8.1: What is Political Economy?

- Last updated

- Save as PDF

- Page ID

- 135862

- Dino Bozonelos, Julia Wendt, Charlotte Lee, Jessica Scarffe, Masahiro Omae, Josh Franco, Byran Martin, & Stefan Veldhuis

- Victor Valley College, Berkeley City College, Allan Hancock College, San Diego City College, Cuyamaca College, Houston Community College, and Long Beach City College via ASCCC Open Educational Resources Initiative (OERI)

Learning Objectives

By the end of this section, you will be able to:

- Describe political economy as a field of study.

- Define key terms associated with political economy.

Introduction

Political economy, as defined in Chapter One, is a subfield of political science that considers various economic theories (like capitalism, socialism, communism, fascism), practices and outcomes either within a state, or among and between states in the global system. In its simplest form, political economy is the study of the relationship between the market and powerful actors, such as a country’s government. The market is defined as the exchange of goods and services within a given territory. This almost always involves the forces of supply and demand and the allocation of resources through private economic decision-making. The interaction between the state and the market through political, economic, and societal institutions can frame deliverable outcomes, such as public goods. This can occur not only within a country, but between them as well. Public goods are defined as goods and services provided by the state that are available for everyone in society. They are nonexcludable and nonrival in nature. Examples include public roads, public hospitals and libraries. Clearly, political economy will involve the mixing of political and economic policy goals. Finally, political economy also studies how individuals interact with the market and society (Britannica, n.d.)

Political economy is a subfield of political science that often overlaps with other fields and subfields in the social sciences, most notably economics. Political economists are tasked with understanding how the state affects the market. A good example is the concept of wealth distribution within a country. Wealth distribution is defined as how a country’s goods, investments, properties, and resources, or wealth, are divided amongst its population. In some countries, wealth is distributed quite evenly, whereas in other countries, wealth is distributed unevenly. Countries with uneven wealth distribution are more susceptible to political tension as some groups often feel they have been denied their ‘fair share of the pie’. Similarly, political economists look at how the market affects the state and its society. For example, market forces can force elected politicians to change their perspectives. A downturn in the market is correlated with the election chances of sitting politicians. Just ask US President George H.W. Bush, who won a decisive victory in the 1991 Gulf War, but the economic downturn a year later overshadowed his accomplishments. It led Clinton’s campaign manager to coin his now famous phrase, “it’s the economy, stupid!”

Given its definition and scope, areas of research within the political economy discipline can be quite diverse. Generally, though, the three main ways political economy are engaged today include:

- Studying how the economy (and/or economic systems) affects politics. (Given the expansive scope of this field, our chapter will focus on economic systems.)

- How political forces affect the economy. (i.e. How do institutions, voters, interest groups affect economic outcomes? How does this influence public policy?)

- How economic foundations and tools can be applied to study politics.

To gain a fuller understanding of how political economy is studied by comparativists, it’s important to consider its history as a subdiscipline as well as a number of key terms used in the practice of the field.

Political Economy: Foundation and Key Terms

Scholars have been thinking about the interaction between society and the economy for centuries. Ancient Greek philosophers such as Plato and Aristotle, wrote about the oikos, which is the ancient Greek word for house. Aristotle saw the oikos as the basic unit within the polis, or city. From oikos is derived the English word econ-omy, or the study of household accounts, which over time has translated into the study of a country’s wealth and assets. Formal study of political economy began in the mid-1700s. Adam Smith’s 1776 work, the Wealth of Nations, is often considered the starting point. His work was followed by David Ricardo, who wrote about comparative advantage, which will be discussed further below. His work complemented Smith’s thoughts about the free market. A few decades later came the writings of Karl Marx, whose reactions to the free market and capitalism still provide much of the basis for contemporary criticism. Over time, the field garnered more widespread attention. Political economy’s growth as a specific discipline in universities was noted by Dunbar as early as 1891, in an article in The Quarterly Journal of Economics published by Oxford University Press. The article attributes public interest in the subject as a significant cause in its expanded role in academia:

It is the perception of the scope and importance of the questions with which political economy deals that turns the popular current so strongly towards it today. It is keenly felt that on the right answer of these questions must depend not only the future progress of society, but also the preservation of much that has been gained by mankind in the past. (Dunbar, 1891)

Political economists also consider various concepts including private goods, property, and property rights. In contrast to public goods, private goods are defined as an economic resource which are acquired or owned exclusively by a person or group. Public and private goods can vary greatly between countries, for instance, healthcare is sometimes a public private good in some countries whereas it is a public good in most countries. A defining feature of private goods is their potential scarcity, and the competition that arises from this scarcity. Property is defined as a resource or commodity that a person or group legally owns. Property can include tangible items, like cars and houses, to intangible items, like patents, copyrights or trademarks.

Property rights are defined as the legal authority to dictate how property, whether tangible or intangible, is used or managed. These concepts help form the foundation for the vast majority of political economy studies.

States can affect the market through a variety of measures. First, they can simply pass laws that regulate the market. Regulation is defined as rules imposed by a government on society. Various types of regulation exist, from rules on protecting public interests, such as the environment to social cohesion. Regulation that affects the marker is often referred to as regulatory policy, economic regulation, or fiscal regulation. For example, an effective form of regulation is through the policy of taxation. Taxation is defined as the process of a government collecting money from its citizens, corporations, and other entities. Taxes can be imposed on income, capital gains and on estates. Taxes are an important part of a functioning society as governments use tax revenue to pay for public goods. Taxes can be used to regulate economic activity. A country can impose higher taxes on a product, driving up the price, to dissuade people from using it. A good example is the taxes imposed on cigarettes. Referred to as sin taxes, these are taxes levied on a product or activity that are deemed harmful to society. Sin taxes exist on tobacco, alcohol, and gambling in almost every state. Taxation, spending, and regulation are referred to as fiscal policy.

In addition to fiscal policy, governments can exercise monetary policy. Monetary policy is defined as the actions taken by a state’s central bank to affect the money supply. Money is simply a medium of exchange. It is a way to store value and is used as a unit of account in economic transactions. Printed money has no intrinsic value. Its value is determined by the government that prints it. A five-dollar bill is worth five dollars because that is what the US government says it is. Of course, the people of a country need to also believe that the printed money is worth what the government says it is. If the public does not, then the money can be worthless. A good example is the former currencies of countries that adopted the Euro. The German mark, the French franc and the Greek drachma no longer have any value.

A central bank can either expand the money supply, to grow the economy and maximize employment. Economic growth is the process by which a country’s wealth increases over time. Or it can contract the money supply, to slow the economy and moderate inflation. An economic slowdown can be the result, which often occurs in the form of a recession. A recession is defined as two consecutive quarters (three months) of declining economic activity. In each instance, a central bank will manipulate the money supply through interest rates. Let’s examine each scenario. A central bank will reduce interest rates to stimulate economic growth. This makes it easier for businesses to borrow money to expand production, increase hiring, or invest in research & development. Similarly, consumers can borrow at lower interest rates to buy homes or consumer goods.

If, however, economic demand is growing too fast, a central bank raises interest rates to cool off the economy. Some may ask what is wrong with a hot economy? Is that not a good thing? Not necessarily, as a major consequence of higher spending is inflation. Inflation is defined as a general increase in prices, usually within a given time. If the public has access to excess cash or credit and decides to spend, it becomes a simple matter of supply and demand. More demand for products and services leads to higher prices. Prices can also rise for other reasons, including higher labor costs, or an increased cost of inputs, such as fuel for transportation. Regardless of the reason, inflation simply means your dollar will not go as far tomorrow as it did today.

Finally, a country’s economy can be affected externally as well through international trade. International trade is defined as the exchange of goods, services, and activities between countries. States, however, never trade equally. In every trading relationship, one country benefits more than the other. Sometimes, the trade surplus or trade deficit is small and not so consequential. Other times, the surplus or deficit can be large and have important consequences. If a country is experiencing large trade deficits, then that country is importing more than it is exporting. A positive effect of a large deficit is that it is likely that the goods, services, and activities being imported are less expensive, which can help lower costs for consumers in that country. A negative effect of a large is that hard money leaves the country. This can affect the money supply of the country. Conversely, a large surplus usually means that prices of goods, services and activities are generally higher in that country. However, the country is bringing in quite a bit of money, which can be used by a government to fund numerous development projects.

A foundational principle in international trade is that of comparative advantage. Comparative advantage refers to the goods, services or activities that one state can produce or provide more cheaply or easily than other states. Developed by David Ricardo in the early 1800s, comparative advantage entails states that can mutually benefit from cooperation and voluntary trade. This is because no nation is entirely self-sufficient and therefore must trade. Even when states can produce the same goods and services, they often have to trade with other states to overcome their different allocation of resources. This is especially true for states with certain natural resources such as oil or minerals. Thus, because nations have different allocations of resources, such as land, labor, or capital, each enjoys a comparative advantage in producing those goods that use its abundant resources. Over time, the ability of one business or entity to engage in production at a lower opportunity cost than another business or entity will lead to specialization. In this scenario, goods will be less expensive, and production will be more efficient for states that engage in trade.

Political Economy as a Modern Discipline

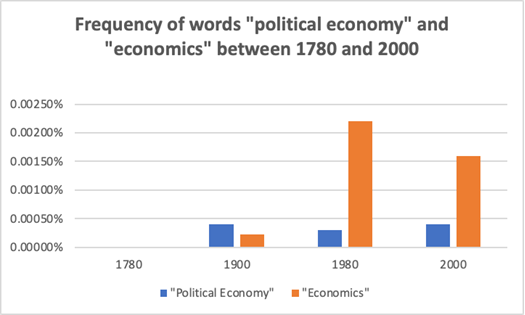

Per Bozonelos (2022), “in the early twentieth century, economics began to separate itself formally from politics by focusing on theories of economic behavior as they related to human behavior”. The graph below details how interest in economics has skyrocketed, whereas interest in political economy has remained relatively constant. One way to distinguish the two disciplines is to think of economics as focused on analysis of the economy, both at the national, or macro level, and at the firm, or micro, level. Principles of economics include calculating market equilibrium given supply and demand, the projection of various outcomes based on finite resources, and observations regarding the distribution of wealth. Instead, think of political economy as an extension of economics, but with a focus on how politics and public policy affects economics.

While political economy is less well known than economics, “the assumed separation of politics and economics is very much a 20th-century phenomenon” (Robbins, 2017). In our 21st century, economists have increasingly accepted and have in most analyses, incorporated politics and policy decisions. A good example includes housing affordability, where the economics of owning a house are highly political. The market does not always mean fairness and “many issues of political economy are bread-and-butter issues that are important to scholars as well as the public at large.” (Robbins, 2017). Economic decisions are not made in a vacuum by “rational” actors always maximizing their economic self-interest. If that were the case, we would not spend more money on a pair of sneakers just because of the brand or color.

The field of political economy can be extended into two more specific subgroups: comparative political economy and international political economy. The subgroups parallel the subdisciplines of political science discussed in Chapter One: comparative politics and international politics. Comparative political economy (CPE) is defined as the comparison across and between countries of the ways in which politics and economics interact. Often, this comparison lends to observations of similar economic policies resulting in different political outcomes, or vice versa, similar political policies resulting in different economic outcomes. Comparative political economy has generally focused on the politics of economic development, the analysis of different economic systems, the effects and implications of globalization, as well as general economic and social policies. International political economy (IPE) is defined as the study of political economy from a global perspective or through international institutions. Conversations over the distribution of wealth take place at a higher level than individual or cross-national studies. IPE focuses on international trade, economic development, international monetary bodies, as well as the influence of multinational corporations and non-governmental organizations.