Goals and objectives

The goals of competition policy are relatively uniform across developed economies: The promotion of domestic competition; the development of new ideas, new products and new enterprises; the promotion of efficiency in the resource-allocation sense; the development of manufacturing and service industries that can compete internationally.

In addition to these economic objectives, governments and citizens frown upon monopolies or monopoly practices if they lead to an undue concentration of political power. Such power can lead to a concentration of wealth and influence in the hands of an elite.

Canada's regulatory body is the Competition Bureau, whose activity is governed primarily by the Competition Act of 1986. This act replaced the Combines Investigation Act. The Competition Tribunal acts as an adjudication body, and is composed of judges and non- judicial members. This tribunal can issue orders on the maintenance of competition in the marketplace. Canada has had anti-combines legislation since 1889, and the act of 1986 is the most recent form of such legislation and policy. The Competition Act does not forbid monopolies, but it does rule as unlawful the abuse of monopoly power. Canada's competition legislation is aimed at anti-competitive practices, and a full description of its activities is to be found on its website at www.competitionbureau.gc.ca. Let us examine some of these proscribed policies.

Anti-competitive practices

Anti-competitive practices may either limit entry into a sector of the economy or force existing competitors out. In either case they lead to a reduction in competition.

Mergers may turn competitive firms into a single organization with excessive market power. The customary justification for mergers is that they permit the merged firms to achieve scale economies that would otherwise be impossible. Such scale economies may in turn result in lower prices in the domestic or international market to the benefit of the consumer, but may alternatively reduce competition and result in higher prices. Equally important in this era of global competition is the impact of a merger on a firm's ability to compete internationally.

Mergers can be of the horizontal type (e.g. two manufacturers of pre-mixed concrete merge) or vertical type (a concrete manufacturer merges with a cement manufacturer). In a market with few suppliers mergers have the potential to reduce domestic competition.

Cartels aim to restrict output and thereby increase profits. These formations are almost universally illegal in individual national economies.

While cartels are one means of increasing prices, price discrimination is another, as we saw when studying monopoly behaviour. For example, if a concrete manufacturer makes her product available to large builders at a lower price than to small-scale builders – perhaps because the large builder has more bargaining power – then the small builder is at a competitive disadvantage in the construction business. If the small firm is forced out of the construction business as a consequence, then competition in this sector is reduced.

We introduced the concept of predatory pricing in Chapter 11. Predatory pricing is a practice that is aimed at driving out competition by artificially reducing the price of one product sold by a supplier. For example, a dominant nationwide transporter could reduce price on a particular route where competition comes from a strictly local competitor. By 'subsidizing' this route from profits on other routes, the dominant firm could undercut the local firm and drive it out of the market.

Predatory pricing is a practice that is aimed at driving out competition by artificially reducing the price of one product sold by a supplier.

Suppliers may also refuse to deal. If the local supplier of pre-mixed concrete refuses to sell the product to a local construction firm, then the ability of such a downstream firm to operate and compete may be compromised. This practice is similar to that of exclusive sales and tied sales. An exclusive sale might involve a large vegetable wholesaler forcing her retail clients to buy only from this supplier. Such a practice might hurt the local grower of aubergines or zucchini, and also may prevent the retailer from obtaining some of her vegetables at a lower price or at a higher quality elsewhere. A tied sale is one where the purchaser must agree to purchase a bundle of goods from a supplier.

Refusal to deal: an illegal practice where a supplier refuses to sell to a purchaser.

Exclusive sale: where a retailer is obliged (perhaps illegally) to purchase all wholesale products from a single supplier only.

Tied sale: one where the purchaser must agree to purchase a bundle of goods from a supplier.

Resale price maintenance involves the producer requiring a retailer to sell a product at a specified price. This practice can hurt consumers since they cannot 'shop around'. In Canada, we frequently encounter a 'manufacturer's suggested retail price' for autos and durable goods. But since these prices are not required, the practice conforms to the law.

Resale price maintenance is an illegal practice wherein a producer requires sellers to maintain a specified price.

Bid rigging is an illegal practice in which normally competitive bidders conspire to fix the awarding of contracts or sales. For example, two builders, who consider bidding on construction projects, may decide that one will bid seriously for project X and the other will bid seriously on project Y. In this way they conspire to reduce competition in order to make more profit.

Bid rigging is an illegal practice in which bidders (buyers) conspire to set prices in their own interest.

Deception and dishonesty in promoting products can either short-change the consumer or give one supplier an unfair advantage over other suppliers.

Enforcement

The Competition Act is enforced through the Competition Bureau in a variety of ways. Decisions on acceptable business practices are frequently reached through study and letters of agreement between the Bureau and businesses. In some cases, where laws appear to have been violated, criminal proceedings may follow.

Regulation, deregulation and privatization

The last three decades have witnessed a significant degree of privatization and deregulation in Canada, most notably in the transportation, communication and energy sectors. Modern deregulation in the US began with the passage of the Airline Deregulation Act of 1978, and was pursued with great energy under the Reagan administration in the eighties. The Economic Council of Canada produced an influential report in 1981, titled "Reforming Regulation," on the impact of regulation and possible deregulation of specific sectors. The Economic Council proposed that regulation in some sectors was inhibiting competition, entry and innovation. As a consequence, the interests of the consumer were in danger of becoming secondary to the interests of the suppliers.

Telecommunications provision, in the era when the telephone was the main form of such communication, was traditionally viewed as a natural monopoly. The Canadian Radio and Telecommunications Commission (CRTC) regulated its rates. The industry has developed dramatically in the last two decades with the introduction of satellite-facilitated communication, the internet, multi-purpose cable networks, cell phones and service integration.

Transportation, in virtually all forms, has been deregulated in Canada since the nineteen eighties. Railways were originally required to subsidize the transportation of grain under the Crow's Nest Pass rate structure. But the subsidization of particular markets requires an excessive rate elsewhere, and if the latter markets become subject to competition then a competitive system cannot function. This structure, along with many other anomalies, was changed with the passage of the Canada Transportation Act in 1996.

Trucking, historically, has been regulated by individual provinces. Entry was heavily controlled prior to the federal National Transportation Act of 1987, and subsequent legislation introduced by a number of provinces, have made for easier entry and a more competitive rate structure.

Deregulation of the airline industry in the US in the late seventies had a considerable influence on thinking and practice in Canada. The Economic Council report of 1981 recommended in favour of easier entry and greater fare competition. These policies were reflected in the 1987 National Transportation Act. Most economists are favourable to deregulation and freedom to enter, and the US experience indicated that cost reductions and increased efficiency could follow. In 1995 an agreement was reached between the US and Canada that provided full freedom for Canadian carriers to move passengers to any US city, and freedom for US carriers to do likewise, subject to a phase-in provision.

The National Energy Board regulates the development and transmission of oil and natural gas. But earlier powers of the Board, involving the regulation of product prices, were eliminated in 1986, and controls on oil exports were also eliminated.

Agriculture remains a highly controlled area of the economy. Supply 'management', which is really supply restriction, and therefore 'price maintenance', characterizes grain, dairy, poultry and other products. Management is primarily through provincial marketing boards.

The role of the sharing economy

The arrival of universal access to the internet has seen the emergence of what is known as the Sharing economy throughout the world. This expression is used to describe commercial activities that, in the first place, are internet-based. Second, suppliers in the sharing economy use resources in the market place that were initially aimed at a different purpose. Airbnb and Uber are good examples of companies in sectors of the economy where sharing is possible. In Uber's case, the 'ride-share' drivers initially purchased their vehicles for private use, and subsequently redirected them to commercial use. Airbnb is a communication corporation that enables the owners of spare home capacity to sell the use of that capacity to short-term renters. With the maturation of such corporations, the concept of 'initial' and 'secondary' use becomes blurred.

Sharing economy: involves enterprises that are internet based, and that use production resources that have use outside of the marketplace.

The importance of the sharing economy is that it provides an additional source of competition to established suppliers, and therefore limits the market power of the latter. At the same time, the emergence of the sharing economy poses a new set of regulatory challenges: If traditional taxis are required to purchase operating permits (medallions), and the ride-share drivers do not require such permits, is there a reasonable degree of competition in the market, and if not what is the appropriate solution? Should the medallion requirement be abolished, or should ride-share drivers be required to purchase one? In the case of Airbnb, the suppliers operate outside of the traditional 'hotel' market. In general they do not charge sales taxes or face any union labour agreements. What is the appropriate response from governments? And how should the sharing economy be taxed?

Price regulation

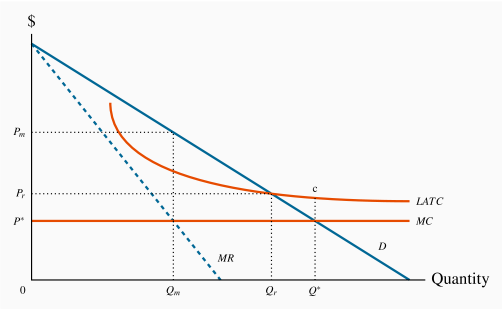

Regulating monopolistic sectors of the economy is one means of reducing their market power. In Chapter 11 it was proposed that indefinitely decreasing production costs in an industry means that the industry might be considered as a 'natural' monopoly: Higher output can be produced at lower cost with fewer firms. Hence, a single supplier has the potential to supply the market at a lower unit cost; unless, that is, such a single supplier uses his monopoly power. To illustrate how the consumer side may benefit from this production structure through regulation, consider Figure 14.2. For simplicity suppose that long-run marginal costs are constant and that average costs are downward sloping due to an initial fixed cost. The profit-maximizing (monopoly) output is where MR=MC at Qm and is sold at the price Pm. This output is inefficient because the willingness of buyers to pay for additional units of output exceeds the additional cost. On this criterion the efficient output is Q×. But LATC exceeds price at Q×, and therefore it is not feasible for a producer.

One solution is for the regulating body to set a price-quantity combination of Pr, and Qr, where price equals average cost and therefore generates a normal rate of profit. This output level is still lower than the efficient output level Q×, but is more efficient than the profit-maximizing output Qm. It is more efficient in the sense that it is closer to the efficient output Q×. A problem with such a strategy is that it may induce lax management: If producers are allowed to charge an average-cost price, then there is a reduced incentive for them to keep strict control of their costs in the absence of competition in the marketplace.

A second solution to the declining average cost phenomenon is to implement what is called a two-part tariff. This means that customers pay an 'entry fee' in order to be able to purchase the good. For example, in many jurisdictions hydro or natural gas subscribers may pay a fixed charge per month for their supply line and supply guarantee, and then pay an additional charge that varies with quantity. In this way it is possible for the supplier to charge a price per unit of output that is closer to marginal cost and still make a profit, than under an average cost pricing formula. In terms of Figure 14.2, the total value of entry fees, or fixed components of the pricing, would have to cover the difference between MC and LATC times the output supplied. In Figure 14.2 this implies that if the efficient output  is purchased at a price equal to the MC the producer loses the amount (c–MC) on each unit sold. The access fees would therefore have to cover at least this value.

is purchased at a price equal to the MC the producer loses the amount (c–MC) on each unit sold. The access fees would therefore have to cover at least this value.

Such a solution is appropriate when fixed costs are high and marginal costs are low. This situation is particularly relevant in the modern market for telecommunications: The cost to suppliers of marginal access to their networks, whether it be for internet, phone or TV, is negligible compared to the cost of maintaining the network and installing capacity.

Two-part tariff: involves an access fee and a per unit of quantity fee.

Finally, a word of caution: Nobel Laureate George Stigler has argued that there is a danger of regulators becoming too close to the regulated, and that the relationship can evolve to a point where the regulator may protect the regulated firms. In contrast, Professor Philippon of New York University argues that regulators are not regulating sufficiently in the US: they have permitted an excessive number of mergers that have, in turn, reduced competition.