The Balance of Payments

The balance of payments (BOP) is a record of all monetary transactions between a country and the rest of the world.

learning objectives

- Explain the components and importance of the balance of payments

The balance of payments (BOP) is a record of all monetary transactions between a country and the rest of the world. This includes payments for the country’s exports and imports, the sale and purchase of assets, and financial transfers. The BOP is given for a specific period of time (usually a year) and in terms of the domestic currency.

Whenever a country receives funds from a foreign source, a credit is recorded on the balance of payments. Sources of funds include exports, the receipt of loans or investment, and income from foreign assets. Whenever a country has an outflow of funds, such as when the country imports goods and services or when it invests in foreign assets, it is recorded as a debit on the balance of payments.

When all components of the BOP accounts are included they must sum to zero with no overall surplus or deficit. For example, if a country is importing more than it exports, its trade balance will be in deficit, but the shortfall will have to be counterbalanced in other ways – such as by funds earned from its foreign investments, by running down central bank reserves, or by receiving loans from other countries.

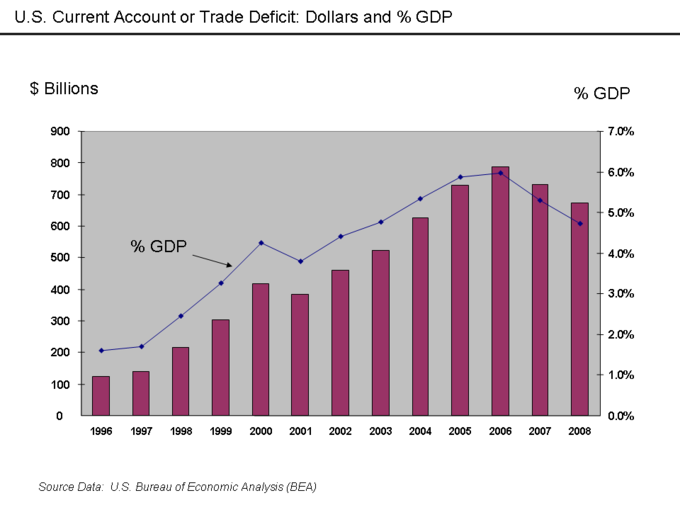

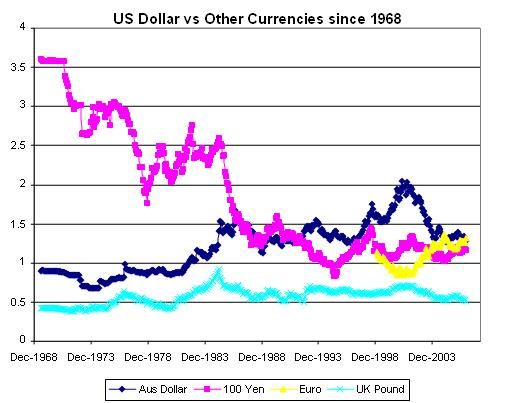

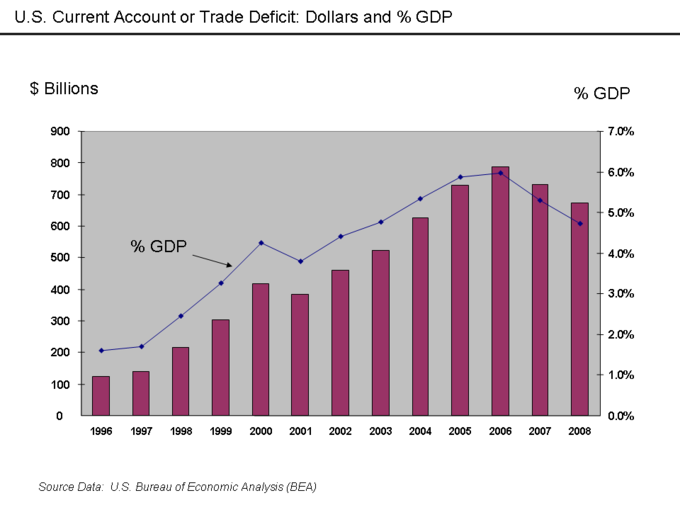

U.S. Current Account: The chart shows the current account deficit of the U.S., both in dollars and as a percent of GDP. Deficits in the current account must be offset by surpluses in the financial and capital accounts.

Components of the Balance of Payments

The BOP can be expressed as:

\[BOP=Current \; Account+Financial \; Account+Capital \; Account+Balancing \; Item\]

The current account records the flow of income from one country to another. It includes the balance of trade (net earnings on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors), and cash transfers.

The financial account records the flow of assets from one country to another. It is composed of foreign direct investment, portfolio investment, other investment, and reserve account flows.

The capital account is typically much smaller than the other two and includes miscellaneous transfers that do not affect national income. Debt forgiveness would affect the capital account, as would the purchase of non-financial and non-produced assets such as the rights to natural resources or patents.

The balancing item is simply an amount that accounts for any statistical errors and ensures that the total balance of payments is zero.

The Current Account

The current account represents the sum of net exports, factor income, and cash transfers.

learning objectives

- Calculate the current account

The current account represents the sum of the balance of trade (net earnings on exports minus payments for imports), factor income (earnings on foreign investments minus payments made to foreign investors), and cash transfers. It is called the current account as it covers transactions in the “here and now” – those that don’t give rise to future claims.

The balance of trade is the difference between a nation’s exports of goods and services and its imports of goods and services. A nation has a trade deficit if its imports exceed its exports. Because the trade balance is typically the largest component of the current account, a current account surplus is usually associated with positive net exports. This, however, is not always the case. Secluded economies like Australia are more likely to feature income deficits larger than their trade surplus.

The net factor income records a country’s inflow of income and outflow of payments. Income refers not only to the money received from investments made abroad (note: the investments themselves are recorded in the capital account but income from investments is recorded in the current account) but also to the money sent by individuals working abroad, known as remittances, to their families back home. If the income account is negative, the country is paying more than it is taking in interest, dividends, etc.

Cash transfers take place when a certain foreign country simply provides currency to another country with nothing received as a return. Typically, such transfers are done in the form of donations, aids, or official assistance.

Calculating the Current Account

Normally, the current account is calculated by adding up the 4 components of current account: goods, services, income and cash transfers.

Goods are traded by countries all over the world. When ownership of a good is transferred from a local country to a foreign country, this is called an export. When a good’s ownership is transferred from a foreign country to a local country, this is called an import. In calculating the current account, exports are marked as a credit (inflow of money) and imports are marked as a debit (outflow of money).

Services can also be traded by countries. This happens frequently in the case of tourism. When a tourist from a local country visits a foreign country, the local country is consuming the foreign services and this is counted as an import. Likewise, when a foreign tourist comes and enjoys the services of a local country, this is counted as an export. Other services can also be transferred between countries, such as when a financial adviser in one country assists clients in another.

A credit of income happens when a domestic individual or company receives money from a foreign individual or company. This would typically take place when a domestic investor receives dividends from an investment made in a foreign country, or when a worker abroad sends remittances back to the local country. Likewise, a debit in the income account takes place when a foreign entity receives money from an investment in the local economy.

Finally, a credit in the cash transfers column would be a gift of aid from a foreign country to the domestic country. Similarly, a debit in the cash transfers column might be the provision of official assistance by the local economy to a foreign economy.

Thus, a country’s current account can by calculated by the following formula:

\(CA=(X−M)+NY+NCT\)

Where \(CA\) is the current account, \(X\) and \(M\) and the export and import of goods and services respectively, \(NY\) is net income from abroad, and \(NCT\) is the net current transfers. When the sum of these four components is positive, the current account has a surplus.

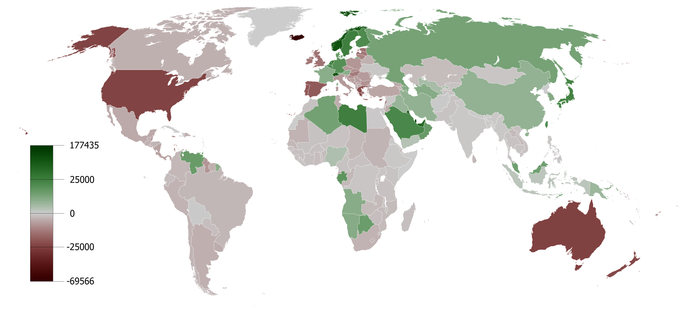

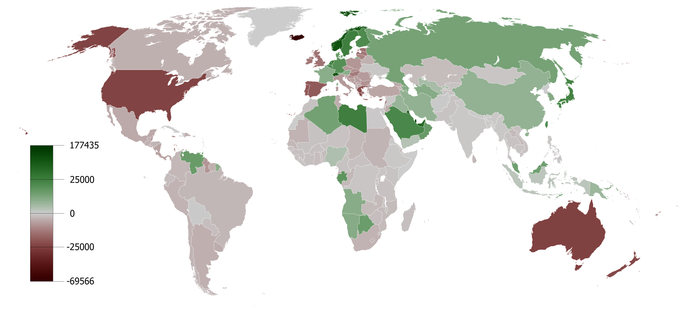

Global Current Accounts: The map shows the per capita current accounts surpluses and deficits of countries around the world from 1980 to 2008. Deeper red implies a higher per capita deficit, while deeper green implies a higher per capita surplus.

The Financial Account

The financial account measures the net change in ownership of national assets.

learning objectives

- Calculate the financial account

The financial account (also known as the capital account under some balance of payments systems) measures the net change in ownership of national assets. When financial account has a positive balance, we say that there is a financial account surplus. A financial account surplus means that the net ownership of a country’s assets is flowing out of a country – that is, foreign buyers are purchasing more domestic assets than domestic buyers are purchasing of assets from the rest of the world. Likewise, we say that there is a financial account deficit when the financial account has a negative balance. This occurs when domestic buyers are purchasing more foreign assets than foreign buyers are purchasing of domestic assets. For example, a financial accounts deficit would exist when Country A’s citizens buy $200 million worth of real estate overseas, while overseas investors purchase only $100 million worth of real estate within Country A.

Calculating the Financial Account

The financial account has four components: foreign direct investment, portfolio investment, other investment, and reserve account flows.

Foreign direct investment (FDI) refers to long term capital investment such as the purchase or construction of machinery, buildings, or even whole manufacturing plants. If foreigners are investing in a country, that is an inbound flow and counts as a surplus item on the financial account. If a nation’s citizens are investing in foreign countries, there is an outbound flow that will count as a deficit. After the initial investment, any yearly profits not re-invested will flow in the opposite direction, but will be recorded in the current account rather than the financial account.

FDI in Austria: Austria has experienced a surplus of foreign direct investment: more foreign investors invest in Austria than Austrian investors do in the rest of the world. This contributes to a financial account surplus.

Portfolio investment refers to the purchase of shares and bonds. It is sometimes grouped together with “other” as short term investment. As with FDI, the income derived from these assets is recorded in the current account; the financial account entry will just be for any buying or selling of the portfolio assets in the international financial markets.

Other investment includes capital flows into bank accounts or provided as loans. Large short term flows between accounts in different nations are commonly seen when the market is able to take advantage of fluctuations in interest rates and/or the exchange rate between currencies. Sometimes this category can include the reserve account.

The reserve account is operated by a nation’s central bank to buy and sell foreign currencies; it can be a source of large capital flows to counteract those originating from the market. Inbound capital flows (from sales of the account’s foreign currency), especially when combined with a current account surplus, can cause a rise in value (appreciation) of a nation’s currency, while outbound flows can cause a fall in value (depreciation). If a government (or, if authorized to operate independently in this area, the central bank itself) does not consider the market-driven change to its currency value to be in the nation’s best interests, it can intervene. Such intervention affects the financial account. Purchases of foreign currencies, for example, will increase the deficit and vis versa.

To calculate the total surplus or deficit in the financial account, sum the net change in FDI, portfolio investment, other investment, and the reserve account.

Interest Rates and the Financial Account

The outflow or inflow of assets in the financial account depends in large part on the domestic interest rate and how it compares to interest rates in other countries. A higher central bank interest rate will tend to increase the interest rate on all domestic financial assets, such as bonds, loans, and government securities. In general, if interest rates are higher in one country than another, an investor would prefer to purchase financial assets in the country with the higher interest rate.

An increase in the domestic interest rate will therefore cause foreign investors to purchase more domestic assets, creating a financial account surplus. Likewise, a fall in the domestic interest rate will cause domestic investors to purchase foreign assets in place of domestic assets, and will cause a financial account deficit.

The Capital Account

The capital account acts as a sort of miscellaneous account, measuring non-produced and non-financial assets, as well as capital transfers.

learning objectives

- Calculate the Capital Account

There are two common definitions of the capital account in economics. The first is a broad interpretation that reflects the net change in ownership of national assets. Under the International Monetary Fund (IMF) definition, however, most of these asset flows are captured in the financial account. Instead, the capital account acts as a sort of miscellaneous account, measuring non-produced and non-financial assets, as well as capital transfers. The capital account is normally much smaller than the financial and current accounts.

Like the financial account, a deficit in the capital account means that money is flowing out of a country and the country is accumulating foreign assets. Likewise, a surplus in the capital account means that a money is flowing into a country and the country is selling (or otherwise disposing of) non-produced, non-financial assets.

Calculating the Capital Account

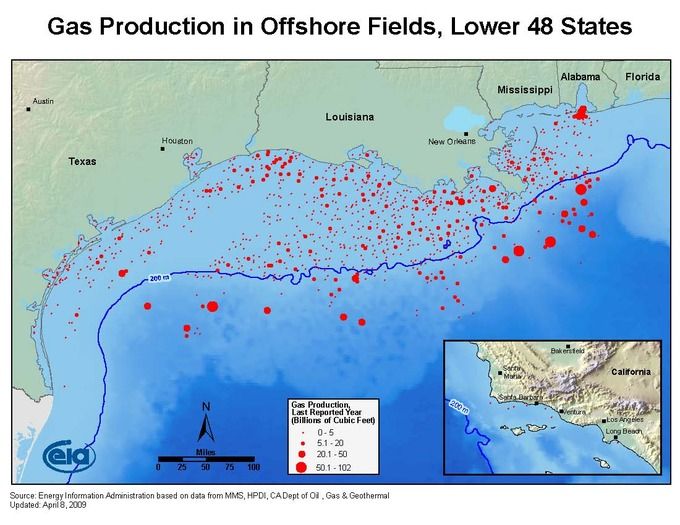

The capital account can be split into two categories: non-produced and non-financial assets, and capital transfers. Non-produced and non-financial assets include things like drilling rights, patents, and trademarks. For example, if a domestic company acquires the rights to mineral resources in a foreign country, there is an outflow of money and the domestic country acquires an asset, creating a capital account deficit.

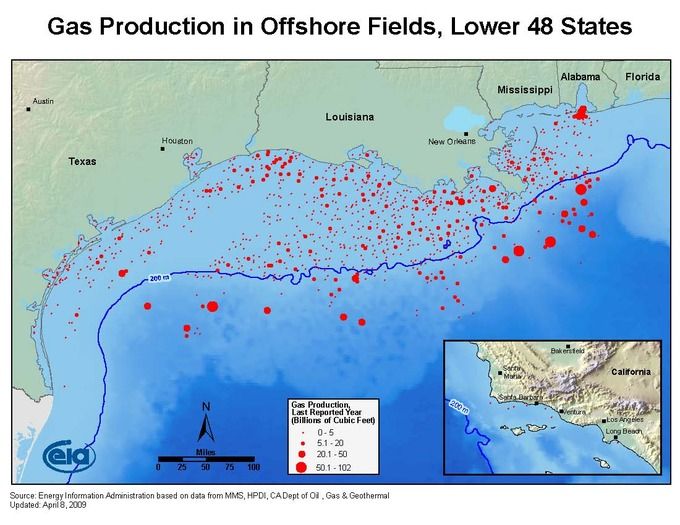

Natural Gas Rights: If a U.S. company sold its rights to drill for natural gas off the southern coast of the U.S., it would be recorded as a credit in the capital account.

Capital transfers include debt forgiveness, the transfer of goods and financial assets by migrants leaving or entering a country, the transfer of ownership on fixed assets, the transfer of funds received to the sale or acquisition of fixed assets, gift and inheritance taxes, death levies, and uninsured damage to fixed asset. For example, if the domestic country forgives a loan made to a foreign country, this transfer creates a deficit in the capital account.

Thus, the balance of the capital account is calculated as the sum of the surpluses or deficits of net non-produced, non-financial assets, and net capital transfers.

Reason for a Zero Balance

Equilibrium in the market for a country’s currency implies that the balance of payments is equal to zero.

learning objectives

- Discuss the long term equilibrium of a country’s balance of payments

Capital Flows

Trade within a country differs in one important way from trade between countries: unless the two nations share a common currency, any trade requires that countries go through the foreign exchange market to trade currency, in addition to trading goods and services. For example, imagine that buyers in France purchase oranges produced in Chile. The French buyers use the euro in order to make the purchase but the Chilean orange producers must be paid with the Chilean peso. This exchange between France and Chile requires that the firms exchange euros for pesos.

In general, there are two reasons for demanding a country’s currency: to purchase assets within the country and to purchase a country’s exports – that is, the goods and services produced within that country. The country’s currency is supplied when it is used to purchase foreign currencies. This also happens for two reasons: to purchase assets in other countries and to import goods or services from other countries.

Imaging that we are analyzing Italy’s economy and its currency transactions with the rest of the world. If an American buyer wishes to purchase bonds issued by an Italian corporation, she becomes part of the world demand for euros to buy Italian assets. Adding the demand for exports to the demand for assets outside of a country, we get the total demand for a country’s currency.

Likewise, a country’s currency is supplied when it is used to purchase currencies in the rest of the world. Italian euros, for eample, are supplied when Italian consumers or firms import goods and services from the rest of the world. Italian euros are also supplied when Italian purchasers acquire assets from other countries.

Equilibrium and Zero Balance

When a country’s balance of payments is equal to zero, there is equilibrium in the market for that country’s currency. Equilibrium occurs when:

Quantity of currency demanded = quantity of currency supplied

We have already seen that the quantity of currency demanded is equal to the demand for exports and demand for domestic assets. The quantity of currency supplied is equal to the demand for imports and the domestic demand for foreign assets. Thus, we can rewrite the relationship:

Exports + (foreign purchases of domestic assets) = imports + (domestic purchases of foreign assets)

Finally, we can rearrange the above formula as:

Exports – imports = (domestic purchases of foreign assets) – (foreign purchases of domestic assets)

The left-hand term is net exports – the difference between the amount of goods and services a country exports and the amount that it imports. We refer to this difference as the current account. When a country exports more goods than it imports, this number is positive and we say that the country has a current accounts surplus. When a country imports more than it exports this number is negative and we say that the country has a current accounts deficit.

The right-hand term is the difference between the foreign assets that people within the country purchase and the domestic assets that are purchased by foreigners. This is called the financial account. These assets include the reserve account (the foreign exchange market operations of a nation’s central bank ), along with loans and investments between the country and the rest of world (but not the future regular repayments/dividends that the loans and investments yield; those are earnings and will be recorded in the current account). The financial account is also sometimes used in a narrower sense that excludes the foreign exchange operation of the central bank. When a country buys more foreign assets that other countries buy of its assets, this balance is positive and there is a financial account surplus.

If the above equation holds true, then any current account surplus must be matched by a financial account deficit, and vice versa. This holds true when a country’s currency market is in equilibrium and there are no external currency controls.

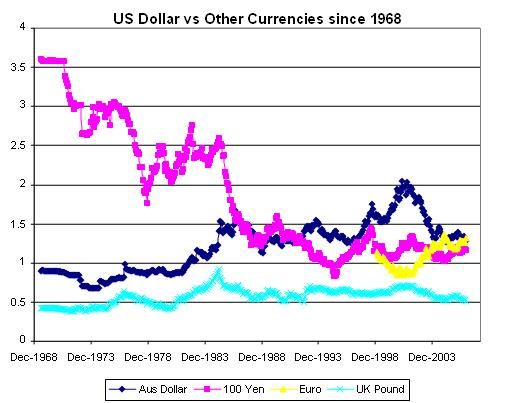

Exchange Rates: Exchange rates are constantly fluctuating to ensure that the quantity of currency supplied equals the quantity demanded. Because of this, the inflows and outflows of money are equal, creating a balance of payments equal to zero.

Key Points

- Whenever a country receives funds from a foreign source, a credit is recorded on the balance of payments. Whenever a country has an outflow of funds, it is recorded as a debit on the balance of payments.

- When all components of the BOP accounts are included they must sum to zero with no overall surplus or deficit.

- BOP=Current Account+Financial Account+ Capital Account+Balancing Item.

- The current account records the flow of income from one country to another.

- The financial account records the flow of assets from one country to another.

- The capital account is typically much smaller than the other two and includes miscellaneous transfers that do not affect national income.

- The balance of trade is the difference between a nation’s exports of goods and services and its imports of goods and services. A nation has a trade deficit if its imports exceeds its exports.

- The net factor income records a country’s inflow of income and outflow of payments. Income refers not only to the money received from investments made abroad but also to remittances.

- Cash transfers take place when a certain foreign country simply provides currency to another country with nothing received as a return.

- A country’s current account can by calculated by the following formula: \(CA=(X−M)+NY+NCT\).

- A financial account surplus means that buyers in the rest of the world are purchasing more of a country’s assets than buyers in the domestic economy are spending on rest-of-world assets.

- The financial account has four components: foreign direct investment, portfolio investment, other investment, and reserve account flows.

- Foreign direct investment (FDI) refers to long term capital investment such as the purchase or construction of machinery, buildings, or even whole manufacturing plants.

- Portfolio investment refers to the purchase of shares and bonds.

- Other investment includes capital flows into bank accounts or provided as loans.

- The reserve account is operated by a nation’s central bank to buy and sell foreign currencies.

- A deficit in the capital account means that money is flowing out of a country and the country is accumulating foreign assets.

- The capital account can be split into two categories: non-produced and non-financial assets, and capital transfers.

- Non-produced and non-financial assets include things like drilling rights, patents, and trademarks.

- Capital transfers include debt forgiveness, the transfer of goods and financial assets by migrants leaving or entering a country, and the transfer of ownership on fixed assets.

- Equilibrium in the foreign exchange market implies that the quantity of currency demanded = quantity of currency supplied.

- The quantity of a currency demanded is from two sources: exports and rest-of-world purchases of domestic assets. The quantity supplied of a currency is also from two sources: imports and domestic purchases of rest-of-world assets.

- Therefore, exports + (rest-of-world purchases of domestic assets) = imports + (domestic purchases or rest-of-world assets).

- Finally, this means that exports – imports = (domestic purchases of rest-of-world assets) – (rest-of-world purchases of domestic assets).

- In other words, the current account balances out the financial account and the balance of payments is zero.

Key Terms

- balance of payments: A record of all monetary transactions between a country and the rest of the world

- credit: An addition to certain accounts.

- balance of trade: The difference between the monetary value of exports and imports in an economy over a certain period of time.

- debit: A sum of money taken out of an account.

- central bank: The principal monetary authority of a country or monetary union; it normally regulates the supply of money, issues currency and controls interest rates.

- interest rate: The percentage of an amount of money charged for its use per some period of time (often a year).

- debt forgiveness: The partial or total writing down of debt owed by individuals, corporations, or nations.

- net exports: The difference between the monetary value of exports and imports.

- foreign exchange: The changing of currency from one country for currency from another country.

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SHARED PREVIOUSLY

- Curation and Revision. Provided by: Boundless.com. License: CC BY-SA: Attribution-ShareAlike

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- Balance of payments. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Balance_of_payments. License: CC BY-SA: Attribution-ShareAlike

- IB Economics/International Economics/Balance of payments. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/IB_Econ...ce_of_payments. License: CC BY-SA: Attribution-ShareAlike

- Balance of payments. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Balance_of_payments. License: CC BY-SA: Attribution-ShareAlike

- U.S. Trade Deficit Dollars and percentage GDP. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:U....entage_GDP.png. License: CC BY-SA: Attribution-ShareAlike

- balance of trade. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/balance_of_trade. License: CC BY-SA: Attribution-ShareAlike

- Current account. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Current_account. License: CC BY-SA: Attribution-ShareAlike

- Balance of payments. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Balance_of_payments. License: CC BY-SA: Attribution-ShareAlike

- credit. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/credit. License: CC BY-SA: Attribution-ShareAlike

- debit. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/debit. License: CC BY-SA: Attribution-ShareAlike

- U.S. Trade Deficit Dollars and percentage GDP. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:U....entage_GDP.png. License: CC BY-SA: Attribution-ShareAlike

- Cumulative Current Account Balance per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Cu...per_capita.png. License: Public Domain: No Known Copyright

- interest rate. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/interest_rate. License: CC BY-SA: Attribution-ShareAlike

- Capital account. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Capital_account. License: CC BY-SA: Attribution-ShareAlike

- Balance of payments. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Balance_of_payments. License: CC BY-SA: Attribution-ShareAlike

- central bank. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/central_bank. License: CC BY-SA: Attribution-ShareAlike

- U.S. Trade Deficit Dollars and percentage GDP. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:U....entage_GDP.png. License: CC BY-SA: Attribution-ShareAlike

- Cumulative Current Account Balance per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Cu...per_capita.png. License: Public Domain: No Known Copyright

- Foreign Direct Investment in Austria. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...in_Austria.gif. License: Public Domain: No Known Copyright

- Balance of payments. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Balance_of_payments. License: CC BY-SA: Attribution-ShareAlike

- Capital account. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Capital_account. License: CC BY-SA: Attribution-ShareAlike

- debt forgiveness. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/debt%20forgiveness. License: CC BY-SA: Attribution-ShareAlike

- U.S. Trade Deficit Dollars and percentage GDP. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:U....entage_GDP.png. License: CC BY-SA: Attribution-ShareAlike

- Cumulative Current Account Balance per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Cu...per_capita.png. License: Public Domain: No Known Copyright

- Foreign Direct Investment in Austria. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...in_Austria.gif. License: Public Domain: No Known Copyright

- US Gulf of Mexico offshore gas. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:US...fshore_gas.jpg. License: Public Domain: No Known Copyright

- Balance of payments. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Balance_of_payments. License: CC BY-SA: Attribution-ShareAlike

- net exports. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/net%20exports. License: CC BY-SA: Attribution-ShareAlike

- foreign exchange. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/foreign_exchange. License: CC BY-SA: Attribution-ShareAlike

- U.S. Trade Deficit Dollars and percentage GDP. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:U....entage_GDP.png. License: CC BY-SA: Attribution-ShareAlike

- Cumulative Current Account Balance per capita. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Cu...per_capita.png. License: Public Domain: No Known Copyright

- Foreign Direct Investment in Austria. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...in_Austria.gif. License: Public Domain: No Known Copyright

- US Gulf of Mexico offshore gas. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:US...fshore_gas.jpg. License: Public Domain: No Known Copyright

- Exchange rates. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...ange_rates.JPG. License: Public Domain: No Known Copyright