Types of Costs

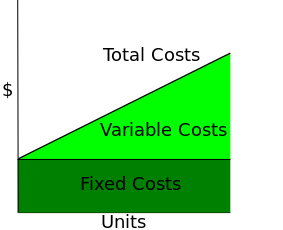

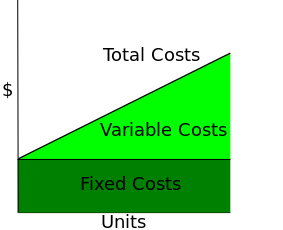

Variable costs change according to the quantity of goods produced; fixed costs are independent of the quantity of goods being produced.

Learning Objectives

- Differentiate fixed costs and variable costs

Total Cost

In economics, the total cost (TC) is the total economic cost of production. It consists of variable costs and fixed costs. Total cost is the total opportunity cost of each factor of production as part of its fixed or variable costs.

Calculating total cost: This graphs shows the relationship between fixed cost and variable cost. The sum of the two equal the total cost.

Variable Costs

Variable cost (VC) changes according to the quantity of a good or service being produced. It includes inputs like labor and raw materials. Variable costs are also the sum of marginal costs over all of the units produced (referred to as normal costs). For example, in the case of a clothing manufacturer, the variable costs would be the cost of the direct material (cloth) and the direct labor. The amount of materials and labor that is needed for each shirt increases in direct proportion to the number of shirts produced. The cost “varies” according to production.

Fixed Costs

Fixed costs (FC) are incurred independent of the quality of goods or services produced. They include inputs (capital) that cannot be adjusted in the short term, such as buildings and machinery. Fixed costs (also referred to as overhead costs) tend to be time related costs, including salaries or monthly rental fees. An example of a fixed cost would be the cost of renting a warehouse for a specific lease period. However, fixed costs are not permanent. They are only fixed in relation to the quantity of production for a certain time period. In the long run, the cost of all inputs is variable.

Economic Cost

The economic cost of a decision that a firm makes depends on the cost of the alternative chosen and the benefit that the best alternative would have provided if chosen. Economic cost is the sum of all the variable and fixed costs (also called accounting cost) plus opportunity costs.

Average and Marginal Cost

Marginal cost is the change in total cost when another unit is produced; average cost is the total cost divided by the number of goods produced.

Learning Objectives

- Distinguish between marginal and average costs

Marginal Cost

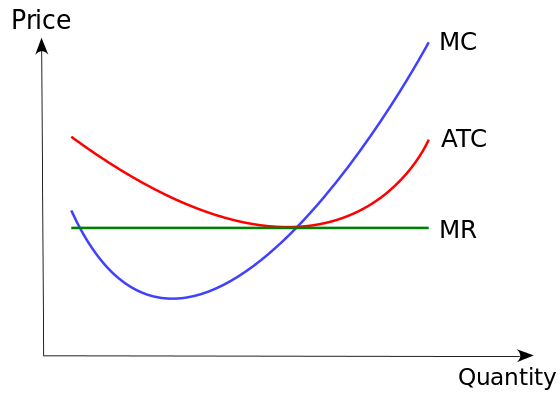

In economics, marginal cost is the change in the total cost when the quantity produced changes by one unit. It is the cost of producing one more unit of a good. Marginal cost includes all of the costs that vary with the level of production. For example, if a company needs to build a new factory in order to produce more goods, the cost of building the factory is a marginal cost. The amount of marginal cost varies according to the volume of the good being produced. Economic factors that impact the marginal cost include information asymmetries, positive and negative externalities, transaction costs, and price discrimination. Marginal cost is not related to fixed costs. An example of calculating marginal cost is: the production of one pair of shoes is $30. The total cost for making two pairs of shoes is $40. The marginal cost of producing the second pair of shoes is $10.

Average Cost

The average cost is the total cost divided by the number of goods produced. It is also equal to the sum of average variable costs and average fixed costs. Average cost can be influenced by the time period for production (increasing production may be expensive or impossible in the short run). Average costs are the driving factor of supply and demand within a market. Economists analyze both short run and long run average cost. Short run average costs vary in relation to the quantity of goods being produced. Long run average cost includes the variation of quantities used for all inputs necessary for production.

Relationship Between Average and Marginal Cost

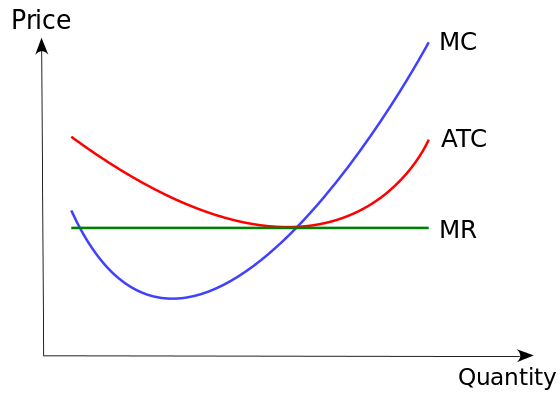

Average cost and marginal cost impact one another as production fluctuate:

Cost curve: This graph is a cost curve that shows the average total cost, marginal cost, and marginal revenue. The curves show how each cost changes with an increase in product price and quantity produced.

- When the average cost declines, the marginal cost is less than the average cost.

- When the average cost increases, the marginal cost is greater than the average cost.

- When the average cost stays the same (is at a minimum or maximum), the marginal cost equals the average cost.

Short Run and Long Run Costs

Long run costs have no fixed factors of production, while short run costs have fixed factors and variables that impact production.

learning objectives

- Explain the differences between short and long run costs

In economics, “short run” and “long run” are not broadly defined as a rest of time. Rather, they are unique to each firm.

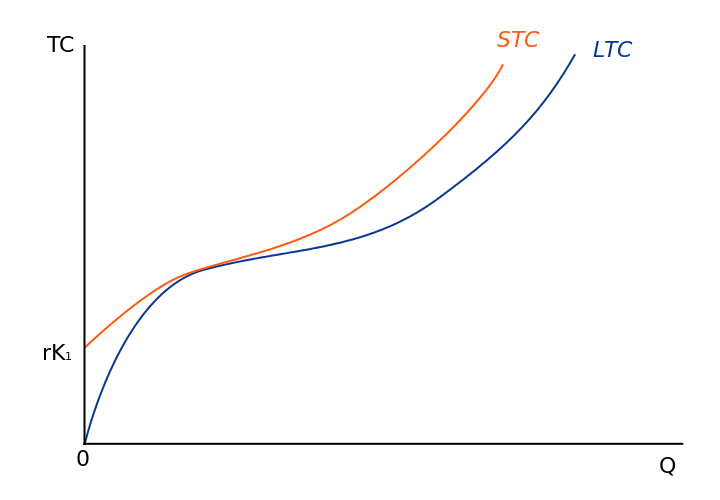

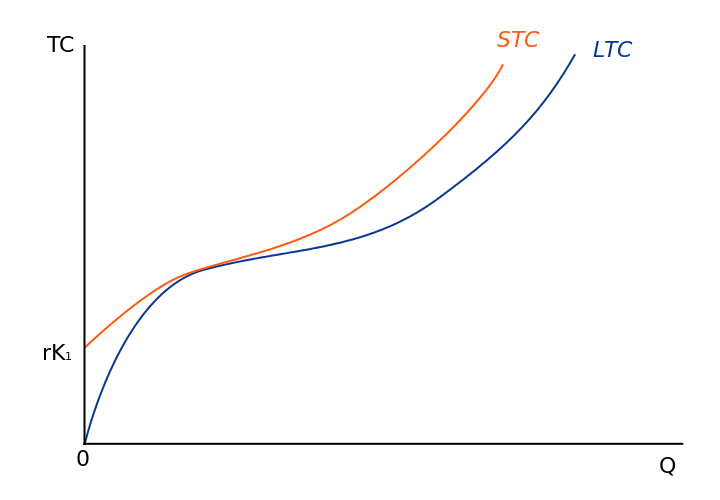

Long Run Costs

Long run costs are accumulated when firms change production levels over time in response to expected economic profits or losses. In the long run there are no fixed factors of production. The land, labor, capital goods, and entrepreneurship all vary to reach the the long run cost of producing a good or service. The long run is a planning and implementation stage for producers. They analyze the current and projected state of the market in order to make production decisions. Efficient long run costs are sustained when the combination of outputs that a firm produces results in the desired quantity of the goods at the lowest possible cost. Examples of long run decisions that impact a firm’s costs include changing the quantity of production, decreasing or expanding a company, and entering or leaving a market.

Short Run Costs

Short run costs are accumulated in real time throughout the production process. Fixed costs have no impact of short run costs, only variable costs and revenues affect the short run production. Variable costs change with the output. Examples of variable costs include employee wages and costs of raw materials. The short run costs increase or decrease based on variable cost as well as the rate of production. If a firm manages its short run costs well over time, it will be more likely to succeed in reaching the desired long run costs and goals.

Differences

The main difference between long run and short run costs is that there are no fixed factors in the long run; there are both fixed and variable factors in the short run. In the long run the general price level, contractual wages, and expectations adjust fully to the state of the economy. In the short run these variables do not always adjust due to the condensed time period. In order to be successful a firm must set realistic long run cost expectations. How the short run costs are handled determines whether the firm will meet its future production and financial goals.

Cost curve: This graph shows the relationship between long run and short run costs.

Economies and Diseconomies of Scale

Increasing, constant, and diminishing returns to scale describe how quickly output rises as inputs increase.

learning objectives

- Identify the three types of returns to scale and describe how they occur

In economics, returns to scale describes what happens when the scale of production increases over the long run when all input levels are variable (chosen by the firm). Returns to scale explains how the rate of increase in production is related to the increase in inputs in the long run. There are three stages in the returns to scale: increasing returns to scale (IRS), constant returns to scale (CRS), and diminishing returns to scale (DRS). Returns to scale vary between industries, but typically a firm will have increasing returns to scale at low levels of production, decreasing returns to scale at high levels of production, and constant returns to scale at some point in the middle.

Long Run ATC Curves: This graph shows that as the output (production) increases, long run average total cost curve decreases in economies of scale, constant in constant returns to scale, and increases in diseconomies of scale.

Increasing Returns to Scale

The first stage, increasing returns to scale (IRS) refers to a production process where an increase in the number of units produced causes a decrease in the average cost of each unit. In other words, a firm is experiencing IRS when the cost of producing an additional unit of output decreases as the volume of its production increases. IRS may take place, for example, if the cost of production of a manufactured good would decrease with the increase in quantity produced due to the production materials being obtained at a cheaper price.

Constant Return to Scale

The second stage, constant returns to scale (CRS) refers to a production process where an increase in the number of units produced causes no change in the average cost of each unit. If output changes proportionally with all the inputs, then there are constant returns to scale.

Diminishing Return to Scale

The final stage, diminishing returns to scale (DRS) refers to production for which the average costs of output increase as the level of production increases. The DRS is the opposite of the IRS. DRS might occur if, for example, a furniture company was forced to import wood from further and further away as its operations increased.

Economic Costs

The economic cost is based on the cost of the alternative chosen and the benefit that the best alternative would have provided if chosen.

learning objectives

- Break down the components of a firm’s economic costs

Economic Cost

Throughout the production of a good or service, a firm must make decisions based on economic cost. The economic cost of a decision is based on both the cost of the alternative chosen and the benefit that the best alternative would have provided if chosen. Economic cost includes opportunity cost when analyzing economic decisions.

An example of economic cost would be the cost of attending college. The accounting cost includes all charges such as tuition, books, food, housing, and other expenditures. The opportunity cost includes the salary or wage the individual could be earning if he was employed during his college years instead of being in school. So, the economic cost of college is the accounting cost plus the opportunity cost.

Components of Economic Costs

Economic cost takes into account costs attributed to the alternative chosen and costs specific to the forgone opportunity. Before making economic decisions, there are a series of components of economic costs that a firm will take into consideration. These components include:

- Total cost (TC): total cost equals total fixed cost plus total variable costs (TC = TFC + TVC).

- Variable cost (VC): the cost paid to the variable input. Inputs include labor, capital, materials, power, land, and buildings. Variable input is traditionally assumed to be labor.

- Total variable cost (TVC): same as variable costs.

- Fixed cost (FC): the costs of the fixed assets (those that do not vary with production).

- Total fixed cost (TFC): same as fixed cost.

- Average cost (AC): total costs divided by output (AC = TFC/q + TVC/q).

- Average fixed cost (AFC): the fixed costs divided by output (AFC = TFC/q). The average fixed cost function continuously declines as production increases.

- Average variable cost (AVC): variable costs divided by output (AVC = TVC/q). The average variable cost curve is normally U-shaped. It lies below the average cost curve, starting to the right of the y axis.

- Marginal cost (MC): the change in the total cost when the quantity produced changes by one unit.

- Cost curves: a graph of the costs of production as a function of total quantity produced. In a free market economy, firms use cost curves to find the optimal point of production (to minimize cost). Maximizing firms use the curves to decide output quantities to achieve production goals.

Key Points

- Total cost is the sum of fixed and variable costs.

- Variable costs change according to the quantity of a good or service being produced. The amount of materials and labor that is needed for to make a good increases in direct proportion to the number of goods produced. The cost “varies” according to production.

- Fixed costs are independent of the quality of goods or services produced. Fixed costs (also referred to as overhead costs) tend to be time related costs including salaries or monthly rental fees.

- Fixed costs are only short term and do change over time. The long run is sufficient time of all short-run inputs that are fixed to become variable.

- The marginal cost is the cost of producing one more unit of a good.

- Marginal cost includes all of the costs that vary with the level of production. For example, if a company needs to build a new factory in order to produce more goods, the cost of building the factory is a marginal cost.

- Economists analyze both short run and long run average cost. Short run average costs vary in relation to the quantity of goods being produced. Long run average cost includes the variation of quantities used for all inputs necessary for production.

- When the average cost declines, the marginal cost is less than the average cost. When the average cost increases, the marginal cost is greater than the average cost. When the average cost stays the same (is at a minimum or maximum), the marginal cost equals the average cost.

- In the short run, there are both fixed and variable costs.

- In the long run, there are no fixed costs.

- Efficient long run costs are sustained when the combination of outputs that a firm produces results in the desired quantity of the goods at the lowest possible cost.

- Variable costs change with the output. Examples of variable costs include employee wages and costs of raw materials.

- The short run costs increase or decrease based on variable cost as well as the rate of production. If a firm manages its short run costs well over time, it will be more likely to succeed in reaching the desired long run costs and goals.

- In economics, returns to scale describes what happens when the scale of production increases over the long run when all input levels are variable (chosen by the firm ).

- Increasing returns to scale (IRS) refers to a production process where an increase in the number of units produced causes a decrease in the average cost of each unit.

- Constant returns to scale (CRS) refers to a production process where an increase in the number of units produced causes no change in the average cost of each unit.

- Diminishing returns to scale (DRS) refers to production where the costs for production do not decrease as a result of increased production. The DRS is the opposite of the IRS.

- Economic cost takes into account costs attributed to the alternative chosen and costs specific to the forgone opportunity.

- Components of economic cost include total cost, variable cost, fixed cost, average cost, and marginal cost.

- Cost curves – a graph of the costs of production as a function of total quantity produced. In a free market economy, firms use cost curves to find the optimal point of production (to minimize cost). Maximizing firms use the curves to decide output quantities to achieve production goals.

- Average cost (AC) – total costs divided by output (AC = TFC/q + TVC/q).

- Marginal cost (MC) – the change in the total cost when the quantity produced changes by one unit.

- Cost curves – a graph of the costs of production as a function of total quantity produced. In a free market economy, firms use cost curves to find the optimal point of production (to minimize cost). Maximizing firms use the curves to decide output quantities to achieve production goals.

Key Terms

- fixed cost: Business expenses that are not dependent on the level of goods or services produced by the business.

- variable cost: A cost that changes with the change in volume of activity of an organization.

- marginal cost: The increase in cost that accompanies a unit increase in output; the partial derivative of the cost function with respect to output. Additional cost associated with producing one more unit of output.

- average cost: In economics, average cost or unit cost is equal to total cost divided by the number of goods produced.

- return to scale: A term referring to changes in output resulting from a proportional change in all inputs (where all inputs increase by a constant factor).

- economic cost: The accounting cost plus opportunity cost.

- cost: A negative consequence or loss that occurs or is required to occur.

- Opportunity cost: The cost of any activity measured in terms of the value of the next best alternative forgone (that is not chosen).

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

- variable cost. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/variable_cost. License: CC BY-SA: Attribution-ShareAlike

- Total cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Total_cost. License: CC BY-SA: Attribution-ShareAlike

- Variable cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Variable_cost. License: CC BY-SA: Attribution-ShareAlike

- Economic cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_cost. License: CC BY-SA: Attribution-ShareAlike

- Fixed cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Fixed_cost. License: CC BY-SA: Attribution-ShareAlike

- fixed cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fixed%20cost. License: CC BY-SA: Attribution-ShareAlike

- CVP-TC-FC-VC. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:CVP-TC-FC-VC.svg. License: CC BY-SA: Attribution-ShareAlike

- marginal cost. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/marginal_cost. License: CC BY-SA: Attribution-ShareAlike

- Marginal cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Marginal_cost. License: CC BY-SA: Attribution-ShareAlike

- Average cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Average_cost. License: CC BY-SA: Attribution-ShareAlike

- average cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/average%20cost. License: CC BY-SA: Attribution-ShareAlike

- CVP-TC-FC-VC. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:CVP-TC-FC-VC.svg. License: CC BY-SA: Attribution-ShareAlike

- Costcurve - Combined. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...-_Combined.svg. License: CC BY-SA: Attribution-ShareAlike

- variable cost. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/variable_cost. License: CC BY-SA: Attribution-ShareAlike

- Long run and short run. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Long_run_and_short_run. License: CC BY-SA: Attribution-ShareAlike

- Economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economi...and_efficiency. License: CC BY-SA: Attribution-ShareAlike

- Average cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Average_cost. License: CC BY-SA: Attribution-ShareAlike

- fixed cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/fixed%20cost. License: CC BY-SA: Attribution-ShareAlike

- CVP-TC-FC-VC. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:CVP-TC-FC-VC.svg. License: CC BY-SA: Attribution-ShareAlike

- Costcurve - Combined. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...-_Combined.svg. License: CC BY-SA: Attribution-ShareAlike

- Relationship between Long-run Cost Curve and Short-run Cost Curve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...Cost_Curve.svg. License: CC BY-SA: Attribution-ShareAlike

- economies of scale, diseconomies of scale, constant returns to scale. Provided by: mbaecon Wikispace. Located at: mbaecon.wikispaces.com/econom...turns+to+scale. License: CC BY-SA: Attribution-ShareAlike

- Returns to scale. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Returns_to_scale. License: CC BY-SA: Attribution-ShareAlike

- return to scale. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/return%20to%20scale. License: CC BY-SA: Attribution-ShareAlike

- average cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/average%20cost. License: CC BY-SA: Attribution-ShareAlike

- CVP-TC-FC-VC. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:CVP-TC-FC-VC.svg. License: CC BY-SA: Attribution-ShareAlike

- Costcurve - Combined. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...-_Combined.svg. License: CC BY-SA: Attribution-ShareAlike

- Relationship between Long-run Cost Curve and Short-run Cost Curve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...Cost_Curve.svg. License: CC BY-SA: Attribution-ShareAlike

- MBAecon - economies of scale, diseconomies of scale, constant returns to scale. Provided by: Wikispaces. Located at: mbaecon.wikispaces.com/econom...turns+to+scale. License: CC BY-SA: Attribution-ShareAlike

- Marginal cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Marginal_cost. License: CC BY-SA: Attribution-ShareAlike

- Economic cost. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_cost. License: CC BY-SA: Attribution-ShareAlike

- Cost curve. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Cost_curve. License: CC BY-SA: Attribution-ShareAlike

- Boundless. Provided by: Boundless Learning. Located at: www.boundless.com//economics/.../economic-cost. License: CC BY-SA: Attribution-ShareAlike

- cost. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/cost. License: CC BY-SA: Attribution-ShareAlike

- Opportunity cost. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/Opportunity+cost. License: CC BY-SA: Attribution-ShareAlike

- CVP-TC-FC-VC. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:CVP-TC-FC-VC.svg. License: CC BY-SA: Attribution-ShareAlike

- Costcurve - Combined. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...-_Combined.svg. License: CC BY-SA: Attribution-ShareAlike

- Relationship between Long-run Cost Curve and Short-run Cost Curve. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi...Cost_Curve.svg. License: CC BY-SA: Attribution-ShareAlike

- MBAecon - economies of scale, diseconomies of scale, constant returns to scale. Provided by: Wikispaces. Located at: mbaecon.wikispaces.com/econom...turns+to+scale. License: CC BY-SA: Attribution-ShareAlike