Learning Objectives

By the end of this section, you will be able to:

- Explain the different types of taxes

- Be familiar with the various revenue sources for Texas

- Explain the budgetary process of Texas

- Explain the budget expenditures of Texas

Taxation

Any government relies on a variety of taxes in order to make revenue to spend on public services. There are different types of taxes:

- Income tax– taxes collected from an individual’s income (There is no state income tax in Texas);

- General sales tax– based on taxes collected from retail prices of items;

- Excise tax– taxes collected on specific products such as tobacco and gasoline;

- Ad valorem tax– taxes based according to the value of the property.

The federal government’s number one tax source for revenue is income tax- The 16th Amendment of the United States Constitution authorized an income tax. The state of Texas’ main revenue source are from sales tax. Article 8 of the Texas Constitution describes the “Taxation and Revenue” specifics. Local governments heavily rely on property taxes as their main source of tax revenue.

Other Revenue Sources

There are also other tax revenue sources that the state of Texas receives from various sources such as:

- Federal grants in aid– these types of funds come from the federal government to aid state or local governments, and sometimes require matching monies from the receiving government and/or are to be used for a specific use.

- Borrowing– The Texas Constitution does allow for the state or local governments to borrow funds through bonds. There are two types of bonds:

- General-obligation bonds: Bonds repaid from taxes, usually approved by taxpayers through vote;

- Revenue bonds: Typically paid through the revenue made from the projects created by the bond i.e. sports facilities, public college dorms.

- Economic Stabilization Fund– The “Rainy Day Fund” is a type of savings account for the state of Texas. Since 1990, any surplus from previous budget cycles, and collections from oil and gas production are deposited in to this account- the Texas Constitution limits the balance of the Rainy Day Fund to no more than 10% of the general revenue deposited during the preceding budget cycle. At the end of fiscal year 2016, Texas’ Rainy Day Fund was approximately $9.7 billion dollars. The Texas Constitution authorizes the Legislature to utilize monies from the Rainy Day Fund for a budget deficit, projected revenue shortfall, or any other purpose they choose.

- “Appropriations for the first two circumstances require approval by three-fifths of the Legislature, while a general-purpose appropriation needs a two-thirds majority for passage. The Legislature has made seven appropriations totaling $10.6 billion from the ESF since its inception, most recently in 2013. All were approved by two-thirds votes. The purposes for these appropriations have included water projects, disaster relief, public education, economic development and health and human services. Only one appropriation—$3.2 billion in 2011, representing 34 percent of the fund balance at that time—was made to cover a budget gap (for fiscal 2011).”

Texas Revenue

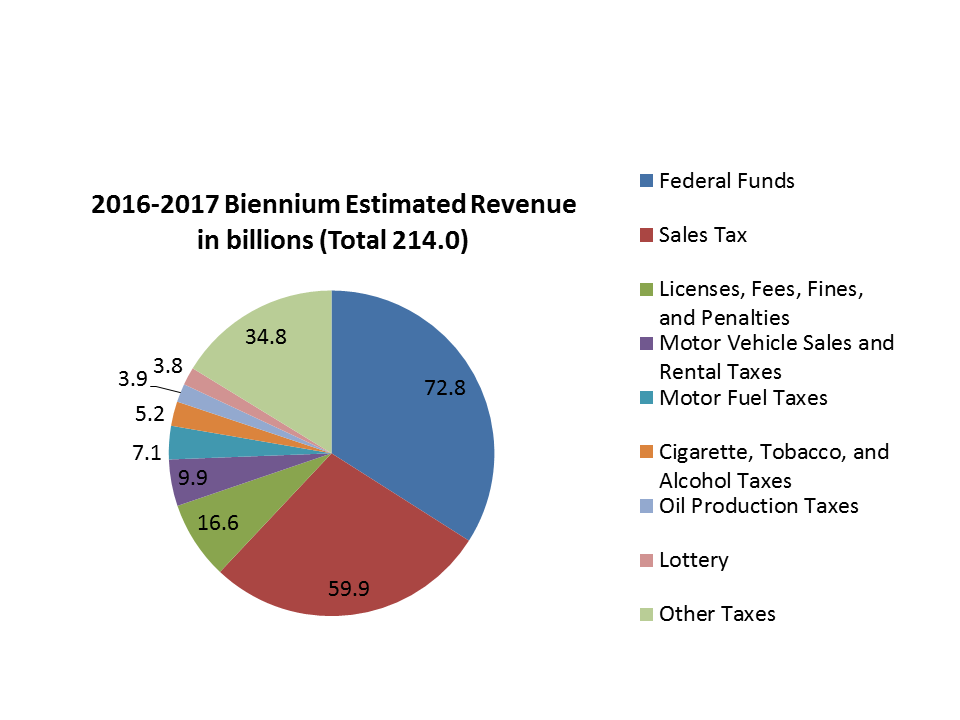

The tax revenue of Texas for 2016-2017 biennium

The estimated total state revenue for the 2016-2017 biennium is $214 billion dollars. The percentage breakdown for certain line items is: 34% will come from federal funds; 28% will be derived from sales taxes; 8% from licenses, fees, fines and penalties; 2.4% from cigarette, tobacco, and alcohol taxes; and 1.8% from the lottery.

Contributors and Attributions

CC licensed content, Original