10.4: Special Purpose Districts

- Page ID

- 129195

The most numerous Texas governmental organizations are special purpose districts. Special purpose districts are independent governmental units that exist as separate entities with administrative and fiscal independence from other local government units. In a publication by the Texas Senate Research Center, they are referred to as invisible governments because people know so little about their function or structure. Many citizens may not be aware of these special districts until they buy a home and find out that there are special districts that have the ability to tax their property, like school districts or community college districts. Most find their legality in Articles 3, 9, and 16 of the Texas Constitution. Originally, they were created to provide infrastructure or to levy taxes in limited circumstances like firefighting or road construction or water and sewage treatment. Today, these districts can have broad powers, including:

- imposing a property tax;

- imposing a sales tax;

- issuing bonds and borrowing money;

- contracting with other entities;

- suing and being sued;

- acquiring, purchasing, selling, or leasing personal property.

Of course, with these “invisible governments”, problems can arise. First, more layers of government can result in inefficiency, redundancy, and waste. Second, the potential for rising property taxes. There is also a question of accountability in how much value is added to the community. Finally, there is concern about transparency and the public actually understanding how their tax dollars are being spent.13

Some counties also have the power of eminent domain, the right of government to take private property for public use, with payment of compensation. The plan to build a high speed railroad that could deliver passengers between Dallas and Houston known as the Texas Bullet

Train sounds like a great idea, but the people who own the land along the proposed plan have other ideas.

The reasons for creating special districts usually arise when it is difficult for local government to provide some of the services needed. For instance, flood control crosses city and/or county lines. It may be difficult for cities or counties to finance these projects. Many times political leaders may want to turn over the responsibility to another entity so it is no longer its problem. They offer flexibility and usually do not conflict with the existing local government. Special districts are mostly apolitical, so it has helps to reduce conflict. Developers will create special districts to help fund roads, water or sewer lines. And, economic development districts have the ability to collect taxes to use for its projects.

Funding for special districts can come from a variety of taxes including property taxes, sales taxes, or hotel/motel occupancy taxes. They can also raise revenue through fees such as water and sewer usage fees, garbage pickup fee, tuition payments or toll road fees. Additionally, special districts can issue bonds to fund projects.

The most visible and understood special purpose districts are the independent school districts. But there are special districts for community colleges, water and waste management, economic and community development, health and safety, agricultural development, transportation, and conservation. As of July 2014, there are approximately 3,350 special districts and almost 2,000 of those report to the Office of the Comptroller of Public Accounts.14

Education

Education is the most recognized form of a special purpose district.

Independent School Districts Texas has 1,108 independent school districts, including charter, university, and military schools. Charter schools are not subject to the same state laws than regular independent school districts, but they are monitored under the statewide testing, and accountability system. Community Colleges and Universities may apply to house a high school program on its campuses where students take both high school and college level courses. The military school districts are for children of military members and civilian employees residing in or employed on a military base. School districts can be created by a petition signed by ten percent of registered voters which is presented to the county judge. The county judge will then order an election for approval by the voters. Another way a school district can be created is by detaching territory from an existing school district and attaching it to a school district that is contiguous to the detached territory. This requires multiple steps and approval by both boards of trustees and the voters in each territory. Two or more school districts may be consolidated if approved by the boards of trustees and the voters of both districts.

Independent school districts are governed by a board of three, five, or seven trustees who can serve three or four year terms. They can be elected from single-member districts or from the district at-large and the elections are non-partisan. The board of trustees have the power to govern and oversee the management of the school district, adopt an annual budget, and set the tax rate each fiscal year. School districts rely on property taxes as the local funding source, but since property values vary across the state, this amount of money also varies across school districts. The state supplements this variation by providing aid to the school districts.

Charter schools were created to improve student learning, increase choice, provide opportunities to attract new teachers, and encourage innovative learning methods. They are funded primarily by the state, but also receive federal funding in addition to grants and local donations. There are four types of charters.

- Home-rule school district charters are adopted by the independent school district wanting to change all of its schools into charter schools.

- Campus program charter schools were once a school in a district that wanted to transition to a charter school.

- Open-enrollment charter schools are nonprofit organizations authorized by the State Board of Education. Most charter schools fall into this group.

- College or university charter schools are developed by higher education institutions.

Community Colleges Public community colleges are two-year institutions that serve local taxing districts and service areas that offer vocational, technical and academics courses that lead to certification or an associate degree. They play an important role in helping to develop the workforce and to prepare students to move to the university level to complete their academic studies. Community colleges in Texas have open-admission policies and they offer continuing and remedial education along with counseling and guidance programs. The first community college district was Blinn College established in 1883. Today, there are fifty community college districts. The following Table 10.1 shows the list of community colleges by geographic region and highlights the larger community college districts.

| Texas Comptroller Region | Community College District | Enrollment |

| Alamo Region | Alamo Community College | 60,818 |

| Victoria College | 3,827 | |

| Capital Region | Austin Community College | 38,362 |

| Central Texas Region | Blinn College | 19,113 |

| Central Texas College | 9,976 | |

| Hill College | 4,421 | |

| McLennan Community College | 8,954 | |

| Temple College | 4,910 | |

| Gulf Coast Region | Alvin Community College | 5,645 |

| Brazosport College | 4,304 | |

| College of the Mainland Community College | 4,673 | |

| Galveston College | 2,423 | |

| Houston Community College | 48,309 | |

| Lee College | 7,773 | |

| Lone Star College System | 78,244 | |

| San Jacinto Community College | 37,895 | |

| Wharton County Junior College | 6,768 | |

| High Plains Region | Amarillo College | 9,844 |

| Clarendon College | 1,633 | |

| Frank Phillips College | 1,452 | |

| South Plains College | 9,279 | |

| Metroplex Region | Collin County Community College | 32,846 |

| Dallas County Community College | 80,627 | |

| Grayson College | 4,284 | |

| Navarro College | 8,463 | |

| North Central Texas College | 10,171 | |

| Tarrant County College | 56,941 | |

| Trinity Valley Community College | 6,562 | |

| Weatherford College | 6,284 | |

| Northwest Region | Cisco College | 3,358 |

| North Central Texas College | 10,171 | |

| Ranger College | 2,399 | |

| Vernon College | 3,055 | |

| Western Texas College | 2,179 | |

| Southeast Region | Angelina College | 4,819 |

| South Texas Region | Coastal Bend College | 4,633 |

| Del Mar College | 11,867 | |

| Laredo Community College | 10,145 | |

| South Texas College | 31,640 | |

| Southwest Texas Junior College | 6,894 | |

| Texas Southmost College | 7,130 | |

| Upper East Region | Kilgore College | 5,294 |

| Northeast Texas Community College | 3,090 | |

| Panola College | 2,771 | |

| Paris Junior College | 4,959 | |

| Texarkana College | 4,234 | |

| Trinity Valley Community College | 6,562 | |

| Tyler Junior College | 10,019 | |

| Upper Rio Grande Region | El Paso Community College | 28,241 |

| West Texas Region | Howard County Junior College | 4,510 |

| Midland College | 5,259 | |

| Odessa College | 6,571 |

Table 10.1 Texas Community College Districts by Comptroller Region Fall 2018 SOURCE: Texas Comptroller of Public Accounts and Texas Higher Education Coordinating Board. List of the community colleges in Texas by region.

Austin Community College has recently partnered with Apple to launch a new app development program (Figure 10.4).

If citizens are interested in establishing a community college district, they must appoint a steering committee to provide leadership. The steering committee will circulate a petition that must be signed by at least ten percent of the registered voters in the proposed district. This petition is sent to the Higher Education Coordinating Board and if approved, then an election will be held for majority approval. These colleges receive funding from the state based on a funding formula. The community college non-partisan, elected board of trustees also raise local money through property taxes and through tuition and fees.

Economic and Community Development

The Texas Constitution was amended in 1987 to recognize the importance of economic development when it serves a public purpose. Special purpose districts can be created to support Arts and Entertainment Districts, Sports Facility Districts, Water Control and Preservation Districts, or Library Districts.

Public Improvement Districts can assist developers in infrastructure improvements such as streets, water and sewer lines, landscaping, sidewalks, or parking facilities. Procedures vary with the different districts, but typically most are governed by an appointed board. The voters have the option of using the local sales tax to help finance the community’s economic development projects.

Water and Waste Management For years, lawmakers have been concerned with making sure that Texas water supplies are dependable and adequate. The Texas Water Development Board, the Texas Commission on Environmental Quality and the Texas Parks and Wildlife Department plan and manage the water resources of Texas. Special purpose districts can be created to provide for water districts, solid waste services, municipal and county water services, stormwater management, water rates and services, water quality control and regional waste disposal.

A Municipal Utility District (MUD) is created primarily to provide water and sewer services to new developments which may be outside of a nearby municipality. A MUD can be created by the legislature or by the Texas Commission on Environment Quality with geographical boundaries. The residents of the district vote to authorize the sale of bonds to develop water and sewer services to that area. Bonds are repaid with the fees charged for those services by the residents. Planned Improvement Districts (PID)is a financing tool that can be used for the same purposes as a MUD, but can also be used for sidewalks, landscaping, parks and other development possibilities.

Health and Safety Districts There are special purpose districts related to health and safety issues for specific geographic areas. Those with health care functions include hospital districts, health services districts, mosquito control districts, and emergency services districts. Those for safety include crime control and prevention districts and jail districts.

The legislature has been authorized to provide for the creation, establishment, maintenance and operation of hospital districts. Those districts are responsible for the medial and hospital care for the needy citizens of the district. After a petition process and voter approval, hospital districts can issue general obligation bonds and revenue bonds. The governing boards can be appointed or elected in non-partisan elections. A health services district can be created between one or more counties and one or more hospital districts to provide health care to indigent citizens on a sliding scale basis. They are authorized to issue revenue bonds and the governing board is usually appointed. Mosquito control districts are created to eradicate mosquitos in the district. After a petition and election process, mosquito control districts can levy a property tax not to exceed twenty-five cents on each $100 of taxable value on the property. In 2003, a constitutional amendment was passed that converted rural fire prevention districts into emergency services districts with the ability to raise the tax from three cents to ten cents per $100 valuation of property.

Jail districts can issue bonds and can levy an ad valorem tax. They are created by one or more counties to construct, acquire or improve a jail facility to serve the district after a petition and election process. Temporary directors are appointed initially and successors will be elected for 2 year terms. If a majority of the voters approve, a crime control and prevention district can be created to provide programs such as crime stoppers telephone lines, radio dispatch, drug and chemical disposal center, block watch programs, senior citizen safety programs, and specific drug and alcohol awareness and family violence programs. The governing body is appointed and the district is financed by a sales and use tax.

Agricultural Development In 2001, the legislature authorized the creation of agricultural development district to promote the development of agricultural facilities. They can impose certain charges and any type of bond. The district will be composed of land that is not located within an incorporated city unless the city agrees. In addition, special districts in this area also include noxious weed control districts and wind erosion districts.

Transportation Counties may work with the Texas Department of Transportation and the Texas Transportation Commission to create road districts to levy taxes and issue bonds for the construction and maintenance of the roads within the district. Additionally, navigation districts have been created to provide for the construction and improvement of waterways in Texas for the purpose of navigation. They are tasked with improving rivers, bays, creeks, streams and canals to prevent overflow, to provide irrigation and to permit navigation. They can also be charged with conserving and developing natural resources, including the improvement, preservation and conservation of inland and coastal water for navigation. The costs for both are funded by bonds or taxes, and the governing boards are appointed.

Evaluating Special Purpose Districts As mentioned earlier in the chapter, special districts operate with little supervision or public participation. There is very little comprehensive review of these districts. They can become large and difficult to oversee and they may duplicate services already provided by cities or counties. The property taxes imposed by special districts have increased almost 300 percent since 1992. Because many of them are small, they are uneconomical. And, because people in the district are unaware of their existence, they are undemocratic.

Recommendations for special districts include comprehensive reviews, local elections to approve tax rate increases, and transparency in budgets and financial statements. When dealing with the tough issues such as flood control, the other local governments should be involved. And before more special districts are created, there should be a review to ensure that there will be no duplication of the existing entities. Finally, special districts, like state agencies, should also be subject to a sunset provision to authorize its continuance. All state agencies are subject to an expiration date and will be abolished on that “sunset” date, unless the legislature passes a bill to continue, usually for a period of twelve years.

Councils of Government (COGs)

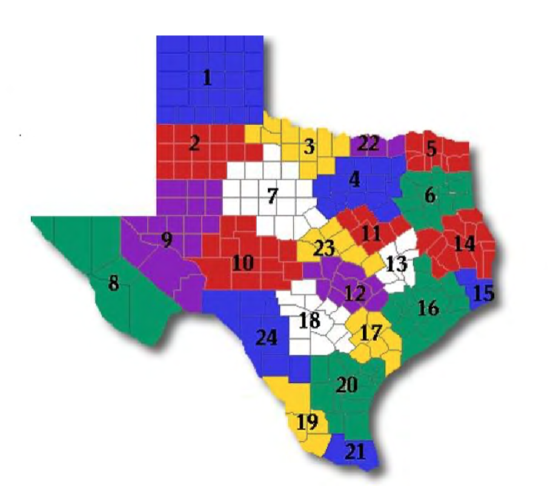

Texas has twenty-four councils of government (COGs) serving its 254 counties regionally. They were organized in the late 1960s and early 1970s. They deal with problem and planning needs that cross the boundaries of local governments. The Texas Association of Regional Councils (TARC) was established in 1973 to allow for the exchange of information and ideas (Map 10.1). They help to educate the public about the services provided by the COGs. Finally, they represent the COGs when state or federal agencies are involved. TARC identifies the following list of services provided by the councils of governments:

- planning and implementing regional homeland security strategies;

- operating law enforcement training academies;

- promoting regional municipal solid waste and environmental quality planning;

- providing cooperative purchasing options for governments;

- managing region-wide services to the elderly;

- maintaining and improving regional 9-1-1 systems;

- promoting regional economic development;

- operating specialized transit systems; and

- providing management services for member governments.

Map 10.1 Twenty-four TARC regions. SOURCE: Unknown Author, licensed under CC BY-SA.

These are organizations, not governments, so they have no authority to make laws, levy taxes, or exercise police powers. They assist in the development of the regions and try to eliminate duplication while promoting regional economies and efficiency. They review and comment on all federal and state grants to prevent communities from competing for resources. Policy decisions are made by its board of directors, two-thirds of which must be members of the participating counties or cities. The funding for the COGs come primarily from the federal government, but they can also receive funding from state or local sources through direct or indirect grants.

13. “Special Purpose Districts,” Texas Public Policy Foundation, Local Government Legislator’s Guide to the Issues 2017-18, https://files.texaspolicy.com/upload...ricts-copy.pdf.

14. “Research Spotlight: Invisible Government: Special Purpose Districts in Texas,” Texas Senate Research Center, October 2014, https://www.senate.texas.gov/_assets..._Districts.pdf.