Money is any object that is generally accepted as payment for goods and services and the repayment of debt.

learning objectives

- Distinguish between the three main functions of money: a medium of exchange, a unit of account, and a store of value

Money is any object that is generally accepted as payment for goods and services and repayment of debts in a given socioeconomic context or country. Money comes in three forms: commodity money, fiat money, and fiduciary money.

Many items have been historically used as commodity money, including naturally scarce precious metals, conch shells, barley beads, and other things that were considered to have value. The value of commodity money comes from the commodity out of which it is made. The commodity itself constitutes the money, and the money is the commodity.

Commodity Money: Conch shells have been used as commodity money in the past. The value of commodity money is derived from the commodity out of which it is made. (CC BY-SA 3.0; ChildofMidnight.

Fiat money is money whose value is not derived from any intrinsic value or guarantee that it can be converted into a valuable commodity (such as gold). Instead, it has value only by government order (fiat). Usually, the government declares the fiat currency to be legal tender, making it unlawful to not accept the fiat currency as a means of repayment for all debts. Paper money is an example of fiat money.

Fiduciary money includes demand deposits (such as checking accounts) of banks. Fiduciary money is accepted on the basis of the trust its issuer (the bank) commands.

Most modern monetary systems are based on fiat money. However, for most of history, almost all money was commodity money, such as gold and silver coins.

Functions of Money

Money has three primary functions. It is a medium of exchange, a unit of account, and a store of value:

- Medium of Exchange: When money is used to intermediate the exchange of goods and services, it is performing a function as a medium of exchange.

- Unit of Account: It is a standard numerical unit of measurement of market value of goods, services, and other transactions. It is a standard of relative worth and deferred payment, and as such is a necessary prerequisite for the formulation of commercial agreements that involve debt. To function as a unit of account, money must be divisible into smaller units without loss of value, fungible (one unit or piece must be perceived as equivalent to any other), and a specific weight or size to be verifiably countable.

- Store of Value: To act as a store of value, money must be reliably saved, stored, and retrieved. It must be predictably usable as a medium of exchange when it is retrieved. Additionally, the value of money must remain stable over time.

Economists sometimes note additional functions of money, such as that of a standard of deferred payment and that of a measure of value. A “standard of deferred payment” is an acceptable way to settle a debt–a unit in which debts are denominated. The status of money as legal tender means that money can be used for the discharge of debts. Money can also act a as a standard measure and common denomination of trade. It is thus a basis for quoting and bargaining prices. Its most important usage is as a method for comparing the values of dissimilar objects.

The Functions of Money

The monetary economy is a significant improvement over the barter system, in which goods were exchanged directly for other goods.

learning objectives

- Analyze how the characteristics of money make it an effective medium of exchange

Barter is a system of exchange in which goods or services are directly exchanged for other goods or services without using a medium of exchange, such as money. The reciprocal exchange is immediate and not delayed in time. It is usually bilateral, though it can be multilateral, and usually exists parallel to monetary systems in most developed countries, though to a very limited extent. The barter system has a number of limitations which make transactions very inefficient, including:

Barter: In a barter system, individuals possessing something of value could exchange it for something else of similar or greater value.

- Double coincidence of wants: The needs of a seller of a commodity must match the needs of a buyer. If they do not, the transaction will not occur.

- Absence of common measure of value: In a monetary economy, money plays the role of a measure of value of all goods, making it possible to measure the values of goods against each other. This is not possible in a barter economy.

- Indivisibility of certain goods: If a person wants to buy a certain amount of another’s goods, but only has payment of one indivisible good which is worth more than what the person wants to obtain, a barter transaction cannot occur.

- Difficulty of deferred payments: It is impossible to make payments in installments and difficult to make payments at a later point in time.

- Difficulty storing wealth: If society relies exclusively on perishable goods, storing wealth for the future may be impractical.

Despite the long list of limitations, the barter system has some advantages. It can replace money as the method of exchange in times of monetary crisis, such as when a the currency is either unstable (e.g. hyperinflation or deflationary spiral) or simply unavailable for conducting commerce. It can also be useful when there is little information about the credit worthiness of trade partners or when there is a lack of trust.

The money system is a significant improvement over the barter system. It provides a way to quantify the value of goods and communicate it to others. Money has several defining characteristics. It is:

- Durable.

- Divisible.

- Portable.

- Liquid.

- A unit of account.

- Legal tender.

- Resistant to counterfeiting.

Money serves four primary purposes. It is:

- A medium of exchange: an object that is generally accepted as a form of payment.

- A unit of account: a means of keeping track of how much something is worth.

- A store of value: it can be held and exchanged later for goods and services at an approximate value.

- A standard of deferred payments (this is not considered a defining purpose of money by all economists).

The use of money as a medium of exchange has removed the major difficulty of double coincidence of wants in the barter system. It separates the act of sale and purchase of goods and services and helps both parties in obtaining maximum satisfaction and profits independently.

Measuring the Money Supply: M1

M1 captures the most liquid components of the money supply, including currency held by the public and checkable deposits in banks.

The Federal Reserve measures the money supply using three main monetary aggregates: M1, M2, and M3.

M1 is the narrowest measure of the money supply, including only money that can be spent directly. More specifically, M1 includes currency and all checkable deposits. Currency refers to the coins and paper money in the hands of the public. Checkable deposits refer to all spendable deposits in commercial banks and thrifts.

M1: The M1 measure includes currency in the hands of the public and checkable deposits in commercial banks.

A broader measure of money than M1 includes not only all of the spendable balances in M1, but certain additional assets termed “near monies”. Near monies cannot be spent as readily as currency or checking account money, but they can be turned into spendable balances with very little effort or cost. Near monies include what is in savings accounts and money-market mutual funds. The broader category of money that embraces all of these assets is called M2. M3 encompassed M2 plus relatively less liquid near monies. In practice, the measure of M3 is no longer used by the Federal Reserve.

Imagine that Laura deposits $900 in her checking account in a world with no other money (M1=$900). The bank sets 10% of the amount aside for required reserves, while the remaining $810 can be lent out by the bank as credit. The M1 money supply increases by $810 when the loan is made (M1=$1,710). In the meantime, Laura writes a check for $400. The total M1 money supply didn’t change; it includes the $400 check and the $500 left in the checking account (M1=$1,710). Laura’s check is accidentally destroyed in the laundry. M1 and her checking account do not change, because the check is never cashed (M1=$1,710). Meanwhile, the bank lends Mandy the $810 credit that it has created. Mandy deposits the money in a checking account at another bank. The bank must keep 10% as reserves and has $729 available for loans. This creates promise-to-pay money from a previous promise-to-pay, inflating the M1 money supply (M1=$2,439). Mandy’s bank now lends the money to someone else who deposits it in a checking account at another bank, and the process repeats itself.

Measuring the Money Supply: M2

M2 is a broader measure of the money supply than M1, including all M1 monies and those that could be quickly converted to liquid forms.

There is no single “correct” measure of the money supply. Instead there are several measures, classified along a continuum between narrow and broad monetary aggregates. Narrow measures include only the most liquid assets, the ones most easily used to spend (for example, currency and checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.). The continuum corresponds to the way that different types of money are more or less controlled by monetary policy. Narrow measures include those more directly affected and controlled by monetary policy, whereas broader measures are less closely related to monetary policy actions.

The different types of money are typically classified as “M”s. Around the world, they range from M0 (the narrowest) to M3 (broadest), but which of the measures is actually the focus of policy formulation depends on a country’s central bank.

M2 is one of the aggregates by which the Federal Reserve measures the money supply. It is a broader classification of money than M1 and a key economic indicator used to forecast inflation. M2 consists of all the liquid components of M1 plus near-monies. Near monies are relatively liquid financial assets that may be readily converted into M1 money. More specifically, near monies include savings deposits, small time deposits (less than $100,000) that become readily available at maturity, and money market mutual funds.

Federal Reserve: Historically, the Federal Reserve has measured the money supply using the aggregates of M1, M2, and M3. The M2 aggregate includes M1 plus near-monies.

Imagine that Laura writes a check for $1,000 and brings it to the bank to start a money market account. This would cause M1 to decrease by $1,000, but M2 to stay the same. This is because M2 includes the money market account in addition to all the money counted in M1.

Other Measurements of the Money Supply

In addition to the commonly used M1 and M2 aggregates, several other measures of the money supply are used as well.

learning objectives

- Explain how the money supply is measured

In addition to the commonly used M1 and M2 aggregates, there are several other measurements of the money supply that are used as well. More specifically:

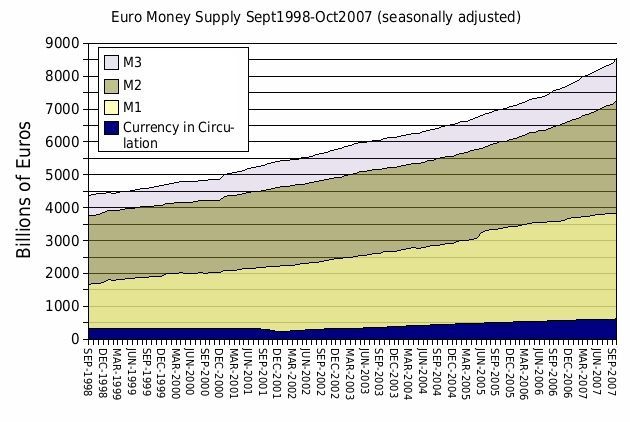

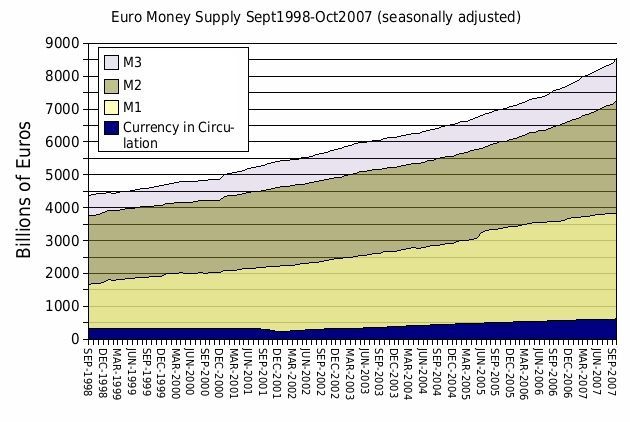

Euro Money Supply: The measures of the money supply are all related, but the use of different measures may lead economists to different conclusions.

- M0: The total of all physical currency including coinage. M0 = Federal Reserve Notes + US Notes + Coins.

- MB: Stands for “monetary base,” referring to the base from which all other forms of money are created. MB is the total of all physical currency plus Federal Reserve Deposits (special deposits that only banks can have at the Fed). MB = Coins + US Notes + Federal Reserve Notes + Federal Reserve Deposits.

- M1: The total amount of M0 (cash/coin) outside of the private banking system plus the amount of demand deposits, travelers checks and other checkable deposits.

- M2: M1 + most savings accounts, money market accounts, retail money market mutual funds, and small denomination time deposits (certificates of deposit of under $100,000).

- M3: M2 + all other certificates of deposit (large time deposits, institutional money market mutual fund balances), deposits of eurodollars and repurchase agreements.

- M4-: M3 + commercial paper.

- M4: M4- + treasury bills (or M3 + commercial paper + T-bills)

- MZM: “Money Zero Maturity” is one of the most popular aggregates in use by the Fed because its velocity has historically been the most accurate predictor of inflation. It is M2 – time deposits + money market funds.

- L: The broadest measure of liquidity that the Federal Reserve no longer tracks. M4 + Bankers’ Acceptance.

The different forms of money in the government money supply statistics arise from the practice of fractional-reserve banking. Fractional-reserve banking is the practice whereby a bank retains only a portion of its customers’ deposits as readily available reserves from which to satisfy demands for withdrawals. Whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created. This new type of money is what makes up the non-M0 components in the M1-M3 statistics.

Key Points

- Money comes in three forms: commodity money, fiat money, and fiduciary money. Most modern monetary systems are based on fiat money.

- Commodity money derives its value from the commodity of which it is made, while fiat money has value only by the order of the government.

- Money functions as a medium of exchange, a unit of account, and a store of value

- The barter system has a number of limitations, including the double coincidence of wants, the absence of a common measure of value, indivisibility of certain goods, difficulty of deferred payments, and difficulty of storing wealth.

- Despite the numerous limitations, the barter system works well when currency is unstable or unavailable for conducting commerce.

- Money is durable, divisible, portable, liquid, and resistant to counterfeiting.

- Money serves as a medium of exchange, a unit of account, a store of value, and a standard of deferred payment.

- The Federal Reserve measures the money supply using three monetary aggregates: M1, M2, and M3.

- M1 is the narrowest measure of the money supply, including only money that can be spent directly.

- M2 is a broader measure, encompassing M1 and near monies.

- M3 includes M2 plus relatively less liquid near monies. However, this measure is no longer used in practice.

- M0 is a measure of all the physical currency and coinage in circulation in an economy.

- MB is a measure that captures all physical currency, coinage, and Federal Reserve deposits (special deposits that only banks can have at the Fed).

- The different forms of money in the government money supply statistics arise from the practice of fractional-reserve banking. Whenever a bank gives out a loan in a fractional-reserve banking system, a new sum of money is created, which makes up the non-M0 components in the M1 -M3 statistics.

Key Terms

- Fiat money: Money that is given value because those who use it believe it has value; the value is not derived from any inherent characteristic.

- barter: An exchange goods or services without involving money.

- M1: The amount of cash in circulation plus the amount in bank checking accounts.

- M0: The amount of coin and banknotes in circulation.

- MB: The portion of the commercial banks’ reserves that is maintained in accounts with their central bank plus the total currency circulating in the public.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- Money. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money. License: CC BY-SA: Attribution-ShareAlike

- Money. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money. License: CC BY-SA: Attribution-ShareAlike

- Money. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money. License: CC BY-SA: Attribution-ShareAlike

- 8 ( Money: Banking).docx. Provided by: economicsforyou Wikispace. Located at: http://economicsforyou.wikispaces.co...+Banking).docx. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/...ion/fiat-money. License: CC BY-SA: Attribution-ShareAlike

- Conch shells. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...nch_shells.jpg. License: CC BY-SA: Attribution-ShareAlike

- Introduction to Economics. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Introd...nomics%23Money. License: CC BY-SA: Attribution-ShareAlike

- Principles of Economics/Money Supply. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Princi...Supply%23Money. License: CC BY-SA: Attribution-ShareAlike

- History of money. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/History_of_money. License: CC BY-SA: Attribution-ShareAlike

- Barter. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Barter. License: CC BY-SA: Attribution-ShareAlike

- home. Provided by: money-credit Wikispace. Located at: http://money-credit.wikispaces.com/. License: CC BY-SA: Attribution-ShareAlike

- Barter. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Barter. License: CC BY-SA: Attribution-ShareAlike

- barter. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/barter. License: CC BY-SA: Attribution-ShareAlike

- Conch shells. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...nch_shells.jpg. License: CC BY-SA: Attribution-ShareAlike

- Olaus Magnus - On Trade Without Using Money. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...sing_Money.jpg. License: Public Domain: No Known Copyright

- Money. Provided by: tradingdiary Wikispace. Located at: http://tradingdiary.wikispaces.com/Money. License: CC BY-SA: Attribution-ShareAlike

- Principles of Finance/Section 1/Chapter/Financial Markets and Institutions/Federal Reserve. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Princip...onetary_policy. License: CC BY-SA: Attribution-ShareAlike

- Money supply. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_supply. License: CC BY-SA: Attribution-ShareAlike

- Unit Four. Provided by: moeller Wikispace. Located at: http://moeller.wikispaces.com/Unit+Four. License: CC BY-SA: Attribution-ShareAlike

- M1. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/M1. License: CC BY-SA: Attribution-ShareAlike

- Conch shells. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...nch_shells.jpg. License: CC BY-SA: Attribution-ShareAlike

- Olaus Magnus - On Trade Without Using Money. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...sing_Money.jpg. License: Public Domain: No Known Copyright

- USCurrency Federal Reserve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...al_Reserve.jpg. License: Public Domain: No Known Copyright

- M2 (economics). Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/M2_(eco...rical_measures. License: CC BY-SA: Attribution-ShareAlike

- M2 (economics). Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/M2_(eco...rical_measures. License: CC BY-SA: Attribution-ShareAlike

- Unit Four. Provided by: moeller Wikispace. Located at: http://moeller.wikispaces.com/Unit+Four. License: CC BY-SA: Attribution-ShareAlike

- Money supply. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_supply. License: CC BY-SA: Attribution-ShareAlike

- M2. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/M2. License: CC BY-SA: Attribution-ShareAlike

- Conch shells. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...nch_shells.jpg. License: CC BY-SA: Attribution-ShareAlike

- Olaus Magnus - On Trade Without Using Money. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...sing_Money.jpg. License: Public Domain: No Known Copyright

- USCurrency Federal Reserve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...al_Reserve.jpg. License: Public Domain: No Known Copyright

- Federal Reserve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Money supply. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_supply. License: CC BY-SA: Attribution-ShareAlike

- Money supply. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_supply. License: CC BY-SA: Attribution-ShareAlike

- Money supply. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Money_supply. License: CC BY-SA: Attribution-ShareAlike

- Fractional reserve banking. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Fracti...eserve_banking. License: CC BY-SA: Attribution-ShareAlike

- M0. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/M0. License: CC BY-SA: Attribution-ShareAlike

- MB. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/MB. License: CC BY-SA: Attribution-ShareAlike

- Conch shells. Provided by: Wikimedia. Located at: https://commons.wikimedia.org/wiki/F...nch_shells.jpg. License: CC BY-SA: Attribution-ShareAlike

- Olaus Magnus - On Trade Without Using Money. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...sing_Money.jpg. License: Public Domain: No Known Copyright

- USCurrency Federal Reserve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...al_Reserve.jpg. License: Public Domain: No Known Copyright

- Federal Reserve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/F...al_Reserve.jpg. License: CC BY-SA: Attribution-ShareAlike

- Euro money supply Sept 1998 - Oct 2007. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Eu...-_Oct_2007.jpg. License: CC BY: Attribution