12.3: Flexible exchange rates and fixed exchange rates

- Page ID

- 45811

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)Floating or flexible rates

Fixed exchange rates

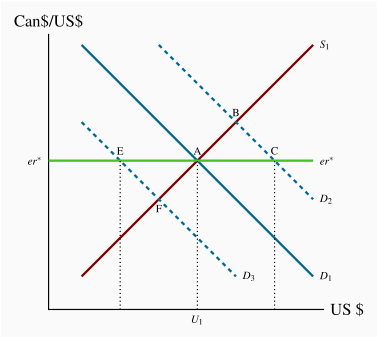

a shift in demand for US$ to D2 creates excess demand AC. The central bank intervenes, supplying AC US$ from official reserve holdings in exchange for Can$. To maintain

a shift in demand for US$ to D2 creates excess demand AC. The central bank intervenes, supplying AC US$ from official reserve holdings in exchange for Can$. To maintain  if demand shifted to D3 would create the opposite condition and central bank would have to buy US$.

if demand shifted to D3 would create the opposite condition and central bank would have to buy US$.

$0.925US) and the Bank of Canada intervened in the foreign exchange market to maintain that rate.

$0.925US) and the Bank of Canada intervened in the foreign exchange market to maintain that rate. . There would be a free market equilibrium at A if the supply curve for US dollars is S1 and the demand curve for US dollars is D1. The central bank does not need to buy or sell US dollars. The market is in equilibrium and clears by itself at the fixed rate.

. There would be a free market equilibrium at A if the supply curve for US dollars is S1 and the demand curve for US dollars is D1. The central bank does not need to buy or sell US dollars. The market is in equilibrium and clears by itself at the fixed rate. there is an excess demand for US dollars equal to AC. To peg

there is an excess demand for US dollars equal to AC. To peg AC), which reduces the monetary base by that amount, just like an open market sale of government bonds. The lower monetary base pushes domestic interest rates up and attracts a larger net capital inflow. Higher interest rates also reduce domestic expenditure and the demand for imports and for foreign exchange. The exchange rate target drives the Bank's monetary policy, which in turn changes both international capital flows and domestic income and expenditure.

AC), which reduces the monetary base by that amount, just like an open market sale of government bonds. The lower monetary base pushes domestic interest rates up and attracts a larger net capital inflow. Higher interest rates also reduce domestic expenditure and the demand for imports and for foreign exchange. The exchange rate target drives the Bank's monetary policy, which in turn changes both international capital flows and domestic income and expenditure. there is an excess supply of US dollars EA. To defend the peg, the Bank of Canada would have to buy EA US dollars, reducing the supply of US dollars on the market to meet the "unofficial" demand. The Bank of Canada would have to buy EA US dollars, reducing the supply of US dollars on the market to meet the "unofficial" demand. The Bank of Canada's purchase would be added to foreign exchange reserves. The Bank would pay for these US dollars by creating more monetary base, as in the case of an open market purchase of government securities. In either case, maintaining a fixed exchange rate requires

there is an excess supply of US dollars EA. To defend the peg, the Bank of Canada would have to buy EA US dollars, reducing the supply of US dollars on the market to meet the "unofficial" demand. The Bank of Canada would have to buy EA US dollars, reducing the supply of US dollars on the market to meet the "unofficial" demand. The Bank of Canada's purchase would be added to foreign exchange reserves. The Bank would pay for these US dollars by creating more monetary base, as in the case of an open market purchase of government securities. In either case, maintaining a fixed exchange rate requires  , and the monetary base is falling as well. In this case, the Canadian dollar is overvalued at

, and the monetary base is falling as well. In this case, the Canadian dollar is overvalued at  ; or, in other words,

; or, in other words,  is too low a price for the US dollar. A higher er is required for long-run equilibrium in the foreign exchange market and the balance of payments. As reserves start to run out, the government may try to borrow foreign exchange reserves from other countries and the International Monetary Fund (IMF), an international body that exists primarily to lend to countries in short-term difficulties.

is too low a price for the US dollar. A higher er is required for long-run equilibrium in the foreign exchange market and the balance of payments. As reserves start to run out, the government may try to borrow foreign exchange reserves from other countries and the International Monetary Fund (IMF), an international body that exists primarily to lend to countries in short-term difficulties.