13: State Finance

- Page ID

- 129190

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)After reading this chapter, you should be able to:

- Explain the basic structure of Texas government finance.

- Articulate the legislature’s role in controlling state revenue and expenditures.

- Identify the roles of agencies and interest groups in the appropriations process.

- Discuss issues and controversies surrounding Texas government finance.

In July, 2020, Texas Comptroller Glenn Hegar delivered bad news to the state. The coronavirus pandemic had a significant negative impact on the state’s economy, which in turn had a negative impact on tax revenues, which meant that state finances were going to be off. Off by about five billion dollars.

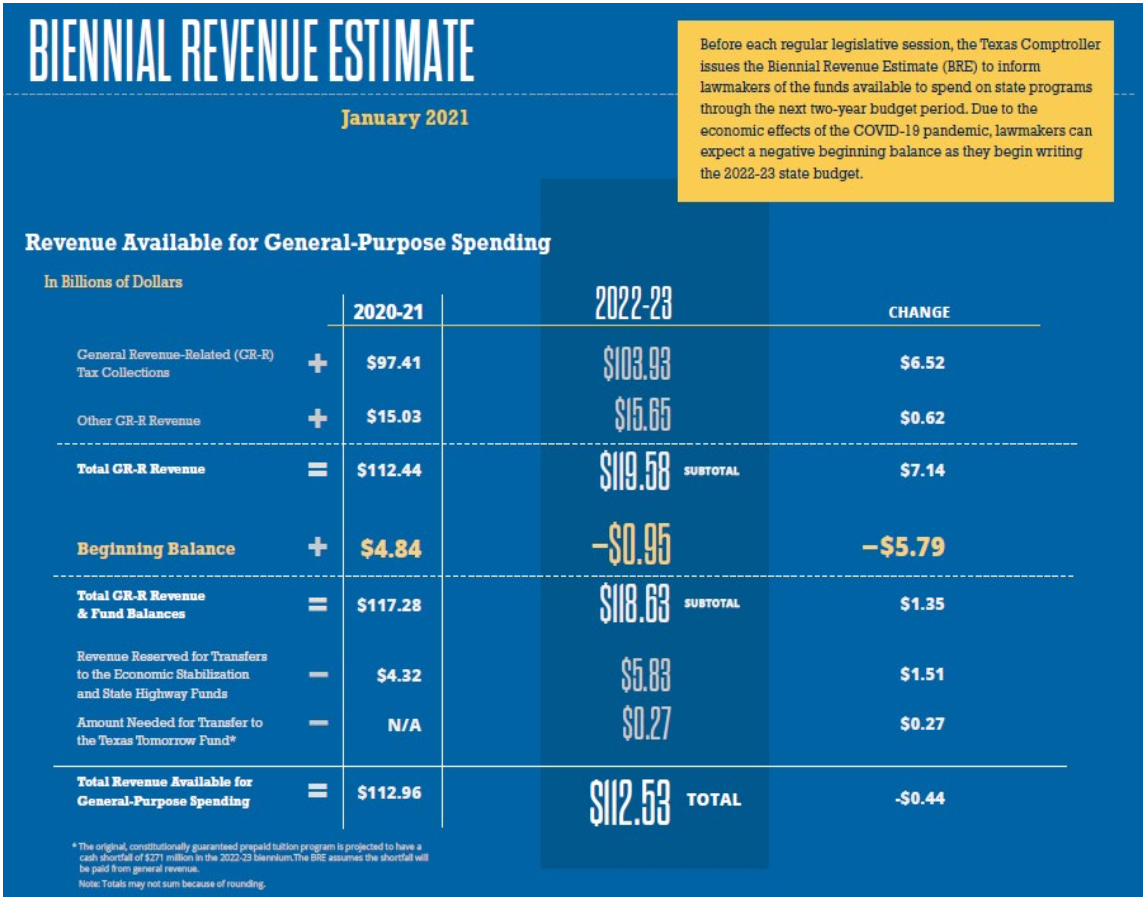

The budget that had been approved the year before was no longer accurate. In a state that prides itself on being pay-as-you-go, this created a problem.1 Prior to each meeting of the state legislature, the comptroller is constitutionally required to provide them with the biennial revenue estimate, which forecasts how much tax revenue with be collected in the state’s general revenue fund, which is used for general purpose spending. This is a major portion of the revenue that funds the state, other sources include federal funds. Constitutionally, these establish a ceiling for state spending. The amount of funding authorized in the General Appropriations Bill must not exceed the estimated revenue. In order to ensure that this is the case, the comptroller must certify the bill stating that the budget does not spend more than will be collected during the next fiscal period. This ensures—at least in theory—a balanced budget.

Prior to the meeting of the Eighty-Sixth Regular Session of the legislature, Hegar claimed the over $121 billion would be available in the general revenue for the budget that would fund the state from September 1, 2019 until August 31, 2021.2 He also warned, as is common, that unforeseen circumstances could impact the actual amount the state would receive. This had happened a decade before when the collapse of the housing market in 2008 reduced the amount of revenue that the state was predicted to receive.3 The state then had to scramble to pay for the resulting deficit, this included significant cuts to education. This time the unforeseen circumstance was a pandemic that shut down a significant part of the state’s economy for almost a year. The original estimate of $121 billion was no longer accurate, in his July speech he delivered a revised estimate of $110 billion. The existing budget had been set with the former figure in mind, meaning that the budget no was no longer balanced. It had originally been in surplus, since the legislature decided not to spend all the funds projected to be available. The state faced a projected shortfall of over four billion dollars, which had to be made up somehow. All this occurred in an environment where the needs of local hospitals and emergency officials were increasing. Texas was once again facing a fiscal crisis.

As time wore on, and federal funds began to have an impact on the state’s economy, revenues increased. More people were purchasing goods and services. The comptroller noted that people were having staycations instead of vacations, so they were spending money in the state that would have otherwise been spent outside the state. As a result, the comptroller continued to revise his estimate, and the numbers started to improve. By the time the Eighty-Seventh Legislature met in January 2021, the comptroller estimated a more manageable one billion dollar deficit for the 2020-2021 budget (Figure 13.1), which the legislature still needed to fund in whatever matter was politically expedient. The comptroller also presented his estimate that $112.5 billion was likely to be collected in the General Revenue Fund between September 1, 2021, and August 31, 2023. This became the upper limit for the spending approved by the legislature for the General Revenue Fund during the session. By staying within those bounds, the state will be able to fulfill the spending commitments it makes in the budget. Baring of course, unforeseen circumstances.

- 13.1: What Is State Finance?

- This page discusses the essential function of state budgets in supporting government operations and the economy. It defines budgets as forecasts of future revenues and expenses that are frequently revised. Unlike private financing, which relies on sales, state financing is tax-dependent, funding services determined by voters. The text underscores the relationship between state budgets, public agencies, and citizens, emphasizing the public welfare aspect of government financing.

- 13.2: The Development of a Budgeting Process

- This page outlines the Texas Constitution's requirement for revenue-raising bills to originate in the House and the balanced budget principle. Key budgeting steps include the General Revenue Estimate, the Legislative Budget Board, fiscal impact assessments, appropriations growth limits, and performance-based budgeting.

- 13.3: The Texas Treasury

- This page details the historical role of Texas's treasury, which has operated since its republic days. It managed cash flow and served as the state bank through the Treasurer’s Business Office until the early 1970s, when the treasury moved from the Capitol.

- 13.4: Revenue, Funds, and Expenditures

- This page summarizes Texas's budget management, focusing on revenue sources like taxes, fees, and federal grants, with a shift from property tax to sales tax. The Economic Stabilization Fund aids during revenue shortfalls, and federal funds support various programs. Expenditure emphasizes education, healthcare, and infrastructure, revealing disparities in funding influenced by reliance on property taxes.

- 13.5: Conclusion

- This page discusses Texas's strict financial oversight rooted in its 1876 constitution, focusing on the budgeting process and key financial terms such as appropriations and dedicated funds. It outlines methods like performance-based budgeting and the Economic Stabilization Fund used to manage and stabilize state expenses, highlighting Texas's ongoing financial governance despite controversies.

1. Cassandra Pollock, “Texas Faces a Looming $4.6 Billion Deficit, Comptroller Projects,” Texas Tribune, July 20, 2020, https://www.texastribune.org/2020/07...t-comptroller/.

2. “Texas Comptroller Glenn Hegar Releases Certification Revenue Estimate,” Texas. Comptroller or Public Accounts, Oct. 10, 2019, https://comptroller.texas.gov/about/...191010-cre.php.

3. “Transparency: Biennial Revenue Estimate 2010-2011, Economic Outlook,” Texas Comptroller or Public Accounts,” https://comptroller.texas.gov/transp...11/outlook.php.