Why Governments Intervene In Markets

Governments intervene in markets when they inefficiently allocate resources.

Learning objectives

Identify reasons why the government might choose to intervene in markets

Governments intervene in markets to address inefficiency. In an optimally efficient market, resources are perfectly allocated to those that need them in the amounts they need. In inefficient markets that is not the case; some may have too much of a resource while others do not have enough. Inefficiency can take many different forms. The government tries to combat these inequities through regulation, taxation, and subsidies. Most governments have any combination of four different objectives when they intervene in the market.

Maximizing Social Welfare

In an unregulated inefficient market, cartels and other types of organizations can wield monopolistic power, raising entry costs and limiting the development of infrastructure. Without regulation, businesses can produce negative externalities without consequence. This all leads to diminished resources, stifled innovation, and minimized trade and its corresponding benefits. Government intervention through regulation can directly address these issues.

Another example of intervention to promote social welfare involves public goods. Certain depletable goods, like public parks, aren’t owned by an individual. This means that no price is assigned to the use of that good and everyone can use it. As a result, it is very easy for these assets to be depleted. Governments intervene to ensure those resources are not depleted.

Macro-Economic Factors

Governments also intervene to minimize the damage caused by naturally occurring economic events. Recessions and inflation are part of the natural business cycle but can have a devastating effect on citizens. In these cases, governments intervene through subsidies and manipulation of the money supply to minimize the harsh impact of economic forces on its constituents.

Socio-Economic Factors

Governments may also intervene in markets to promote general economic fairness. Government often try, through taxation and welfare programs, to reallocate financial resources from the wealthy to those that are most in need. Other examples of market intervention for socio-economic reasons include employment laws to protect certain segments of the population and the regulation of the manufacture of certain products to ensure the health and well-being of consumers.

Former President Bill Clinton signing welfare reform: Former President signing a welfare reform bill. Welfare programs are one way governments intervene in markets.

Other Objectives

Governments can sometimes intervene in markets to promote other goals, such as national unity and advancement. Most people agree that governments should provide a military for the protection of its citizens, and this can be seen as a type of intervention. Growing a large and impressive military not only increases a country’s security, but may also be a source of pride. Intervening in a way that promotes national unity and pride can be an extremely valuable goal for government officials.

Price Ceilings

A price ceiling is a price control that limits how high a price can be charged for a good or service.

Learning objectives

Define price ceilings

A price ceiling is a price control that limits the maximum price that can be charged for a product or service. Generally ceilings are set by governments, although groups that manage exchanges can set ceilings as well. The purpose of a price ceiling is to protect consumers of a certain good or service. By establishing a minimum price, a government wants to ensure the good is affordable for as many consumers as possible.

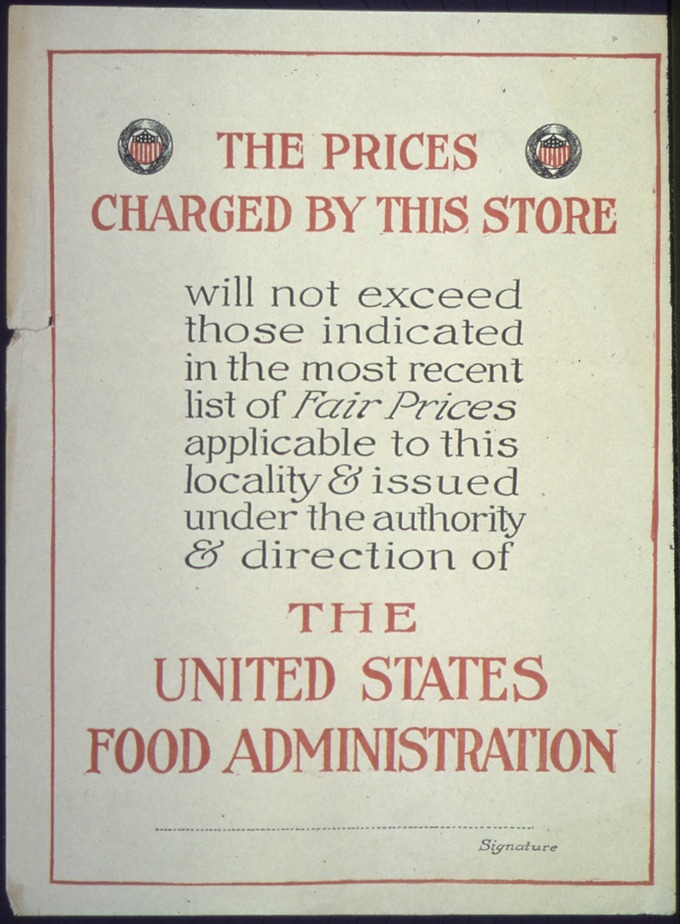

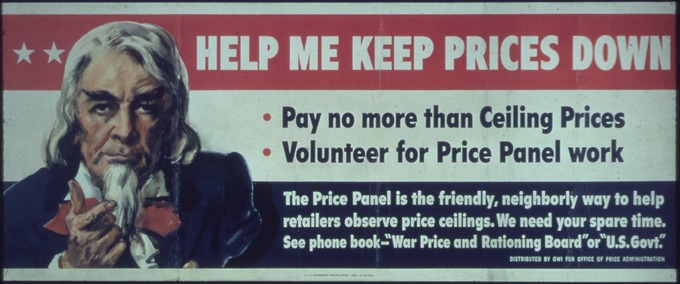

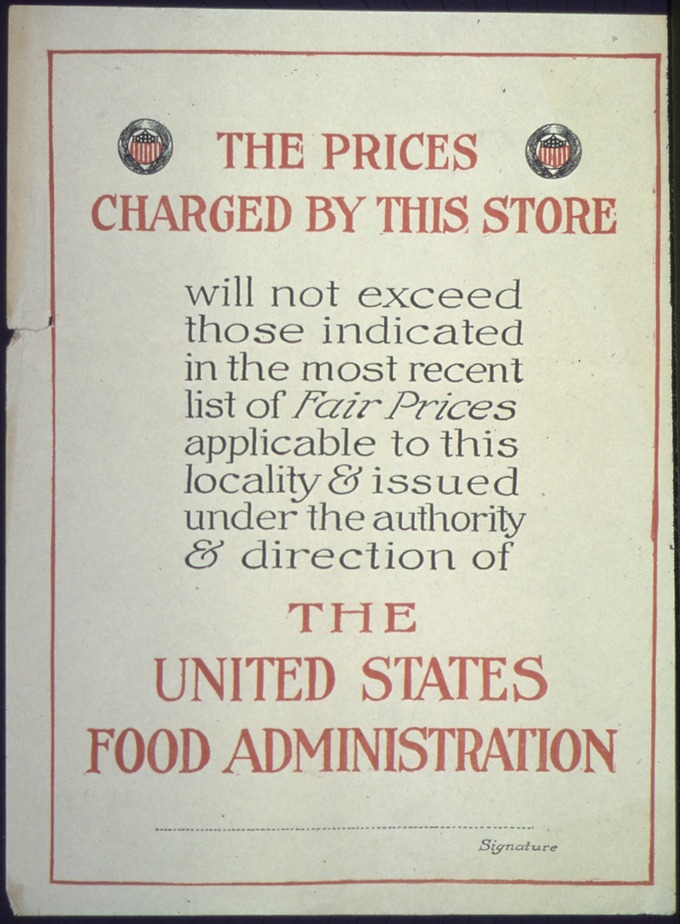

US Poster for Price Ceilings: Governments often impose price ceilings in times of war to ensure goods are available to as many people as possible.

An example of a price ceiling is rent control. These regulations require a more gradual increase in rent prices than what the market may demand. This regulation is meant to protect current tenants. Without rent control, there could be situations where the demand for housing in an area could cause rent prices to make a substantial jump. Unable to afford the new, significantly higher rent, a majority of the neighborhood’s tenants may be forced to move out of the neighborhood. Rent controls limit the possibility of tenant displacement by minimizing the amount by which rent can be increased.

By definition, however, price ceilings disrupt the market. By setting a maximum price, any market in which the equilibrium price is above the price ceiling is inefficient. There will be excess demand because the price cannot increase enough to clear the excess.

For a price ceiling to be effective, it must be less than the free-market equilibrium price. This is the price established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. It is also the price that the market will naturally set for a given good or service. If the price ceiling is higher than what the market would already charge, the regulation would not be effective. As a result, a government will do significant research into the current market conditions for a good before setting a price ceiling.

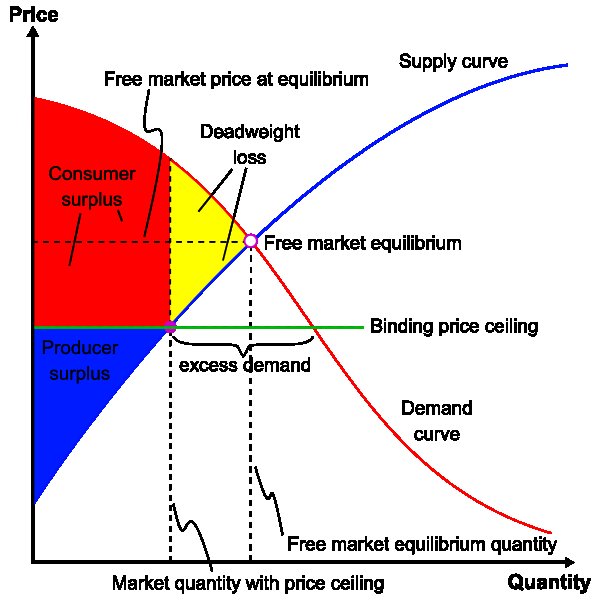

Price Ceiling Impact on Market Outcome

A binding price ceiling will create a surplus of supply and will lead to a decrease in economic surplus.

Learning objectives

Explain how price controls lead to economic inefficiency

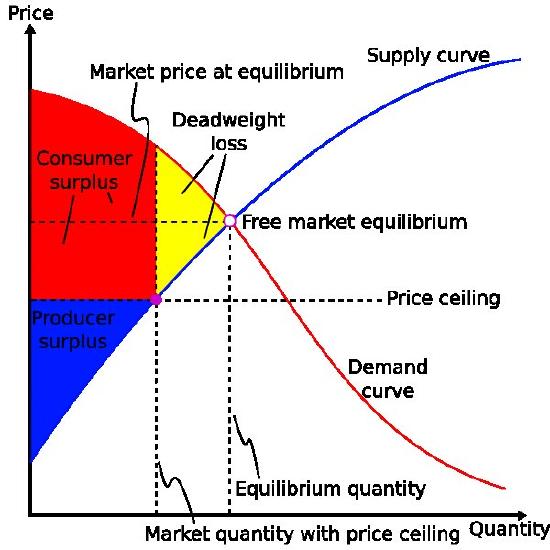

A price ceiling will only impact the market if the ceiling is set below the free-market equilibrium price. This is because a price ceiling above the equilibrium price will lead to the product being sold at the equilibrium price.If the ceiling is less than the economic price, the immediate result will be a supply shortage. As you can see from the chart below, a lower base price means less of a good will be produced. The quantity demanded will increase because more people will be willing to pay the lower price to get the good while producers will be willing to supply less, leading to a shortage.

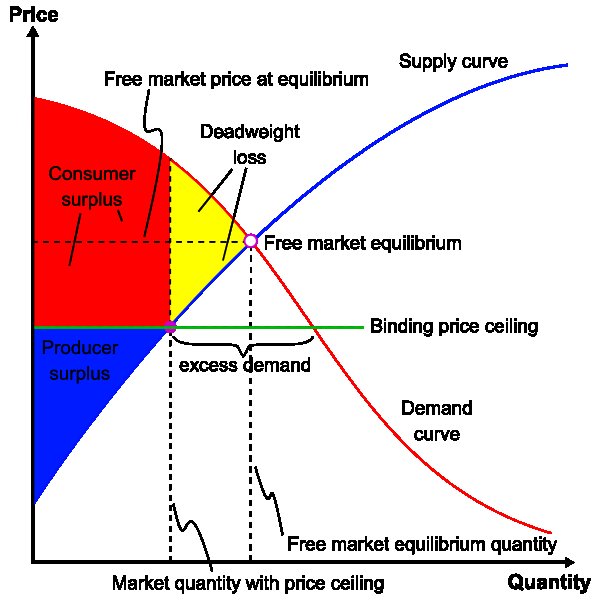

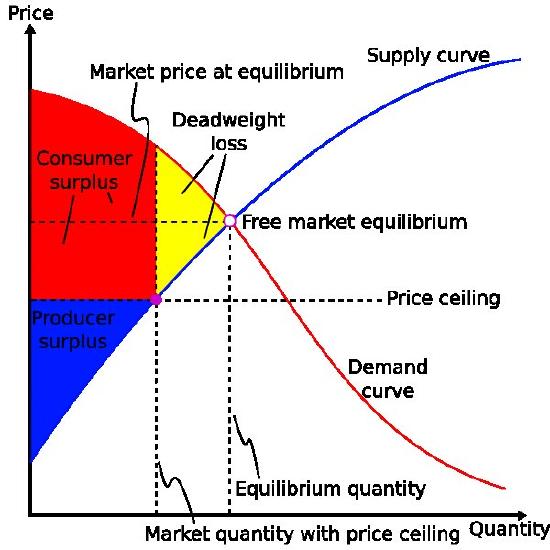

Price Ceiling Chart: If a price ceiling is set below the free-market equilibrium price (as shown where the supply and demand curves intersect), the result will be a shortage of the good in the market. The dead weight loss, represented in yellow, is the minimum dead weight loss in such a scenario. If individuals who value the good most are not capable of purchasing it, there is a potential for a higher amount of dead weight loss.

A price ceiling will also lead to a more inefficient market and a decreased total economic surplus. Economic surplus, or total welfare, is the sum of consumer and producer surplus. Consumer surplus is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest that they are willing pay. Producer surplus is the amount that producers benefit by selling at a market price that is higher than the least they would be willing to sell for. An effective price ceiling will lower the price of a good, which means that the the producer surplus will decrease. While the effective price ceiling will also decrease the price for consumers, any benefit gained from that will be minimized by decreased sales caused by decreased available supply for sale from producers due to the decrease in price. This translates into a net decrease total economic surplus, otherwise known as deadweight loss. This loss is signified in the attached chart as the yellow triangle.

Rationing

If a ceiling is to be imposed for a long period of time, a government may need to ration the good to ensure availability for the greatest number of consumers. One way the government may ration the good is to issue ticket to consumers. A government will only allow as much of good to be out in the marketplace as there are available tickets. To obtain the good, the consumer must present the ticket and the money to the vendor when making the purchase. This is generally considered a fair way to minimize the impact of a shortage caused by a ceiling, but is generally reserved for times of war or severe economic distress.

Black Market

Prolonged shortages caused by price ceilings can create black markets for that good. A black market is an underground network of producers that will sell consumers as much of a controlled good as they want, but at a price higher than the price ceiling. Black markets are generally illegal. However these markets provide higher profits for producers and more of a good for a consumers, so many are willing to take the risk of fines or imprisonment.

Price Floors

A binding price floor is a price control that limits how low a price can be charged for a product or service.

Learning objectives

Define price floors

A price floor is a price control that limits how low a price can be charged for a product or service. Generally floors are set by governments, although groups that manage exchanges can set price floors as well. The purpose of a price floor is to protect producers of a certain good or service. By establishing a minimum price, a government seeks to promote the production of the good or service and ensure that the producers have sufficient resources to go about their work.

For a price floor to be effective, it must be greater than the free-market equilibrium price. This is the price established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. It is also the price that the market will naturally set for a given good or service. If the price floor is lower than what the market would already charge, the regulation would serve no purpose. Since the price is set artificially high, there will be a surplus: there will be a higher quantity supplied and a lower quantity demanded than in a free market. As a result, a government will generally do significant research into the current market conditions for a good or service before setting a price floor.

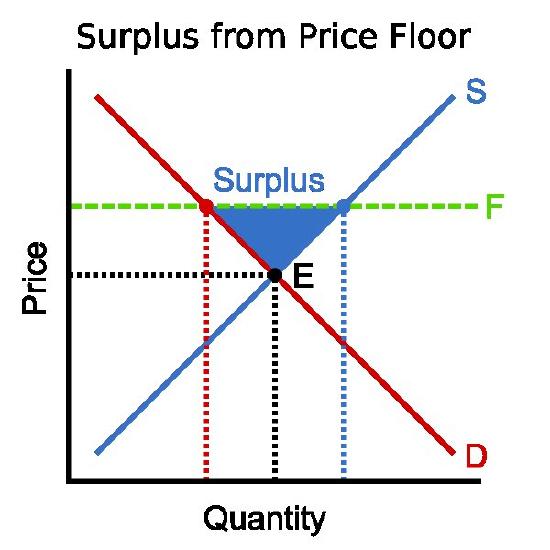

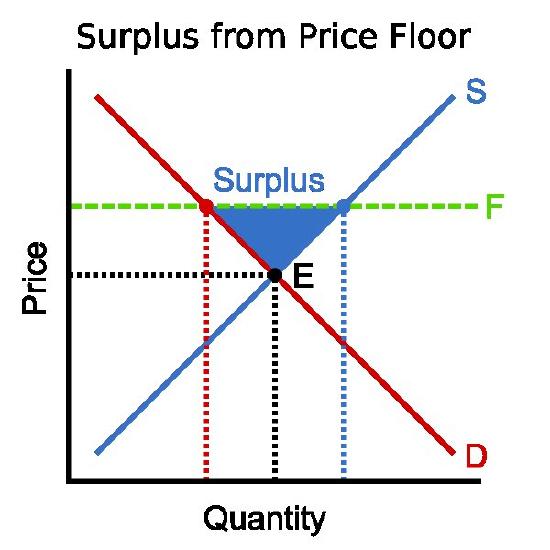

Price Floor: If a price floor is set above the equilibrium price, consumers will demand less and producers will supply more.

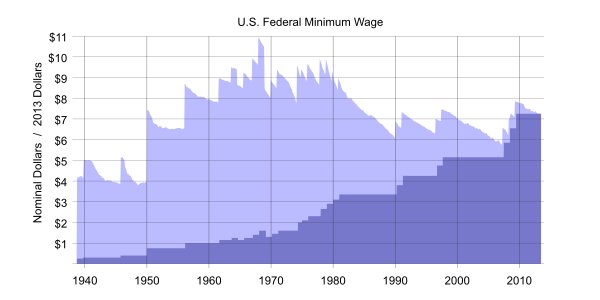

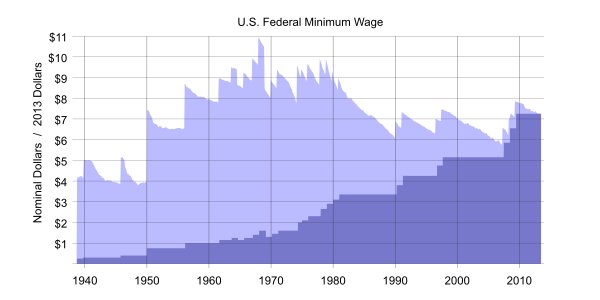

An example of a price floor is the federal minimum wage. In this case the suppliers are employees and employers are the consumers. The federal government has established a price that all employers must pay their workers. Obviously employers can pay more than that amount, but they cannot pay less. The purpose of setting this floor is to ensure that all employees make enough money from their jobs to provide for their basic needs.

History of the Federal Minimum Wage: History of the federal minimum wage in real and nominal dollars. The federal minimum wage is one example of a price floor.

Price Floor Impact on Market Outcome

Binding price floors typically cause excess supply and decreased total economic surplus.

Learning objectives

Show how price floors contribute to market inefficiency

A price floor will only impact the market if it is greater than the free-market equilibrium price. If the floor is greater than the economic price, the immediate result will be a supply surplus. As you can see from, a higher base price will lead to a higher quantity supplied. However, quantity demand will decrease because fewer people will be willing to pay the higher price. This will lead to a surplus of supply.

Surplus from a price floor: If a price floor is set above the free-market equilibrium price (as shown where the supply and demand curves intersect), the result will be a surplus of the good in the market.

A price floor will also lead to a more inefficient market and a decreased total economic surplus. Economic surplus, or total welfare, is the sum of consumer and producer surplus. Consumer surplus is the monetary gain obtained by consumers because they are able to purchase a product for a price that is less than the highest that they are willing pay. Producer surplus is the amount that producers benefit by selling at a market price that is higher than the least they would be willing to sell for. An effective price floor will raise the price of a good, which means that the the consumer surplus will decrease. While the effective price floor will also increase the price for producers, any benefit gained from that will be minimized by decreased sales caused by decreased demand from consumers due to the increase in price. This translates into a net decrease total economic surplus, otherwise known as deadweight loss.

Since well designed price floors create surpluses, the big issue is what to do with the excess supply. The first option is to let inventories grow and have the private producers bear the cost of storing it. The other option is for the government that set the price floor to purchase the excess supply and store it on its own. The government could then sell the surplus off at a loss in times of a food shortage.

Introduction to Deadweight Loss

Deadweight loss is the decrease in economic efficiency that occurs when a good or service is not priced at its pareto optimal level.

Learning objectives

Define deadweight loss

Deadweight loss is the decrease in economic efficiency that occurs when a good or service is not priced and produced at its pareto optimal level. When output is at its pareto optimal point, the price, production, and consumption of a good cannot be altered for one person’s benefit without making at least one other worse off. In a perfectly competitive market, products are priced at the pareto optimal point.

When deadweight loss occurs, it comes at the expense of either the consumer economic surplus or the producer’s economic surplus. Consumer surplus is the gain that consumers receive when they are able to purchase a product for less than the price they are willing to pay; producer surplus is the benefit producers receive when the sell a product for more than they are willing to sell for. While price controls, subsidies and other forms of market intervention might increase consumer or producer surplus, economic theory states that any gain would be outweighed by the losses sustained by the other side. This net harm is what causes deadweight loss.

Deadweight loss can be visually represented on supply and demand graphs. Known as Harberger’s triangle, the deadweight loss equals the area within the following three points:

Deadweight loss: This chart illustrates the deadweight loss created when a price floor is instituted on the market for a good. The amount of deadweight loss is shown by the triangle highlighted in yellow. This area is known as Harberger’s triangle.

- where the supply and demand curve intersect, otherwise known as the free market equilibrium;

- the point on the supply curve where the y-coordinate equals the non-pareto optimal price;

- the point on the demand curve where the y-coordinate equals the non-pareto optimal price.

Example – Price Ceilings and Deadweight Loss

The chart above shows what happens when a market has a binding price ceiling below the free market price. Without the price ceiling, the producer surplus on the chart would be everything to the left of the supply curve and below the horizontal line where y equals the free market equilibrium price. The consumer surplus would equal everything to the left of the demand curve and above the free market equilibrium price line.

With the price ceiling, instead of the producer’s surplus going all the way to the pareto optimal price line, it only goes as high as the price ceiling.The consumer surplus extends down to the price ceiling, but it is limited on the right by Harberger’s triangle. In this case, the reason for that limitation is due to quantity produced. The consumer would purchaser more of the product at the ceiling price, but the producers are unwilling to supply enough to meet that demand because it is not profitable. As a result all of the goods that might have been produced and consumed if the good was priced optimally are not, representing a net loss for society.

Arguments for and Against Government Price Controls

Many argue that price controls ensure resource availability, but most economists agree that these controls should be used sparingly.

Learning objectives

Justify the use of price controls when certain conditions are met

When unemployment is especially high or when there is a shortage of goods, it can be difficult for people to get what they need at an affordable price. The main appeal of government imposed price controls is that they can ensure that citizens can purchase what they need in times of national economic hardship.

USFA Depression Price Fixing Poster: During the depression the US government fixed prices on basic staples, such as food, to ensure people would be able to obtain their basic necessities.

Well designed price controls can do three things. First, these regulations can ensure that a basic staple, such as food, remains affordable to most of a country’s citizens. Second, regulation can protect the producers of a good and ensure that they get sufficient revenue. This in turn limits the possibility of shortages, which benefits consumer. Finally, when shortages occur, price controls can prevent producers from gouging their customers on price.

Generally price controls are used in combination with other forms of government economic intervention, such as wage controls and other regulatory elements.

While price controls may appear to be a sound decision in theory, most economists believe these controls should be used sparingly. By keeping prices artificially low through price ceilings, consumers demand a higher quantity than producers are willing to supply, leading to a shortage in the controlled product. As Nobel Prize winner Milton Friedman said, “We economists do not know much, but we do know how to create a shortage. If you want to create a shortage of tomatoes, for example, just pass a law that retailers can’t sell tomatoes for more than two cents per pound. Instantly you’ll have a tomato shortage. ”

Price floors often lead to surpluses, which can be just as detrimental as a shortage. One of the best known price floors in the minimum wage, which establishes a base line per hour wage that must be paid for work. As a result, employers hire fewer employees than they would if they could pay workers lower than the minimum wage. As a result the supply of workers is greater than the amount of work, which creates higher unemployment.

Taxes

Governments use its tax systems to raise funds for its programs and influence its citizens’ economic actions.

Learning objectives

Categorize types of taxes into ad valorem taxes and excise taxes

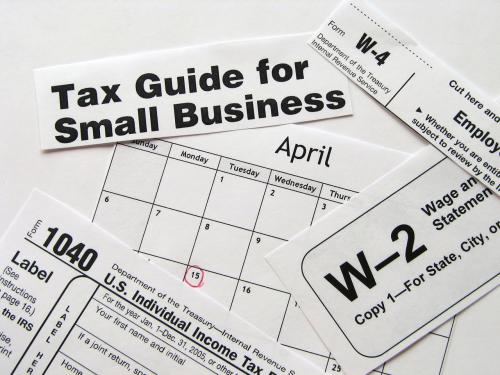

Taxes are the primary means for governments to raise funds for its programs and to pay off its debts. It can also be used to influence its citizens’ financial behavior.. Choosing the right set of rules that have all of the elements of a good tax system can be a challenge for any government.

Tax: Taxes are a tool used by governments to raise money and influence their citizens’ economic choices.

Elements of a Good Tax System

- Efficient: A tax system should raise the necessary revenues without unduly burdening the taxpayer.

- Understandable: A tax system should be easily understandable by the average citizen who has to pay the tax.

- Equitable: The tax burden should be distributed equitably among a nation’s citizens. Generally, this means that those that are wealthier should pay more.

- Benefit Principle: Generally, the people who use public services should pay for them with higher taxes. However this principle is difficult to enforce in practice.

Two Types of Tax Systems

- Direct Taxation: A direct tax is assessed on the income of the taxpayer and is generally collected before the taxpayer collects his wages.

- Indirect Taxation: An indirect tax is an avoidable tax assessed on certain activities, such as purchasing goods or services. Examples of an indirect tax include sales tax and VAT (value added tax).

Types of Tax Structures

- Proportional Tax: Otherwise known as a flat tax, a flat tax rate is applied to all earned income regardless of how much the taxpayer earns. So a person making $20,000 would pay the same rate as a person making $120,000, but would pay significantly less in real dollars.

- Progressive Tax: The more a person earns, the higher the tax rate. Generally in a progressive tax system, income is divided into “brackets. ” For example, assume a tax system divides earners into people two groups. Those who earn less than $100,000 pay 10% and people who earn $100,000 or more pay 20%. A person earning $20,000 would have to pay 10%, or $2,000, while a person who earns $120,000 would have to pay 20%, or $24,000.

- Regressive Tax: In a regressive tax system, poorer families pay a higher tax rate. Although a regressive tax system is never explicitly used, some claim a sales tax is a type of regressive tax. Since high income earners spend a lower proportion of their income on goods and services in comparison to low income earners, the rich tend to pay proportionally less sales tax.

Ad Valorem vs Excise Tax

Ad Valorem (or Value Added) and Excise Taxes are types of indirect taxes. Both are generally assessed on the sale of goods. These two taxes differ in three ways:

- An excise tax typically applies to a narrower range of products, such as gasoline, tobacco, and alcohol.

- An excise tax is typically heavier than an ad valorem, accounting for a higher fraction of a product’s retail price.

- Excise taxes are typically a fixed fee per unit, meaning that the government earns its revenue based on volume sold. Ad valorem taxes are proportional to the price of the good, so the government earns revenue based on the value of the good or service being sold.

Taxation Impact on Economic Output

Tax incidence falls mostly upon the group that responds least to price, or has the most inelastic price-quantity curve.

Learning objectives

Analyze how changes in taxes affect the price of a good for sellers and buyers

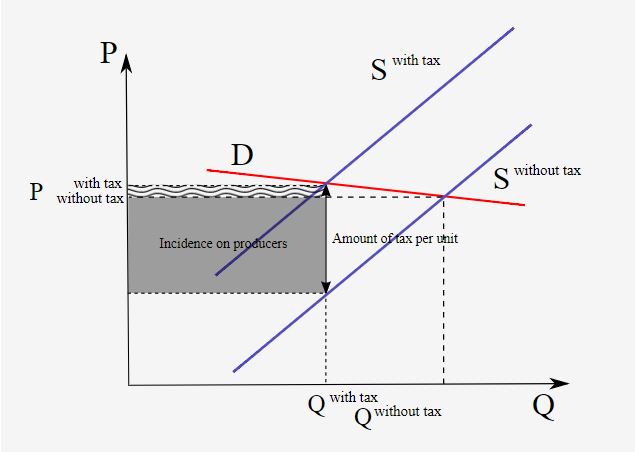

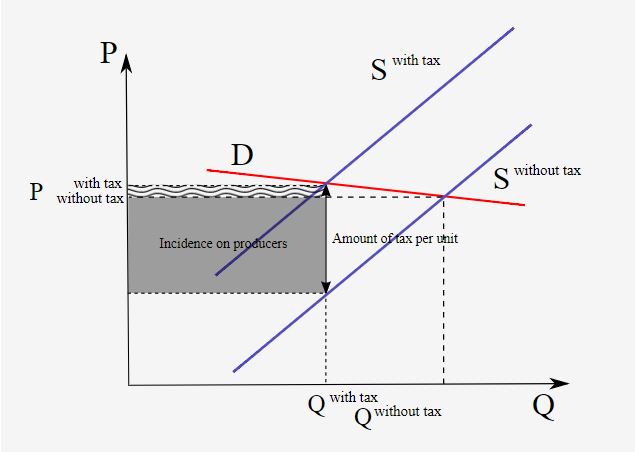

Tax incidence is the effect a particular tax has on the two parties of a transaction; the producer that makes the good and the consumer that buys it. The burden of the tax is not dependent on whether the state collects the revenue from the producer or consumer, but on the price elasticity of supply and the price elasticity of demand. To understand how elasticities influence tax incidence, its important to consider the two extreme scenarios and how the tax burden is distributed between the two parties.

Inelastic supply, elastic demand

Because supply is inelastic, the firm will produce the same quantity no matter what the price. Because demand is elastic, the consumer is very sensitive to price. A small increase in price leads to a large drop in the quantity demanded. The imposition of the tax causes the market price to increase and the quantity demanded to decrease. Because consumption is elastic, the price consumers pay doesn’t change very much. Because production is inelastic, the amount sold changes significantly. The producer is unable to pass the tax onto the consumer and the tax incidence falls on the producer.

Tax Incidence of Producer: When supply is inelastic but demand is elastic, the majority of the tax is paid for by the consumer. Since quantity demanded drops significantly in this scenario, the producer is forced to sell less.

Elastic supply, inelastic demand

Consumption is inelastic, so the consumer will consume the same quantity no matter the price. The producer will be able to produce the same amount of the good, but will be able to increase the price by the amount of the tax. As a result, the entirety of the tax will be borne by the consumer.

Similarly elastic supply and demand

Generally consumers and producers are neither perfectly elastic or inelastic, so the tax burden is shared between the two parties in varying proportions. If one party is comparatively more inelastic than the other, they will pay the majority of the tax.

Increasing tax

If the government increases the tax on a good, that shifts the supply curve to the left, the consumer price increases, and sellers’ price decreases. A tax increase does not affect the demand curve, nor does it make supply or demand more or less elastic. This potential increase in tax could be called marginal, because it is a tax in addition to existing levies.

Key Points

- The government tries to combat market inequities through regulation, taxation, and subsidies.

- Governments may also intervene in markets to promote general economic fairness.

- Maximizing social welfare is one of the most common and best understood reasons for government intervention. Examples of this include breaking up monopolies and regulating negative externalities like pollution.

- Governments may sometimes intervene in markets to promote other goals, such as national unity and advancement.

- For a price ceiling to be effective, it must be less than the free-market equilibrium price.

- The purpose of a price ceiling is to protect consumers of a certain good or service. By establishing a maximum price, a government wants to ensure the good is affordable for as many consumers as possible.

- Rent control is an example of a price ceiling.

- A price ceiling has an economic impact only if it is less than the free-market equilibrium price.

- An effective price ceiling will lower the price of a good, which decreases the producer surplus. The effective price ceiling will also decrease the price for consumers, but any benefit gained from that will be minimized by the decreased sales due to the drop in supply caused by the lower price.

- If a ceiling is to be imposed for a long period of time, a government may need to ration the good to ensure availability for the greatest number of consumers.

- Prolonged shortages caused by price ceilings can create black markets for that good.

- A price floor is economically consequential if it is greater than the free-market equilibrium price.

- Price floors lead to a surplus of the product.

- Supply surpluses created by price floors are generally added to producer’s inventory or are purchased by governments.

- Consumer surplus is the gain obtained by consumers because they can obtain a product for a lower price than they would be willing to pay.

- Producer surplus is the benefit producers get by selling at a price higher than the lowest price they would sell for.

- Deadweight loss can be caused by monopolies, binding price controls, taxes, subsidies, and externalities.

- When deadweight loss occurs, it comes at the expense of consumer surplus and/or producer surplus.

- Deadweight loss can be visually represented on supply and demand graphs as a figure known as Harberger’s triangle.

- The main appeal of governmental imposed price controls is that they can ensure that citizens can purchase what they need in times of national economic hardship.

- Well designed price controls can ensure that basic staples are affordable, minimize the possibility of shortages, and prevent price gouging when shortages occur.

- By keeping prices artificially low through price ceilings, economists argue that demand is increased to a point where supply cannot keep up, leading to a shortage in the controlled product.

- Price floors often lead to surpluses, which can be just as detrimental as a shortage.

- A good tax system should be efficient, understandable and equitable. It should also allocate the costs of public services to those who use it, although that principle is hard to execute in practice.

- A direct tax is assessed on a person’s income. Indirect taxes are assessed on an individual’s participation in certain activities, such as making a purchase.

- The three types of tax systems are proportional, progressive, and regressive.

- Ad valorem and excise taxes are two types of indirect taxes.

- When supply is inelastic and demand is elastic, the tax incidence falls on the producer.

- When supply is elastic and demand is inelastic, the tax incidence falls on the consumer.

- Tax incidence is the analysis of the effect a particular tax has on the two parties of a transaction; the producer that makes the good and the consumer that buys it.

- A marginal tax is an increase in a tax on a good that shifts the supply curve to the left, increases the consumer price, and decreases the price for the sellers.

Key Terms

- inefficient market: An economy where social optimality is not acheived; an economy where resources are not optimally allocated

- free-market equilibrium price: The price established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers

- Price ceiling: An artificially set maximum price in a market.

- black market: trade that is in violation of restrictions, rationing or price controls

- free-market equilibrium price: The price established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers

- price floor: A mandated minimum price for a product in a market.

- Pareto optimal: Describing a situation in which the profit of one party cannot be increased without reducing the profit of another.

- deadweight loss: A loss of economic efficiency that can occur when an equilibrium is not Pareto optimal.

- Price control: A law that sets the maximum or minimum amount for which a good may be sold.

- staple: A basic or essential supply.

- progressive: Increasing in rate as the taxable amount increases

- regressive: Whose rate decreases as the amount increases.

- elastic: Sensitive to changes in price.

- Tax incidence: The effect a particular tax has on the two parties of a transaction.