13.2: The Development of a Budgeting Process

- Page ID

- 129216

Article 3, Section 33 of the Texas Constitution states: “All bills for raising revenue shall originate in the House of Representatives, but the Senate may amend or reject them as other bills.”5 Section 49 mandates debt not exceed revenue:

No debt shall be created by or on behalf of the State, except to supply casual deficiencies of revenue, repel invasion, suppress insurrection, defend the State in war, or pay existing debt and the debt created to supply deficiencies in the revenue, shall never exceed in the aggregate at any one time two hundred thousand dollars.6

The latter is notable since it establishes the principle of a balanced budget in the state. If no debt is authorized, then presumably the budget remains in balance since expenses will be covered by existing revenues. Chapter 3 on the Texas Constitution detailed how Section 49 has continued to be amended to allow for the sale of bonds to fund additional spending.

As with the national government, the growth in spending—along with the increased complexity of the areas of spending—let to calls to oversee the process. This became over time the budgeting process in place today. Key steps along the way include the General Revenue Estimate; Legislative Budget Board; fiscal notes; limitations on rate growth; and performance based budgeting.

Step One: General Revenue Estimate

On November 11, 1942, voters approved an amendment to Article 49, Section 3, “requiring all bills passed by the Legislature on and after January 1, 1945, appropriating money for any purpose, to be sent to the Comptroller of Public Accounts for his approval.”7 In addition, the comptroller is required to provide “an itemized estimate of the anticipated revenue based on the laws then in effect that will be received by and for the State.”8 This estimate is called the General Revenue Estimate, and is presented to the legislature prior each regular session. They cannot authorize spending from the general revenue beyond this figure. This is the basis of the principle of pay-as-you-go, but this principle does not apply to many other funds received by the state. It is limited to the General Revenue Fund.

Step Two: Legislative Budget Board

In 1949, the Legislative Budget Board (LBB) was created All state agencies were required to submit budget requests to them, which would then be reviewed and any necessary changes would be recommended.9

The LBB is a permanent joint committee of the legislature responsible for taking the budgetary requests and using them to draft the budget for the state. The LBB is governed by a ten person board. Five members of the board serve as representatives of an office (i.e., in an ex- officio capacity): the lieutenant governor, the speaker of the House, the chairs of the House Appropriations and Ways and Means Committees, and the Senate Finance Committee. Two House members and three additional senators are appointed by the speaker and lieutenant governor respectively.

The LBB staff also produces the Fiscal Size-Up after the end of each session of the legislature. The Fiscal Size-Up thoroughly documents the revenues and expenditures contained in the General Appropriations Bill. The Fiscal Size-Up has been the source for the bulk of the information contained in this chapter.

Step Three: Fiscal Notes

In 1973, the legislature mandated that the LBB research the fiscal impact of bills under consideration. These are called fiscal notes, and they inform members of the legislature of the potential impact of a bill on spending or revenue collection.

Step Four: Limitations on Rate of Growth

In 1978 the voters approved an amendment to Article 8 of the Texas Constitution that limited the rate of growth of appropriations to that of the state’s economy.10 Once complied, the legislature will be able to make informed decisions how to adjust the budget accordingly. (The Texas Government Code exempts other funds, such as dedicated and federal funds, from this limitation11; dedicated funds will be discussed later in the chapter.)

Step Five: Performance Based Budgeting

In 1991 the state created the Strategic Planning and Performance Budgeting System, which required each executive branch agency to create five year strategic plans that tied the budgets in with the development and accomplishment of agency goals. This performance based budgeting system goes beyond a simple request for funds into a system that allows for expenditures to be evaluated in terms of their measurable accomplishments.

The Budget Process for 2020-2021

As a way of illustrating the budget process, consider the timeline of the 2020-2021 biennial budget12:

- May and June 2018: The LBB sent instructions to all state agencies regarding how to submit requests, and what sorts of requests would be considered. These are called Legislative Appropriations Requests (LARs).

- July and August 2018: Each state agency submitted their complete LARs, as well as strategic plans, to the LBB and the Governor’s Office of Budget, Planning and Policy (GOBPP).

- September to December 2018: Hearings were held by both the LBB and the GOBPP on the LARs and strategic plans submitted by the state agencies. Each then creates their own budget recommendations that were submitted to the legislature when it convened January 8, 2019.

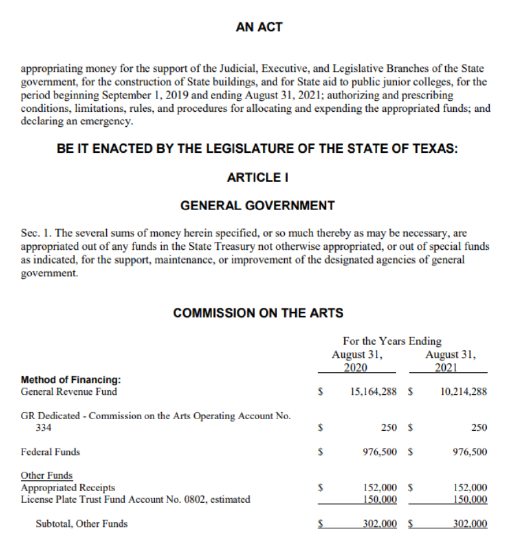

- January 2019: The comptroller submitted the 2020-2021 Biennial Budget Estimate as required. Each chamber of the legislature submitted the LBBs recommended budget, as did the governor. These documents containing approximately 1000 pages each. These were the foundation of what became the General Appropriations Bill (Figure 13.2).

- February and March 2019: Hearing on the two different versions of the General Appropriations Bill were held in, respectively, the House Appropriations Committee and subcommittees and the Senate Finance Committee.

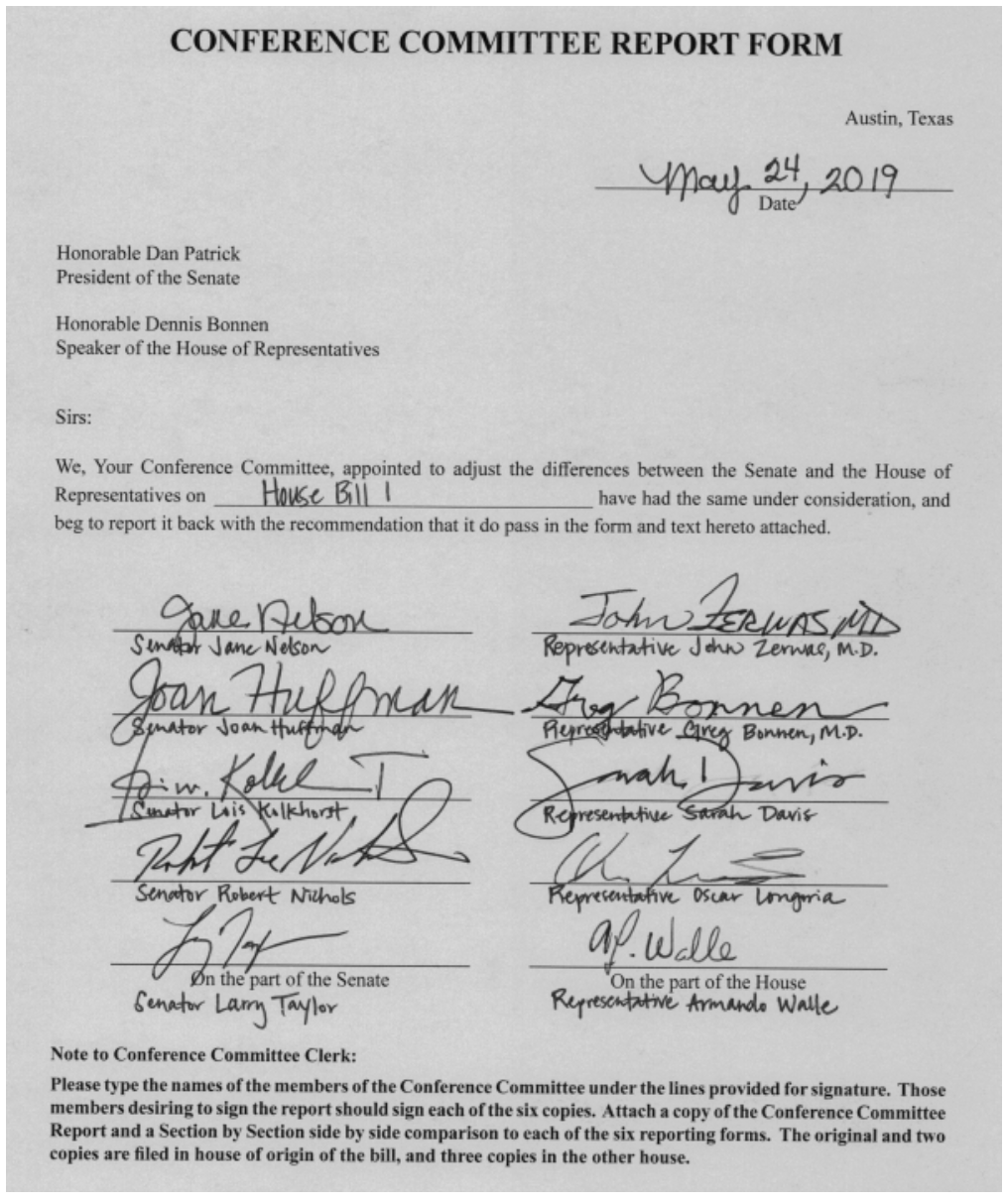

- April and May 2019: Mark up began in the House and Senate committees, which allowed for the documents to be modified. Once approved by the committees, they were reported to the floor of each chamber, and made available for further amendments. Once passed by each chamber, a Conference Committee was appointed by the presiding officer of each chamber, differences were reconciled and presented on the floor of each chamber as a conference report which was then approved (Figure 13.3).

In addition to the General Appropriations Bill, the legislature passed a supplemental budget measure which funded the deficit that emerged in the 2018-2019 budget due to less than anticipated revenue collection (Figure 13.4).

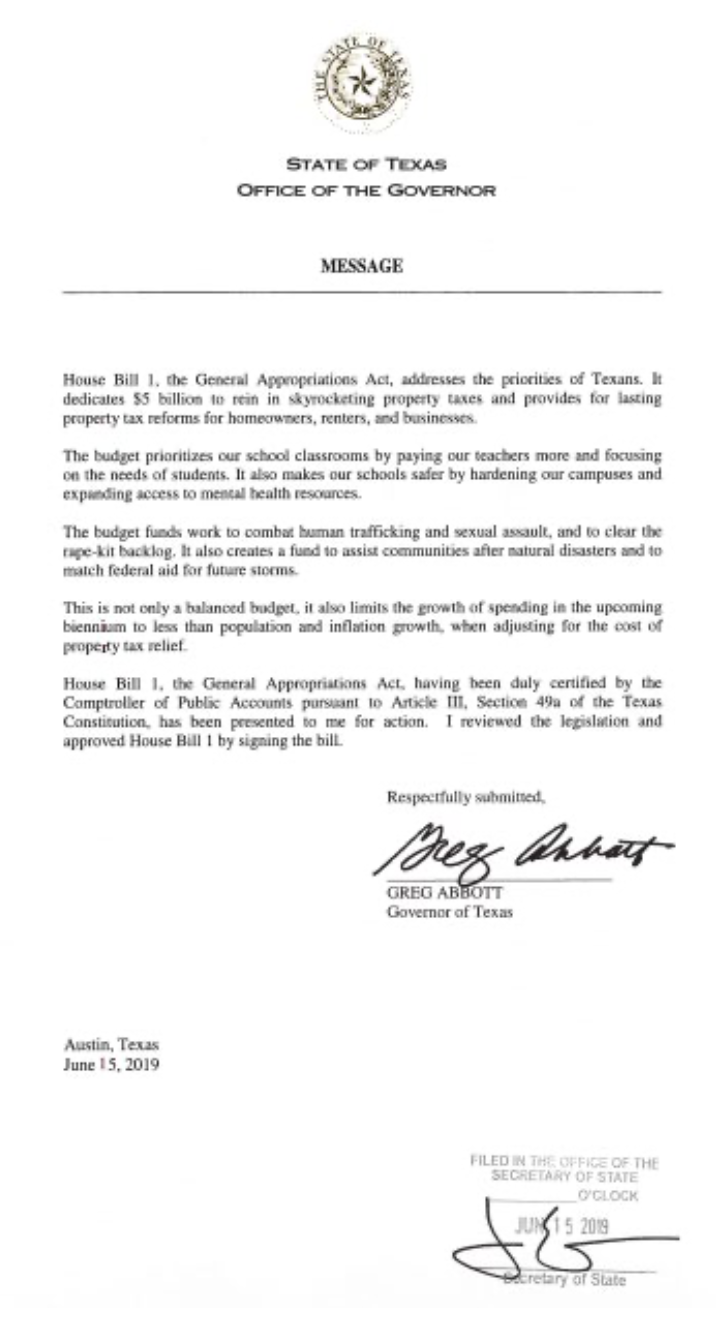

- June 2019: The conference report was certified by the comptroller in order to ensure that the amount appropriated would be covered by anticipated revenue. The bill then went to the governor for review. While the governor has line item veto authority, and has used it in the past, he vetoed no specific spending item in the 2020-2021 budget. He issued a brief signing statement regarding the bill, which stated the General Appropriations Act addressed the priorities of Texans by reining in property taxes, paying our teachers more, and funding work to combat human trafficking and sexual assault (Figure 13.5).

- September 1, 2019: The fiscal year began, and state agencies could begin drawing money from the treasury. They will continue to be able to do so until August 31, 2021, after which the budget approved by the Eighty-Seventh Legislature kicks in.

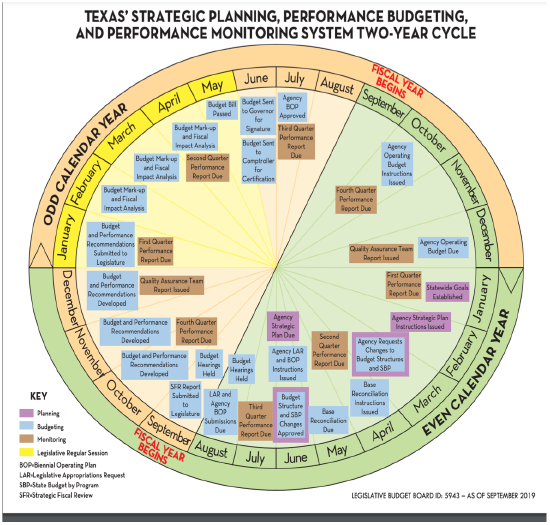

Figure 13.6 from the LBB illustrates the process.

5. Tex. Const. art. III, §49, https://www.investopedia.com/terms/b/budget.asp.

6. Tex. Const. art. III, §49, https://www.investopedia.com/terms/b/budget.asp.

7. JR 1, 47th Regular Session, amends Tex. Const. art. III, §49a, Nov. 11, 1942, Legislative Reference Library of Texas, https://lrl.texas.gov/legis/billsear...NumberDetail=1.

8. Tex. Const. art III, §49a, https://statutes.capitol.texas.gov/D...CN.3.htm#3.49a.

9. Tex. Const. art. III, §49a, https://statutes.capitol.texas.gov/D...CN.3.htm#3.49a.

10. Tex. Const. art VIII, §22, https://law.justia.com/constitution/...te's%20economy.

11. Government Code, “Title 3. Legislative Branch; Subtitle B. Legislation; Chapter 316. Appropriations; Subchapter A. Limit on Growth of Appropriations,” https://statutes.capitol.texas.gov/d...htm/GV.316.htm.

12. Texas Legislative Reference Library, “Budget Process for the 2020-2021 Biennium,” https://lrl.texas.gov/legis/Budget2020_21.pdf.