexed to the Federal Funds rate – a homeowner might pay an adjustable interest rate that is set at the level of the Federal Funds rate plus four percent, for example. A high Federal Funds rate, therefore, has a contractionary effect on economic activity, while a low Federal Funds rate has an expansionary effect.

The Fed doesn’t control the Federal Funds rate directly – it is negotiated between borrowing and lending banks – but it does set a target interest rate and uses open market operations in order to achieve that rate. The target Federal Funds rate is decided by the governors at the Federal Open Market Committee (FOMC) meetings, who will either increase, decrease, or leave the target rate unchanged based on the economic conditions within the country. Influencing the Federal Funds rate is the primary monetary policy tool that the Fed uses to achieve its dual mandate of stable prices and low unemployment.

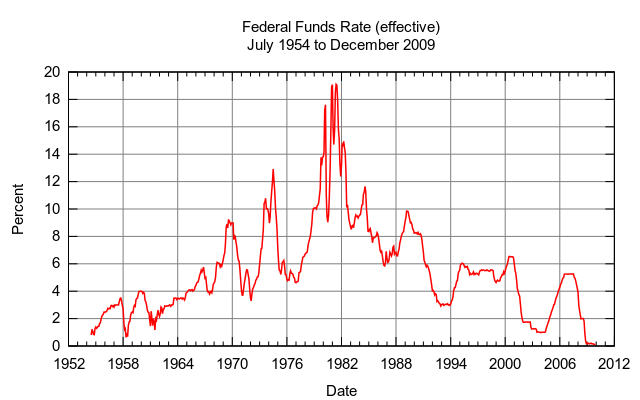

Federal Funds Rate 1954-2009: The graph shows the federal funds rate for the past fifty years. The peak in the 1980s reflects the contractionary monetary policy the Fed instituted to combat high levels of inflation due to oil shocks, and the low rate in the late 2000s reflects expansionary monetary policy meant to combat the effects of recession.

Open Market Operations

Open market operations (OMOs) are the purchase and sale of securities in the open market by a central bank.

learning objectives

- Discuss the use of open market operations to implement monetary policy

The Federal Reserve has several tools at its disposal to reach its monetary policy objectives. These include the discount rate, the fed funds target rate, and the reserve requirement, and open market operations (OMOs). OMOs are considered to be the most flexible option for the Federal Reserve out of all of these.

On a general level, OMO are the purchase and sale of securities in the open market by a central bank, as a means of controlling the money supply and the related prevailing interest rate.

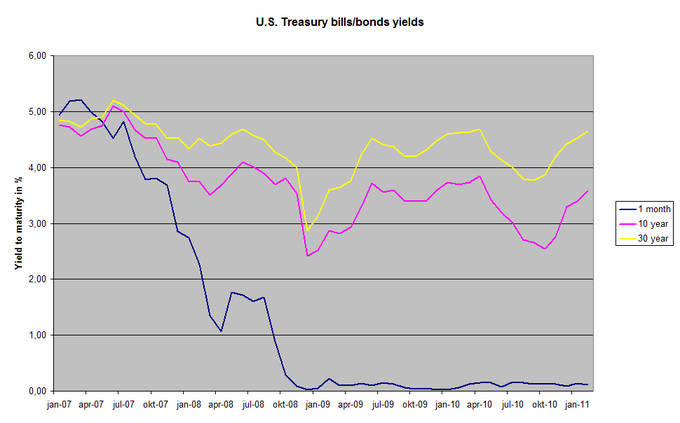

US Treasury Bill Yields: By buying and selling US Treasury bills on the open market, the Federal Reserve hopes to change their yields, which will then affect the interest rates in the broader market.

In the United States, the Federal Reserve Bank of New York conducts open market operations. They are under the oversight of the Federal Reserve Open Market Committee (FOMC). The FOMC makes a plan for open market operations over the short term, and publicly announce it after their regularly scheduled meetings.

Historically, the Federal Reserve has used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate–the interest rate at which depository institutions lend reserve balances to other depository institutions overnight–around the target established by the FOMC.

OMO Mechanism

OMOs are typically either expansionary or contractionary in nature. In an expansionary platform, the OMO will seek to increase the money supply and reduce interest rates in order to promote economic growth. In a contractionary scheme, the OMO will seek to reduce the money supply and increase interest rates in an effort to deter economic growth. Therefore, the implementation of contractionary policy will result in the selling of bonds (cash in exchange for debt holding) and an expansionary policy (buy bonds in exchange for cash) will result in an increase in the money supply at a lower interest rate as a means to enhance growth opportunities and revitalize the economy.

The interest rate targeted through the OMO manipulation of the money supply is the fed funds target rate or the rate that member Fed banks charge one another for overnight loans. The target rate is important monetary tool from the perspective that the higher the fed funds rate relative to the return on loanable funds, the greater the incentive for banks to meet their reserve requirement (the bank will lose money) thereby placing limits on the growth of the money supply through the loanable funds market. In addition to this direct interest rate channel, the fed funds rate influences many other interest rates in the economy and by so doing contributed to either incentivizing borrowing for growth or disincentivizing the same.

Setting and Achieving the Interest Rate Target

The Federal Reserve (Fed) has an ability to directly influence economic growth and stability through the use of monetary policy.

learning objectives

- Describe the way in which the Federal Reserve targets the interest rate

The Federal Reserve (Fed) has an ability to directly influence economic growth and stability through the use of monetary policy. Though the central bank can directly influence the money supply the majority of its activities center around interest rates, the outcome of changes to the money supply.

Interest Rate Mechanism

The Fed can set a reserve ratio, which is in effect the required reserves (percentage of deposits ) that a bank must hold either on site or at the Fed. The requirement must be satisfied on a daily basis. However, given daily bank dynamics of withdrawals, deposits and loan of funds some banks may fall short of their daily reserve requirement. For banks in need of reserve funds, the overnight or short-term bank loan market is available.

Banks can seek to borrow from other banks holding funds at the Fed. The rate that Fed member banks charge one another is referred to as the Federal Funds rate, or Fed Funds rate for short (rate for funds held at the Fed). The rate is indirectly influenced and targeted by the Fed via a direct channel of open market operations and is communicated to the public as a Fed Funds target range as a standard part of the Fed Open Market Committee communications. It is important to note that the Fed does not set the fed funds target rate, it only issues a range that it targets through active management of the money supply.

Using its open market channel, the Fed buys government bonds to increase the money supply and sells the same bonds to reduce it. Adding to the money supply will typically lead to lower interest rates, while reducing the money supply will increase interest rates. The Fed actively adjusts the buying and selling of bonds to achieve the target interest rate. This in turn impacts the rate that Fed member banks are willing to charge each other for overnight loans, or the Fed Funds rate. The fed funds rate will be within the range of the target; if not the Fed will adjust its open market operations (buying and selling of bonds) to achieve the range.

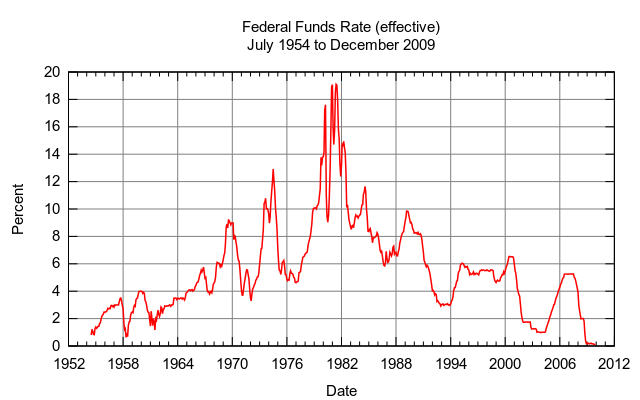

Historical effective federal funds target rate: The graphic depicts the movement in the effective federal funds target rate. The target rate has historically been set in terms of a range; the current range as depicted in the graph is 0.00 to 0.25 percent.

Executing Expansionary Monetary Policy

Central banks initiate expansionary policy during periods of economic slowing, increasing the money supply and reducing interest rates.

learning objectives

- Explain common expansionary monetary policy tools

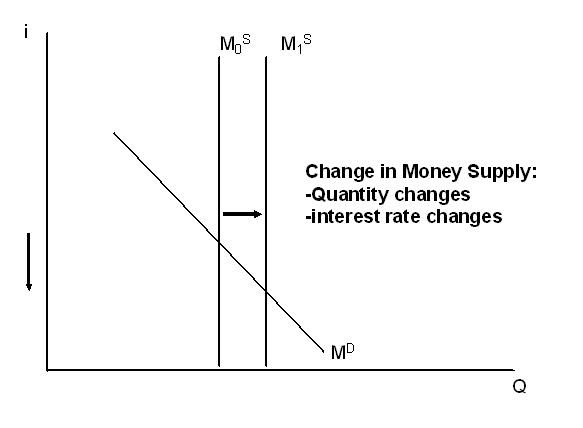

Monetary policy is based on the relationship between money supply and interest rates, where the interest rate is essentially the price of money. The two variables have an inverse relationship. As a result, as the money supply in an economy is increased, the interest rate will generally decrease and if the money supply is contracted, interest rates will generally increase.

Relationship between money supply and interest rates: As money supply increases, the interest rate decreases, as depicted in the graph above.

The money supply is a monetary policy mechanism available to a central bank as part of its mandate to promote economic growth and maintain full employment. Central banks use monetary policy to stabilize the economy; during periods of economic slowing central banks initiate expansionary policy, whereby the bank increases the money supply in order to lower prevailing interest rates. As the cost of money falls the demand for funds increases, thereby expanding consumer and investment spending and promoting economic growth.

Expansionary policy

An active expansionary policy increases the size of the money supply, decreasing the interest rate. Central banks can increase the money supply through open market operations and changes in the reserve requirement.

Bank reserves

Banks and other depository institutions are required to keep a certain amount of funds in reserve in order to maintain enough liquidity to meet unexpected demand for deposits. Banks can keep these reserves as cash in their vaults or as deposits with the Federal Reserve (the Fed). By adjusting the reserve requirement, the Fed can effectively change the availability of loanable funds.

In an expansionary policy regime, the Fed would reduce the reserve requirement. Banks would be able to issue more loans with the same reserves, thereby increasing the supply of money and the level of economic activity and investment.

Federal Funds market

From day to day, the amount of reserves a bank wants to hold may change as its deposits and transactions change. When a bank needs additional reserves on a short-term basis, it can borrow them from other banks that happen to have more reserves than they need. These loans take place in a private financial market called the federal funds market.

The interest rate on the overnight borrowing of reserves is called the Federal Funds rate or simply the ” fed funds rate.” It adjusts to balance the supply of and demand for reserves. For example, if the supply of reserves in the fed funds market is greater than the demand, then the funds rate falls, and if the supply of reserves is less than the demand, the funds rate rises.

At a lower fed funds rate, banks are more likely to increase loans, thereby expanding investment activity (in factories, for example, not financial instruments) and promoting economic growth.

Expansionary monetary policy will seek to reduce the fed funds target rate (a range). The Fed does not control this rate directly but does control the interest rate indirectly through open market operations.

Open market operations

The major tool the Fed uses to affect the supply of reserves in the banking system is open market operations—that is, the Fed buys and sells government securities on the open market. These operations are conducted by the Federal Reserve Bank of New York.

In an expansionary policy regime, the Fed purchases government securities from a bank in exchange for cash. Payment for the bonds increases the bank’s reserves. As a result, the bank may have more reserves than required. The bank can lend these unneeded reserves to another bank in the federal funds market. Thus, the Fed’s open market purchase increased the supply of reserves (money) to the banking system, and the federal funds rate (interest rate) falls.

Executing Restrictive Monetary Policy

The central bank may initiate a contractionary or restrictive monetary policy to slow growth.

learning objectives

- Explain common restrictive monetary policy tools

Monetary policy is based on the relationship between money supply and interest rates, where the interest rate is the price of money. The interest rate, therefore, has an inverse relationship with the money supply. As a result, as the money supply in an economy is decreased, the interest rate is assumed to increase and if the money supply is increased, interest rates are typically assumed to decrease.

Contractionary monetary policy: Contractionary monetary policy results in a reduction in the money supply, depicted as a leftward shift, which results in an increase in interest rates as well as a decrease in the quantity of loanable funds.

The money supply is a monetary policy mechanism available to a central bank as part of its initiatives to promote economic growth and maintain full employment. Central banks use monetary policy to stabilize the economy; during periods of economic slowing central banks initiate expansionary policy, whereby the bank increases the money supply in order to lower prevailing interest rates. As the cost of money falls, economic theory assumes that the demand for funds will increase, thereby expanding consumer and investment spending and promoting economic growth. During periods where the economy is showing signs of growing too quickly or operating above full employment, the central bank may initiate a contractionary or restrictive monetary policy by reducing the money supply and allowing interest rates to increase and economic growth to slow.

Restrictive policy

An active contractionary policy restricts the size of the money supply, increasing the interest rate. Central banks can decrease the money supply through open market operations and changes in the reserve requirement.

Bank reserves

Banks and other depository institutions keep a certain amount of funds in reserve to meet unexpected outflows. Banks can keep these reserves as cash in their vaults or as deposits with the Fed. By adjusting the reserve requirement, the Fed can effectively change the availability of loanable funds.

In a contractionary policy regime, the Fed would increase the reserve requirement, thereby effectively restricting the funds that banks have available for loans.

Federal funds market

From day to day, the amount of reserves a bank wants to hold may change as its deposits and transactions change. When a bank needs additional reserves on a short-term basis, it can borrow them from other banks that happen to have more reserves than they need. These loans take place in a private financial market called the federal funds market.

The interest rate on the overnight borrowing of reserves is called the federal funds rate or simply the “funds rate.” It adjusts to balance the supply of and demand for reserves. For example, if the supply of reserves in the fed funds market is lower than the demand, then the funds rate increases.

At higher fed funds rates, banks are more likely to limit borrowing and their provision of loanable funds, thereby decreasing access to loanable funds and reducing economic growth.

Restrictive monetary policy will seek to increase the fed funds target rate. The Fed does not control this rate directly but does control the interest rate indirectly through open market operations.

Open market operations

The major tool the Fed uses to affect the supply of reserves in the banking system is open market operations—that is, the Fed buys and sells government securities on the open market. These operations are conducted by the Federal Reserve Bank of New York.

In a contractionary policy regime, the Fed sells government securities from a bank in exchange for cash. Payment for the bonds decreases the bank’s reserves, reducing the supply of funds that the bank has for loans. The Fed’s open market purchase decreases the supply of reserves (money) to the banking system, and the federal funds rate (interest rate) increases. In net, this reduces the financial resources available to stimulate growth and leads to a contraction in the economy.

The Taylor Rule

Taylor’s rule was designed to provide monetary policy guidance for how a central bank should set short-term interest rates.

learning objectives

- Explain the Taylor Rule and its use by central banks

The Taylor rule is a formula developed by Stanford economist John Taylor. It was designed to provide monetary policy guidance for the Federal Reserve. The formula suggests short-term interest rates depending on changing economic conditions, in order to keep the economy stable in the short term, and minimize inflation over the long term.

Professor John Taylor: Stanford University Professor John Taylor is the creator of the Taylor Rule, a monetary policy instrument developed to promote stable economic growth and limit short-run economic disruption related to inflation.

The rule stipulates how much a central bank should change the nominal interest rate (real rate plus inflation) in response to changes in inflation, output, or other economic conditions. In particular, the rule stipulates that for each one-percent increase in inflation, the central bank should raise the nominal interest rate by more than one percentage point.

The factors that the Taylor rule suggests taking into account when setting inflation-adjusted short-term interest rates are:

- the level of actual inflation relative to the target,

- how far economic activity is above or below its “full employment” level, and

- what the level of the short-term interest rate is that would be consistent with full employment.

The Taylor rule advocates setting interest rates relatively high (contractionary policy) when inflation is high or when the employment rate exceeds the economy’s full employment level. Expansionary policies with low interest rates are recommended by the Taylor rule in times when the economy is slow (i.e. unemployment is high, or inflation is low).

The Taylor rule doesn’t always provide an easy answer. For example, in times of stagflation, inflation may be high while unemployment is also high. However, the Taylor rule can still provide a handy “rule of thumb” to policy makers on how to balance these conflicting issues when setting the interest rates.

The Taylor rule fairly accurately demonstrates how monetary policy has been conducted under recent leaders of the Federal Reserve, such as Volker and Greenspan. However, the Federal Reserve does not follow the Taylor rule as an explicit policy.

Key Points

- The required reserve ratio is a tool in monetary policy, given that changes in the reserve ratio directly impacts the amount of loanable funds available.

- Money growth in the economy can occur through the multiplier effect resulting from the reserve ratio.

- The higher the reserve requirement is set, the less the amount of funds banks will have to loan out, leading to lower money creation. Alternatively, the higher the reserve requirement the, lower the supply of loanable funds, the higher the interest rate and the slower the resulting economic growth.

- The Fed targets the rate for federal funds via its open market operations.

- The Fed seeks to be the lender of last resort by charging banks a higher rate than the federal funds rate.

- The discount rate difference over the fed funds rate can be varied by the Fed based on bank liquidity needs.

- Banks may borrow reserves from one another overnight in order to maintain their required reserve ratio. The rate of interest negotiated between banks for these loans is the Federal Funds rate.

- The Federal Funds rate is directly related to the interest rate paid by firms and individuals. If a bank can borrow reserves cheaply, it can afford to offer loans to the public at lower rates. Thus, a high Federal Funds rate is contractionary, while a low federal funds rate is expansionary.

- The Federal Reserve doesn’t control the Federal Funds rate directly, but it does set a target interest rate and uses open market operations in order to achieve that rate.

- The Fed doesn’t control the federal funds rate directly, but it does set a target interest rate and uses open market operations in order to achieve that rate.

- In the United States, the Federal Reserve Bank of New York uses open market operations to implement monetary policy.

- This occurs under the oversight of the Federal Reserve Open Market Committee (FOMC).

- The short-term objective for open market operations is specified by the FOMC and is publicly communicated following the FOMC meeting.

- Historically, the Federal Reserve has used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate–the interest rate at which depository institutions lend reserve balances to other depository institutions overnight–around the target established by the FOMC.

- Though the Fed can directly influence the money supply through open market operations, the majority of the Fed’s activities seek to target interest rates, the outcome of changes in money supply.

- Using its open market channel, the Fed buys government bonds to increase the money supply and sells the same bonds to reduce it.

- The Fed actively adjusts the buying and selling of bonds to achieve the target interest rate. This in turn impacts the rate that Fed member banks are willing to charge each other for overnight loans, or the fed funds rate.

- In an expansionary policy regime, the Fed would reduce the reserve requirement, thereby effectively increasing the amount of loans that a bank can issue.

- Expansionary monetary policy will seek to reduce the fed funds target rate (a range).

- In an expansionary policy regime, the Fed purchases government securities via open market operations from a bank in exchange for cash; the Fed’s purchase increases the supply of reserves (money) to the banking system, and the federal funds rate ( interest rate ) falls.

- In a contractionary policy regime, the Fed may increase the reserve requirement, thereby effectively restricting the funds that banks have available for loans.

- Restrictive monetary policy will seek to increase the fed funds rate, which is the interest banks charge on loans to other banks.

- In a contractionary policy regime, the Fed uses open market operations to sell government securities from a bank in exchange for cash and thereby reduce the money supply and increase interest rates.

- The rule states that the real short-term interest rate (that is, the interest rate adjusted for inflation ) should be determined according to three factors.

- The rule recommends a relatively high interest rate (contractionary monetary policy ) when inflation is above its target or when the economy is above its full employment level.

- The rule recommends a relatively low interest rate (expansionary monetary policy) when inflation is below its target or when the economy is below its full employment level.

Key Terms

- monetary policy: The process by which the central bank, or monetary authority manages the supply of money, or trading in foreign exchange markets.

- money supply: The total amount of money (bills, coins, loans, credit, and other liquid instruments) in a particular economy.

- loanable funds: Money available to be issued as debt.

- open market operations: An activity by a central bank to buy or sell government bonds on the open market. A central bank uses them as the primary means of implementing monetary policy.

- discount rate: An interest rate that a central bank charges to depository institutions that borrow reserves from it.

- fed funds rate: Short for Federal Funds rate. The interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis.

- reserve: Banks’ holdings of deposits in accounts with their central bank.

- federal funds rate: The interest rate at which depository institutions actively trade balances held at the Federal Reserve with each other.

- fed funds target rate: The interest rate at which depository institutions actively trade balances held at the Federal Reserve, called federal funds, with each other, usually overnight, on an uncollateralized basis.

- open market operations: An activity by a central bank to buy or sell government bonds on the open market. A central bank uses them as the primary means of implementing monetary policy.

- reserve ratio: A central bank regulation employed by most, but not all, of the world’s central banks, that sets the minimum fraction of customer deposits and notes that each commercial bank must hold as reserves (rather than lend out).

- reserve requirement: The minimum amount of deposits each commercial bank must hold (rather than lend out).

- full employment: A state when an economy has no cyclical or deficient-demand unemployment.

- Taylor Rule: A way of determining the appropriate change in interest rates for a given change in inflation.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- money supply. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/money_supply. License: CC BY-SA: Attribution-ShareAlike

- Reserve requirement. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Reserve_requirement. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...loanable-funds. License: CC BY-SA: Attribution-ShareAlike

- monetary policy. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/monetary_policy. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- discount rate. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/discount_rate. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: CC BY-SA: Attribution-ShareAlike

- Bank rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Bank_rate. License: CC BY-SA: Attribution-ShareAlike

- open market operations. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/open%20...t%20operations. License: CC BY-SA: Attribution-ShareAlike

- fed funds rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fed%20funds%20rate. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: Public Domain: No Known Copyright

- Federal funds rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Federal_funds_rate. License: CC BY-SA: Attribution-ShareAlike

- reserve. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/reserve. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...ral-funds-rate. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: Public Domain: No Known Copyright

- Federal Funds Rate 1954 thru 2009 effective. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fe..._effective.svg. License: CC BY-SA: Attribution-ShareAlike

- FRB: Open Market Operations. Provided by: U.S. Federal Reserve System. Located at: http://www.federalreserve.gov/moneta...openmarket.htm. License: Public Domain: No Known Copyright

- fed funds target rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fed%20f...0target%20rate. License: CC BY-SA: Attribution-ShareAlike

- open market operations. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/open%20...t%20operations. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: Public Domain: No Known Copyright

- Federal Funds Rate 1954 thru 2009 effective. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fe..._effective.svg. License: CC BY-SA: Attribution-ShareAlike

- US Treasury bills and bonds yield. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...onds_yield.png. License: CC BY: Attribution

- Federal funds rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Federal_funds_rate. License: CC BY-SA: Attribution-ShareAlike

- reserve ratio. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/reserve%20ratio. License: CC BY-SA: Attribution-ShareAlike

- open market operations. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/open%20...t%20operations. License: CC BY-SA: Attribution-ShareAlike

- fed funds rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fed%20funds%20rate. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: Public Domain: No Known Copyright

- Federal Funds Rate 1954 thru 2009 effective. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fe..._effective.svg. License: CC BY-SA: Attribution-ShareAlike

- US Treasury bills and bonds yield. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...onds_yield.png. License: CC BY: Attribution

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ective.svg.png. License: CC BY: Attribution

- Monetary policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Monetary_policy. License: CC BY-SA: Attribution-ShareAlike

- Reserve requirement. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Reserve_requirement. License: CC BY-SA: Attribution-ShareAlike

- Open market operation. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Open_market_operation. License: CC BY-SA: Attribution-ShareAlike

- Federal funds. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Federal_funds. License: CC BY-SA: Attribution-ShareAlike

- Federal funds rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Federal_funds_rate. License: CC BY-SA: Attribution-ShareAlike

- reserve requirement. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/reserve%20requirement. License: CC BY-SA: Attribution-ShareAlike

- open market operations. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/open%20...t%20operations. License: CC BY-SA: Attribution-ShareAlike

- fed funds rate. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fed%20funds%20rate. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: Public Domain: No Known Copyright

- Federal Funds Rate 1954 thru 2009 effective. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fe..._effective.svg. License: CC BY-SA: Attribution-ShareAlike

- US Treasury bills and bonds yield. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...onds_yield.png. License: CC BY: Attribution

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ective.svg.png. License: CC BY: Attribution

- Boundless. Provided by: Boundless Learning. Located at: https://figures.boundless.com/332/la...ey-supply.jpeg. License: CC BY-SA: Attribution-ShareAlike

- Monetary policy. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Monetary_policy. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...ull-employment. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: Public Domain: No Known Copyright

- Federal Funds Rate 1954 thru 2009 effective. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fe..._effective.svg. License: CC BY-SA: Attribution-ShareAlike

- US Treasury bills and bonds yield. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...onds_yield.png. License: CC BY: Attribution

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ective.svg.png. License: CC BY: Attribution

- Boundless. Provided by: Boundless Learning. Located at: https://figures.boundless.com/332/la...ey-supply.jpeg. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikispaces. Located at: moeller.wikispaces.com/file/v...431/graph2.GIF. License: CC BY-SA: Attribution-ShareAlike

- Taylor rule. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Taylor_rule. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...on/taylor-rule. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Discount window. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Discount_window. License: Public Domain: No Known Copyright

- Federal Funds Rate 1954 thru 2009 effective. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Fe..._effective.svg. License: CC BY-SA: Attribution-ShareAlike

- US Treasury bills and bonds yield. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...onds_yield.png. License: CC BY: Attribution

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ective.svg.png. License: CC BY: Attribution

- Boundless. Provided by: Boundless Learning. Located at: https://figures.boundless.com/332/la...ey-supply.jpeg. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikispaces. Located at: moeller.wikispaces.com/file/v...431/graph2.GIF. License: CC BY-SA: Attribution-ShareAlike

- Provided by: Wikimedia. Located at: upload.wikimedia.org/wikipedi...ohnBTaylor.jpg. License: CC BY: Attribution