6.2: Chapter 37- The Scope and Size of the Federal Government

- Page ID

- 73478

Scope of the Federal Government

When we refer to the federal government’s scope, we are talking about the range of things that it does. People categorize federal government’s activities in numerous different ways. This is one way of looking at them:

Social Welfare—This government activity encompasses programs such as Social Security, Medicare, Medicaid, and the Supplemental Nutrition Assistance Program, among others. Social welfare programs are located throughout the federal bureaucracy.

War-Making—This activity, which is now under the auspices of the Department of Defense—we used to call it the Department of War—encompasses the branches of the armed services (e.g., Army, Navy, Air Force) and represents the United States’ ability to project armed destruction around the globe. It is also responsible for the more than 700 military bases that the Defense Department maintains in the United States and around the world.

Diplomacy—The Department of State is responsible for diplomacy and for carrying out America’s non-military foreign policy.

Justice and Law Enforcement—The Department of Justice handles all federal criminal prosecutions and civil suits in which the U.S. government has an interest. It also contains within it the Federal Bureau of Investigation (FBI); the Drug Enforcement Agency (DEA); the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF); and the U.S. Marshalls Service. Also included in this category is the Department of Homeland Security, which includes the Coast Guard; Immigration and Customs Enforcement (ICE); Customs and Border Protection; and the Federal Emergency Management Agency (FEMA); among many others.

Commerce—A number of federal agencies exist to promote commerce of one sort or another: The Commerce Department, the Department of Agriculture, and the Department of the Interior are the most prominent.

Fiscal and Monetary Issues—The Treasury Department manages the federal government’s finances, manages tax collection through the Internal Revenue Service (IRS), services the federal debt, supervises financial institutions, and goes after counterfeiters. The Federal Reserve System, a quasi-public, quasi-private central banking system for the United States, is charged with stabilizing prices and maximizing employment—two functions that can be at loggerheads. It accomplishes these tasks by adjusting interest rates.

Infrastructure—The Department of Transportation promotes and regulates transportation, including the Federal Highway Administration (FHWA), the Federal Aviation Administration (FAA), and the National Highway Traffic Safety Administration (NHTSA). We can also include in this category the Department of Energy which, among other things, regulates nuclear power stations and the country’s national electricity grids. Finally, the Department of Housing and Urban Development (HUD) belongs in this category.

Human Services—The Department of Health and Human Services contains, among many others, the Centers for Disease Control and Prevention (CDC), the National Institutes of Health (NIH), and the Food and Drug Administration (FDA). It administers Medicare and Medicaid. We can also put the Department of Education and the Environmental Protection Agency in the Human Services category. We can put the Department of Veterans Affairs here as well, although some would argue that it fits better in the War-Making category because its expenses are a direct result of our war-making and our preparations for war-making. The Department of Labor deals with worker safety, compensation, and working conditions.

Another way to understand the federal government’s scope and size is through an historical lens—by looking at the year in which cabinet-level departments were created. (3)

| Department | Year Established |

|---|---|

| State | 1789 |

| Treasury | 1789 |

| Justice | 1789 |

| War/Defense | 1789/1949 |

| Interior | 1849 |

| Agriculture | 1889 |

| Commerce | 1913 |

| Labor | 1913 |

| Health and Human Services | 1953 |

| Housing and Urban Development | 1965 |

| Transportation | 1966 |

| Energy | 1967 |

| Environmental Protection Agency | 1970 (elevated to cabinet level in 1990) |

| Education | 1979 |

| Veterans Affairs | 1987 |

| Homeland Security | 2002 |

Size of the Federal Government

We can understand the size of the federal government by asking a few basic questions.

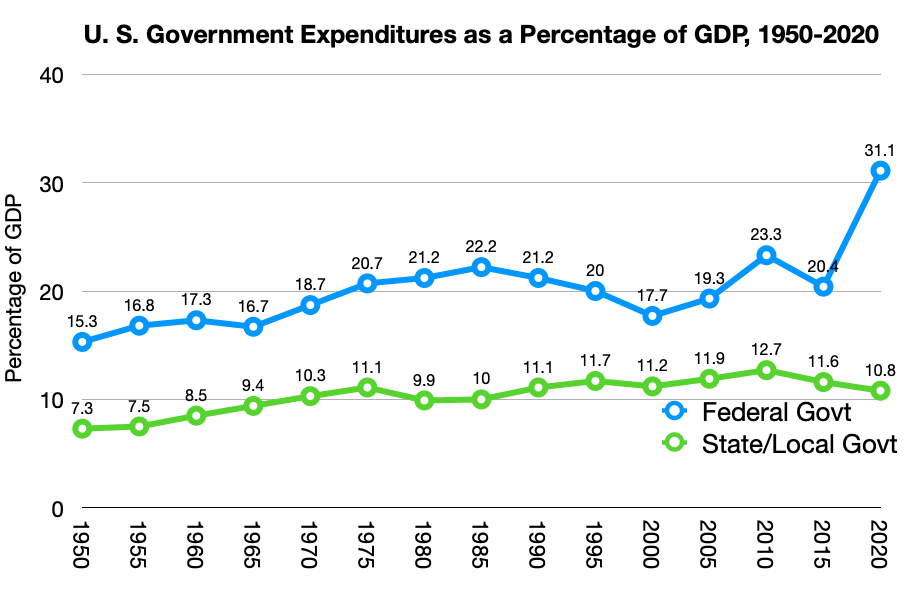

How much does the federal government spend? According to the Treasury Department, in 2021, the federal government spent about $6.8 trillion and took in about $4 trillion in revenue. (4) The first thing we should notice is that the annual deficit—the shortfall between revenue and spending—is more than two trillion dollars. The next thing to notice is that $6.8 trillion dollars is a great deal of money. One way to put the federal government’s size in perspective is to see how much it spends relative to the overall size of the American economy, and also how its spending compares to that of state governments.

How many people does the federal government employ? As with many such questions, the answer depends on who you want to count. According to the Office of Personnel Management, as reported by the Congressional Research Service, there are about 2.1 million federal government civilian employees. (6) There are an additional 1.3 million active duty military and Coast Guard employees. (7) Add those two figures together and we have about 3.4 million federal government employees, but that’s not the whole picture. The federal government conducts much work using private contractors—employing people as diverse as private sector soldiers engaged in war zones and janitors hired to maintain federal buildings. Paul Light, New York University public service professor, estimates that the federal government employs some 3.7 million private contractors, plus nearly 500,000 Postal Service employees who are not counted in our federal civilian employee tally. (8) Add them all up, and we can safely say that between 7 and 8 million people directly owe their livelihoods to a federal government paycheck—out of a population of over 330 million people.

What is the size and impact of federal regulations? Another way to understand the federal government’s size is to understand how many regulations it issues and what impacts they have. According to the Federal Register, the federal regulations code totaled 9,745 pages in 1950 and had grown to 185,484 pages by 2018. (9) These regulations range from the Fair Labor Standards Act requirement for companies to pay overtime for nonexempt employees who work more than forty hours per week, to the Affordable Care Act’s provision banning private health insurance companies from denying coverage to people who have pre-existing medical conditions or from charging them more.

Corporations and the spokespeople they fund inevitably argue that federal regulations are too costly and won’t provide benefits worth the costs. This argument is almost always wrong. A Pew Charitable Trusts’ analysis concluded that “Historically, compliance costs have been less and benefits greater than industry predictions, and regulation typically poses little challenge to economic competitiveness.” (10) Their analysis showed that regulation-compliance costs were always lower than the industries said they would be, for example, for fighting acid rain, mandating seat belts and air bags in cars, mandating emissions changes to cars, banning chlorofluorocarbons that were putting a hole in the earth’s ozone, and others. Further, these kinds of regulations pay enormous societal benefits. Mandatory seat belts have saved more than 7,000 lives per year, and the ban on chlorofluorocarbons led to cheaper substitutes that have saved businesses and customers billions of dollars. In a federal regulation costs and benefits review of a single decade, the Office of Management and Budget (OMB) estimated that regulations cost businesses and consumers between $74 and $110 billion but provided between $269 and $872 billion worth of benefits. (11)

The U.S. tax code may be a different matter. If we consider the federal tax code as a form of regulation, we can say with confidence that this particular regulation is excessively complex and burdensome, especially when compared to other developed countries’ tax systems. The American tax code is several thousand pages long and so complex that the Internal Revenue Service Taxpayer Advocate publishes an annual tax system roadmap that is, itself, byzantine. Tax compliance is a multibillion-dollar business in the United States, compared to a country like Japan, whose government collects withholdings so precisely that most workers don’t even have to file a tax return. (12) Tax compliance costs refer to the time, accountants, software, lawyers and other expenses that individuals, families, nonprofit organizations, and businesses need to complete their taxes. Obviously, low and middle-income families who take the standard deduction aren’t spending a great deal in tax compliance costs, but wealthy families and businesses go to considerable lengths to exploit the loopholes built into the tax code. That takes time and the employment of specialists who know the code. In terms of time alone, U.S. tax-system compliance may run as high as 8 billion hours of work, even after the 2017 tax bill’s simplifications. (13)

Historical Evolution of the Federal Government

From our perspective, the federal government didn’t do much during its first eighty years. It delivered the mail. It fought wars and conducted foreign policy. It created its own bank. It taxed imports, regulated the money supply, and granted patents. It fought amongst itself over the issue of slavery and admitted new states to the union. We can say without being too facetious, that that’s about it. It didn’t have any environmental regulations. No worker safety, pay, or hours-regulations either. It didn’t promote energy efficiency or public health. It didn’t smooth out economic downturns through its social welfare programs—because it didn’t have any. For even longer than its first eighty years, its peacetime military was miniscule compared to the size of the country. It didn’t have a space program or fund inoculations. It didn’t defend people’s civil rights—again, for much longer than its first eighty years.

Pre-Civil War-era per-capita federal government spending hovered around $30. In the years following World War I, federal government spending had risen to about $129 per person. By 2004, it had reached $7,100 per capita. (14) A back-of-the envelope calculation using OMB and Census information indicates that currently the federal government is spending about $13,800 per person. The federal government generally balanced its budget during peacetime until the 1930s. A balanced budget means that spending matches tax receipts. Since the 1930s, the federal government has generally not balanced its budget—except during the Clinton administration—instead, the government finances its annual deficits by selling Treasury notes to domestic and international investors.

The federal government has grown due to four main reasons, with which you should be familiar. One impetus for government expansion has been war. Prosecuting and financing warfare were and is an important factor in government growth, from the first city states through the modern world’s great power competition. (15) Federal spending spiked during the Civil War, World War I, World War II, the Korean War, the Cold War, the Vietnam War, and the War on Terror. Military equipment had to be built; troops trained, paid, and veterans cared for; and oil had to be purchased so that America could project power to conflict zones—the U.S. military has long been one of the world’s largest emitters of greenhouse gases. Government grew during wartime as it curtailed civil liberties and propagandized its own people to maintain civilian morale and to sufficiently demonize the enemy. To finance war, it had to raise taxes and sell war bonds and other financial instruments. During World War I, the United States government established the War Industries Board, the War Finance Corporation, and the National War Labor Board to coordinate industrial production and labor relations—a set of government operations that didn’t just fade away after the war ended. (16) Similar government economic regulations ramped up during World War II as well. Cold War competition with the Soviet Union stimulated everything from atomic weapons and power development to the interstate highway system, commercial airlines, GPS and weather satellites, to the internet.

Another element driving federal government expansion has been corporate demand. Many people operate under the myth that government and business are implacable enemies. One does not have to buy into the Marxist idea that government is merely the tool of the capitalist class, to realize that government and businesses are in a symbiotic relationship. While businesses chafe from time to time at “too much” government regulation, on the whole, businesses benefit from the stability and predictability afforded by government regulating the economy. Witness the way that regulation of commercial drones allowed their use in a way that was standardized, predictable, and economically viable. (17) Such was the case with electricity, automobiles, airlines, pharmaceuticals, cellular communications, and every other large, complex industry. On a more basic level, myriad businesses benefit from publicly financed infrastructure—which we can broadly define to include everything from roads and bridges to schools and sanitation systems. Indeed, note that people debilitated by illiteracy or easily preventable diseases tend not to talk on their cell phones while driving their cars to their jobs in the biotech industry. Business leaders know this basic fact, even though they may balk at paying their fair share of the taxes needed to provide the seeds of economic vitality.

Finally, we can talk about direct government intervention that props up businesses and entire industries. Where would the nuclear power industry be without federally subsidized liability insurance? Where would the automobile industry be without federally subsidized highways, access to cheap oil courtesy of the U.S. military, and auto manufacturers post-Great Recession federal bailout? Where would the airlines be without government support for airports, the security and safety provisions that make us feel reasonably safe, and the Federal Aviation Administration’s domestic airspace regulations? If the government didn’t provide these supports, businesses would quickly go bankrupt trying to fund them.

Popular demand is another significant reason for the federal government’s growth. The federal government has grown because the people have demanded that it solve real problems. Political Scientist Douglas Amy put it best:

[B]ig government is not something that has been forced on Americans by liberal elitists and power-hungry bureaucrats. We have it because we ourselves have demanded big government to deal with the many big problems we have faced in our society. We have called for big government programs when it has been obvious that there are serious problems that cannot be solved through individual effort or by the natural workings of the free market. (18)

Think about the various problems that transcend state boundaries that are too large and/or complex for community-based solutions. People have demanded national efforts to clean the water and air; to ensure that people have equal employment opportunity regardless of sex, race, religion, or national origin; to fight the scandal of old-age poverty and ill-health; to counter the monopoly power of railroads, steel companies, and internet platforms; to provide health coverage when the market finds it profitable to let poor people die untreated in the car they happen to be living in; to protect national parks and public lands; to interdict and disrupt domestic and international terrorists. Government is good when it responds to problems articulated by the general population. People can argue about the particular form that the government response takes—whether this healthcare policy is better than that or whether air pollution is best fought via specific regulations or fossil fuel taxes—but they recognize that collective action through government is the best chance we have to avoid the brutal and nasty conditions that are the calling card of anarchy, which is literally the absence of government.

In addition, in the decades after the Civil War, American capitalism grew into a particularly aggressive and socially destructive type—note that capitalism comes in a variety of flavors, some of which are much more palatable than are others—and this fact engendered public demand for action. As Matt Stoller, Open Markets Institute fellow, writes, “The people organized for their rights against these new private centralizing corporations and an unstable political economy.” (19) Americans have used government to struggle against monopolized economic power from the late nineteenth century’s Gilded Age until the Obama administration’s capitulation in the wake of the Great Recession. Thus, government took on powers to try to deal with the external aspects of America’s particular brand of capitalism—the ruined farmers, exploited workers, monopolies’ excesses, pollution, bad food, dangerous or worthless drugs, the financial speculation, and the invasions of privacy. Ordinary people simply cannot deal with the predations of America’s brand of capitalism without attempting to bring in government, which is the only comparably powerful societal force that can—potentially—stand up to concentrated economic power. In her history of capitalism, historian Joyce Appleby argued that the American founders’ preferences for limited government were “undermined” by “the new concentration of power in industrial corporations,” but it took until well after the Civil War “for the public to realize the need for a government equipped to monitor and curtail the great industrial enterprises.” (20)

The final reason government has expanded in the United States and virtually everywhere is societal density and complexity. The earliest political states organized within dense people-groupings who engaged in the radically complex, up to then, practice of growing food and domesticating animals. As political scientist James Scott writes, “The imperative of collecting people, settling them close to the core of power, holding them there, and having them produce a surplus in excess of their own needs animates much of early statecraft.” (21) In many ways, settled agricultural society was a step backwards for human freedom and health. (22) However, it certainly became increasingly complex. For thousands of years, government size has reflected the types of societies they governed: While agrarian societies were vastly more socially dense and complex than hunter-gatherer life, they pale in comparison to the scale and complexity of the industrialized and urbanized societies that developed in the latter part of the nineteenth century. In 1880, fully 50 percent of the American population worked on farms, but by 1920, only 25 percent did. Also, by 1920, the majority of Americans lived and worked in urban centers. (23) According to the Census Bureau, the American population exploded from 50 million in 1880 to 106 million in 1920.

Societal density and complexity have real consequences for governance. You’ve heard the old saying: “Your right to swing your arm ends when it meets my face.” In a society with a geographically dispersed population, people simply come into conflict with each other less often, so there is not as much need for police, courts, laws, and regulations. Complexity and social density act together to promote bigger government because of the rising number and scope of individual and group conflicts. As anthropologist Joseph Tainter made clear, complexity in society gives rise to ever more sophisticated and robust problem-solving mechanisms and processes—most of which involve government. (24) Geographer Jared Diamond reiterated Tainter’s point by writing that the “prerequisites for communal decision-making become unattainable in much larger communities,” and that “a large society must be structured and centralized if it is to reach decisions effectively.” (25)

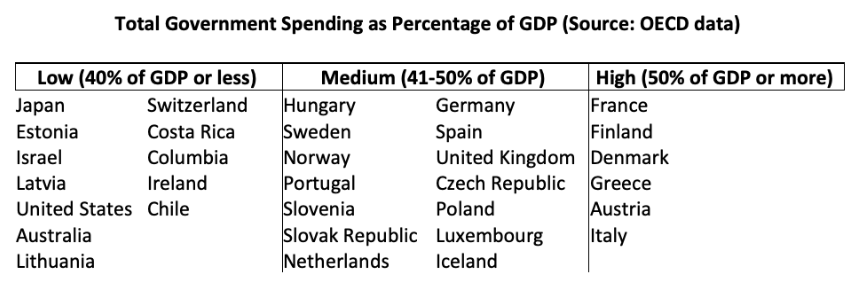

The reasons for growth in the American government—war, corporate demands, popular demands, and social density and complexity—operate on governments all over the world, so the U.S. federal government is not unusual in this respect. To be clear, these factors operate on liberal democracies and authoritarian regimes alike.

References

- Brian Maffly, “A Search for an Ancient Crocodile in Utah’s Bears Ears Leads to a Major Discovery of Triassic Fossils,” The Salt Lake Tribune. February 24, 2018.

- Noel Kirkpatrick, “Ancient Fossils Found on Lands Once Part of Bears Ears National Monument,” Mother Nature Network. February 26, 2018.

- Thomas A. Garrett and Russell M. Rhine, “On the Size and Growth of Government,” Federal Reserve Bank of St. Louis Review. January/February 2006.

- U.S. Treasury Historical Tables.

- The Office of Management and Budget.

- Congressional Research Service, Federal Workforce Statistics Sources: OPM and OMB. October 24, 2019. Page 4.

- The Department of Defense.

- Paul C. Light, The True Size of Government. The Volcker Alliance Issue Paper. October 2017. Page 3.

- Statistics from the Federal Register.

- Pew Charitable Trusts, Government Regulation: Costs Lower, Benefits Greater than Industry Estimates. May 2015. Page 1.

- The Office of Management and Budget, 2016 Draft Report to Congress on the Benefits and Costs of Federal Regulations and Agency Compliance with the Unfunded Mandates Reform Act.

- Taxpayer Advocate Service Roadmap. Selena Maranjian, “You Won’t Believe How Complex Our Tax System Is—Here’s How to Make Sense of It,” The Motley Fool. July 21, 2019. Demian Brady, “U.S. Tax System Lags in International Comparison,” National Taxpayer Union Foundation. May 1, 2017.

- Demian Brady, “Trump Tax Cuts Eased Complexity and Compliance Burden on American Taxpayers,” Townhall. April 16, 2019.

- Thomas A Garrett and Russell M. Rhine, “On the Size and Growth of Government,” Federal Reserve Bank of St. Louis Review. January/February 2006.

- James C. Scott, Against the Grain. A Deep History of the Earliest States. New Haven, CT: Yale University Press, 2018. Pages 150-182. Paul Kennedy, The Rise and Fall of the Great Powers: Economic Change and Military Conflict from 1500 to 2000. New York: Random House, 1987.

- Paul Johnson, A History of the American People. New York: Harper Collins, 1997. Pages 646-647.

- Dave Marcontell and Steve Douglas, “Why the Use of Drones Still Faces Big Regulatory Hurdles,” Forbes. September 10, 2018. Traci Browne, “Police Drones Market Increases with FAA Rules, Test Cases,” Robotics Business Review. May 8, 2017.

- Douglas J. Amy, “The Real Reason for Big Government,” Huffington Post. August 8, 2012.

- Matt Stoller, Goliath: The 100-Year War Between Monopoly Power and Democracy. New York: Simon and Schuster, 2019. Page 9.

- Joyce Appleby, The Relentless Revolution. A History of Capitalism. New York: W. W. Norton & Company. Pages 216-217.

- James C. Scott, Against the Grain. A Deep History of the Earliest States. New Haven, CT: Yale University Press, 2018. Page 151.

- Richard Manning, Against the Grain: How Agriculture Has Hijacked Civilization. New York: North Point Press, 2004.

- Jill Lepore, These Truths. A History of the United States. New York: W. W. Norton & Co. 2018. Page 375.

- Joseph A. Tainter, The Collapse of Complex Societies. Cambridge, UK: Cambridge University Press, 1988. Note that Tainter’s thesis is that as complexity increases and resources are stretched thin, there is a diminishing marginal return on increased investments in complexity, leading to societal collapse.

- Jared Diamond, Guns, Germs, and Steel. The Fates of Human Societies. New York: W. W. Norton & Company, 1997. Page 287.

Media Attributions

- Budget GDP 2020a © David

- Spending OECD